Stablecoins will become increasingly regulated, only allowed to hold nominally risk-free assets, if they want to connect to regulated, legal institutions.

This includes cash and Treasuries. As such, stablecoins are a way to monetize Treasuries.

This includes cash and Treasuries. As such, stablecoins are a way to monetize Treasuries.

In other words, if stablecoins are backed in part by Treasuries, and the stablecoin market cap continues to grow, this is a new source of demand for US government debt.

Cash and Treasuries of various durations get mixed together in a basket, blurring the line between them.

Cash and Treasuries of various durations get mixed together in a basket, blurring the line between them.

USDC, GUSD, and USDP have already gone this route.

USDT is the one that holds other types of assets as well, which are not backed by the full faith and credit of the US government.

Entities that don't conform to regulations are basically eurodollars- offshore dollars.

USDT is the one that holds other types of assets as well, which are not backed by the full faith and credit of the US government.

Entities that don't conform to regulations are basically eurodollars- offshore dollars.

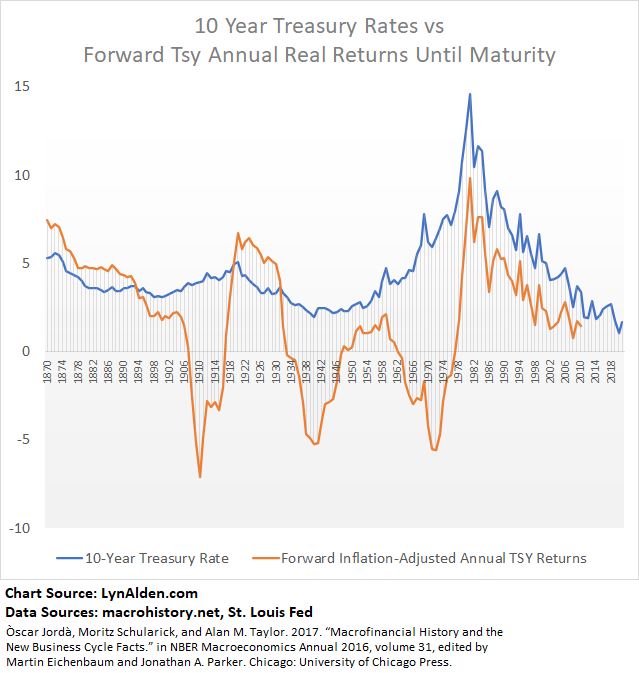

Whenever a sovereign government becomes highly indebted in its own currency, financial repression follows.

This means that interest rates on the debt are held below the inflation rate for a long period of time, and institutions are mandated to own the debt.

This means that interest rates on the debt are held below the inflation rate for a long period of time, and institutions are mandated to own the debt.

Stablecoins are used primarily for crypto trading but also somewhat for a medium of exchange.

Some companies like Facebook (via Diem & Novi) are aiming to increase their usage as medium of exchange. We'll see if they are successful.

Some companies like Facebook (via Diem & Novi) are aiming to increase their usage as medium of exchange. We'll see if they are successful.

I do think that custodial stablecoins will increase as a medium of exchange in the 2020s decade. And if so, that means retail investors might increasingly hold both cash and Treasuries, rather than just cash in a bank, all wrapped up together as collateral for the stablecoins.

By increasing the fungibility between cash and Treasuries as collateral for the same asset token, it broadens the type of financial repression that is possible. It's another lever to hold interest rates on government debt well below the inflation rate.

On the institutional side, standing repo facilities increase the fungibility between Treasuries and cash. On the retail and institutional side, regulated stablecoins also increase the fungibility between Treasuries and cash.

I think this is a factor that has macro implications for real rates over the long run, but that few macro investors are paying attention to yet.

For confirmation, we'll need to see the precise details of how US stablecoin regulation shakes out.

For confirmation, we'll need to see the precise details of how US stablecoin regulation shakes out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh