Good #BLS #NFP Jobs Day.

Below are my pre-report observations on what to look for.

Stay tuned for quick analysis and, thereafter, the @jobqualityindex data related to today's report.

Below are my pre-report observations on what to look for.

Stay tuned for quick analysis and, thereafter, the @jobqualityindex data related to today's report.

https://twitter.com/DanielAlpert/status/1479433415640457221

Non-farms payrolls up 199,000

Private sector up 211,000 (loss of government workers)

Unemployment rate falls to 3.9% as labor force increases by only 168,000. LFPR flat at 61.9.

Stay tuned for additional analysis, but this is miserable data.

Private sector up 211,000 (loss of government workers)

Unemployment rate falls to 3.9% as labor force increases by only 168,000. LFPR flat at 61.9.

Stay tuned for additional analysis, but this is miserable data.

Upward revisions for two prior months totaled 141,000. Not bad, but nowhere near enough to offset the bad news today.

Leisure and hospitality hiring DID stall in December, up only 41,000 vs. 211,000 in November. Retail jobs fell (at Christmas!) by 13,300 (perhaps seasonal adj?)

Leisure and hospitality hiring DID stall in December, up only 41,000 vs. 211,000 in November. Retail jobs fell (at Christmas!) by 13,300 (perhaps seasonal adj?)

M/M hourly wages grew at an eye-watering 0.6%, while hours remained flat. But the growth was concentrated in hard to fill services jobs (spilling over from low paying into professionals as well) - Manufacturing and Construction did not benefit as much.

This is also the second month of EXTREME divergence between the household survey and the establishment survey in terms of the number of jobs added.

December:

Household 651,000

Establishment 199,000

November:

Household 1,090,000

Establishment 249,000

This is abnormal.

December:

Household 651,000

Establishment 199,000

November:

Household 1,090,000

Establishment 249,000

This is abnormal.

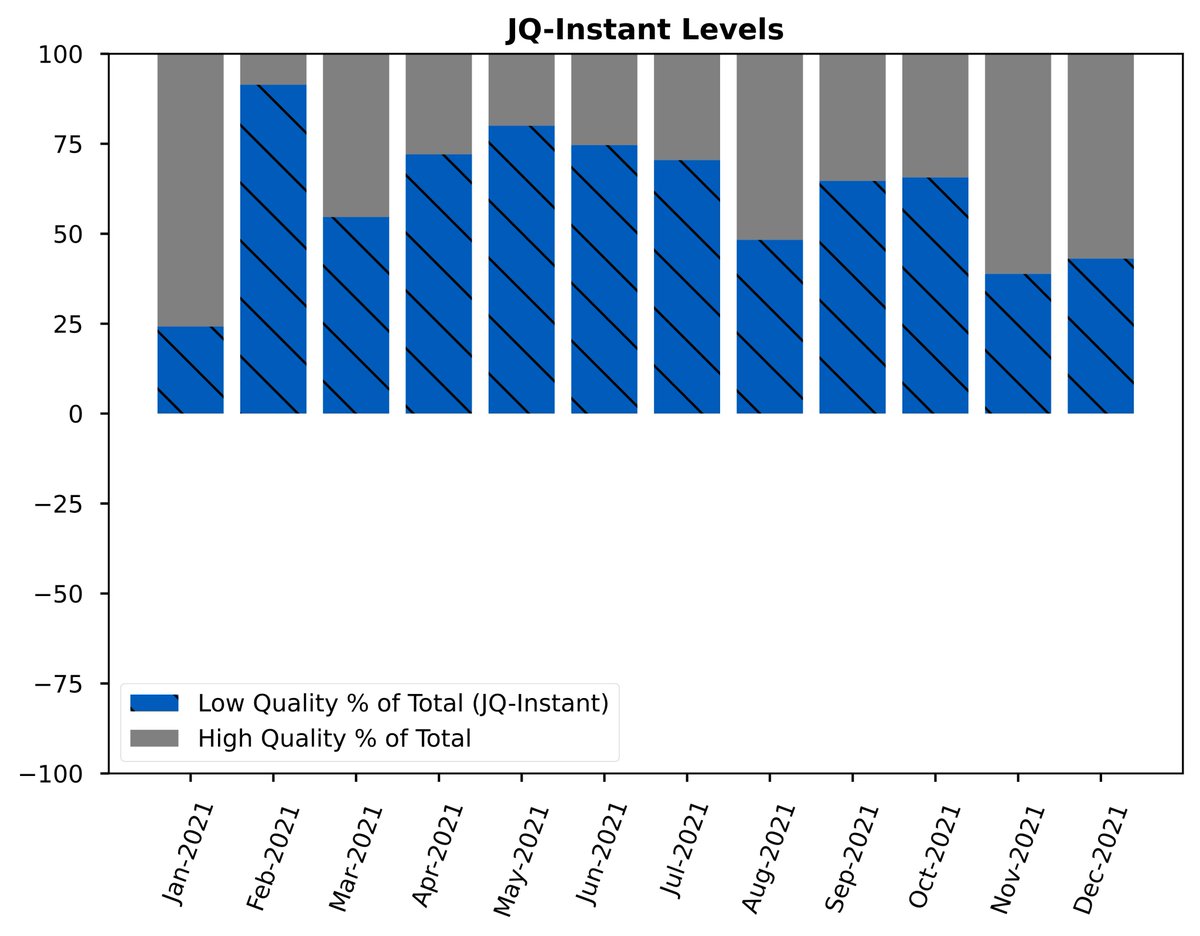

As it did last month, the @jobqualityindex JQInstant measure of all jobs created in December shows that most were in high-quality sectors paying more than the average weekly income for all jobs (unsurprising given the collapse in L&H and retail hiring, etc.):

The one month lagging @jobqualityindex for Nov-2021 came in at 81.17 (3 month trailing average). This value represents a 0.08% change from the prior month, Oct-2021 and is indicative of the same shift of employment to higher paying positions. (see prior tweet).

This report truly complicates the policy picture.

On the one hand, we have a buffer stock of labor that has still not returned to work.

Then we have Omicron, which may further delay that process.

The Fed is tightening monetary policy.

And no more fiscal relief on the horizon.>>

On the one hand, we have a buffer stock of labor that has still not returned to work.

Then we have Omicron, which may further delay that process.

The Fed is tightening monetary policy.

And no more fiscal relief on the horizon.>>

Add in the relief of supply pressures (almost all of the bottlenecks will be history by the end of Q1) and attendant disinflationary imports, and I am much more concerned now with a more sudden demand side collapse than I previously was.

Hourly wage growth not sustainable then.

Hourly wage growth not sustainable then.

• • •

Missing some Tweet in this thread? You can try to

force a refresh