𝐓𝐡𝐞 𝟓𝟐-𝐖𝐞𝐞𝐤 𝐈𝐧𝐝𝐞𝐱 𝐒𝐜𝐚𝐧𝐧𝐞𝐫 📊

A THREAD 🧵

Please Like & RT this if you find value 🙏

The 52-week index filter on @screener_in is one of the most effective ways to filter out stocks for #equity segment.

Here's how it can help you 👇

A THREAD 🧵

Please Like & RT this if you find value 🙏

The 52-week index filter on @screener_in is one of the most effective ways to filter out stocks for #equity segment.

Here's how it can help you 👇

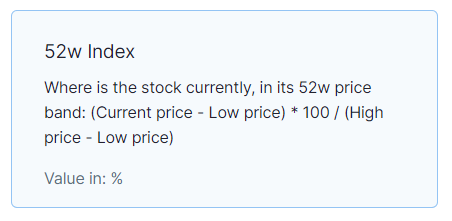

1/ The 52-week index is simply a stock in its 52-week band.

The formula is:

(𝘊𝘶𝘳𝘳𝘦𝘯𝘵 𝘱𝘳𝘪𝘤𝘦 - 𝘓𝘰𝘸 𝘱𝘳𝘪𝘤𝘦) * 100 / (𝘏𝘪𝘨𝘩 𝘱𝘳𝘪𝘤𝘦 - 𝘓𝘰𝘸 𝘱𝘳𝘪𝘤𝘦)

𝗩𝗮𝗹𝘂𝗲 𝗶𝗻 %

The formula is:

(𝘊𝘶𝘳𝘳𝘦𝘯𝘵 𝘱𝘳𝘪𝘤𝘦 - 𝘓𝘰𝘸 𝘱𝘳𝘪𝘤𝘦) * 100 / (𝘏𝘪𝘨𝘩 𝘱𝘳𝘪𝘤𝘦 - 𝘓𝘰𝘸 𝘱𝘳𝘪𝘤𝘦)

𝗩𝗮𝗹𝘂𝗲 𝗶𝗻 %

2/ Now you may ask what is the 𝟱𝟮-𝘄𝗲𝗲𝗸 𝗯𝗮𝗻𝗱?

Lets understand this with an example -

Take this example of #Birlasoft.

Current Price= ₹531

52-Week High= ₹538

52-Low= ₹216

So, its 𝟱𝟮-𝘄𝗲𝗲𝗸 𝗯𝗮𝗻𝗱 comes at -

= (531-216)/(538-216)*100

= 97.5%

Lets understand this with an example -

Take this example of #Birlasoft.

Current Price= ₹531

52-Week High= ₹538

52-Low= ₹216

So, its 𝟱𝟮-𝘄𝗲𝗲𝗸 𝗯𝗮𝗻𝗱 comes at -

= (531-216)/(538-216)*100

= 97.5%

3/ What does this mean?

Basically, we want to look at stocks that are in the top half of their 52-week band (the highlighted area in the diagram) or within 75% of its 𝟱𝟮-𝘄𝗲𝗲𝗸 𝗯𝗮𝗻𝗱.

Basically, we want to look at stocks that are in the top half of their 52-week band (the highlighted area in the diagram) or within 75% of its 𝟱𝟮-𝘄𝗲𝗲𝗸 𝗯𝗮𝗻𝗱.

4/ The main reason we want to select these stocks are because we want stocks wherein the demand is more than its supply.

A stock within its 52-week band means that buyers are still activated here. This simply shortens our filtering process.

A stock within its 52-week band means that buyers are still activated here. This simply shortens our filtering process.

6/ This isn't perfect but it gives you with around 200 names during the weekend, you have to go through them manually and trade stocks that are outperforming the broader #NIFTY500 and breaking out of sound technical structures.

7/ The best thing about this is that it gives us stocks to trade that are structurally quite good (HH-HL).

ᴛʜᴀɴᴋ ʏᴏᴜ!♥️

𝐑𝐞𝐭𝐰𝐞𝐞𝐭 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐭𝐰𝐞𝐞𝐭 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐡𝐫𝐞𝐚𝐝 𝐟𝐨𝐫 𝐛𝐞𝐭𝐭𝐞𝐫 𝐫𝐞𝐚𝐜𝐡. ✊

ᴛʜᴀɴᴋ ʏᴏᴜ!♥️

𝐑𝐞𝐭𝐰𝐞𝐞𝐭 𝐭𝐡𝐞 𝐟𝐢𝐫𝐬𝐭 𝐭𝐰𝐞𝐞𝐭 𝐢𝐧 𝐭𝐡𝐢𝐬 𝐭𝐡𝐫𝐞𝐚𝐝 𝐟𝐨𝐫 𝐛𝐞𝐭𝐭𝐞𝐫 𝐫𝐞𝐚𝐜𝐡. ✊

• • •

Missing some Tweet in this thread? You can try to

force a refresh