@prism_protocol - strategies 101

S02E02 - Yield cluster at @nebula_protocol

Today we will look at possible partnership between Nebula Protocol and Prism Protocol, that would provide a pretty decent option for a passive income.

/1

S02E02 - Yield cluster at @nebula_protocol

Today we will look at possible partnership between Nebula Protocol and Prism Protocol, that would provide a pretty decent option for a passive income.

/1

We all hope WAGMI. We write it on CT, we encourage one another as fellow #LUNAtics - and for good reasons. The spirit of community thrives.

But ser, what are we gonna do, once we finally make it?

@nebula_protocol and @prism_protocol might help with it.

/2

But ser, what are we gonna do, once we finally make it?

@nebula_protocol and @prism_protocol might help with it.

/2

Not sure about you, but once I make it, I will move a significant portion of my portfolio to a ‘safe haven’ - @anchor_protocol-Earn-like where I can enjoy 20-30% APR, which would allow me and my family not to worry about 💰 anymore.

What would that look like?

/3

What would that look like?

/3

I imagine that “safe” portfolio would be made of:

- $aUST

- $LUNA, $SCRT, $ATOM (for the staking APR)

- various LP tokens

… and perhaps some other yield-bearing tokens. Anything that is has somewhat low volatility and provides a cashflow to live off.

/4

- $aUST

- $LUNA, $SCRT, $ATOM (for the staking APR)

- various LP tokens

… and perhaps some other yield-bearing tokens. Anything that is has somewhat low volatility and provides a cashflow to live off.

/4

I could manage that portfolio myself, but… do I need to?

How about creating a cluster on @nebula_protocol that would contain the above tokens in certain proportions?

I could just sprinkle $UST into it, and just claim rewards every month - a self-paid salary, if you will.

/5

How about creating a cluster on @nebula_protocol that would contain the above tokens in certain proportions?

I could just sprinkle $UST into it, and just claim rewards every month - a self-paid salary, if you will.

/5

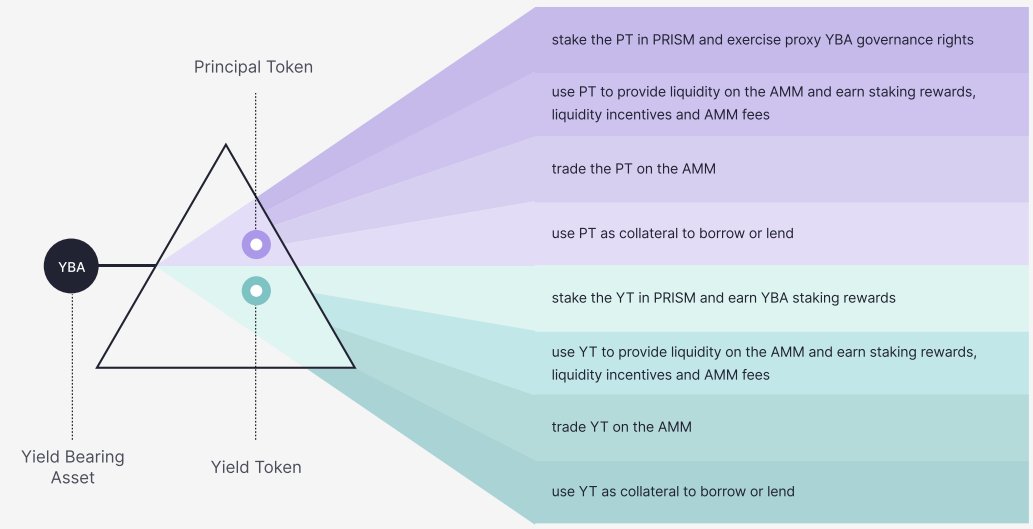

@prism_protocol can make that even better.

If the cashflow is all I need, the “non-yield-bearing” part of the token is unnecessary. I won’t say “useless”, but simply not needed in this scenario.

@prism_protocol will allow us to remove that part, keeping just the cashflow.

/6

If the cashflow is all I need, the “non-yield-bearing” part of the token is unnecessary. I won’t say “useless”, but simply not needed in this scenario.

@prism_protocol will allow us to remove that part, keeping just the cashflow.

/6

All of that in the spirit of making the best use of your capital.

As I have explained in S01E03, the price of $yLUNA-perp, assuming 10% staking APR should float around 0.59 $LUNA.

That’s 0.41 $LUNA we could turn into cashslow.

/7

As I have explained in S01E03, the price of $yLUNA-perp, assuming 10% staking APR should float around 0.59 $LUNA.

That’s 0.41 $LUNA we could turn into cashslow.

https://twitter.com/AgilePatryk/status/1450133297917480961?s=20

/7

Swapping $pLUNA into $yLUNA will give me another 10% * 0.41 / 0.59 = 6.94% APR.

That just turned my $LUNA staking rewards from 10% to almost 17% (+airdrops…).

That was at the cost of price action, but once I make it, I would not need to make it again, right?

/8

That just turned my $LUNA staking rewards from 10% to almost 17% (+airdrops…).

That was at the cost of price action, but once I make it, I would not need to make it again, right?

/8

Replicate the same for $ATOM, $SCRT, $DOT …

Add some $aUST or $oaUST...

… and you end up with a well-diversified portfolio that is (a) cashflow-heavy, (b) provides a reasonably stable cashflow, (c) still has an upside potential, as staking rewards scale with asset price.

/9

Add some $aUST or $oaUST...

… and you end up with a well-diversified portfolio that is (a) cashflow-heavy, (b) provides a reasonably stable cashflow, (c) still has an upside potential, as staking rewards scale with asset price.

/9

With all of that embedded into @nebula, we get a formula I would be quite willing to use to fund my crypto-retirement.

Or, share that with frens and family outside CT as a way to gain/retain FI with the smart use of crypto.

/10

Or, share that with frens and family outside CT as a way to gain/retain FI with the smart use of crypto.

/10

Please let me know if you enjoyed the episode - I appreciate the feedback and try to improve my game in sharing knowledge in approachable and easy-to-understand way.

/11

/11

Stay tuned for:

S02E03 - Fixed-rate borrowing on @mars_protocol

A 🧵with the full list of episodes (with links):

/12-end

S02E03 - Fixed-rate borrowing on @mars_protocol

A 🧵with the full list of episodes (with links):

https://twitter.com/AgilePatryk/status/1448951059402137611

/12-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh