1/ We took a close look at the #Solana ecosystem. Here’s a thread on the report and thoughts on the recent network activity. grayscale.com/wp-content/upl…

@Grayscale @DCGco @Sonnenshein @mattmaximo1

@Grayscale @DCGco @Sonnenshein @mattmaximo1

2/ Solana is designed to provide developers with a highly performant Web 3.0 #cloud platform that offers scalability at the Layer 1 blockchain level.

3/ By being fast (400 millisecond block times), low cost (~$0.001 per transaction), and decentralized (2,242 global nodes), Solana aims to eliminate the need for Layer 2 solutions that other blockchains require.

4/ Solana is expanding the size of the Web 3.0 cloud market by enabling new users, increased usage, and more mainstream applications. We see the following as potentially comparable innovations:

5/

Mainframe>PC: Lowered costs & expanded access like Solana's low-cost Tx features

On-Prem>Cloud: Reduced complexity like Solana's single layer dApp approach

Desktop>Mobile: Created a new design space for apps like Solana's more powerful scalability

Mainframe>PC: Lowered costs & expanded access like Solana's low-cost Tx features

On-Prem>Cloud: Reduced complexity like Solana's single layer dApp approach

Desktop>Mobile: Created a new design space for apps like Solana's more powerful scalability

6/ Solana’s cloud economy has seen rapid growth over the past year with the ecosystem value exceeding $100 billion across different segments.

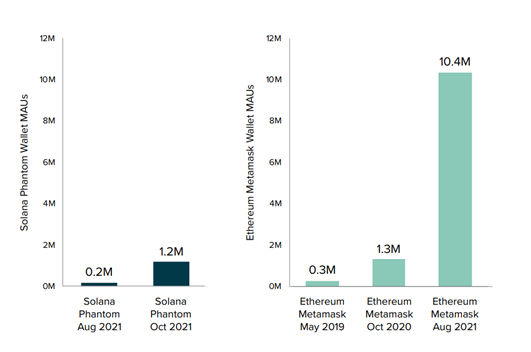

7/ Solana has built a large and fast-growing community of users. Solana user growth is roughly where #Ethereum was in October 2020

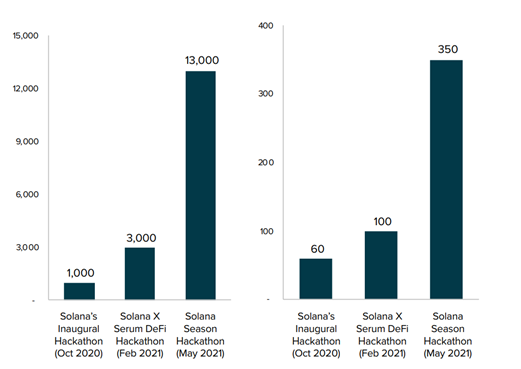

8/ Developers are key for a Web 3.0 cloud ecosystems to be successful. Developer interest in Solana has been rising sharply since the network launched.

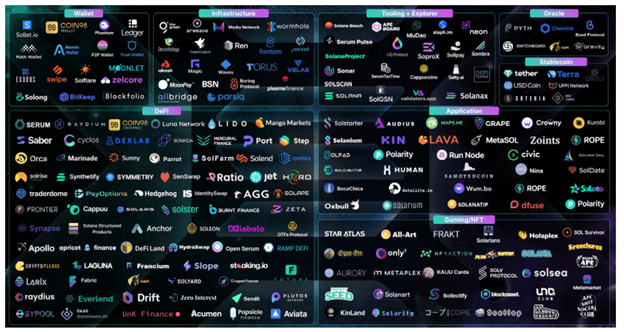

9/ Solana’s community has built a large ecosystem of over 500 dApps across DeFi, NFTs and other Web 3.0 use cases in the short time since the network launched.

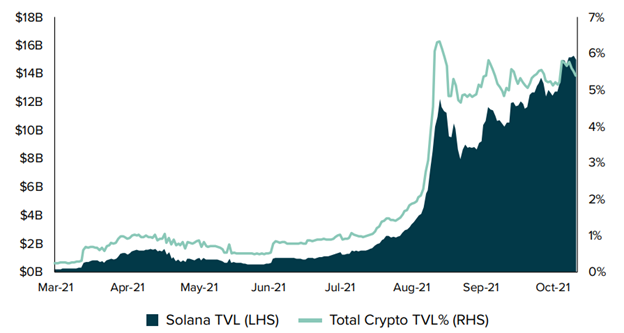

10/ The Total Value Locked (TVL) in Solana DeFi dApps has grown ~15x to over $14B since the network launched. That’s ~5.5% of all Crypto TVL.

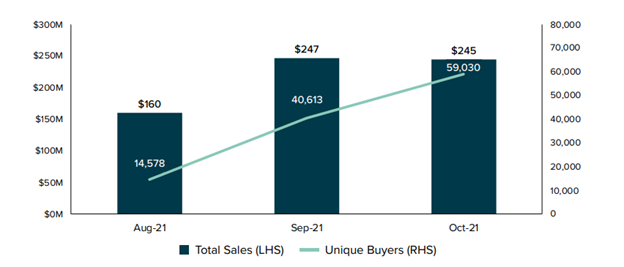

11/ Finance is not the only sector of the #Solana digital economy that has experienced growth. Solana-based NFTs have risen to over $1 billion in value while monthly sales volume has risen to ~$250 million, while buyers have increased ~4x over recent months.

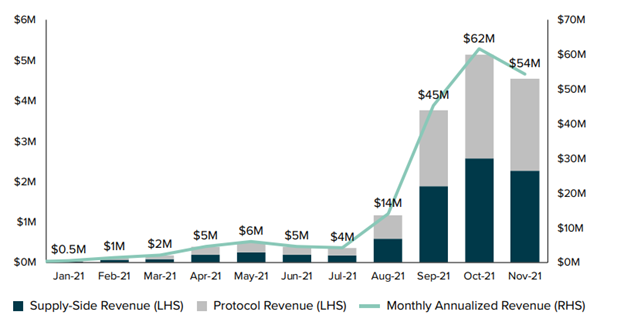

12/ As a result of Solana’s innovative technology approach, growing user base, vibrant developer and dApp ecosystem, and rising network usage, fee revenues have risen over 100x to ~$4.5B during the month of November (~$54M annualized).

13/ Solana’s biggest risk is the technology is new and the network is still maturing. The network outage from September and the DDoS attack last week are both examples of Solana's intentional scalability trade-offs.

cointelegraph.com/news/solana-re…

cointelegraph.com/news/solana-re…

14/ These events highlight development work that can be done, but it’s important to not lose perspective and remember that #Ethereum and #Bitcoin went through growing pains as well.

15/ After the DAO hard fork, ETH got a lot of now mostly forgotten criticism from the community. This is natural since most people in crypto are newcomers each cycle and many back in 2016 forgot about the challenges that Bitcoin overcame years earlier.

en.wikipedia.org/wiki/The_DAO_(…

en.wikipedia.org/wiki/The_DAO_(…

16/ Bitcoin had a value overflow incident in 2010 that required a new software client and blockchain fork to correct. It also led to the network alert system Satoshi put in place until 2012.

en.bitcoin.it/wiki/Value_ove…

en.bitcoin.it/wiki/Alert_sys…

en.bitcoin.it/wiki/Value_ove…

en.bitcoin.it/wiki/Alert_sys…

17/ Point is: building a successful decentralized Web3 network is hard, especially when you’re taking a novel approach. What matters is how the team and community respond to the inevitable challenges, whether its BTC in 2010, ETH in 2016, or SOL in 2021. @aeyakovenko @rajgokal

18/ Bottom line: The Web 2.0 cloud market is a $350B revenue and $4.6T market value opportunity. Web 3.0 platforms are already capturing share. Solana has a unique tech approach and fast-growing ecosystem that has positioned it as a leading Web 3.0 platform.

• • •

Missing some Tweet in this thread? You can try to

force a refresh