We are at a 20 year low of hiring yield = hires/opening. HR folks, you are not imagining it.

Both an unusually synchronized surge in hiring efforts across organizations as well as a low unemployment rate are driving this.

I am often asked: what can employers do?

Both an unusually synchronized surge in hiring efforts across organizations as well as a low unemployment rate are driving this.

I am often asked: what can employers do?

Improvements to retention & recruitment can both increase your ability to be selective in hiring, rather than desperate.

For most, start with retention. You already convinced these people to work with you. You are in constant communication with them.

How?

For most, start with retention. You already convinced these people to work with you. You are in constant communication with them.

How?

Your employees know what they care about most. Find ways to hear them honestly (pulse surveys, supervisor evals, labor-mgmt partnership...).

Then deliver. Every employer made big operational changes in pandemic. Use job & org design to smooth rough edges created unintentionally

Then deliver. Every employer made big operational changes in pandemic. Use job & org design to smooth rough edges created unintentionally

Labor is in the drivers seat right now.

The figure shows the ratio of employee-initiated quits to employer-initiated discharges or layoffs. Highest in 20 years.

If you don't deliver, you will lose talent.

The figure shows the ratio of employee-initiated quits to employer-initiated discharges or layoffs. Highest in 20 years.

If you don't deliver, you will lose talent.

Rub is employee asks usually eat into profit/operating margins. CFO may not want to spend but will pay in turnover.

Corporate profits at record high & grew much faster rate than comp costs since 2019Q4.

Some orgs enjoying positive productivity & demand shocks & are flush. Use $

Corporate profits at record high & grew much faster rate than comp costs since 2019Q4.

Some orgs enjoying positive productivity & demand shocks & are flush. Use $

Others are struggling to stay above water, often smaller or legacy employers or those with public goods aspects that struggle to capture value they create.

Listening & job & org design is what you have. Smooth edges. Reduce time on least productive tasks.

Listening & job & org design is what you have. Smooth edges. Reduce time on least productive tasks.

Improve occupational & public health. Have a healthy staff. Lose less sick & personal days.

Short staffing creates a vicious cycle where the job is worse for people there & so it's hard to hire to alleviate short staffing.

Make a push to break into a better equilibrium.

Short staffing creates a vicious cycle where the job is worse for people there & so it's hard to hire to alleviate short staffing.

Make a push to break into a better equilibrium.

On recruitment, standard stuff. Know your competitive advantages as an employer.

Also, figure out what appeals differentially to your best hires.

Communicate those.

You've failed to attract specific people you want. Offer to pay them for a failed-hire interview. Find out why.

Also, figure out what appeals differentially to your best hires.

Communicate those.

You've failed to attract specific people you want. Offer to pay them for a failed-hire interview. Find out why.

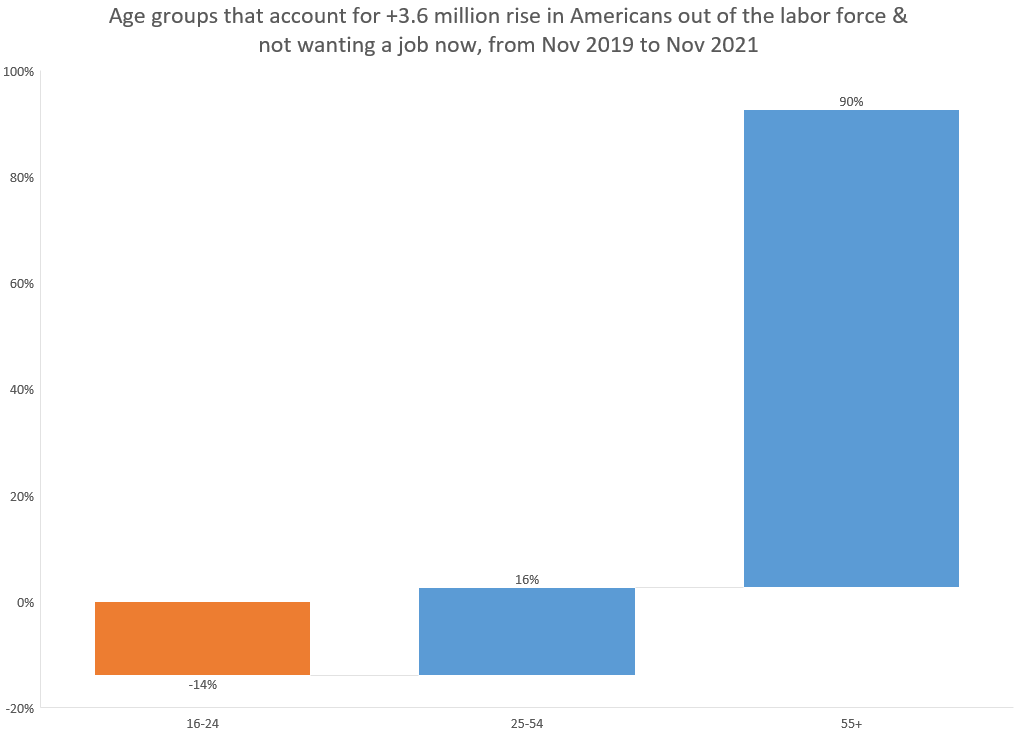

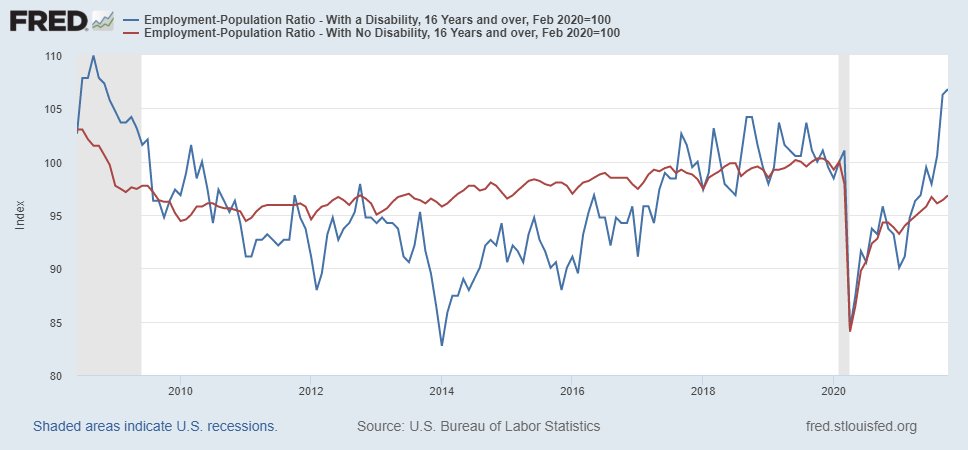

Smart employers are recognizing the talent of Americans with a disability.

Their employment rate is above its pre-pandemic level, unlike for those without a disability.

COVID-forced shifts toward remote work may have yielded increases in their relative productivity.

Their employment rate is above its pre-pandemic level, unlike for those without a disability.

COVID-forced shifts toward remote work may have yielded increases in their relative productivity.

We are experiencing a #GreatReallocation, not a #GreatResignation.

Employment rates & number of jobs have risen dramatically since spring. They're not falling.

Most quits are to better jobs, driven by change in employer productivity rankings & circumstances of workers' lives.

Employment rates & number of jobs have risen dramatically since spring. They're not falling.

Most quits are to better jobs, driven by change in employer productivity rankings & circumstances of workers' lives.

If you can't compete successfully for talent, that's hard for you but great for people quitting for better fits.

If you have to close shop,💔. Silver lining, lots of places are recruiting.

If you have to close shop,💔. Silver lining, lots of places are recruiting.

• • •

Missing some Tweet in this thread? You can try to

force a refresh