Hi @StarTerra_io!

I did some math around @play_nity allocations and arrived at a different result than yours. 🤨

Could you lend me a hand, please? In absence of clear guidance it is difficult to prepare a tool to estimate future allocation.

🧵👇

/1

I did some math around @play_nity allocations and arrived at a different result than yours. 🤨

Could you lend me a hand, please? In absence of clear guidance it is difficult to prepare a tool to estimate future allocation.

🧵👇

/1

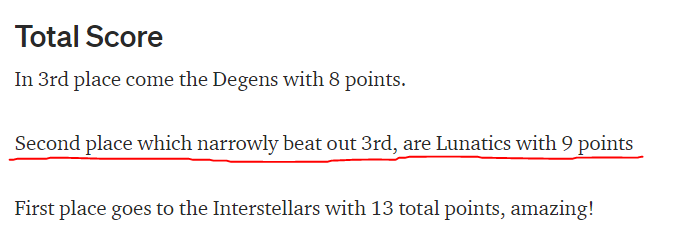

I have joined the IDO as a member of #LUNAtics faction.

Lunatics ranked 2nd. In previous IDOs that meant 30% of gamified pool would go to Lunatics - I assume that's true for $PLY as well, though the article did not mention that explicitly.

/2

Lunatics ranked 2nd. In previous IDOs that meant 30% of gamified pool would go to Lunatics - I assume that's true for $PLY as well, though the article did not mention that explicitly.

/2

That would mean total allocation to Lunatics faction is:

15% (standard) + 15% * 30% (gamified) = 19.5%

With total raise of 420k UST, 19.5% translates to 81.9k UST total allocation.

/3

15% (standard) + 15% * 30% (gamified) = 19.5%

With total raise of 420k UST, 19.5% translates to 81.9k UST total allocation.

/3

AFAIK:

(1) Half of that allocation is guaranteed and split among faction members equally

(2) The other half is lottery-based, with each member getting a lottery ticket for each 250 STE they have (more STE = higher chance of getting a lottery allocation)

Let's focus of (1)

/4

(1) Half of that allocation is guaranteed and split among faction members equally

(2) The other half is lottery-based, with each member getting a lottery ticket for each 250 STE they have (more STE = higher chance of getting a lottery allocation)

Let's focus of (1)

/4

Guaranteed allocation per Lunatics member would be:

81.9k * 50% / NoLFM,

where NoLFM - Number of Lunatics Faction Members.

Now it get's a bit tricky to figure out the actual NoLFM...

/5

81.9k * 50% / NoLFM,

where NoLFM - Number of Lunatics Faction Members.

Now it get's a bit tricky to figure out the actual NoLFM...

/5

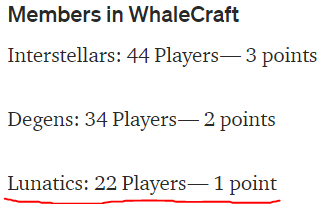

Medium article (linked below) mentions 703 total members in Lunatics faction and 22 Lunatics in the WhaleCraft faction.

So either:

NoLFM = 703 (total)

OR:

NoLFM = 703 - 22 = 681 (without whales)

medium.com/@StarTerra/pla…

/6

So either:

NoLFM = 703 (total)

OR:

NoLFM = 703 - 22 = 681 (without whales)

medium.com/@StarTerra/pla…

/6

Problem is:

81.9k * 50% / 703 = 58.25 UST

81.9k * 50% / 681 = 60.13 UST

Each of these is lower than the actual allocation of 63.97 UST.

Don't get me wrong - I am not complaining about getting higher allocation - but I would like to understand where it came from.

/7

81.9k * 50% / 703 = 58.25 UST

81.9k * 50% / 681 = 60.13 UST

Each of these is lower than the actual allocation of 63.97 UST.

Don't get me wrong - I am not complaining about getting higher allocation - but I would like to understand where it came from.

/7

To arrive at ~63.97, we would need to assume NoLFM=640. That's a whole 63 less that the "total" and 41 less than "total - whales".

The only explanation I could come up with (Occam's razor) is: squadrons.

/8

The only explanation I could come up with (Occam's razor) is: squadrons.

/8

Assuming:

(a) "total" accounted for unique wallet addresses (in squadrons and solo)

(b) NoLFM = NumberOfSquadrons + NumberOfSoloFactdionMembers

(c) there were 10 squadrons

(d) only 73 persons signed up for the squadrons

...

/9

(a) "total" accounted for unique wallet addresses (in squadrons and solo)

(b) NoLFM = NumberOfSquadrons + NumberOfSoloFactdionMembers

(c) there were 10 squadrons

(d) only 73 persons signed up for the squadrons

...

/9

...then we would indeed get NoLFM = 640.

Only I can hardly believe only 73 persons would sign up for squadrons when the total squadrons capacity is 100 persons (10 squadrons, 10 members each).

/10

Only I can hardly believe only 73 persons would sign up for squadrons when the total squadrons capacity is 100 persons (10 squadrons, 10 members each).

/10

This is where I run out of ideas. I would like to reverse-engineer these calculations and describe it somewhere - lack of such description is quite frustrating for me (numbers junkie) and possible for other #LUNAtics too.

Halp plz?

/11-end

Halp plz?

/11-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh