#Bitcoin $BTC update - HTF picture

1/25

The recent move above 51k was encouraging as we have left the major downtrend.

What is next?

A) TA Update

B) S2N Update

C) On-chain metrics

D) Derivatives/Leverage

F) Macro

🧵

1/25

The recent move above 51k was encouraging as we have left the major downtrend.

What is next?

A) TA Update

B) S2N Update

C) On-chain metrics

D) Derivatives/Leverage

F) Macro

🧵

2/25

1) TA Update

The chart above uses a little "trick". Instead of using the a often quite noisy 4h-1d candlestick chart I sometimes use a rolling 24h chart based on a 4h chart that nicely reduces the noise and provides a clear picture of market structure.

1) TA Update

The chart above uses a little "trick". Instead of using the a often quite noisy 4h-1d candlestick chart I sometimes use a rolling 24h chart based on a 4h chart that nicely reduces the noise and provides a clear picture of market structure.

3/25

There is a nice break of the recent downtrend that was supported by a break in momentum trend as shown by S2N ratio in the second chart. The change in momentum often leads the price change as also seen in July. Pinned tweet shows it called the bottom correctly in July.

There is a nice break of the recent downtrend that was supported by a break in momentum trend as shown by S2N ratio in the second chart. The change in momentum often leads the price change as also seen in July. Pinned tweet shows it called the bottom correctly in July.

4/25

The key question is now, how strong this move can be and when is that decided.

Looking also at the lower chart that shows the volume oscillator, it is obvious that the area of 52-54k has recently and also during the September sell-off seen huge sell volumes.

The key question is now, how strong this move can be and when is that decided.

Looking also at the lower chart that shows the volume oscillator, it is obvious that the area of 52-54k has recently and also during the September sell-off seen huge sell volumes.

5/25

At those points a lot of liquidity was released, esp. recently that led to strong liquidations. I therefore think if we cross these levels with a decisive move, we would be able to revisit old ATHs pretty soon.

At those points a lot of liquidity was released, esp. recently that led to strong liquidations. I therefore think if we cross these levels with a decisive move, we would be able to revisit old ATHs pretty soon.

6/25

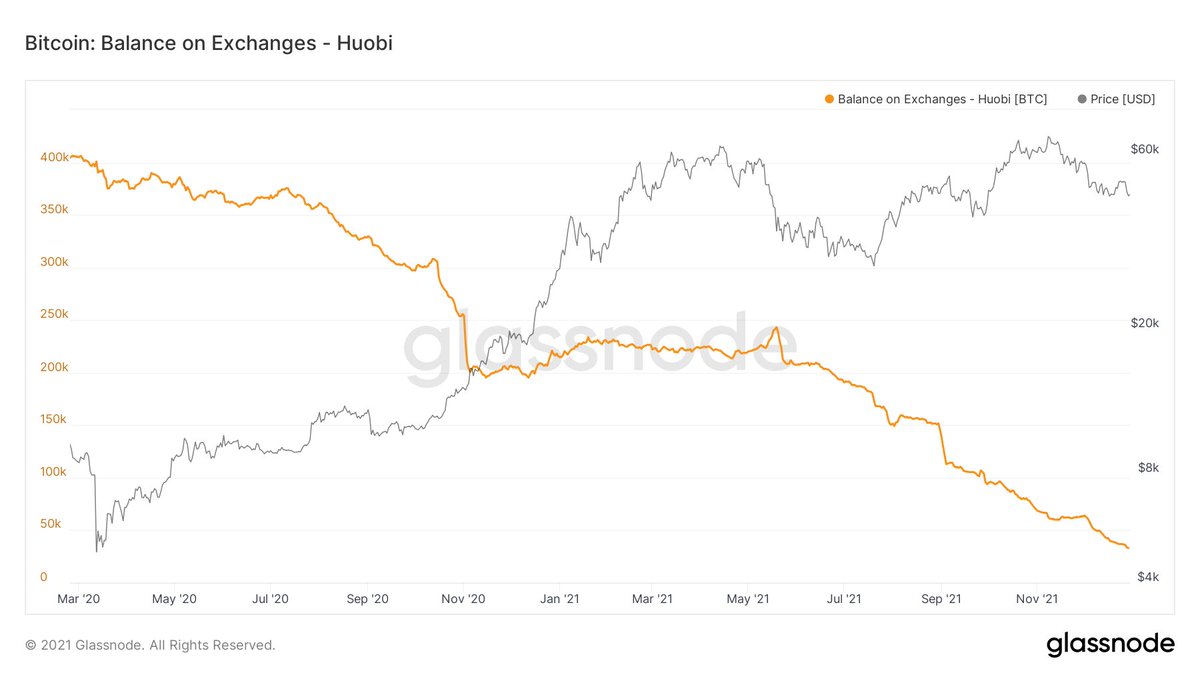

AS @lightcrypto and @QCPCapital have explained in great threads, a lot of the selling was de-risking towards the YE and selling out of China connected to some ban-related deadlines at certain exchanges.

AS @lightcrypto and @QCPCapital have explained in great threads, a lot of the selling was de-risking towards the YE and selling out of China connected to some ban-related deadlines at certain exchanges.

7/25

This selling could therefore be a one-time event and is already done, so chances are good these levels are less of a resistance than they just purely technically would be.

This selling could therefore be a one-time event and is already done, so chances are good these levels are less of a resistance than they just purely technically would be.

8/25

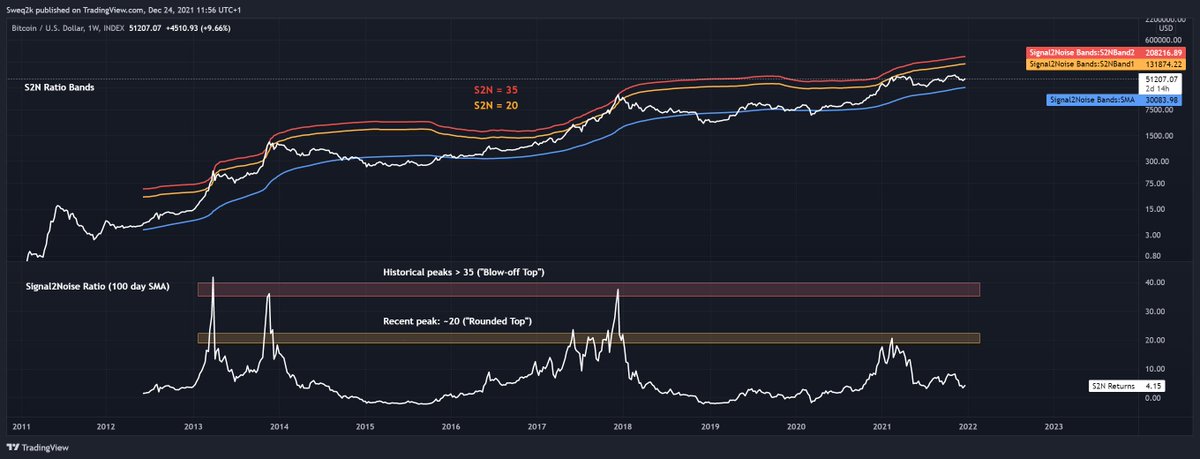

B) S2N Update

Current S2N Ratio: 4.15x

in % of "Blow-off top" S2N values: 12%

in % of "2021 Top" S2N values: 21%

As of TODAY the price of $BTC could be at

USD 131,874 for a S2N peak value of ~20x as in Feb 2021.

B) S2N Update

Current S2N Ratio: 4.15x

in % of "Blow-off top" S2N values: 12%

in % of "2021 Top" S2N values: 21%

As of TODAY the price of $BTC could be at

USD 131,874 for a S2N peak value of ~20x as in Feb 2021.

9/25

The almost 3 Quarters of consolidations have led to a cooling off of $BTC vs its longer term trend. A similar trend deviation as earlier this year "allows" a price of over 130k, so if we revisit old ATHs, there is no "overheating" and we could go way further!

The almost 3 Quarters of consolidations have led to a cooling off of $BTC vs its longer term trend. A similar trend deviation as earlier this year "allows" a price of over 130k, so if we revisit old ATHs, there is no "overheating" and we could go way further!

10/25

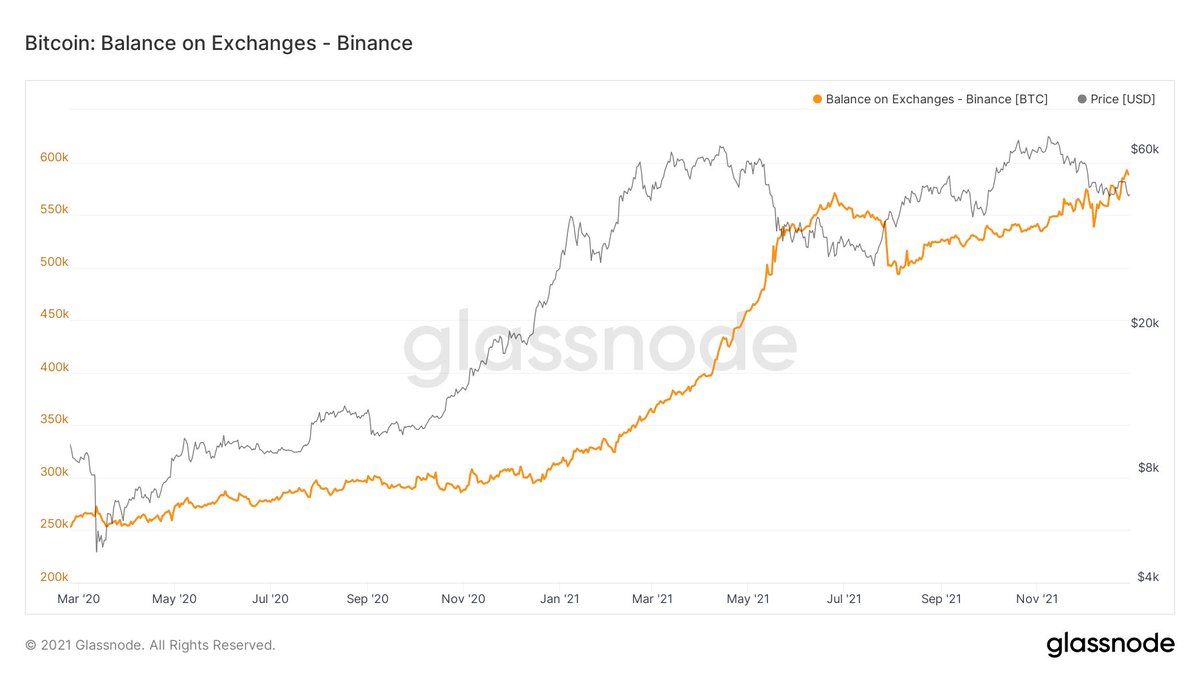

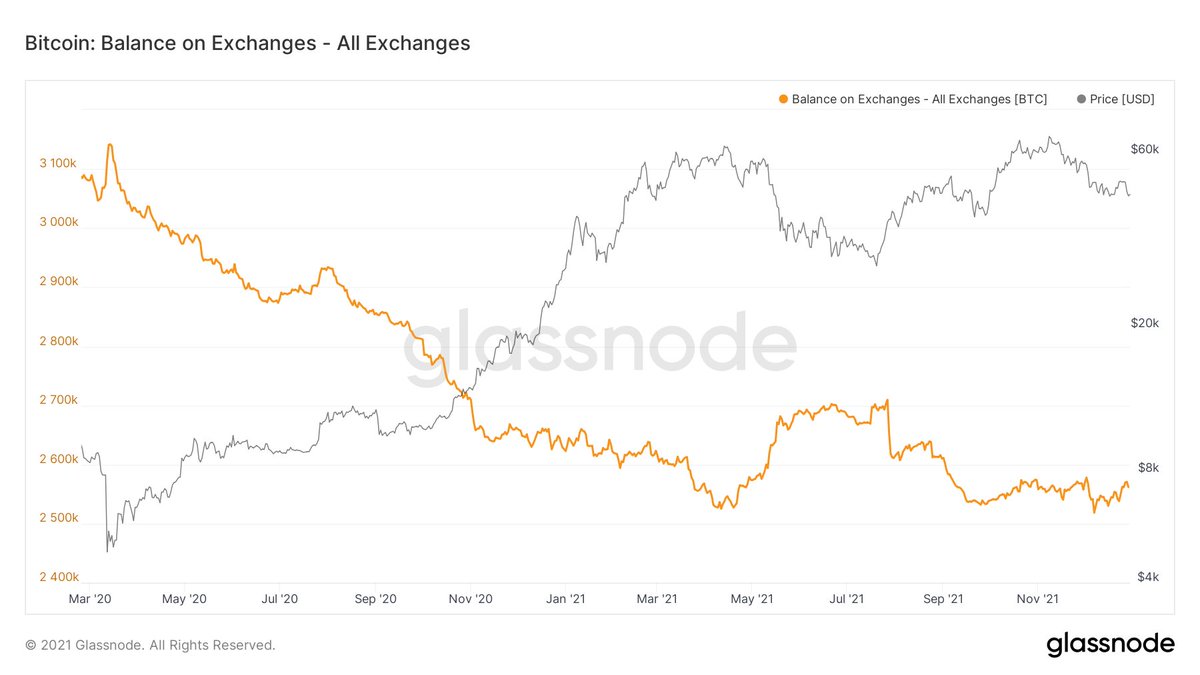

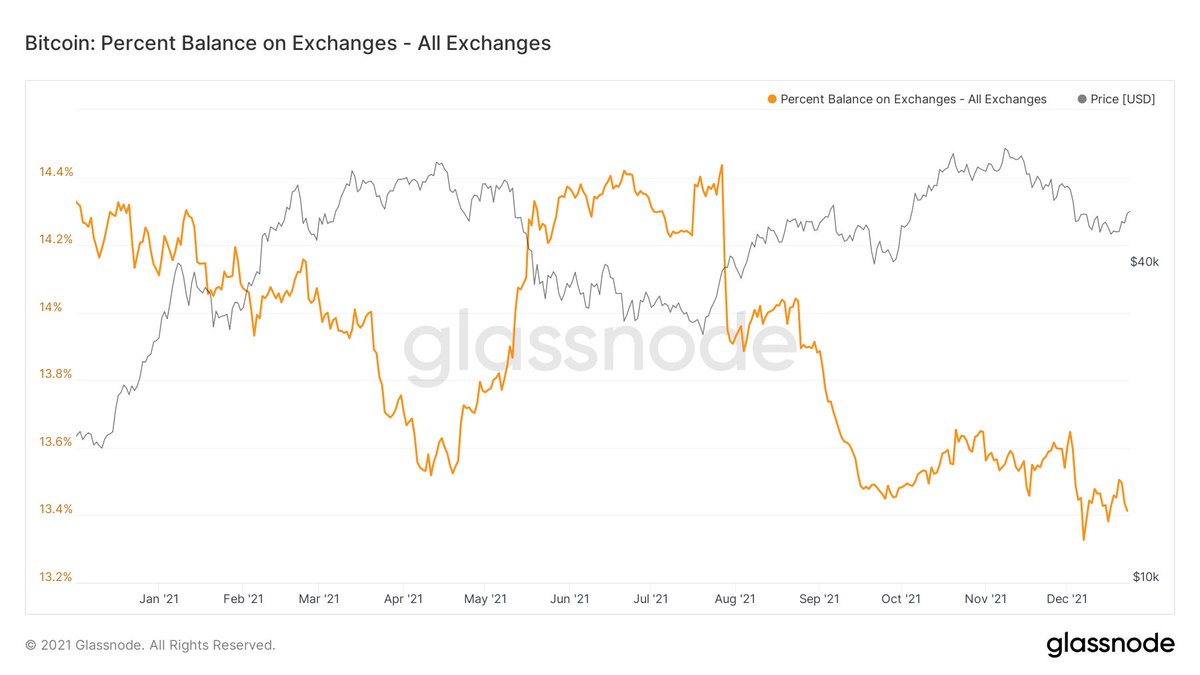

C) On-chain metrics

i) Exchange balances are still declining, despite a small recent bounce, this is positive

C) On-chain metrics

i) Exchange balances are still declining, despite a small recent bounce, this is positive

11/25

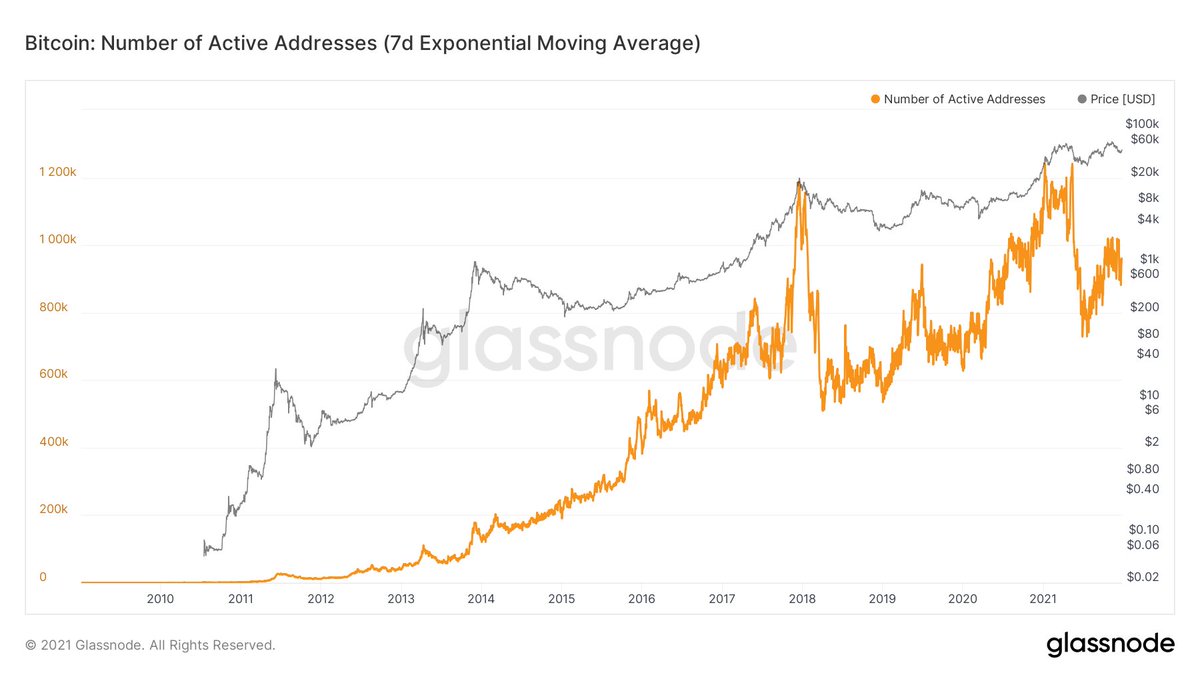

ii) Number of active addresses slighly declining, would like to see this picking up for a stronger sustained move, activity is important! --> neutral to negative

ii) Number of active addresses slighly declining, would like to see this picking up for a stronger sustained move, activity is important! --> neutral to negative

12/25

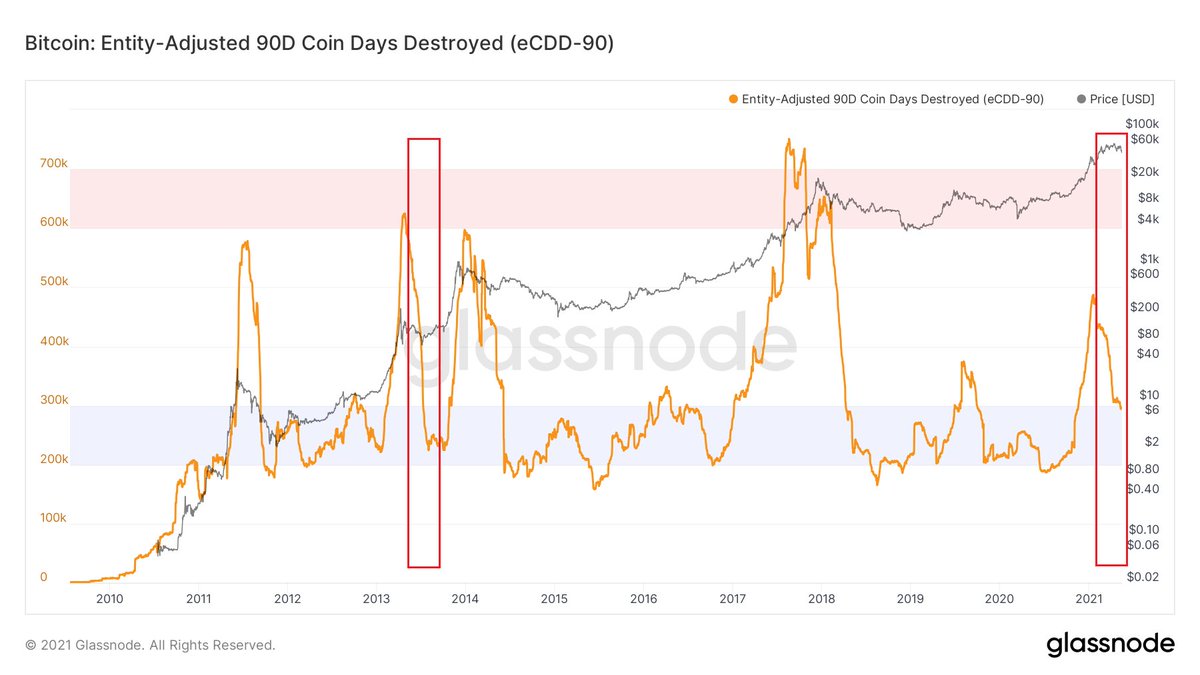

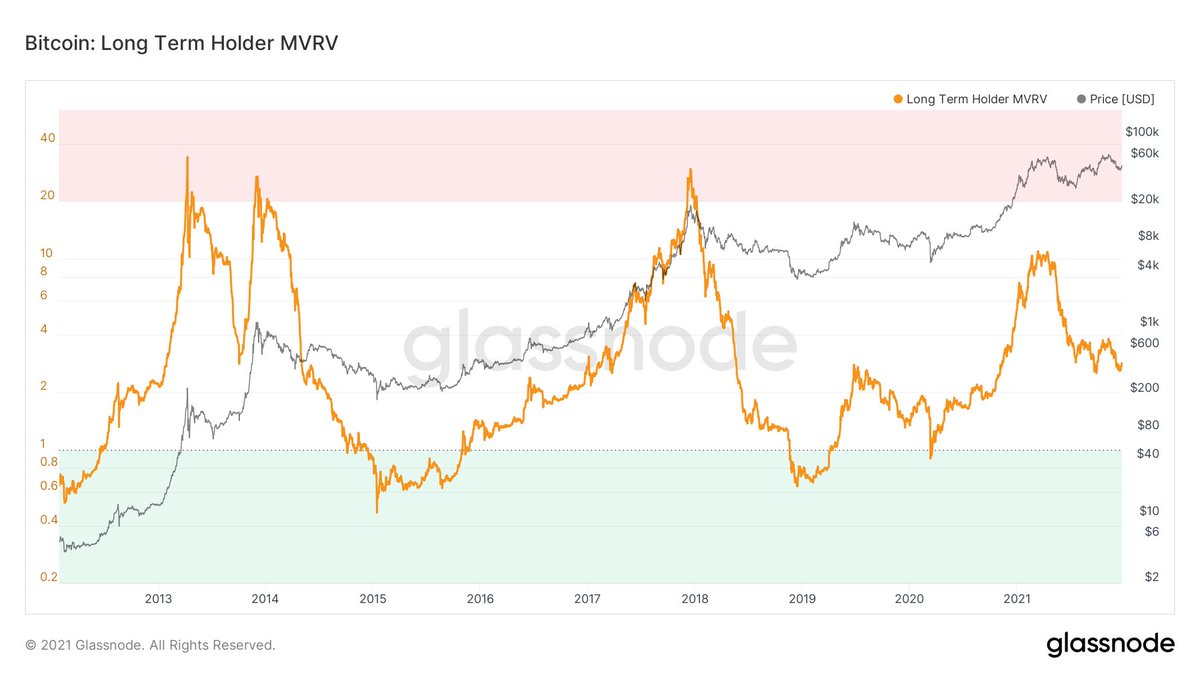

iii) Long term holder market value to realized value. Similar picture as S2N above. The same level back in 2020 was way below 20k! --> positive

iii) Long term holder market value to realized value. Similar picture as S2N above. The same level back in 2020 was way below 20k! --> positive

13/25

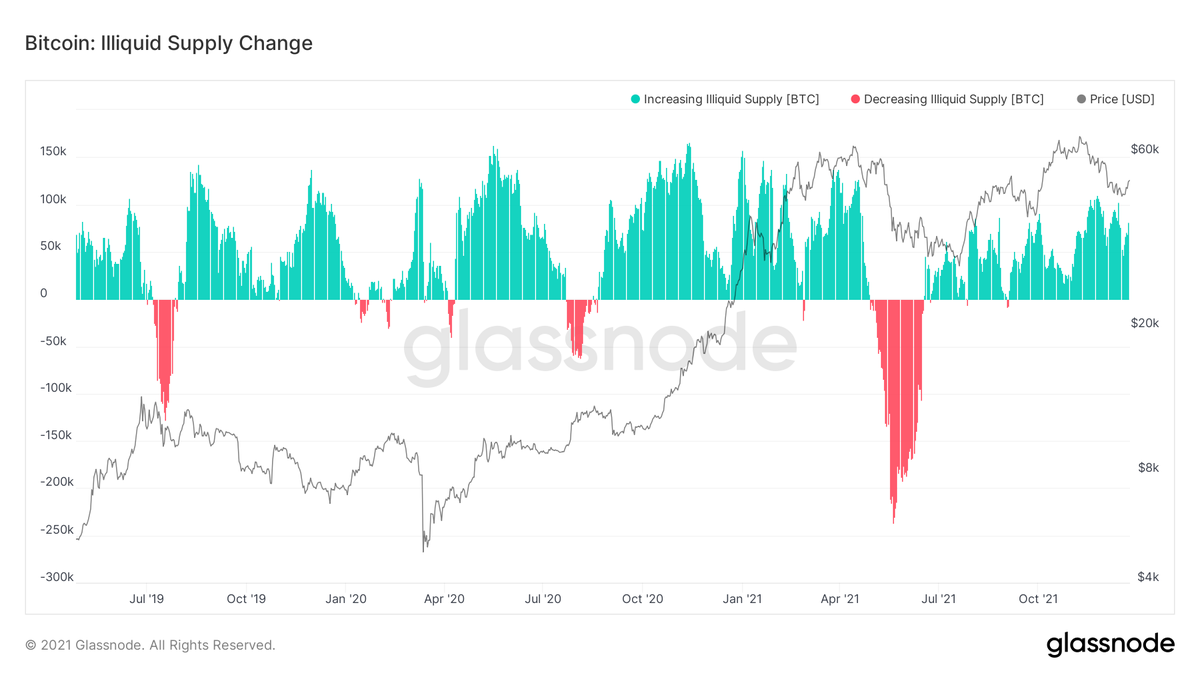

iv) Illiquid supply: Accounts with more inflows than outflows (illiquid supply), which you can interpret as the non-trading, longer-term holder, is increasing AND is increasing during the recent dip. Compare this to May where this metric went negative. --> Positive

iv) Illiquid supply: Accounts with more inflows than outflows (illiquid supply), which you can interpret as the non-trading, longer-term holder, is increasing AND is increasing during the recent dip. Compare this to May where this metric went negative. --> Positive

14/25

So on-chain wise we are at a good spot and have "room to run" until the market is regarded as oversold and the distribution process of LTH starts. But activity and volume need to pick up for a really strong rally.

So on-chain wise we are at a good spot and have "room to run" until the market is regarded as oversold and the distribution process of LTH starts. But activity and volume need to pick up for a really strong rally.

15/25

D) Derivatives and funding

I know one can go really deep here into various sub-segments, but as I'm not trading, I just reflect briefly on this topic on a more aggregated level.

D) Derivatives and funding

I know one can go really deep here into various sub-segments, but as I'm not trading, I just reflect briefly on this topic on a more aggregated level.

16/25

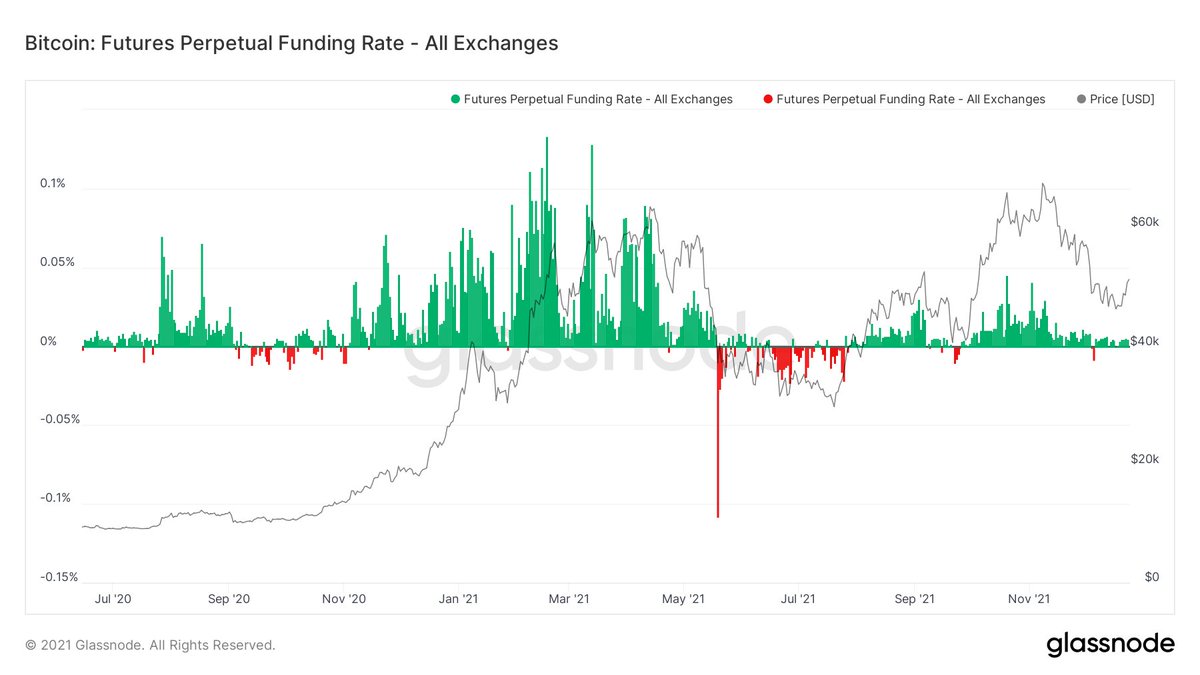

Overall funding rate looks very reasonable, which is not a surprise after the correction and the current sentiment.

Overall funding rate looks very reasonable, which is not a surprise after the correction and the current sentiment.

17/25

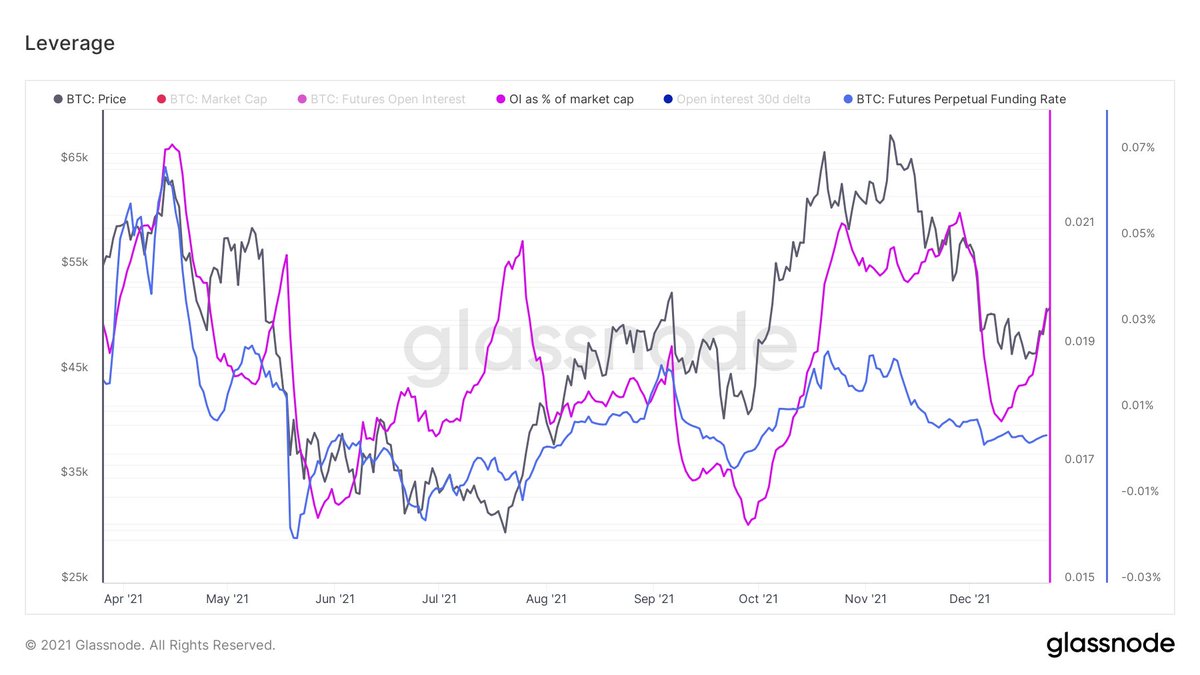

Looking at OI as % of market cap, what you can interpret as a total leverage, has already picked up.

We had a strong pick-up in July, with a decreasing funding rate, so massive shorts were built that got then squeezed.

Looking at OI as % of market cap, what you can interpret as a total leverage, has already picked up.

We had a strong pick-up in July, with a decreasing funding rate, so massive shorts were built that got then squeezed.

18/25

In late November the positioning was extreme long with funding and OI high. The bump in OI with crushing funding speaks for shorts building ahead of the dump.

In late November the positioning was extreme long with funding and OI high. The bump in OI with crushing funding speaks for shorts building ahead of the dump.

19/25

Now the increase of OI is not that strong and the funding remained flat, so - in aggregate - I conclude that we are not in extreme position.

Now the increase of OI is not that strong and the funding remained flat, so - in aggregate - I conclude that we are not in extreme position.

20/25

F) Macro

The most difficult one obviously and I keep this short as I do not have a crystal ball.

First: Omicron. I think it becomes evident that the variant is less severe despite spreading rapidly, so I do not expect a super negative impact from it.

F) Macro

The most difficult one obviously and I keep this short as I do not have a crystal ball.

First: Omicron. I think it becomes evident that the variant is less severe despite spreading rapidly, so I do not expect a super negative impact from it.

21/25

Scenario 1: Inflation runs further high and the Fed is speeding up with tapering and rate hikes. This would be bad for risk assets.

Scenario 2: Inflation and growth have peaked and will come down quicker than anticipated in the US, while China is starting to fire up.

Scenario 1: Inflation runs further high and the Fed is speeding up with tapering and rate hikes. This would be bad for risk assets.

Scenario 2: Inflation and growth have peaked and will come down quicker than anticipated in the US, while China is starting to fire up.

22/25

China's credit impulse might start to increase which would be especially good for the Asian region and risk taking from there.

China's credit impulse might start to increase which would be especially good for the Asian region and risk taking from there.

https://twitter.com/macro_daily/status/1473704859107012609?s=20

23/25

If the FED is not forced to act quicker due to the slowing inflation and growth, while China is starting to awake, we could see a less severe / later policy action + USD falling + global risk ok.

This scenario would be positive for risk assets! (But also bumpy...)

If the FED is not forced to act quicker due to the slowing inflation and growth, while China is starting to awake, we could see a less severe / later policy action + USD falling + global risk ok.

This scenario would be positive for risk assets! (But also bumpy...)

24/25

I'm leaning towards scenario 2 generally and also because I think Scenario 1 is consensus and I like to be contrarian 😂

I'm leaning towards scenario 2 generally and also because I think Scenario 1 is consensus and I like to be contrarian 😂

25/25

Summary:

A) TA --> Supportive, > 54k important step

B) S2N --> Supportive

C) On-chain metrics --> Supportive

D) Derivatives/Leverage --> Neutral

F) Macro --> We will see, pot. positive surprise

Merry X-Mas!

Summary:

A) TA --> Supportive, > 54k important step

B) S2N --> Supportive

C) On-chain metrics --> Supportive

D) Derivatives/Leverage --> Neutral

F) Macro --> We will see, pot. positive surprise

Merry X-Mas!

As always, pls retweet if you like!

• • •

Missing some Tweet in this thread? You can try to

force a refresh