Teaching People The Basics Of Investing

A short thread featuring my friend @Gautam__Baid, and his approach to this difficult problem

A short thread featuring my friend @Gautam__Baid, and his approach to this difficult problem

Suppose your friend Bob is new to investing.

He has just opened a Robinhood account.

But he has no knowledge of the fundamental concepts of investing -- how to analyze companies, how to pick stocks, etc.

Over time, Bob wants to learn these things.

How would you help him?

He has just opened a Robinhood account.

But he has no knowledge of the fundamental concepts of investing -- how to analyze companies, how to pick stocks, etc.

Over time, Bob wants to learn these things.

How would you help him?

Well, there are tons of good resources that Bob can use to pick up the basics of investing.

There are excellent books.

Buffett's shareholder letters.

Lots of great YouTube videos.

Blogs.

Twitter threads.

Podcasts.

Etc.

There are excellent books.

Buffett's shareholder letters.

Lots of great YouTube videos.

Blogs.

Twitter threads.

Podcasts.

Etc.

But the sheer volume of material is overwhelming.

At this stage, Bob cannot distinguish the good stuff from the not-so-good.

He also doesn't know which material is "at his level" and which is too advanced.

And he doesn't have unlimited time on his hands to figure this all out.

At this stage, Bob cannot distinguish the good stuff from the not-so-good.

He also doesn't know which material is "at his level" and which is too advanced.

And he doesn't have unlimited time on his hands to figure this all out.

What Bob needs is a *curator*.

That is, an expert investor has to look at all this material in the shoes of a newbie like Bob.

Then, this investor has to pick and choose, arrange this material, and join the dots in a way that gives Bob maximum knowledge per unit of time spent.

That is, an expert investor has to look at all this material in the shoes of a newbie like Bob.

Then, this investor has to pick and choose, arrange this material, and join the dots in a way that gives Bob maximum knowledge per unit of time spent.

My friend @Gautam__Baid thinks he can be this curator.

He's an expert investor.

Everyday, he reads, watches, and listens to tons of stuff on investing.

And through writing his book, The Joys Of Compounding, he's developed a feel for how to explain investing to non-experts.

He's an expert investor.

Everyday, he reads, watches, and listens to tons of stuff on investing.

And through writing his book, The Joys Of Compounding, he's developed a feel for how to explain investing to non-experts.

The other thing Bob needs is a teacher.

Someone Bob can talk to. Ask questions of. Clarify his understanding with. Etc.

And @Gautam__Baid believes he can play that role as well.

Someone Bob can talk to. Ask questions of. Clarify his understanding with. Etc.

And @Gautam__Baid believes he can play that role as well.

So, here's @Gautam__Baid's idea to help people learn the basics of investing.

First, Gautam curates a *learning list* -- a set of high quality investing resources.

These are generally available for free online: articles, YouTube videos, blog posts, etc.

First, Gautam curates a *learning list* -- a set of high quality investing resources.

These are generally available for free online: articles, YouTube videos, blog posts, etc.

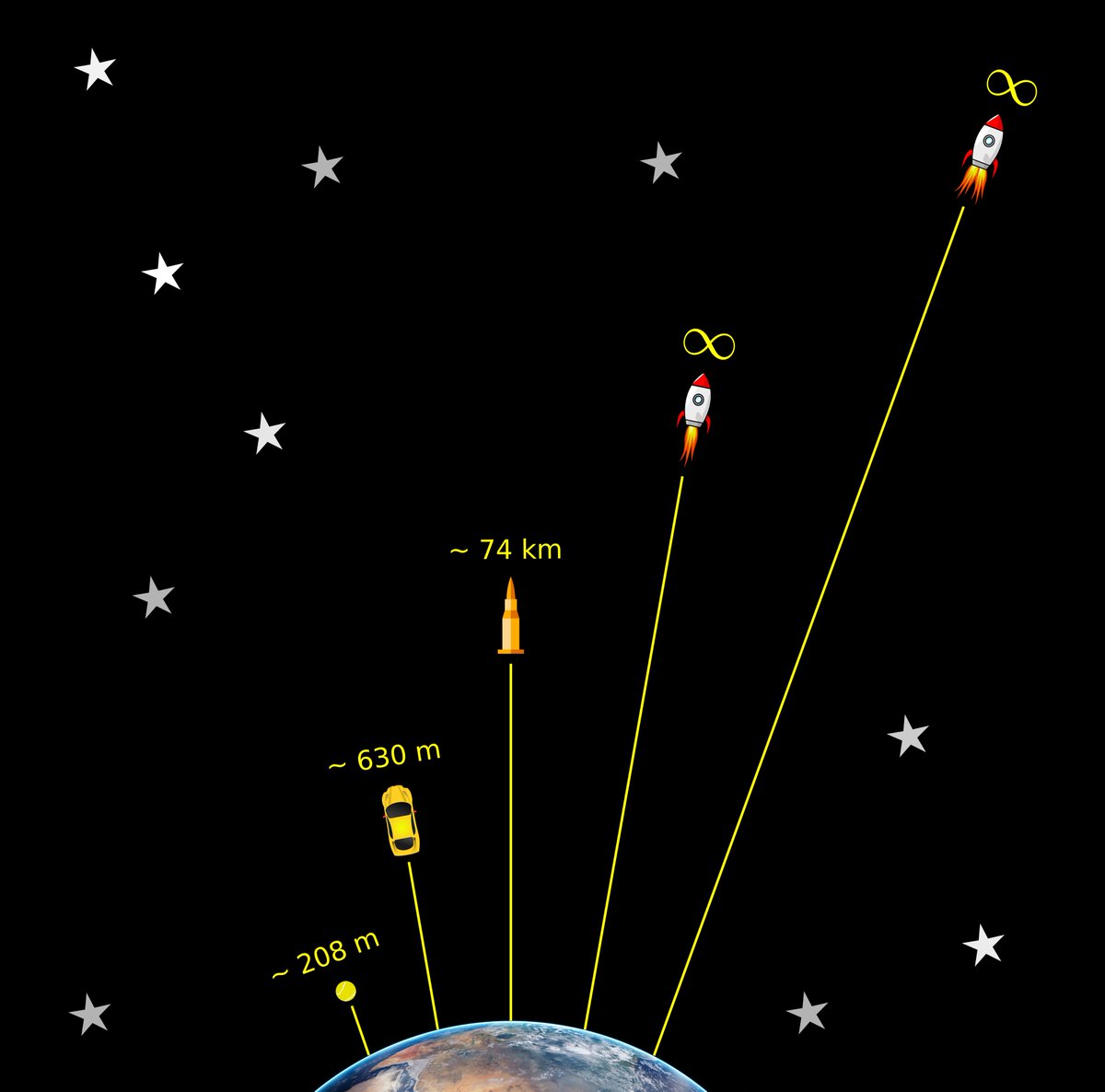

Second, Gautam *orders* the items in this list -- starting at the basics, gradually moving to more advanced stuff.

This forms a sort of "curriculum" for new investors.

Gautam sub-divides this curriculum into 4 weeks -- with 5 or 6 items to be crossed off the list each week.

This forms a sort of "curriculum" for new investors.

Gautam sub-divides this curriculum into 4 weeks -- with 5 or 6 items to be crossed off the list each week.

Third, Gautam adds his own notes and insights next to each item in the curriculum.

This helps learners understand how each item fits into the broader curriculum, how concepts from different items connect together, etc.

This helps learners understand how each item fits into the broader curriculum, how concepts from different items connect together, etc.

Fourth, Gautam makes himself available -- via an online forum -- to answer any questions learners may have as they go through the 4-week curriculum.

Plus, learners can interact with each other via the forum as well.

Plus, learners can interact with each other via the forum as well.

These are the key ideas behind Chapter (@chapter_HQ) -- a new format to help people learn stuff:

1) A curated list of high-quality resources,

2) A 4-week curriculum with an expert's notes/insights,

3) A forum to ask questions of the expert and interact with fellow learners.

1) A curated list of high-quality resources,

2) A 4-week curriculum with an expert's notes/insights,

3) A forum to ask questions of the expert and interact with fellow learners.

Gautam has created just such a "Chapter" -- called "Fundamental Investing Principles".

I've seen the items Gautam has picked for this Chapter. They're great resources -- drawing on wisdom from Peter Lynch, Howard Marks, Seth Klarman, etc.

I've seen the items Gautam has picked for this Chapter. They're great resources -- drawing on wisdom from Peter Lynch, Howard Marks, Seth Klarman, etc.

Gautam's charging $40 to enroll into this Chapter.

If you like Gautam, if you think this new format looks interesting, if you have $40 and some time to spare, give it a shot!

Note: the 4-week curriculum starts next Monday (Jan 03, 2022).

Link: getchapter.app/gautam/investi…

If you like Gautam, if you think this new format looks interesting, if you have $40 and some time to spare, give it a shot!

Note: the 4-week curriculum starts next Monday (Jan 03, 2022).

Link: getchapter.app/gautam/investi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh