UiPATH $PATH 3Q22 Earnings

- Rev $221m +50% ↗️

- GP $178m +37% ↗️ margin 80% -772 bps↘️

- NG EBIT $9m ↗️ margin 4% +1334 bps✅

- NG Net Inc $2m ⤴️ margin 1% +1545 bps✅

- 9m OCF $-49m margin -8% -1087 bps↘️

- 9m FCF $-31m margin -5% -769 bps↘️

- Rev $221m +50% ↗️

- GP $178m +37% ↗️ margin 80% -772 bps↘️

- NG EBIT $9m ↗️ margin 4% +1334 bps✅

- NG Net Inc $2m ⤴️ margin 1% +1545 bps✅

- 9m OCF $-49m margin -8% -1087 bps↘️

- 9m FCF $-31m margin -5% -769 bps↘️

➡️ Strong Business Metrics 💪🏻

- ARR $818m +58% ↗️

- Net New ARR $92m +42% ↗️

- RPO $580m +80% 🚀

- cRPO $359m +69% 🚀

- Gross Retention 98% ➡️

- Net Retention 145%+ ✅

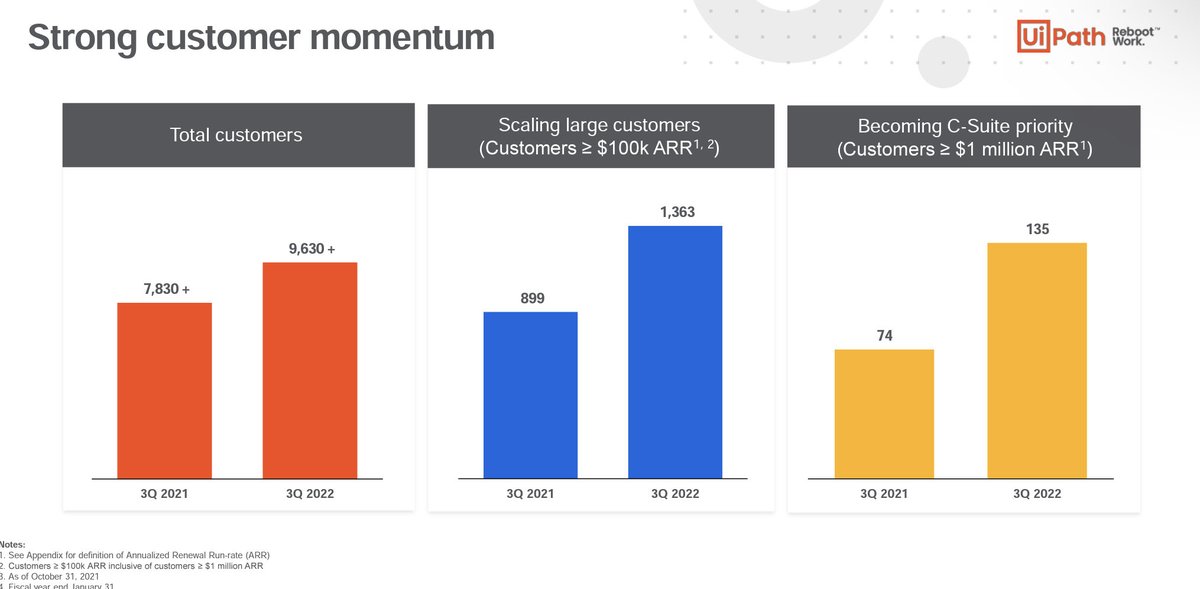

- Cust 9.6k+ +1.8k +23%YoY ↗️ +6%QoQ ↗️

- Cust >$100k ARR 1,363 +52%YoY ↗️ +9%QoQ ↗️

- ARR $818m +58% ↗️

- Net New ARR $92m +42% ↗️

- RPO $580m +80% 🚀

- cRPO $359m +69% 🚀

- Gross Retention 98% ➡️

- Net Retention 145%+ ✅

- Cust 9.6k+ +1.8k +23%YoY ↗️ +6%QoQ ↗️

- Cust >$100k ARR 1,363 +52%YoY ↗️ +9%QoQ ↗️

➡️ Strong Business Metrics 💪🏻 (cont’d)

- Cust >$1m ARR 135 +82% YoY 🚀 +14% QoQ ↗️

- Partners 4.9k 📶 +200 +4%QoQ ↗️

4Q22 Guide

- ARR $901-903m ↗️

- Rev $281-283m ↗️

- NG EBIT $10-20m ↗️

Tech Partnerships: Snowflake, CrowdStrike, Qlik and Alteryx.

- Cust >$1m ARR 135 +82% YoY 🚀 +14% QoQ ↗️

- Partners 4.9k 📶 +200 +4%QoQ ↗️

4Q22 Guide

- ARR $901-903m ↗️

- Rev $281-283m ↗️

- NG EBIT $10-20m ↗️

Tech Partnerships: Snowflake, CrowdStrike, Qlik and Alteryx.

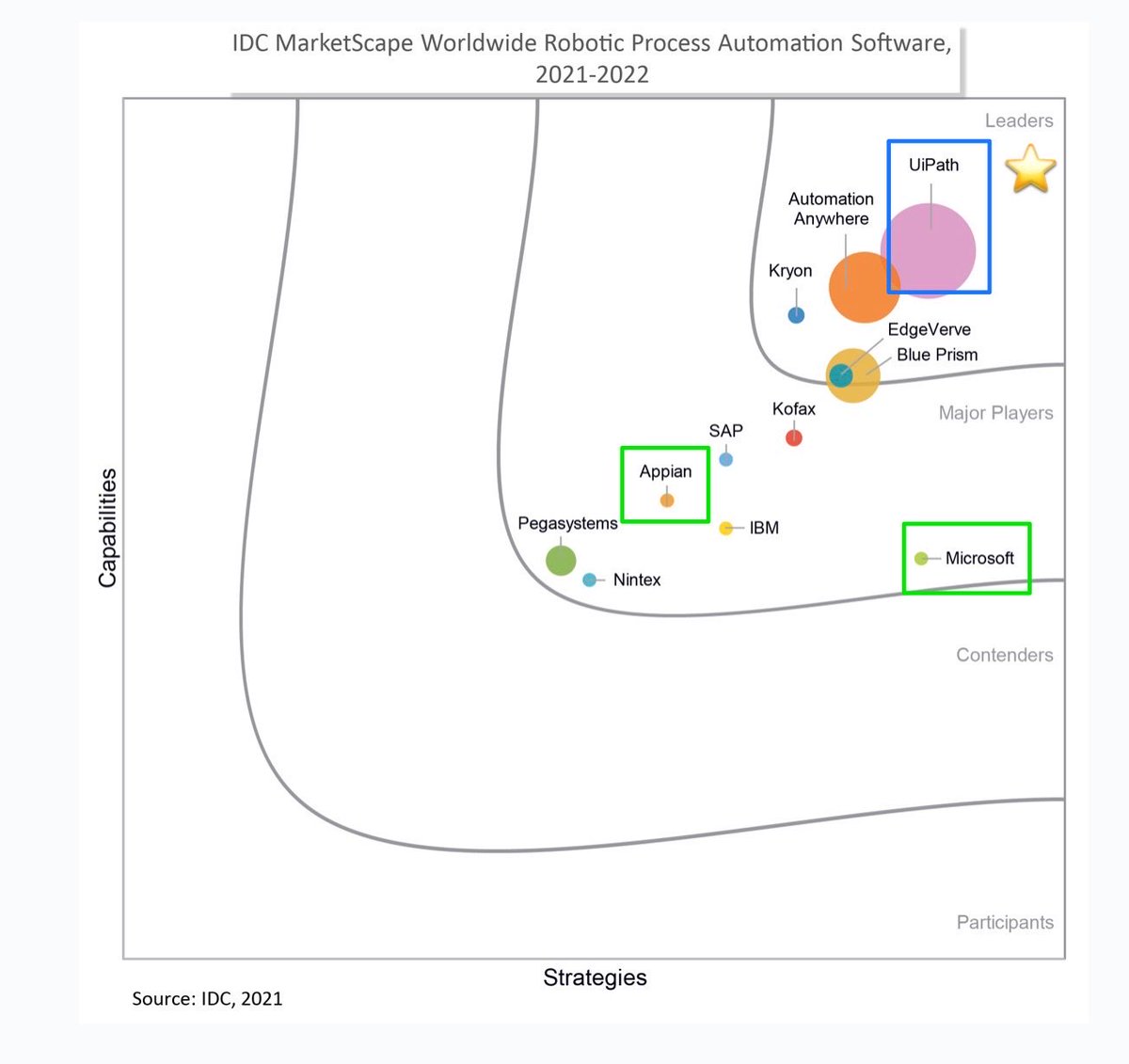

2 | 🏆 UiPath Top Dog

UiPath named a leader in the inaugural IDC MarketScape: Worldwide Robotic Process Automation Software 2021-2022 Vendor Assessment.

UiPath named a leader in the inaugural IDC MarketScape: Worldwide Robotic Process Automation Software 2021-2022 Vendor Assessment.

2 | 🏆 UiPath Top Dog (cont’d)

UiPath named a Robotic Process Automation (RPA) Leader and Star Performer in the Technology Vendor Landscape for the 5th consecutive year, according to Everest Group’s Robotic Process Automation Products PEAK Matrix® Assessment 2021.

UiPath named a Robotic Process Automation (RPA) Leader and Star Performer in the Technology Vendor Landscape for the 5th consecutive year, according to Everest Group’s Robotic Process Automation Products PEAK Matrix® Assessment 2021.

3 | Competitive Landscape

“….we have not seeing any material moves in terms of the competitive landscape”

“…the first IDC report that put us in a very clear leadership position.”

“….we have not seeing any material moves in terms of the competitive landscape”

“…the first IDC report that put us in a very clear leadership position.”

4 | Microsoft - Not a Major Threat

“If we take into account the deals where Microsoft is participating versus the deals where Microsoft is not participating, we are not seeing material changes in our winning rate.”

“If we take into account the deals where Microsoft is participating versus the deals where Microsoft is not participating, we are not seeing material changes in our winning rate.”

4 | Microsoft - Not a Major Threat (cont’d)

“…I can say Microsoft has doesn't have a meaningful impact on our ability to win customers.”

“…Microsoft is focused with their RPA mostly on citizen developer and personal productivity. This is a small part of our overall time.

“…I can say Microsoft has doesn't have a meaningful impact on our ability to win customers.”

“…Microsoft is focused with their RPA mostly on citizen developer and personal productivity. This is a small part of our overall time.

4 | Microsoft - Not a Major Threat (cont’d)

So I don't see that in the coming years Microsoft investment in competing with us will really derail us from our growth trajectory that we are seeing and we are building right now.”

So I don't see that in the coming years Microsoft investment in competing with us will really derail us from our growth trajectory that we are seeing and we are building right now.”

5 | Differentiating Factor

“…when it comes to real enterprise enterprise automation. Customers are choosing UiPath…because we offer an end-to-end platform, that is suitable from small use cases to the most complex use cases.”

“…when it comes to real enterprise enterprise automation. Customers are choosing UiPath…because we offer an end-to-end platform, that is suitable from small use cases to the most complex use cases.”

6 | Duration

“duration is going to be something we keep an eye on…really don't drive duration from a business standpoint…”

“duration is going to be something we keep an eye on…really don't drive duration from a business standpoint…”

7 | Ultimately driven by Customer Success

“Really, what defines when a customer is expands is when they start seeing those bursts of ROI…that actually can come two to three months out, and then continue to come as they go across departments.

“Really, what defines when a customer is expands is when they start seeing those bursts of ROI…that actually can come two to three months out, and then continue to come as they go across departments.

7 | Ultimately driven by Customer Success (cont’d)

…more often than not, we see multiple buying patterns that multiple points in the year of when customers buy again speaks to the strength of our land and expand model…”

…more often than not, we see multiple buying patterns that multiple points in the year of when customers buy again speaks to the strength of our land and expand model…”

8 | Investing for the Long-Term

“…while we're committed to long-term operating margins that we've talked about of 20% plus our priority right now is investment”

“…we've talked about being roughly cash flow neutral not afraid to go a little plus or minus against that”.

“…while we're committed to long-term operating margins that we've talked about of 20% plus our priority right now is investment”

“…we've talked about being roughly cash flow neutral not afraid to go a little plus or minus against that”.

➡️ Final Takeaway on UiPath $PATH:

With high Net Retention 145%+, ARR growing rapidly +58%, if UiPath continues to deliver long-term customer success, the durability of its revenues will become increasingly clearer.

With high Net Retention 145%+, ARR growing rapidly +58%, if UiPath continues to deliver long-term customer success, the durability of its revenues will become increasingly clearer.

➡️ Final Takeaway on UiPath $PATH (cont’d):

In the near-term, it remains focused on reinvesting and growing and with high software gross margins of >90%, with eventual operating leverage, path towards long-term operating profitability of 20%+ is clear. Thesis unchanged.

In the near-term, it remains focused on reinvesting and growing and with high software gross margins of >90%, with eventual operating leverage, path towards long-term operating profitability of 20%+ is clear. Thesis unchanged.

• • •

Missing some Tweet in this thread? You can try to

force a refresh