1/10

THREAD: There's No "Great Resignation"

There's this idea that a post-pandemic "labor shortage," yielding wage inflation, is caused by disinterest in work.

A good example of the "paralysis of aggregates" I spoke of in this @Bloomberg podcast this week:

bloomberg.com/news/articles/…

THREAD: There's No "Great Resignation"

There's this idea that a post-pandemic "labor shortage," yielding wage inflation, is caused by disinterest in work.

A good example of the "paralysis of aggregates" I spoke of in this @Bloomberg podcast this week:

bloomberg.com/news/articles/…

2/10

That's an easy snap judgment to arrive at when you correlate the malaise related to these 19 months of plague with the fact that, in the aggregate, millions of workers have, in fact, not yet returned to their jobs:

That's an easy snap judgment to arrive at when you correlate the malaise related to these 19 months of plague with the fact that, in the aggregate, millions of workers have, in fact, not yet returned to their jobs:

3/10

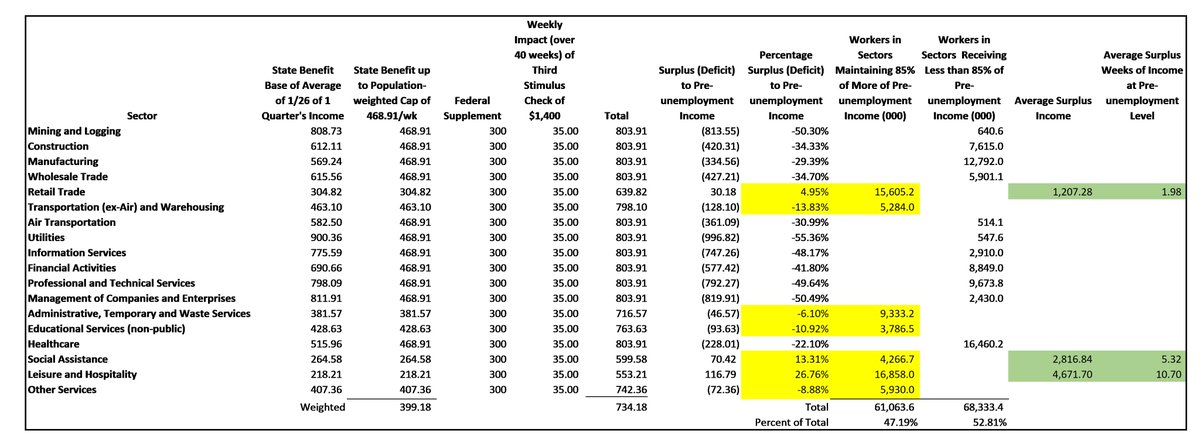

But if that is where you stop in your analysis you miss the underlying realities. First of all, we know where the unfilled jobs are - they are disproportionately in the low-wage/low-hours (read "low income") sectors. See the income levels below for guidance and bear with me:

But if that is where you stop in your analysis you miss the underlying realities. First of all, we know where the unfilled jobs are - they are disproportionately in the low-wage/low-hours (read "low income") sectors. See the income levels below for guidance and bear with me:

4/10

Not all sectors have lost jobs since January 2020, and not all job losses, of course, are due to a lack of workers. In some sectors that have seen the highest levels of income growth (see professional and technical services), and a tight jobs market, there are more jobs now.

Not all sectors have lost jobs since January 2020, and not all job losses, of course, are due to a lack of workers. In some sectors that have seen the highest levels of income growth (see professional and technical services), and a tight jobs market, there are more jobs now.

5/10

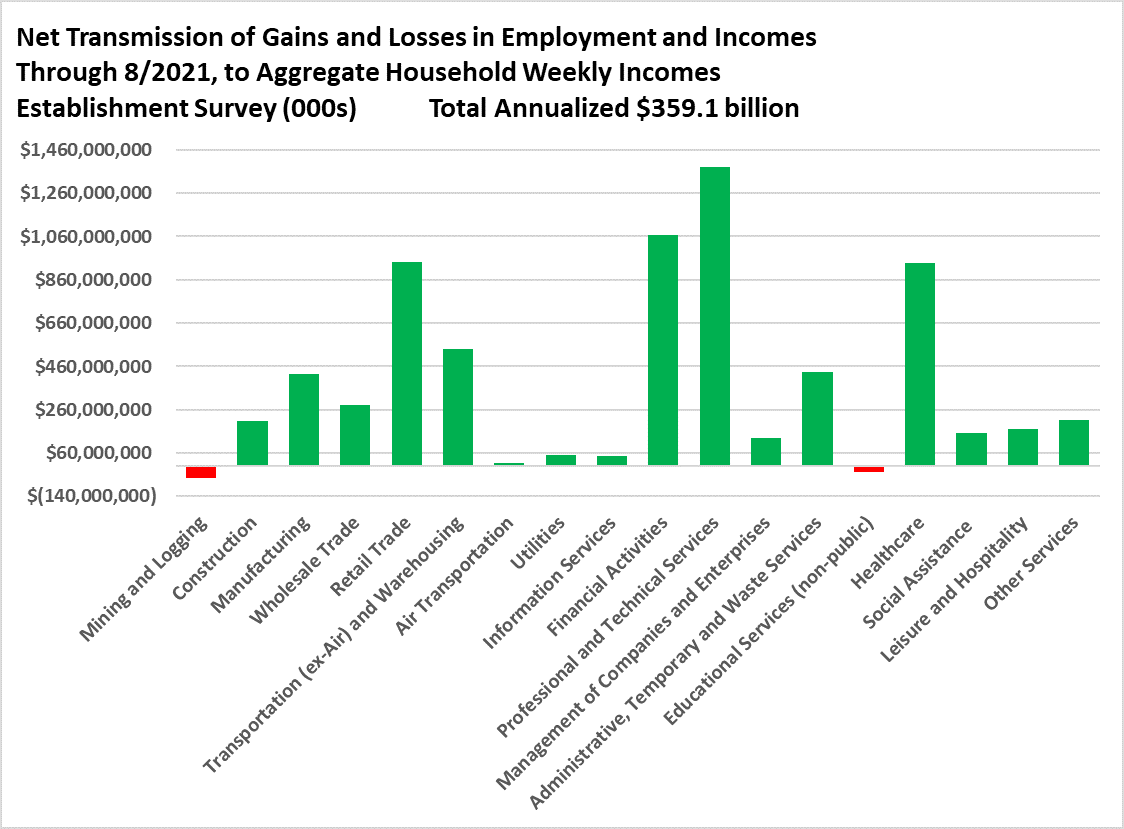

In fact by far the biggest winners of the $359 billion annualized bounty in increased household incomes to date have been in the two of the highest paid sectors (with a relatively lower propensity to spend what they earn - and therefore less of an impact on price inflation).

In fact by far the biggest winners of the $359 billion annualized bounty in increased household incomes to date have been in the two of the highest paid sectors (with a relatively lower propensity to spend what they earn - and therefore less of an impact on price inflation).

6/10

By contrast, there has been a pearl-clutching gasp about the PERCENTAGE increases in wages and incomes to workers in leisure and hospitality, retail, social assistance, admins etc. (orange dots - R axis) But expressed in dollars (blue bars - L axis) - um - not so much, eh?

By contrast, there has been a pearl-clutching gasp about the PERCENTAGE increases in wages and incomes to workers in leisure and hospitality, retail, social assistance, admins etc. (orange dots - R axis) But expressed in dollars (blue bars - L axis) - um - not so much, eh?

7/10

And all that talk about elevated quits rates (JOLTS data)? Surprise, its mostly in the low income sectors that saw the high percentage changes as workers move from onw employer to another for better pay - just as you would expect them to do - not to go home and "lay flat."

And all that talk about elevated quits rates (JOLTS data)? Surprise, its mostly in the low income sectors that saw the high percentage changes as workers move from onw employer to another for better pay - just as you would expect them to do - not to go home and "lay flat."

8/10

So what about workers who haven't gone back yet? Have they thrown in the towel? Nope.

They simply don't have to go back to the lousy jobs on offer to them - YET.

They have the option to stay off their feet a little longer, a reasonable choice, but only for a few more weeks:

So what about workers who haven't gone back yet? Have they thrown in the towel? Nope.

They simply don't have to go back to the lousy jobs on offer to them - YET.

They have the option to stay off their feet a little longer, a reasonable choice, but only for a few more weeks:

9/10

As with the prices of goods, distortions in the price of labor resulting from the post-pandemic reopening and the pandemic-era actions taken to rescue and preserve our households and enterprises, are unique and cannot be understood from data aggregates (or headlines).>>

As with the prices of goods, distortions in the price of labor resulting from the post-pandemic reopening and the pandemic-era actions taken to rescue and preserve our households and enterprises, are unique and cannot be understood from data aggregates (or headlines).>>

10/10

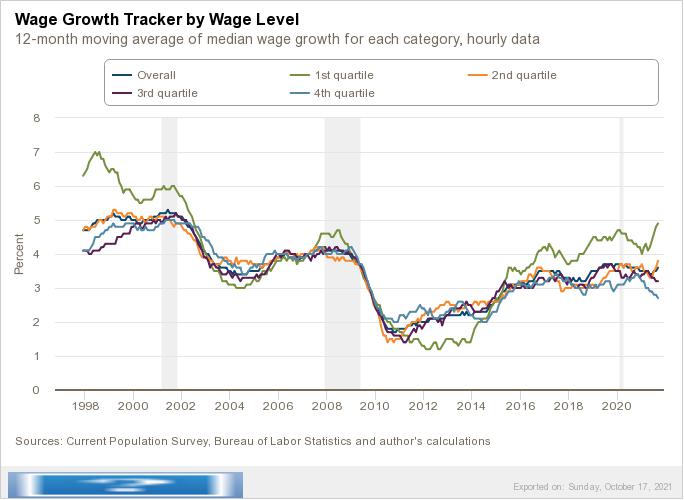

And here's another riddle that comes from the @AtlantaFed wage tracker.

Who benefitted most from high percentage growth in wages?

16 to 24 year-olds disproportionately so!

As well as the unskilled and low income as discussed above.

FOR NOW.

More workers coming back.

END

And here's another riddle that comes from the @AtlantaFed wage tracker.

Who benefitted most from high percentage growth in wages?

16 to 24 year-olds disproportionately so!

As well as the unskilled and low income as discussed above.

FOR NOW.

More workers coming back.

END

• • •

Missing some Tweet in this thread? You can try to

force a refresh