$SPELL is breaking out.

A thread on price action, news, collaborations, and whether I'm bullish or bearish.

A thread on price action, news, collaborations, and whether I'm bullish or bearish.

$SPELL's most recent dump was largely attributed to inflationary token supply (lots of token rewards for yield farmers).

A few weeks ago, @danielesesta promised to bring token emissions to zero. How's it going?

A few weeks ago, @danielesesta promised to bring token emissions to zero. How's it going?

Pretty well. Emissions have been cut 10% across pools and are down to about 461m $SPELL per week.

At current prices, that's about $8 million worth. Not quite yet 'breaking even' from a protocol revenue perspective, but headed that way.

A long way to go.

At current prices, that's about $8 million worth. Not quite yet 'breaking even' from a protocol revenue perspective, but headed that way.

A long way to go.

https://twitter.com/MIM_Spell/status/1472598534104965120?s=20

Fees are looking great, especially now that we're seeing serious adoption cross-chain.

Over 10% of loans are now originated away from Ethereum (AVAX, FTM, Arbitrum).

I see this driving a lot of revenue going forward as round trip fees to borrow are often $1k on $ETH

Over 10% of loans are now originated away from Ethereum (AVAX, FTM, Arbitrum).

I see this driving a lot of revenue going forward as round trip fees to borrow are often $1k on $ETH

More activity on alt L1s and L2s will be great for TVL and fees, but at the cost of more fees paid out to liquidity providers inflating supply.

Keep an eye out for emissions on these new protocols: scaling thoughtlessly could put $SPELL in the same situation as a month ago.

Keep an eye out for emissions on these new protocols: scaling thoughtlessly could put $SPELL in the same situation as a month ago.

Three major potential collabs are going on as well:

1. @AndreCronjeTech (founder of $CRV) is hinting at some type of 🐸 collab on FTM

2. @danielesesta is still talking about a $Sushi takeover

3. Dani is going on @UpOnlyTV with @cobie

1. @AndreCronjeTech (founder of $CRV) is hinting at some type of 🐸 collab on FTM

2. @danielesesta is still talking about a $Sushi takeover

3. Dani is going on @UpOnlyTV with @cobie

https://twitter.com/AndreCronjeTech/status/1472124649882497025?s=20

Next up is a cauldron for borrowing against $ETH at 0%. That will help with:

• TVL

• Stability

• Competition against $DAI

I still see Abra's main value prop as loans against yield-bearing assets. So I'm not a huge fan but I do see the benefits.

• TVL

• Stability

• Competition against $DAI

I still see Abra's main value prop as loans against yield-bearing assets. So I'm not a huge fan but I do see the benefits.

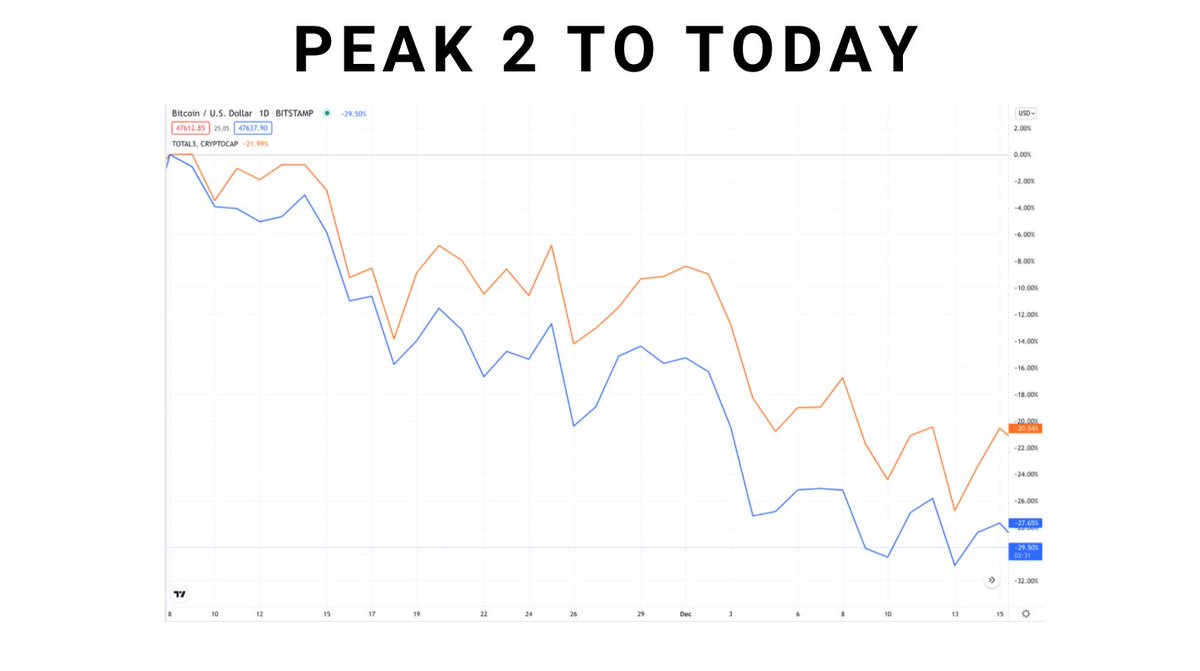

For price action, $SPELL has definitely reversed the trend and is strong against a downward-moving market.

Watch out for a knife fight at 2 cents, though. it's been a battleground in the past.

Watch out for a knife fight at 2 cents, though. it's been a battleground in the past.

Lightning round:

1. $UST cauldron coming on $FTM

2. Up to $4 billion in $MIM

3. Potential Polygon deployment

4. New round of buybacks/distributions just happened

5. Pilot program to allow democratization of cauldrons

1. $UST cauldron coming on $FTM

2. Up to $4 billion in $MIM

3. Potential Polygon deployment

4. New round of buybacks/distributions just happened

5. Pilot program to allow democratization of cauldrons

I think the price dump humbled the team and I see them running the protocol in a much more dynastic, long-term-thinking way than a month ago.

When it's all green, it's easy to be a hero.

When it's red, you've got to do something. And the team has weathered their first storm.

When it's all green, it's easy to be a hero.

When it's red, you've got to do something. And the team has weathered their first storm.

Where do I get my info?

1. @danielesesta, @0xM3rlin, @squirrelcrypto, @MIM_Spell

2. medium.com/abracadabra-mo…

3. dashboard.abracadabra.money

1. @danielesesta, @0xM3rlin, @squirrelcrypto, @MIM_Spell

2. medium.com/abracadabra-mo…

3. dashboard.abracadabra.money

If you'd like to support this type of in-depth analysis, please do me a few favors!

1. Give me follow: @JackNiewold. I tweet about small-cap alts.

2. Give the first tweet a like or RT, it's linked here👇

1. Give me follow: @JackNiewold. I tweet about small-cap alts.

2. Give the first tweet a like or RT, it's linked here👇

https://twitter.com/JackNiewold/status/1472636695279378436?s=20

And please check out my newsletter! We write in-depth, data-backed research on altcoins like $SPELL.

(we also caught $SPELL in early October)

Link here: cryptopragmatist.com/sign-up-twitte…

(we also caught $SPELL in early October)

Link here: cryptopragmatist.com/sign-up-twitte…

Correction: @AndreCronjeTech is the founder of Yearn, not Curve. Misspoke, my apologies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh