@prism_protocol - strategies 101

S02E03 - Fixed-rate lending at @mars_protocol

Originally, I planned on describing fixed-rate borrowing. After doing more homework I could not figure out, how it would work, so I decided to settle on fixed-rate lending.

Brain so smooth. 🧠🤷

/1

S02E03 - Fixed-rate lending at @mars_protocol

Originally, I planned on describing fixed-rate borrowing. After doing more homework I could not figure out, how it would work, so I decided to settle on fixed-rate lending.

Brain so smooth. 🧠🤷

/1

Small refresher on @mars_protocol - this dApp will bring money-market primitive to @terra_money.

At launch, we will be able to lend/borrow $UST, $LUNA, $MIR and $ANC. Further tokens to be added via governance votes.

/2

At launch, we will be able to lend/borrow $UST, $LUNA, $MIR and $ANC. Further tokens to be added via governance votes.

/2

Both collateralized and non-collateralized loans will be possible - in the latter case loan will go issued to a protocol.

E.g. we will be able to farm $ANC - $UST by providing $ANC to Mars, with Mars supplying the $UST part. (2x leverage in this case).

/3

E.g. we will be able to farm $ANC - $UST by providing $ANC to Mars, with Mars supplying the $UST part. (2x leverage in this case).

/3

Lending and borrowing will have variable rates, which depend on utilisation (0%-100%) of particular coin/pool.

Details in @mars_protocol litepaper:

mars-protocol.medium.com/mars-protocol-…

/4

Details in @mars_protocol litepaper:

mars-protocol.medium.com/mars-protocol-…

/4

Simple examples assuming 200k $MIR deposited to Mars

* 20k $MIR borrowed in total -> 10% utilisation -> low interest rate

* 120k $MIR borrowed -> 60% utilisation -> medium interest rate

* 180k $MIR borrowed -> 90% utilisation -> high interest rate

/5

* 20k $MIR borrowed in total -> 10% utilisation -> low interest rate

* 120k $MIR borrowed -> 60% utilisation -> medium interest rate

* 180k $MIR borrowed -> 90% utilisation -> high interest rate

/5

So, the interest rate will change from day to day, from block to block.

Goodbye @anchor_protocol stability, welcome @mars_protocol versatility.

But what if we could 'fix' the rate?

/6

Goodbye @anchor_protocol stability, welcome @mars_protocol versatility.

But what if we could 'fix' the rate?

/6

Once you deposit $LUNA / $MIR / $ANC / $UST to Mars, you will receive $maLUNA / $maMIR / $maANC / $maUST as a deposit confirmation.

Similar mechanism as with $UST --- $aUST on @anchor_protocol Earn.

/7

Similar mechanism as with $UST --- $aUST on @anchor_protocol Earn.

/7

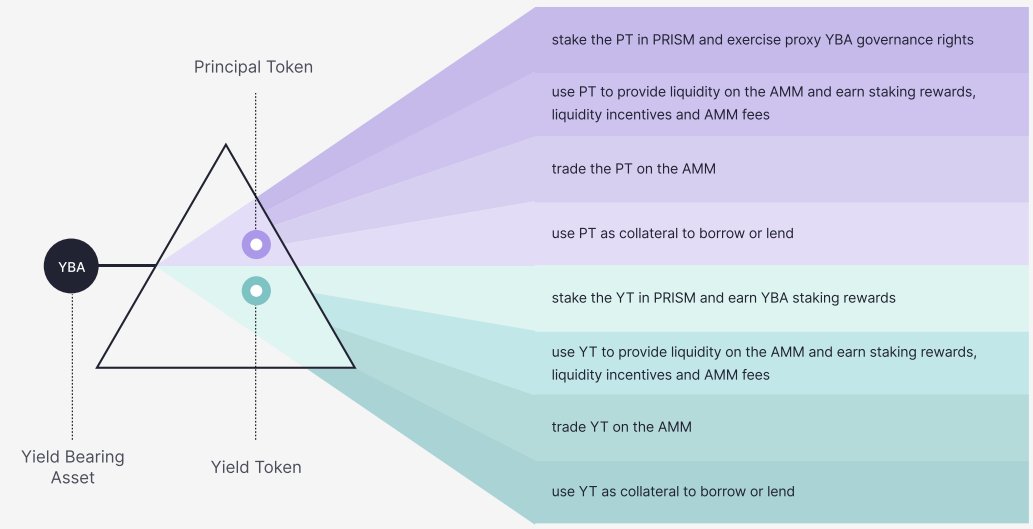

As you might have guessed, $maLUNA, $maUST etc. will be yield-bearing tokens (YT).

@prism_protocol can work its magic and split $maUST into:

- $ymaUST -> yield-bearing part of maUST

- $pmaUST -> principal part of maUST

/7

@prism_protocol can work its magic and split $maUST into:

- $ymaUST -> yield-bearing part of maUST

- $pmaUST -> principal part of maUST

/7

I personally don't believe yield on $maUST could be higher than on Anchor Earn (happy to be surprised here!), so I expect full suite of refractions will available:

- perpetual

- 12M

- 9M

- 6M

- 3M

(reminder: this is part of future roadmap for @prism_protocol)

/8

- perpetual

- 12M

- 9M

- 6M

- 3M

(reminder: this is part of future roadmap for @prism_protocol)

/8

Back to fixed-rate lending!

Now that we have $ymaUST or $ymaANC, we could... sell it on the market.

I have already described that for $yLUNA - selling the yield part allows us to get entire yield (discounted) up-front. Guaranteed (market) rate.

/9

Now that we have $ymaUST or $ymaANC, we could... sell it on the market.

I have already described that for $yLUNA - selling the yield part allows us to get entire yield (discounted) up-front. Guaranteed (market) rate.

https://twitter.com/AgilePatryk/status/1450863583684870146?s=20

/9

Once $ymaUST (or other YT from Mars) is sold, we have $UST and can re-invest it to our desire.

Buy more $LUNA.

Invest in an IDO.

Do some farming.

Buy yourself something new and shiny.

Or buy $yLUNA, stake it and receive staking APR and airdrops. 🤝

/10

Buy more $LUNA.

Invest in an IDO.

Do some farming.

Buy yourself something new and shiny.

Or buy $yLUNA, stake it and receive staking APR and airdrops. 🤝

/10

As always - I hope you enjoyed the read!

Stay tuned for:

S02E04 - Possible co-op plays with @staderlabs

A 🧵 with the full list of episodes (with links):

/11-end

Stay tuned for:

S02E04 - Possible co-op plays with @staderlabs

A 🧵 with the full list of episodes (with links):

https://twitter.com/AgilePatryk/status/1448951059402137611

/11-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh