Leverage Thread 🧵

Leverage can make or break people.

Specially when we talk about derivative product which already leverage. If not aware about effect and side-effects then definitely.

Inspired by Wayne (Famous Portfolio and strategic builder).

Leverage can make or break people.

Specially when we talk about derivative product which already leverage. If not aware about effect and side-effects then definitely.

Inspired by Wayne (Famous Portfolio and strategic builder).

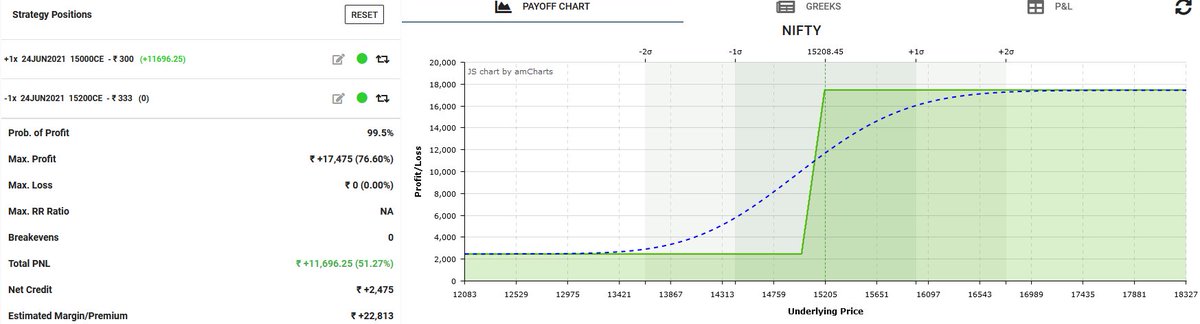

As we know derivative product approx 6x leverage which means for 6L we normally pay 1L for taking it delivery in account. What if we take without leverage, less leverage risk exposure or even 10x leverage. Any system robustness checked by its drawdown properties.

When we can no leverage or 2x (small aggressive) most probable chance of survival in market higher, when we go by 5x-10x exposure which can easily kill in few drawdown phase, even completely.

Warren Buffett also emphasized so many times about leverage and risk.

Warren Buffett also emphasized so many times about leverage and risk.

He took approx. 1.6x exposure as working with insurance company benefits.

According all system historical drawdown need to be very careful about leverage specially if drawdown big in statics then can even broke with 2x.

According all system historical drawdown need to be very careful about leverage specially if drawdown big in statics then can even broke with 2x.

There is one leverage vs risk graph famous by Kelly. Where Kelly explained how it can be suicidal if leverage go insane specially.

Recently we have seen good heavy correction in March 2020 fall where you can think how some leverage fund go bankrupt easily, but same opposite and also as opportunity from low leverage product performs exceptional due to nice gain.

Same like in excel in last line where gain increase then we can see nice profit popup which trying to explain when to use it smartly.

According to Wayne; every system we need to take it some optimum figure like if system performance well with 2x and xx roi expected.

According to Wayne; every system we need to take it some optimum figure like if system performance well with 2x and xx roi expected.

We already running more than expected means system running already more than optimum value and need to be careful with leverage or reduce leverage, vice-versa when system running under drawdown and already low we should take advantage of leverage to enhance performance.

Market have mean reversion nature and when ever it's go under water, it's best to use leverage smartly that time.

I am personally using 1-2x exposure in between bcoz of trading overnight positional. But sometimes 3x when I see good opportunity when risk small Reward big.

I am personally using 1-2x exposure in between bcoz of trading overnight positional. But sometimes 3x when I see good opportunity when risk small Reward big.

Thanks everyone for read, it's on you how to use or avoid.

Return* vs risk graph. When we go for Insan return generally it's broke.

This early luck or success; many ppl think its (leverage) holygrail as well, i will keep doubling the money and greed kill in next moment when face drawdown.

• • •

Missing some Tweet in this thread? You can try to

force a refresh