Partner @FinalityCap | Ex. Head of Research @Grayscale (@DCGco) | FMR. Head of Digital Asset Strategy @Fundstrat

How to get URL link on X (Twitter) App

https://twitter.com/David_Grid/status/1949805156217893226

2/ We haven’t seen $BMNR around this estimated valuation multiple since it last bottomed after the first investor unlock back in late July

2/ We haven’t seen $BMNR around this estimated valuation multiple since it last bottomed after the first investor unlock back in late July

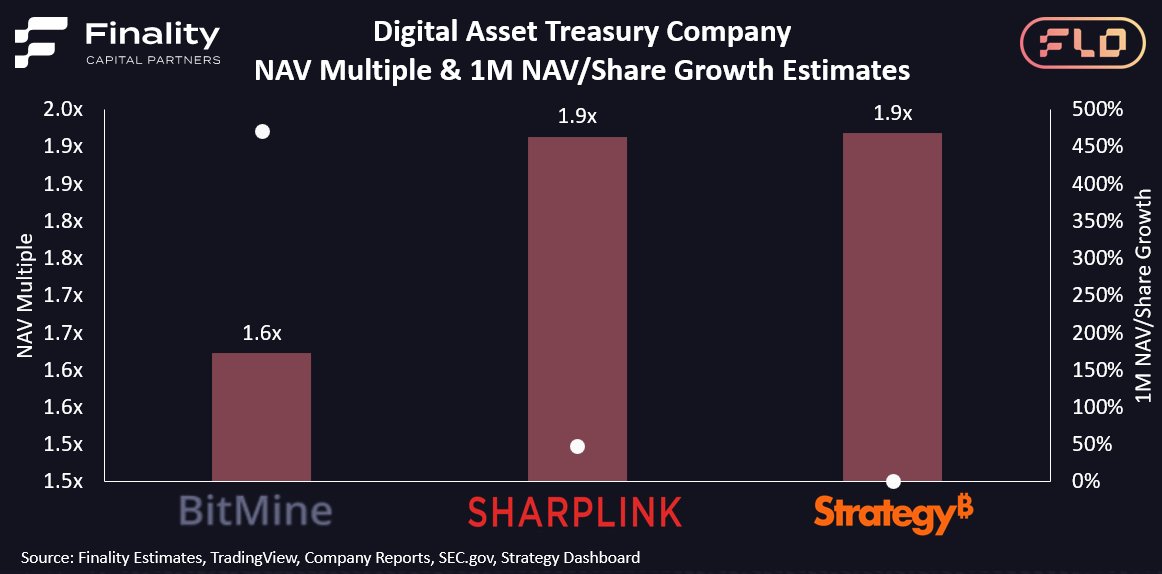

2/ While @BitMNR may be the leading Ethereum ($ETH) treasury company, it looks like its trading at a cheaper NAV multiple than @SharpLinkGaming and @MicroStrategy, despite much faster growth

2/ While @BitMNR may be the leading Ethereum ($ETH) treasury company, it looks like its trading at a cheaper NAV multiple than @SharpLinkGaming and @MicroStrategy, despite much faster growth

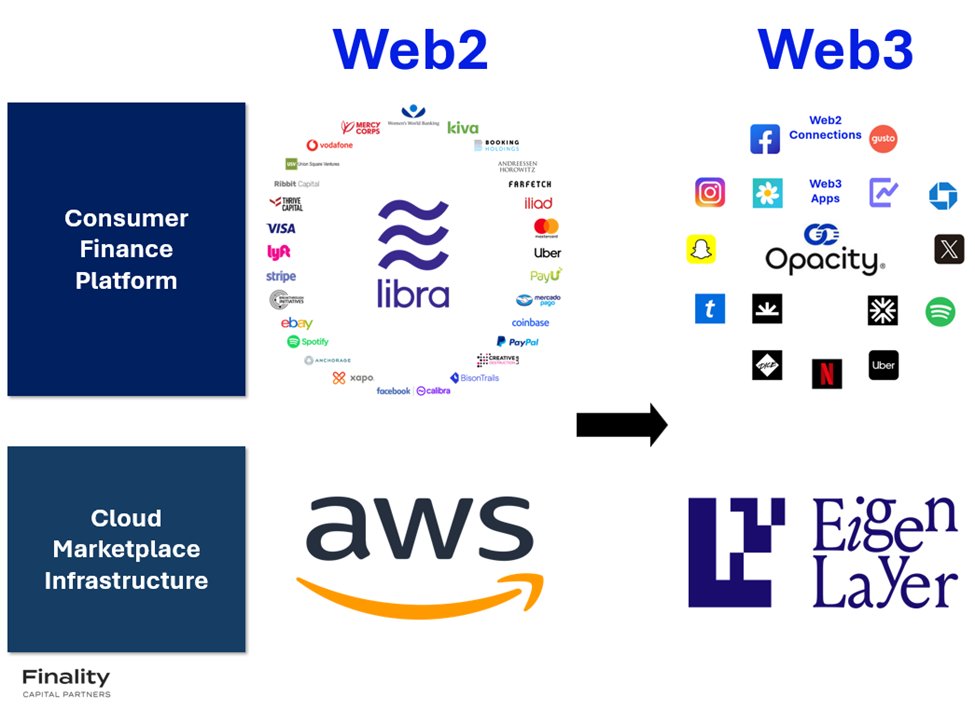

2/ A common criticism of Web3 has been there’s only a few applications that offer real world utility and have meaningful user adoption.

2/ A common criticism of Web3 has been there’s only a few applications that offer real world utility and have meaningful user adoption.https://x.com/adam_winnick/status/1837993464442781951

https://twitter.com/Grayscale/status/14994973693810892812/ Crypto assets are becoming a key component of The Postmodern Portfolio by offering allocators a new category that extends the risk and return spectrum beyond traditional alternatives like #realestate or #privateequity.

https://twitter.com/CoinDeskData/status/13218418517883863042/ Big tech stocks have come to dominated the S&P 500 but we think this paradigm could change over the next decade in favor of crypto.

https://twitter.com/aenigma_capital/status/11012577323242373122: The price of Bitcoin was in a bubble at the end of 2017 following a year that saw 1900%+ returns. Only a year later, the market sits at the opposite extreme as demonstrated by the selloff at the end of 2018 that saw prices plunge by more than 80% from previous highs.