You asked for a thread on 62% on stablecoins using leveraged LP farming with @TarotFinance...

Well, it's at 75% at the time of writing, for the same amount of leverage! 🤑

Here's how you can use a leveraged LP strategy 👇 👻

Well, it's at 75% at the time of writing, for the same amount of leverage! 🤑

Here's how you can use a leveraged LP strategy 👇 👻

1/

First things first - make sure you understand how leverage works.

See this thread.

Btw, the graphic has a mistake in it on the risk side -- sorry about that! 😬

I uploaded the correct one in the comments!

First things first - make sure you understand how leverage works.

See this thread.

Btw, the graphic has a mistake in it on the risk side -- sorry about that! 😬

I uploaded the correct one in the comments!

https://twitter.com/shivsakhuja/status/1476283069753540608?s=20

2/

TL;DR - Leverage is a financial tool to amplify your returns while taking on more risk..

If you want to understand how a LP / AMM works in general, see this thread:

TL;DR - Leverage is a financial tool to amplify your returns while taking on more risk..

If you want to understand how a LP / AMM works in general, see this thread:

https://twitter.com/shivsakhuja/status/1473794498081689601?s=20

3/ Now, for a leveraged LP strategy:

$fUSDT and $USDC are both stablecoins – so they should (ideally) always be the same price.

When you provide liquidity to a stable pair like this, you don't have impermanent loss risk.

& since these are stables, there's no price risk either.

$fUSDT and $USDC are both stablecoins – so they should (ideally) always be the same price.

When you provide liquidity to a stable pair like this, you don't have impermanent loss risk.

& since these are stables, there's no price risk either.

4/

Because these risks are greatly mitigated, you might feel safer taking on more leverage.

This is where @TarotFinance comes in with its leveraged liquidity pools.

Essentially, you're borrowing more tokens and providing liquidity with these borrowed tokens.

Because these risks are greatly mitigated, you might feel safer taking on more leverage.

This is where @TarotFinance comes in with its leveraged liquidity pools.

Essentially, you're borrowing more tokens and providing liquidity with these borrowed tokens.

5/

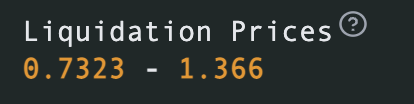

Luckily for us, @TarotFinance does all the hard math to calculate:

- the APR of the pool with our desired amount of leverage

- liquidation prices

Luckily for us, @TarotFinance does all the hard math to calculate:

- the APR of the pool with our desired amount of leverage

- liquidation prices

6/

How to use @TarotFinance:

1. Convert some FTM to equal parts USDC and fUSDT

2. Now provide liquidity for the USDC - fUSDT pair on @SpookySwap

3. Go to tarot.to

4. Find the $USDC / $fUSDT pool (SpookySwap)

5. Deposit your LP tokens

6. Click leverage

How to use @TarotFinance:

1. Convert some FTM to equal parts USDC and fUSDT

2. Now provide liquidity for the USDC - fUSDT pair on @SpookySwap

3. Go to tarot.to

4. Find the $USDC / $fUSDT pool (SpookySwap)

5. Deposit your LP tokens

6. Click leverage

7/

7. Move the slider to select how much leverage you want to take.

At ~10.2x, the liquidation price is ~$0.73 - $1.36.

8. You'll have to "Approve" the tokens, and then click Leverage.

9. Done! At any point, you can reduce your leverage, by clicking the "Deleverage" button.

7. Move the slider to select how much leverage you want to take.

At ~10.2x, the liquidation price is ~$0.73 - $1.36.

8. You'll have to "Approve" the tokens, and then click Leverage.

9. Done! At any point, you can reduce your leverage, by clicking the "Deleverage" button.

8/

You can go full degen if you want with > 14x leverage if you want to juice up the APR even more.

The liquidation price at that level is ~$0.90 - $1.10.

That's not terrible, but it's a lot easier to get liquidated at those levels, than at 10x leverage..

You can go full degen if you want with > 14x leverage if you want to juice up the APR even more.

The liquidation price at that level is ~$0.90 - $1.10.

That's not terrible, but it's a lot easier to get liquidated at those levels, than at 10x leverage..

9/

One thing to keep in mind: this liquidity pool is ridiculously small - only a few hundred thousand $.

This means that the APR can change drastically when $ flows in / out, especially for large positions.

So make sure to monitor it.

One thing to keep in mind: this liquidity pool is ridiculously small - only a few hundred thousand $.

This means that the APR can change drastically when $ flows in / out, especially for large positions.

So make sure to monitor it.

10/

My goal with this thread is to inform you of how to use a leveraged LP using @TarotFinance - not recommending this pool specifically.

My goal with this thread is to inform you of how to use a leveraged LP using @TarotFinance - not recommending this pool specifically.

11/

Now, if you want to actually understand how providing liquidity to stable pairs works, and the risks involved, see this thread

Now, if you want to actually understand how providing liquidity to stable pairs works, and the risks involved, see this thread

https://twitter.com/shivsakhuja/status/1466384167499808768?s=20

12/

You can also use @TarotFinance to provide leveraged liquidity to other pairs in the #fantom ecosystem like:

- $FTM - $BOO

- $BTC - $ETH

- $FTM - $USDC

These pools are larger, and some have pretty juicy APRs (especially if you use leverage)

You can also use @TarotFinance to provide leveraged liquidity to other pairs in the #fantom ecosystem like:

- $FTM - $BOO

- $BTC - $ETH

- $FTM - $USDC

These pools are larger, and some have pretty juicy APRs (especially if you use leverage)

13/ If you liked this thread, RT / follow - help a fellow farmer! 👨🌾

I write about #DeFi strategies, concepts and projects everyday..

Here are my previous threads on #DeFi:

I write about #DeFi strategies, concepts and projects everyday..

Here are my previous threads on #DeFi:

https://twitter.com/shivsakhuja/status/1470898910218440708?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh