#Millwall 2020/21 financial results covered “a strong season, despite the challenges of the COVID-19 pandemic”, when they finished 11th in the Championship and reached the fourth round of the FA Cup and third round of the Carabao Cup. Some thoughts in the following thread.

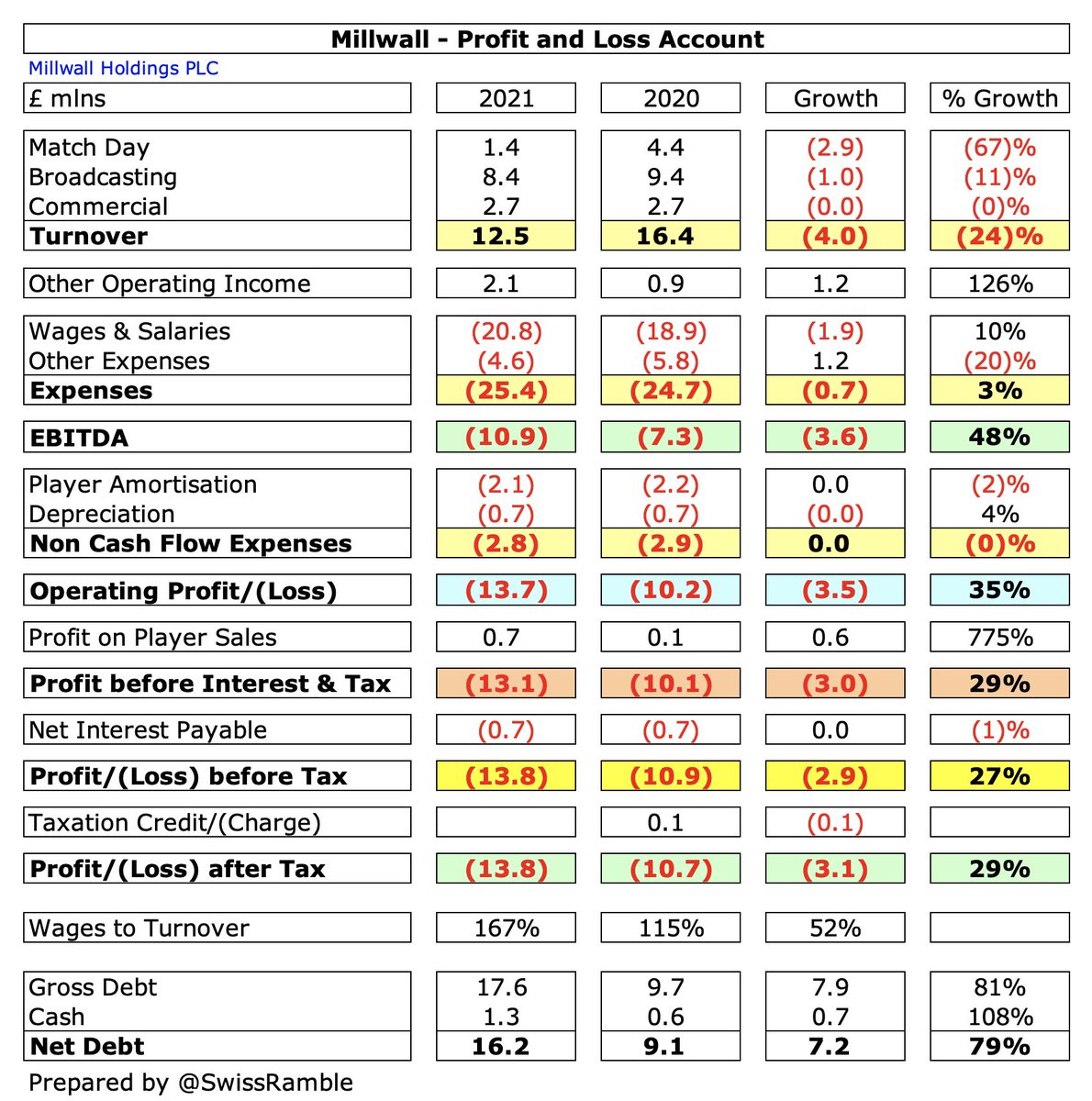

#Millwall pre-tax loss widened from £10.9m to £13.8m, largely due to revenue falling £3.9m (24%) from £16.4m to £12.5m, though operating expenses were up £0.7m (3%). Partly offset by profit on player sales increasing £0.6m to £0.7m and other income rising £1.2m to £2.1m.

#Millwall £4.0m revenue decrease was largely driven by match day falling £3.0m (67%) from £4.4m to £1.4m, as COVID meant games being played behind closed doors, while broadcasting also decreased £1.0m (11%) from £9.4m to £8.4m. Commercial income held steady at £2.7m.

Despite the revenue fall, #Millwall wage bill rose £1.9m (10%) from £18.9m to £20.8m, but other expenses were cut £1.2m (20%) to £4.6m, due to reduction in activity and close financial management. Player amortisation and depreciation were flat.

#Millwall £13.8m loss is not great, but it is still only mid-table in the Championship. As owner John Berylson said, “You have teams that are going to lose £20-30m this season – some were losing that before the pandemic.” Note: #NCFC profit boosted by £60m from player sales.

#Millwall profit was “significantly impacted” by COVID with total revenue loss to date estimated as £7m, including £6m in 2020/21, partly offset by iFollow streaming income and £1.4m staff furlough income.

#Millwall bottom line only benefited from £0.7m profit from player sales, though this was actually much higher than £76k in the prior season. Still the lowest reported in the Championship, far below the likes of #NCFC £60m, WBA £29m and Bristol City £26m.

#Millwall have not posted a profit in the last 10 years, losing £78m in this period. In fairness, their losses had been reducing (from £12m in 2015 to only £1m in 2019), but the onset of the pandemic (and a rising wage bill) has resulted in sizeable losses since then.

#Millwall have rarely made big money from player sales, only generating a profit above £0.5m once in the last 10 years: £5.4m in 2019, thanks to George Saville’s move to #Boro. Similar story this season with Jason McCarthy’s return to Wycombe the only noteworthy sale.

#Millwall operating loss (excluding player sales and interest) widened from £10.2m to £13.7m, as revenue fell, but expenses increased. Club’s worst ever performance, but actually one of the best results in the Championship, where most clubs operate at a significant loss.

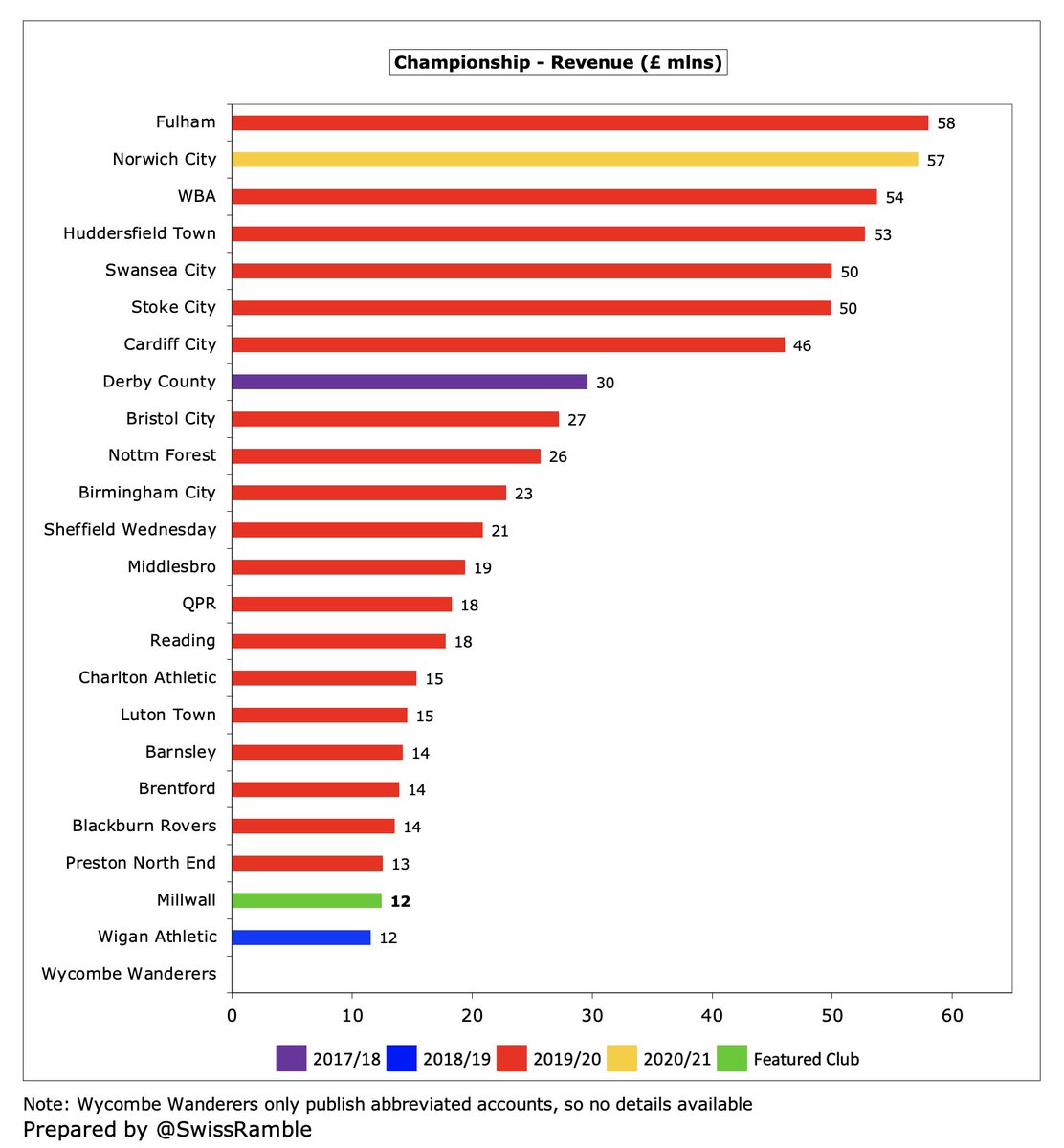

The impact of COVID means that #Millwall £12.5m revenue is their lowest since they were last in League One four years ago. It has dropped by a third since their pre-pandemic £18.4m peak in 2019, which was also boosted by the run to FA Cup quarter-finals.

#Millwall £12.5m revenue is one of the smallest in the Championship, significantly below clubs in receipt of parachute payments, e.g. #NCFC £57m, though others will see similar revenue reductions when they publish 2020/21 accounts with a full season of COVID.

#Millwall chief executive Steve Kavanagh said, “The quality and wealth of many of the clubs playing in the Championship continued to rise, with an increasing number of clubs in receipt of parachute payments from the Premier League”, worth £43m in first season after relegation.

Kavanagh added, “The impact (of parachute payments) is to increase both the value of transfer fees and player salaries meaning that, despite the investment made by #Millwall, it continues not to match the level of salary costs of many clubs in the league.”

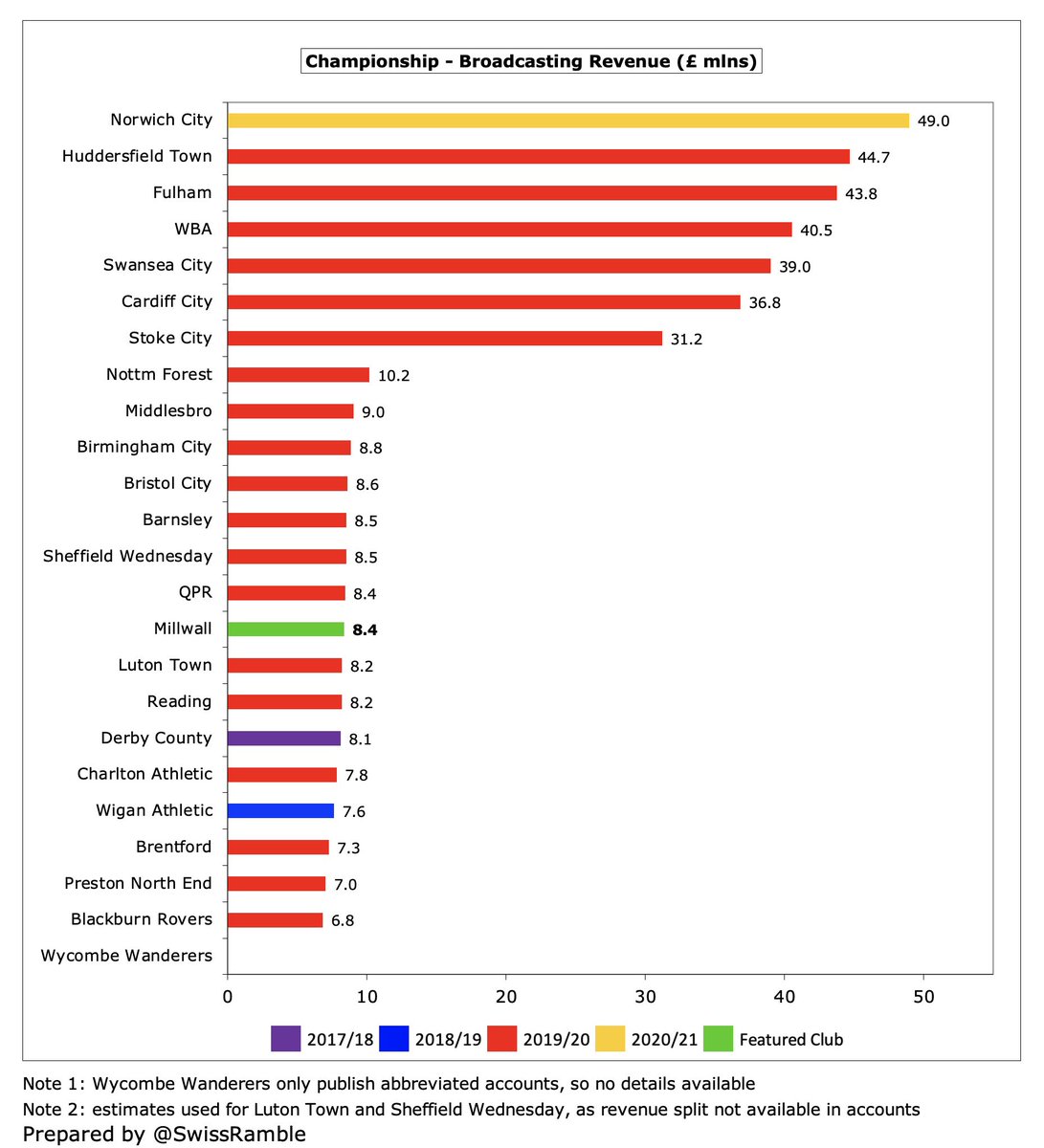

#Millwall broadcasting income fell by £1.0m (11%) from £9.4m to £8.4m, due to COVID impact, having peaked at £10.0m in 2018 due to FA Cup money. Most Championship clubs earn £7-9m from TV, but there is a massive gap to clubs with parachute payments.

#Millwall match day income fell £3.0m (67%) from £4.4m to £1.4m, as all home games were played behind closed doors because of the pandemic (except 2 with highly restricted numbers). Even before the drop, crowds were firmly in the bottom half of the Championship.

#Millwall will be happy that grounds returned to full capacity at the start of 2021/22 season. Their 13,734 average attendance in 2019/20 (for games played with fans) was one of the lowest in the Championship, but was club’s highest since they were in the top flight in 1988/89.

Despite the challenges posed by the pandemic, #Millwall commercial income was unchanged at £2.7m. This was a decent achievement, but this is still one of the lowest in the Championship, miles below the likes of Bristol City and Stoke City (around £14m).

#Millwall shirt sponsor is Huski Chocolate, who signed a five-year agreement in 2019/20 for “the biggest deal in the club’s history”. Macron has been the kit supplier since 2018. Mansionbet increased their sponsorship agreement in 2020/21.

#Millwall other operating income increased from £0.9m to £2.1m, including staff furlough income £1.4m, donations £0.3m, loan fees £0.2m and other income £0.1m. Note: #HTAFC sizeable £6.3m in 2019/20 included £5.7m from player loans.

Despite the revenue fall, #Millwall wage bill rose £1.9m (10%) from £18.9m to £20.8m, reflecting investment into the playing squad and football management team. Wages have more than doubled since promotion to the Championship from £9.4m paid in League One in 2017.

Even after the growth #Millwall £21m wage bill is still very much on the low side in the Championship. It is obviously much smaller than clubs benefiting from parachute payments, e.g. #NCFC £67m in 2020/21, though also a full £5m less than the club above them, #BRFC £26m.

#Millwall wages to turnover ratio increased from 115% to 167%, which is not great, though is clearly impacted by COVID. Also, most clubs in the ultra-competitive Championship have ratios above 100%, i.e. much worse than UEFA’s recommended 70% upper limit.

#Millwall total directors’ remuneration rose 21% from £312k to £377k, but this was still a fair bit lower than the likes of Birmingham City £1.6m, Fulham £948k, Stoke City £834k and Cardiff City £712k.

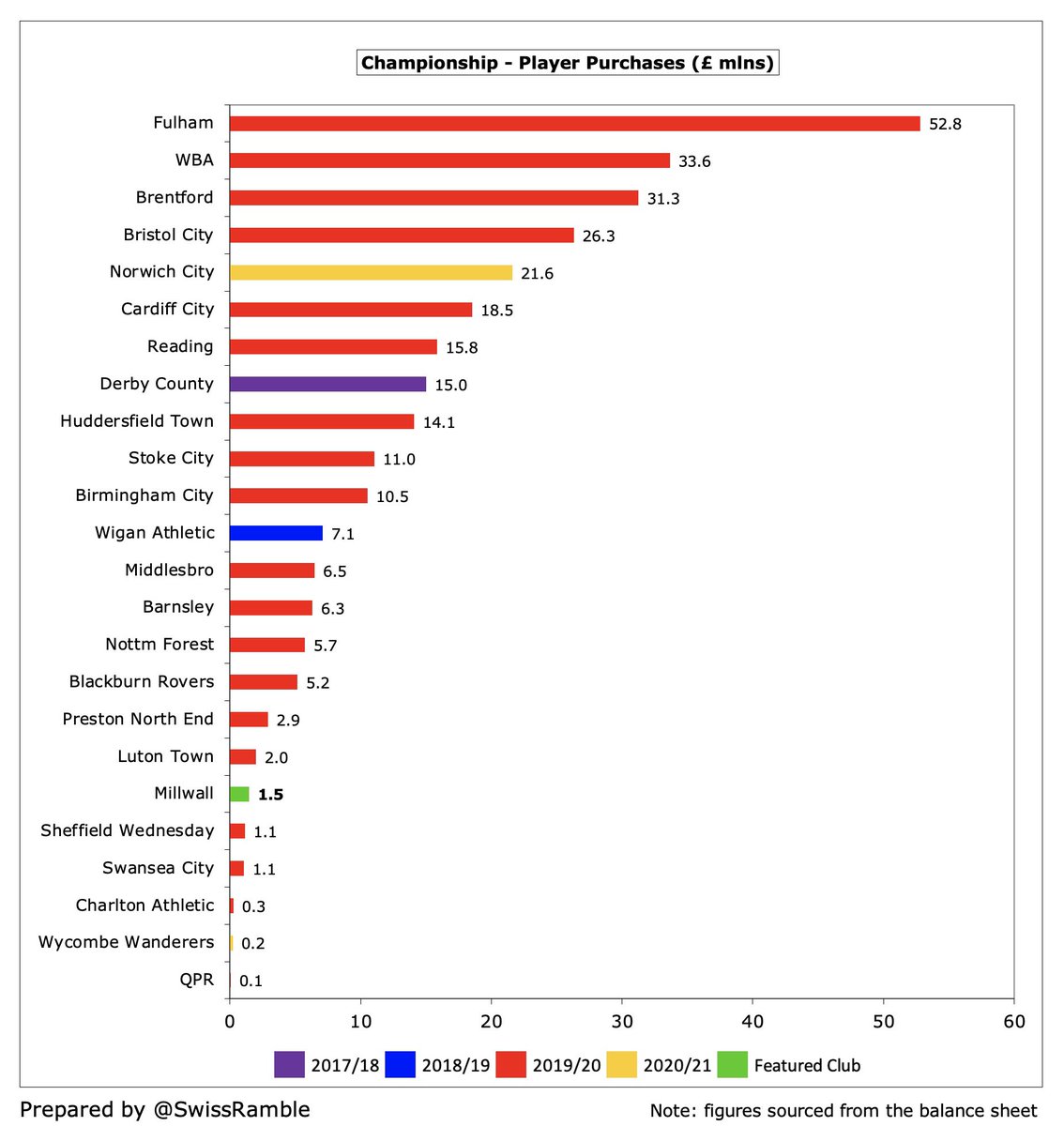

#Millwall player amortisation, the annual charge to expense transfer fees over a player’s contract, fell slightly to £2.1m, miles below the likes of #FFC £40m and Stoke City £30m, highlighting the club’s philosophy of developing home grown players from the academy.

Indeed #Millwall £1.5m expenditure on player purchases in 2020/21 was one of the lowest in the Championship, paling into insignificance compared to recruitment at clubs relegated from the top flight, e.g. #FFC £53m and WBA £34m (both in 2019/20).

The small transfer spend is nothing new for #Millwall. Even if gross spend has increased in the last 5 years, the annual average is still less than £2m. The objective seems to be to balance the books, leading to a low number of senior players compared to other clubs.

#Millwall gross debt increased from £10m to £18m, due to a new £8m EFL loan, repayable over next 3 seasons, which was used to repay money owed to HMRC. Loan notes from the owners remain £10m, though repayment has been extended again to July 2023.

#Millwall £18m gross debt is very small compared to many other clubs in the Championship, e.g. Stoke City £187m and #BRFC £156m, though would be much higher without the owners effectively writing-off £30m by waiving interest and converting loans into equity.

Although debt is high in the Championship, most of it is provided by owners who charge little or no interest. #Millwall chairman John Berylson’s company CHV charges 12% a year on the loan notes, but interest payments have been frequently suspended.

Furthermore, #Millwall have no transfer debt, i.e. outstanding stage payments. Few Championship clubs owe large amounts for transfers, though there are some notable exceptions, such as #FFC £86m and #MCFC £23m.

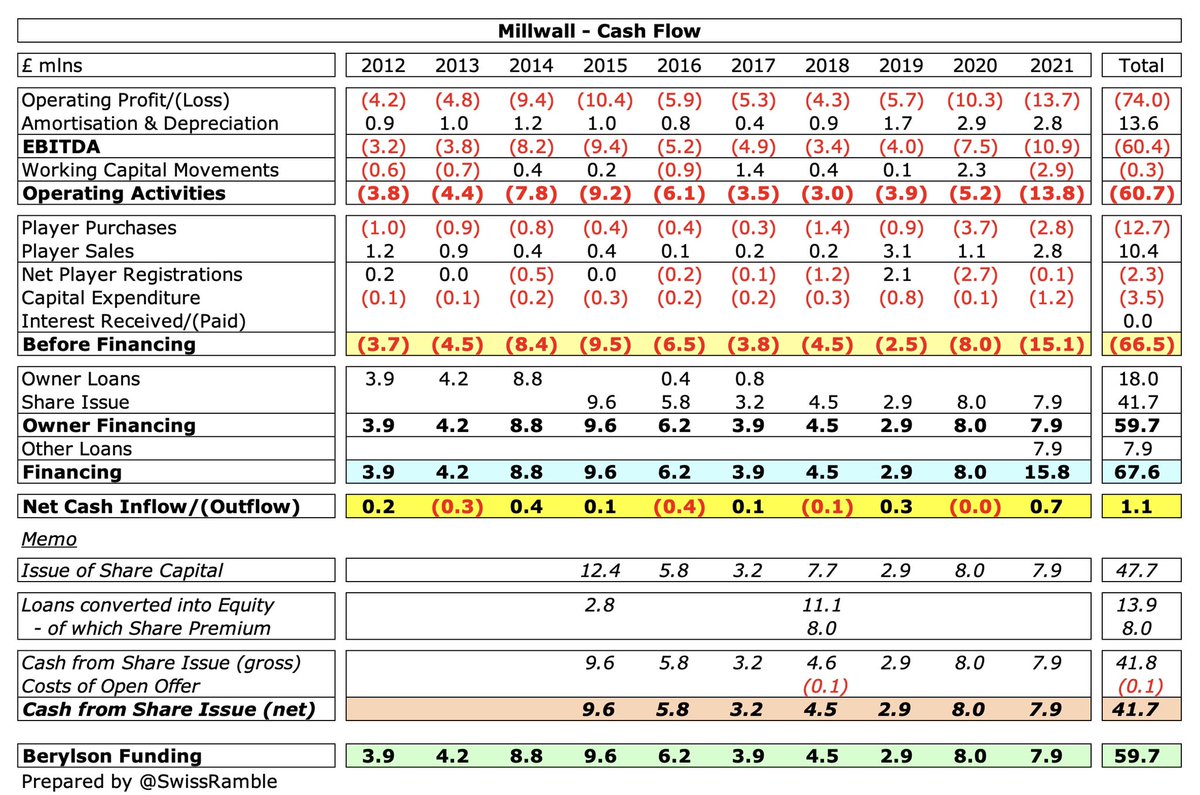

#Millwall had £13.8m negative operating cash flow in 2020/21 before breaking-even on player purchases and sales, though then had £1.2m capital expenditure. The £15m deficit was funded by Berylson issuing £7.9m of shares plus a loan from EFL, also for £7.9m.

As a result, #Millwall cash balance increased from £0.6m to £1.3m, which is not that much, but the reality is that most clubs in the Championship have less than £2m in the bank, relying on money from their owners.

In fact, #Millwall owners have provided £60m of funding in last 10 years (£42m share capital and £18m loans). Almost entirely used to cover the club’s operating losses with very little spent on infrastructure (£3m) or player purchases – only £2m (net of sales).

In fairness, owner financing is nothing unusual in the Championship with #Millwall £8m in 2020/21 being nowhere near the most. For example, in 2019/20 the highest amounts of funding came at #FFC £78m, Bristol City £59m, Stoke City £46m and Reading £38m.

#Millwall have noted that the club is “well within” the £39m losses allowed over the 3-year monitoring period for Profitability and Sustainability (FFP) rules, even before permitted deductions for academy, community and infrastructure.

#Millwall’s best opportunity to generate more revenue is by developing the land adjoining the stadium. They have a regeneration plan to create affordable housing, student accommodation, retail and office space, a hotel and conference centre plus a stadium expansion.

The good news for the club is that an agreement has been reached with Lewisham council, with the threat of Compulsory Purchase Orders being removed, so #Millwall’s scheme to transform the area around the stadium can go ahead, albeit delayed by the pandemic.

#Millwall continue to punch well above their weight in the Championship, given their relatively low revenue and wages, though it is clear that Berylson will have to continue funding the club’s losses, especially while the effects of COVID continue to be felt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh