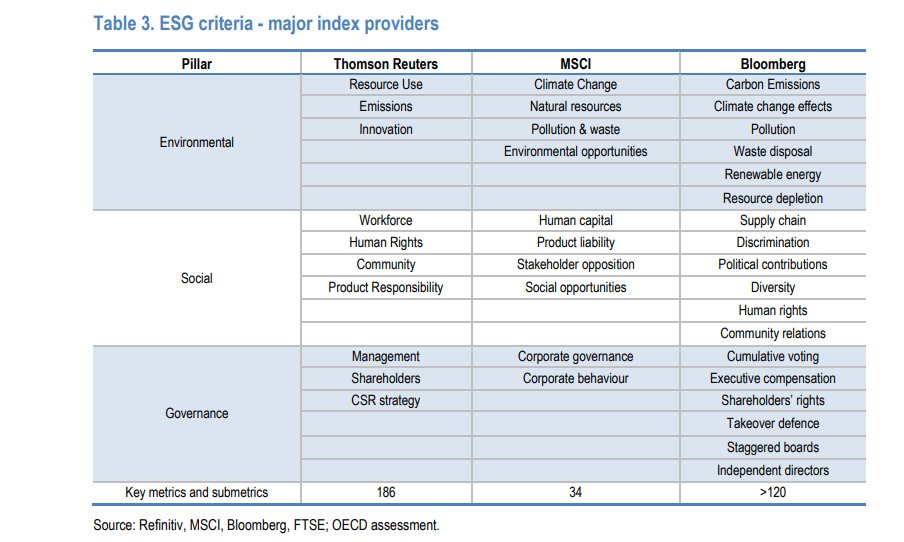

For more details on ESG rating click here oecd.org/finance/ESG-In…

or other reference material on USG rating sesgovernance.com/pdf/home-repor…

or other reference material on USG rating sesgovernance.com/pdf/home-repor…

ESG is a report on environmental, social & governance (ESG) effects published by a company. It enables the company to make the risks & opportunities it faces more transparent. It is a communication tool to convince skeptical observers that the actions of the company are honest.

What is an ESG Disclosure?

The ESG Disclosure provides guidance to assist companies in navigating the choices associated with ESG reporting, such as:

- Multiple stakeholders' ESG

information needs;

- Multiple reporting provisions ;

The ESG Disclosure provides guidance to assist companies in navigating the choices associated with ESG reporting, such as:

- Multiple stakeholders' ESG

information needs;

- Multiple reporting provisions ;

- Internal objectives for reporting; External objectives for reporting (e.g., measuring impact, compliance, etc.);

- Concerns about reporting “volume and clutter” obscuring important information.

- Concerns about reporting “volume and clutter” obscuring important information.

Three process steps (assess, decide, document) and six essential questions make up the ESG disclosure judgment process. The process phases and key questions provide a straightforward, practical method for increasing confidence in externally reported ESG data.

The following are the main concerns:-

1. Why report ESG information?

2. For whom should ESG information be reported?

3. Where should ESG information be reported?

1. Why report ESG information?

2. For whom should ESG information be reported?

3. Where should ESG information be reported?

4. What ESG information should be reported?

5. How should ESG information be prepared and presented?

6. How much ESG information should be reported?

5. How should ESG information be prepared and presented?

6. How much ESG information should be reported?

The process steps are:

1. Assess options neutrally, objectively, and in accordance with a list of criteria to identify information which: -

- Supports reporting goals and

purposes,

- Has business value

- Meets the needs of the primary

intended audience(s)

1. Assess options neutrally, objectively, and in accordance with a list of criteria to identify information which: -

- Supports reporting goals and

purposes,

- Has business value

- Meets the needs of the primary

intended audience(s)

- Is supportable

- Can be clearly communicated

2. Decide on the basis of management and experts' evaluations, assumptions, opinions, and subjective assessments (if appropriate).

3.Document the process, the decision, and any uncertainties or sensitivities concerning the judgment.

- Can be clearly communicated

2. Decide on the basis of management and experts' evaluations, assumptions, opinions, and subjective assessments (if appropriate).

3.Document the process, the decision, and any uncertainties or sensitivities concerning the judgment.

1. Increases the Transparency of Corporations

It expands corporate disclosure beyond traditional financial metrics and increases corporate transparency on environmental and social metrics.

It expands corporate disclosure beyond traditional financial metrics and increases corporate transparency on environmental and social metrics.

Sustainability reporting enables stakeholders to assess the company's performance in a balanced and understandable manner, facilitating corporate accountability, as promulgated by one of the principles of the Code of Corporate Governance.

2. Enhances Risk Management

Sustainability reports allow publicly traded companies to investigate emerging areas of risk and identify opportunities that would otherwise go unnoticed by other analytical and system-based approaches.

Sustainability reports allow publicly traded companies to investigate emerging areas of risk and identify opportunities that would otherwise go unnoticed by other analytical and system-based approaches.

A sustainable risk management approach provides useful information to management in order to identify emerging issues and develop adequate solutions to protect the company's reputation and increase shareholder value.

3. Encourages Stakeholder Engagement

Identification and engagement with stakeholders are critical steps in sustainability reporting, as cited by various international sustainability frameworks.

Identification and engagement with stakeholders are critical steps in sustainability reporting, as cited by various international sustainability frameworks.

Companies that are publicly traded must identify their stakeholders in order to effectively engage those who are interested in and affected by the company's sustainability performance.

Given the diverse nature and interests of stakeholders such as shareholders, employees, customers, suppliers, and communities, stakeholder engagement allows the company to consider the information needs of various stakeholders when disclosing sustainability-related information.

4. Enhances Stakeholder Communication

The company provides a framework for measuring non-financial performance by extending public disclosures beyond financial disclosure to include non-financial disclosure of social, environmental, and impact interactions and impact.

The company provides a framework for measuring non-financial performance by extending public disclosures beyond financial disclosure to include non-financial disclosure of social, environmental, and impact interactions and impact.

It also provides guidance on opportunities and threats to non-financial risk management. For benchmarking and assessing sustainability performance against existing frameworks, sustainability reports can be employed to show how the organization influences

The Global Reporting Initiative is an independent worldwide organization whose framework is extensively utilized by corporations and stakeholders to analyze and disclose their influence on sustainability concerns like climate change,human rights,governance & social well-being.

Under universal and specialized requirements, the standards provide for qualitative and quantitative information disclosures. Universal standards are looking for data on general management characteristics whereas specific standards allow for reporting based on business operations

The Sustainability Accounting Standards Board (SASB)

In 2018 SASB released ESG standards to provide details and implementation of the underlying financial metrics. The SASB ESG framework is best suited to assess financial performance on a basis of an entity's ESG practices.

In 2018 SASB released ESG standards to provide details and implementation of the underlying financial metrics. The SASB ESG framework is best suited to assess financial performance on a basis of an entity's ESG practices.

The International Integrated Reporting Council (IIRC)

The "Integrated reporting Framework" is a group of international leaders with mission. In a concise and similar format, the Framework offers material information on the strategy, governance, performance

The "Integrated reporting Framework" is a group of international leaders with mission. In a concise and similar format, the Framework offers material information on the strategy, governance, performance

and outlook of an organization, an essential change in corporate reporting.

For more information Click Here

integratedreporting.org/wp-content/upl…

For more information Click Here

integratedreporting.org/wp-content/upl…

CDP (formerly the Carbon Disclosure Project)

It was created in 2000 in London and operates as a worldwide, non-profit organization. CDP seeks from some of the world's major listing enterprises standardized information on climate change, water and forestry

It was created in 2000 in London and operates as a worldwide, non-profit organization. CDP seeks from some of the world's major listing enterprises standardized information on climate change, water and forestry

via yearly questionnaires delivered on behalf of institutional investors endorsing them as 'CDP' signatories.

For more information Click Here

rolls-royce.com/~/media/Files/…

For more information Click Here

rolls-royce.com/~/media/Files/…

The United Nations Global Compact (UNGC)

It's a strategic policy initiative for companies who want to connect their operations and strategies with 10 internationally acknowledged values in the areas of human rights, labor, the environment, and anti-corruption.

It's a strategic policy initiative for companies who want to connect their operations and strategies with 10 internationally acknowledged values in the areas of human rights, labor, the environment, and anti-corruption.

It is made up of over 13,000 organizations in 80 local networks all around the world. In an annual Communication on Success, business participants are expected to publicly report on their progress.

For more information Click Here

unido.org/sites/default/…

For more information Click Here

unido.org/sites/default/…

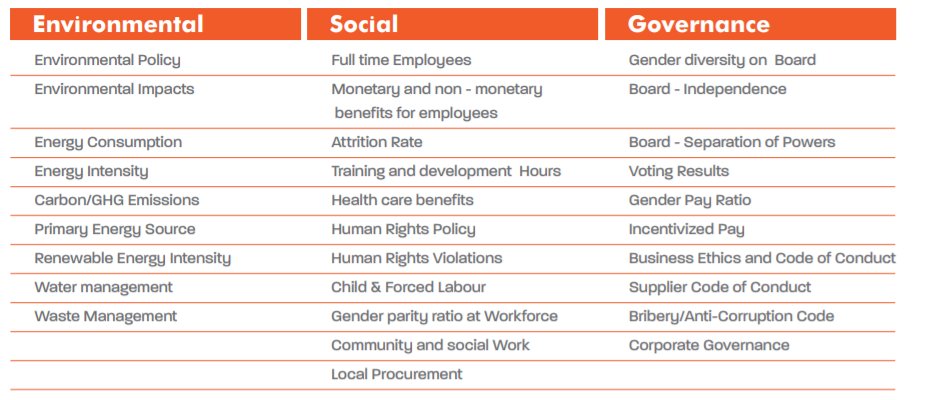

ESG Key Performance Indicators

We believe that certain ESG Key Performance Indicators should be the focal point of ESG reporting.

We believe that certain ESG Key Performance Indicators should be the focal point of ESG reporting.

EU Law

EU law requires large companies to communicate certain data on their social and environmental management challenges and how they operate.

EU Directive 2014/95/EU also called the Non-financial Reporting Directive (NFRD),

EU law requires large companies to communicate certain data on their social and environmental management challenges and how they operate.

EU Directive 2014/95/EU also called the Non-financial Reporting Directive (NFRD),

NFRD recognizes that the disclosure of non-financial information is essential in order to manage change towards a sustainable global economy combining long-term profitable with social justice and environmental protection. The Directive amends accounting Directive 2013/34/EU to

the extent necessary to ensure that the company's activity develops, performs, and takes place and has its effect on, at a minimum, environmental, social and workers' issues, respect of human rights, anti-corruption issues and its activities.

In order to help companies communicate environmental and social information, the EU has issued guidelines and published guidelines on the reporting of climate information. Furthermore, the EU has initiated a public consultation on the NFRD review. The 2017 OCED report complies

(voluntary and mandatory)ESG reporting requirements worldwide by institutional investors and through company disclosure.The report notes that the reporting requirement is usually voluntary (observe or explain) and that the methods or metrics should be used are not prescriptive

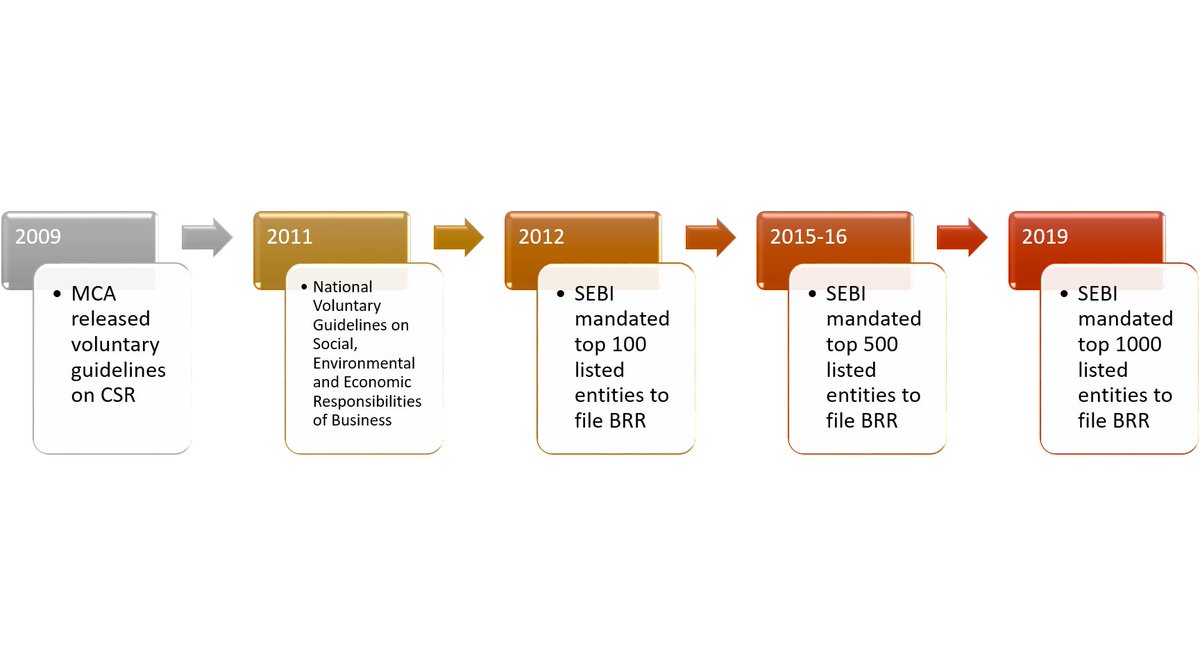

The Indian legislative framework has attempted to cover the various aspects of ESG in a fragmented manner. The Board's report, for example, must disclose energy conservation, absorption of technology, etc.

The aspects should be covered in detail – the company must communicate actions taken or impacts on energy conservation, actions taken to use alternative energy sources, investment of capital in energy conservation facilities, efforts to absorb technology, etc.

Furthermore, a director has a fiduciary duty to the community as well as to the environment. CSR activities include different socio-economic activities which are required in the annual report separately.

Nevertheless, the closest requirement is the reporting of business responsibility (BRR), for which only the ESG perspective has been mandated and discussed in the next lesson.

Business Responsibility Reporting (BPR)

The first step in Indian promotion of non-financial reporting in India can be described as a compulsory BRR or Business Responsibility Report. The initiative was one of the answers to India's commitment to the UN Business

The first step in Indian promotion of non-financial reporting in India can be described as a compulsory BRR or Business Responsibility Report. The initiative was one of the answers to India's commitment to the UN Business

and Human Rights Guiding Principles and sustainable development goals.

The BRR is based on 9 principles in accordance with the 'Social, Ecological and Business Economic Responsibilities National Voluntary Guidelines.'

The BRR is based on 9 principles in accordance with the 'Social, Ecological and Business Economic Responsibilities National Voluntary Guidelines.'

BRR 9 Principles -

1) Businesses should conduct and govern themselves with ethics, transparency and accountability;

2) Businesses should provide goods and services that are safe and contribute to sustainability throughout their life cycle;

1) Businesses should conduct and govern themselves with ethics, transparency and accountability;

2) Businesses should provide goods and services that are safe and contribute to sustainability throughout their life cycle;

3) Businesses should promote the well- being of all the employees;

4) Businesses should respect the interests of and be responsive towards all stakeholders, especially those who are disadvantaged, vulnerable and marginalized;

5)Businesses should respect and promote human right;

4) Businesses should respect the interests of and be responsive towards all stakeholders, especially those who are disadvantaged, vulnerable and marginalized;

5)Businesses should respect and promote human right;

6) Businesses should respect, protect and make efforts to restore the environment;

7) Businesses when engaged in influencing public and regulatory policy, should do so in a responsible manner;

8) Businesses should support inclusive growth and equitable development; and

7) Businesses when engaged in influencing public and regulatory policy, should do so in a responsible manner;

8) Businesses should support inclusive growth and equitable development; and

9) Businesses should engage with and provide value to their customers and consumers in a responsible manner.

The BRR is published by Ministry of Corporate Affairs (MCA). The guidelines expect companies to develop an improved understanding of the transformation process which enhances their accountability.

The National Voluntary Guidelines (NVG) was further revised and the MCA developed the National Guidelines for Responsible Business Conduct (NGRBC). The guidelines provided for the enterprises to-

- conducting and governing in an ethical, transparent and accountable way with integrity,

- provide goods and services in a manner that is sustainable and safe,

- respect and promote the well-being of all employees, including those in their value chains,

- provide goods and services in a manner that is sustainable and safe,

- respect and promote the well-being of all employees, including those in their value chains,

- respect the interests of and be

responsive to all their stakeholders,

- respect and promote human rights,

- respect and make efforts to protect

and restore the environment,

responsive to all their stakeholders,

- respect and promote human rights,

- respect and make efforts to protect

and restore the environment,

- when engaging in influencing public

and regulatory policy, should do so in

a manner that is responsible and

transparent,

- promote inclusive growth and

equitable development, and

- engage with and provide value to their

consumers in a responsible manner.

and regulatory policy, should do so in

a manner that is responsible and

transparent,

- promote inclusive growth and

equitable development, and

- engage with and provide value to their

consumers in a responsible manner.

On March 25, 2021, SEBI decided to replace the existing Business Responsibility Report ("BRR"), for the purpose of reporting on a voluntary basis for FY 2021-22 and on a mandatory basis for FY2022-23 for the top 1,000 listed entities (by market capitalisation).

For detailed Information On BRR Click Here

vinodkothari.com/wp-content/upl…

vinodkothari.com/wp-content/upl…

Summary of Disclosures & Principles

Section A and B focusses on “quantitative data” while Section C focusses on “qualitative data”

Section A and B focusses on “quantitative data” while Section C focusses on “qualitative data”

Survey

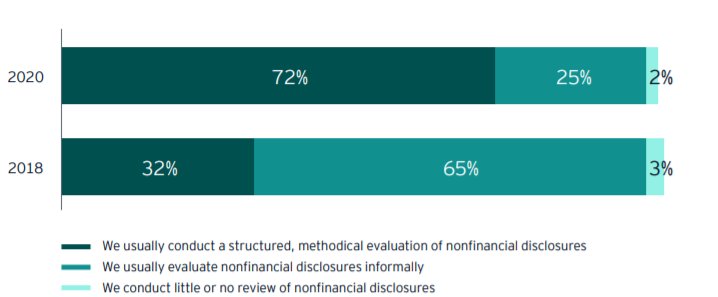

This survey report is published by EY on "How will ESG performance shape your future?"

Below is the detail of Survey-

1. Today, 72% of investors surveyed claimed to conduct a structured, methodological assessment of non-financial disclosure – a major jump from the 32%

This survey report is published by EY on "How will ESG performance shape your future?"

Below is the detail of Survey-

1. Today, 72% of investors surveyed claimed to conduct a structured, methodological assessment of non-financial disclosure – a major jump from the 32%

who reported using a structured approach in 2018.

The vast majority of investors usually say that they carry out a structured and formal evaluation of ESG information.

The vast majority of investors usually say that they carry out a structured and formal evaluation of ESG information.

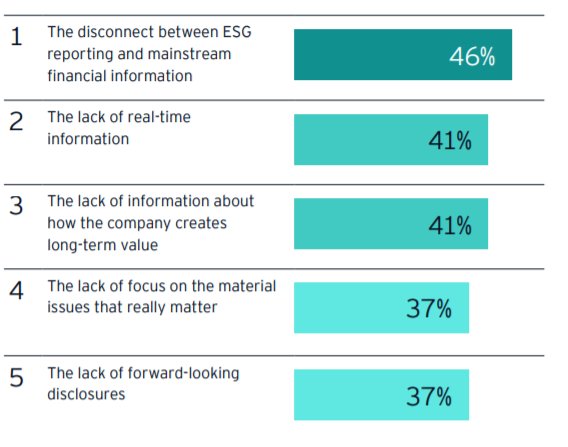

2. The five most significant challenges to the effectiveness and utility of ESG reporting.

Source of the image:-

assets.ey.com/content/dam/ey…

Source of the image:-

assets.ey.com/content/dam/ey…

For a detailed information Click Here

assets.ey.com/content/dam/ey…

KPMG report on ESG Click Here

assets.kpmg/content/dam/kp…

assets.ey.com/content/dam/ey…

KPMG report on ESG Click Here

assets.kpmg/content/dam/kp…

Wells Fargo and QBE: An ESG Case Study- This case study shows how ESG was used in analysing denominated US dollar,financial sector, and to inform an Australian insured company, QBE Insurance Group of the move from Wells Fargo Bank, for substantive improvement in MSCI ESG rating.

To read full report Click Here

cameronhume.com/wp-content/upl…

cameronhume.com/wp-content/upl…

Citigroup and Standard Chartered: An ESG Case Study

This case study demonstrates how ESG was used to analyse the euro-denominated banking sector and inform a switch from Citigroup to Standard Chartered Bank, resulting in an improvement in both credit rating and MSCI ESG score.

This case study demonstrates how ESG was used to analyse the euro-denominated banking sector and inform a switch from Citigroup to Standard Chartered Bank, resulting in an improvement in both credit rating and MSCI ESG score.

To read full report click here

cameronhume.com/wp-content/upl…

cameronhume.com/wp-content/upl…

Additional Reading

Having gone through the course, this section outlines some of the resources, materials and templates that can help you to do deep into the subject.

Also, you will find links and brochures on this topic.

Having gone through the course, this section outlines some of the resources, materials and templates that can help you to do deep into the subject.

Also, you will find links and brochures on this topic.

External Links / Reference Material

gfoa.org/materials/esg-…

home.kpmg/xx/en/home/ins…

home.kpmg/xx/en/home/ins…

irisbusiness.com/blog/2021/4/es…

pwc.com/sk/en/environm…

gfoa.org/materials/esg-…

home.kpmg/xx/en/home/ins…

home.kpmg/xx/en/home/ins…

irisbusiness.com/blog/2021/4/es…

pwc.com/sk/en/environm…

cfainstitute.org/en/advocacy/is…

docs.wbcsd.org/2019/04/ESG_Di…

corpgov.law.harvard.edu/2021/05/28/sec…

docs.wbcsd.org/2019/04/ESG_Di…

corpgov.law.harvard.edu/2021/05/28/sec…

So that's it, this is the end of the course.

Thank you for the patience.

Thank you for the patience.

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh