SOLANA MONEY ATTRACTION ?

The @solana ecosystem is now experiencing a major decline in comparison with other large ecosystem. So, does Solana ecosystem still attract the money flow?

Check this thread below.

#Solanaszn #money #attraction

The @solana ecosystem is now experiencing a major decline in comparison with other large ecosystem. So, does Solana ecosystem still attract the money flow?

Check this thread below.

#Solanaszn #money #attraction

@solana 1. Price & TVL correlation

Each time the $SOL price witnessed a major decline, the same happened with the TVL of the ecosystem. However, until now, the $SOL price is now creating the lower low since Dec 4th crash, but the TVL of the ecosystem...

#Solanaszn #money #attraction

Each time the $SOL price witnessed a major decline, the same happened with the TVL of the ecosystem. However, until now, the $SOL price is now creating the lower low since Dec 4th crash, but the TVL of the ecosystem...

#Solanaszn #money #attraction

@solana 2. Price & TVL correlation

... still stabilize above $10B. Another way of understanding, I believe the money flow is more appeared in the Solana ecosystem more than the native token itself. Now let's find out where exactly the money stay?

#Solanaszn #money #attraction

... still stabilize above $10B. Another way of understanding, I believe the money flow is more appeared in the Solana ecosystem more than the native token itself. Now let's find out where exactly the money stay?

#Solanaszn #money #attraction

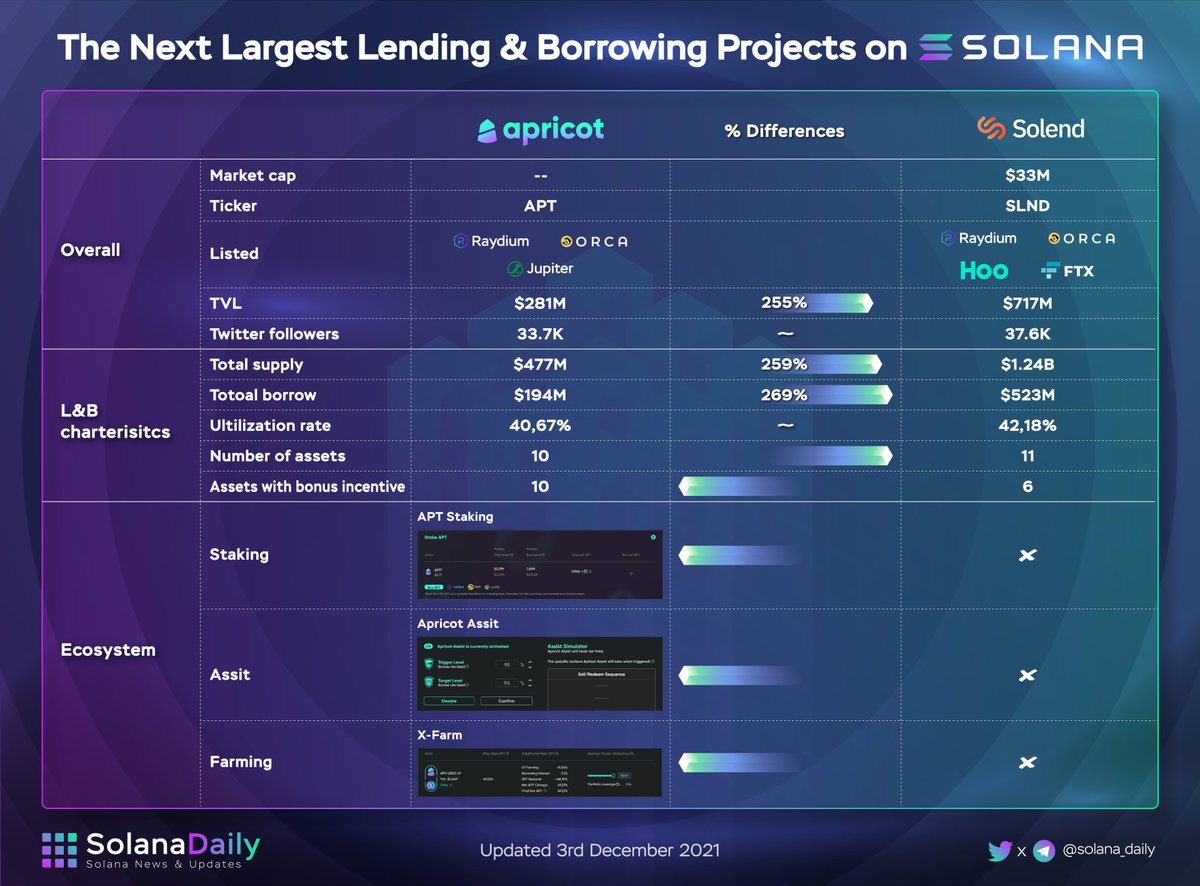

@solana 3. Lending and borrowing activities

As can be seen from the infographic about the lending and borrowing status of Solana, all lending and borrowing projects show minor fluctuation in both supply and borrowing value. As in the hazardous condition...

#Solanaszn #money #attraction

As can be seen from the infographic about the lending and borrowing status of Solana, all lending and borrowing projects show minor fluctuation in both supply and borrowing value. As in the hazardous condition...

#Solanaszn #money #attraction

@solana 4. Lending and borrowing activities

... of the market like this, I believe this minor movement showed positivity of the ecosystem. We do not know for sure that this movement is the result of the the balance between depositing and withdrawing...

#Solanaszn #money #attraction

... of the market like this, I believe this minor movement showed positivity of the ecosystem. We do not know for sure that this movement is the result of the the balance between depositing and withdrawing...

#Solanaszn #money #attraction

@solana 5. Lending and borrowing activities

... or the slow down of the lending and borrowing activities on Solana. However, it is showed that the lending activities of the Solana ecosystem is not taking much impact from the decline of the market.

#Solanaszn #money #attraction

... or the slow down of the lending and borrowing activities on Solana. However, it is showed that the lending activities of the Solana ecosystem is not taking much impact from the decline of the market.

#Solanaszn #money #attraction

@solana 6. Active users of Solana projects

As can be seen, most users of the ecosystem are now concentrating on the DEX and lending sector. Besides that, a farming project also being utilized in this period of time.

#Solanaszn #money #attraction

As can be seen, most users of the ecosystem are now concentrating on the DEX and lending sector. Besides that, a farming project also being utilized in this period of time.

#Solanaszn #money #attraction

@solana 7. Solana TVL ranking

In the TVL ranking of Solana, we can be easily seen that all projects witnessed major decline in TVL except 2 projects: Saber and Sunny, which mostly concentrated on stable assets/ pools

#Solanaszn #money #attraction

In the TVL ranking of Solana, we can be easily seen that all projects witnessed major decline in TVL except 2 projects: Saber and Sunny, which mostly concentrated on stable assets/ pools

#Solanaszn #money #attraction

@solana 8. Solana TVL ranking

This phenomenon showed that the money flow in Solana ecosystem is now shifting from assets to the stable assets for safety in this condition of market.

#Solanaszn #money #attraction

This phenomenon showed that the money flow in Solana ecosystem is now shifting from assets to the stable assets for safety in this condition of market.

#Solanaszn #money #attraction

@solana 9. TVL between ecosystem

The Solana ecosystem is now experiencing one of the most competitive competition in the crypto market. The rivals of Solana includes BSC, Avalanche, Terra, Fantom,.. All the ecosystem are so young and having ambition to overthrow Ethereum

#Solanaszn

The Solana ecosystem is now experiencing one of the most competitive competition in the crypto market. The rivals of Solana includes BSC, Avalanche, Terra, Fantom,.. All the ecosystem are so young and having ambition to overthrow Ethereum

#Solanaszn

@solana 10. I believe that the decline of TVL in Solana ecosystem is just a temporary reaction of the market. The Solana ecosystem has been one of the first ecosystem growing after the crash in May, and now the slowdown of TVL is a correction of the money flow

#Solanaszn #money

#Solanaszn #money

@solana 11. The money might shift to other ecosystems, or change from risk-on asset to stable assets for safety. But above all, I believe the Solana ecosystem has all the factors to have a sustainable growth in the future, and to be the fasted ecosystem to overthrow Ethereum.

#Solanaszn

#Solanaszn

• • •

Missing some Tweet in this thread? You can try to

force a refresh