@prism_protocol - strategies 101

S02E01 - @pylon_protocol capital efficiency

Yay! We made it to the 2nd seasons!

Pretty much all of the episodes will be focused on various partnerships Prism Protocol can get into to bring value to #LUNAtics.

Buckle up!

/1

S02E01 - @pylon_protocol capital efficiency

Yay! We made it to the 2nd seasons!

Pretty much all of the episodes will be focused on various partnerships Prism Protocol can get into to bring value to #LUNAtics.

Buckle up!

/1

How the pools on @pylon_protocol work:

(1) You deposit $UST

(2) Pylon deposits $UST to @anchor_protocol

(3) Yield is redirected to: $MINE buybacks (10%), dev team (90%)

/2

(1) You deposit $UST

(2) Pylon deposits $UST to @anchor_protocol

(3) Yield is redirected to: $MINE buybacks (10%), dev team (90%)

/2

(4) Dev team supplies their token into the pool

(5) Pool distributes tokens at a stead rate per minute

(6) You can collect your tokens as defined in the pool (that might vary)

(7) You get your $UST back once the pool reaches maturity (6/12/18 months / whatever)

/3

(5) Pool distributes tokens at a stead rate per minute

(6) You can collect your tokens as defined in the pool (that might vary)

(7) You get your $UST back once the pool reaches maturity (6/12/18 months / whatever)

/3

Ad. (1) Imagine all the things you could do with your $UST when it wasn't locked up in the pool.

19.5% with ⚓️

30-40% with delta-neutral farming

10-40x with a good IDO ( $PSI anyone?)

Farm $APOLLO at the last 2 weeks of CFE?

...

Is the price you pay = lost opportunity.

/4

19.5% with ⚓️

30-40% with delta-neutral farming

10-40x with a good IDO ( $PSI anyone?)

Farm $APOLLO at the last 2 weeks of CFE?

...

Is the price you pay = lost opportunity.

/4

Ad. (7) That's the moment when "missed opportunity" window closes. You get your $UST back, you do your thing with it.

But... does it have to be that way? I mean: it's only the yield on $UST / $aUST that the dev team and @pylon_protocol need after all...

/5

But... does it have to be that way? I mean: it's only the yield on $UST / $aUST that the dev team and @pylon_protocol need after all...

/5

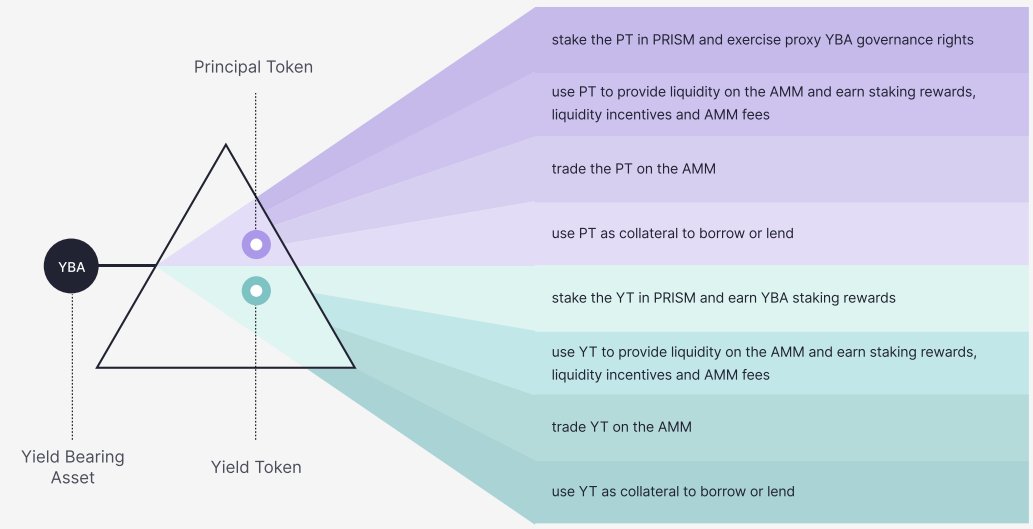

Enter: fixed-term refraction of $aUST.

Instead of putting $UST into the 12m-pool, just refract $aUST into $yaUST-12m and $paUST-12m.

$yaUST-12m reflects 12 months of⚓️ yield on your UST -> only that is used by the pools on @pylon_protocol.

You can keep your $paUST-12m!

/6

Instead of putting $UST into the 12m-pool, just refract $aUST into $yaUST-12m and $paUST-12m.

$yaUST-12m reflects 12 months of⚓️ yield on your UST -> only that is used by the pools on @pylon_protocol.

You can keep your $paUST-12m!

/6

You can sell your $paUST-12m and get some $UST back.

You can wait 12 months - by that time all yield from $yaUST-12m was paid out and it's value is $0.00.

That means:

$paUST-12m becomes $aUST

(Well, you will still have to swap 1:1).

/7

You can wait 12 months - by that time all yield from $yaUST-12m was paid out and it's value is $0.00.

That means:

$paUST-12m becomes $aUST

(Well, you will still have to swap 1:1).

/7

Alternative: buy some $yaUST on the market. Pay a fixed price to get into the pool without having to remember to collect your unlocked $UST (after 12-18 months, one might need a really good memory)...

/8

/8

But ser, does buying $yaUST really makes any sense?

If you've read my previous 🧵on fixed-term refractions of $aUST (link below), you might have noticed the pricing of $yaUST in various fixed-term variants.

/9

If you've read my previous 🧵on fixed-term refractions of $aUST (link below), you might have noticed the pricing of $yaUST in various fixed-term variants.

https://twitter.com/AgilePatryk/status/1455482953300127751

/9

A reminder for the 3 most popular pool durations:

- $yaUST-18m = 0.302 $UST

- $yaUST-12m = 0.184 $UST

- $yaUST-6m = 0.096 $UST

Instead of locking 1 $UST for 6m/12m/18m, you can pay 0.096 / 0.184 / 0.302 $UST to buy $yaUST-6/12/18m and swap it for a stream of new tokens.

/10

- $yaUST-18m = 0.302 $UST

- $yaUST-12m = 0.184 $UST

- $yaUST-6m = 0.096 $UST

Instead of locking 1 $UST for 6m/12m/18m, you can pay 0.096 / 0.184 / 0.302 $UST to buy $yaUST-6/12/18m and swap it for a stream of new tokens.

/10

Enter the pool at 9.6% / 18.4% / 30.2% of the original price.

Yes, you won't get that $yaUST back - that's for sure. You keep the vast majority of your money in your pocket though, decreasing the cost of lost opportunity.

I.e. you can do stuff with that $UST!

/11

Yes, you won't get that $yaUST back - that's for sure. You keep the vast majority of your money in your pocket though, decreasing the cost of lost opportunity.

I.e. you can do stuff with that $UST!

/11

I hope you enjoyed the read!

Next up:

S02E02 - Yield cluster at @nebula_protocol.

Full list of episodes (with links):

Next up:

S02E02 - Yield cluster at @nebula_protocol.

Full list of episodes (with links):

https://twitter.com/AgilePatryk/status/1448951059402137611

• • •

Missing some Tweet in this thread? You can try to

force a refresh