Money Flow in #Fantom Ecosystem

We need to have a deeper understanding of the Money Flow in the Market. Then, we're about to know which projects can attract cash flow and which ones can keep cash flow. Please refer to Money Flow in the Crypto Market with our threads below.

#FTM

We need to have a deeper understanding of the Money Flow in the Market. Then, we're about to know which projects can attract cash flow and which ones can keep cash flow. Please refer to Money Flow in the Crypto Market with our threads below.

#FTM

1/ How Does Money Flow In Crypto?

1.1/ Fiat to Bitcoin

The Crypto Money Flow Cycle begins with Fiat. Investors will take cash in exchange for Stable Coin, and the first thing most people do after owning Stable Coin is the exchange for Bitcoin - King of Cryptocurrencies.

1.1/ Fiat to Bitcoin

The Crypto Money Flow Cycle begins with Fiat. Investors will take cash in exchange for Stable Coin, and the first thing most people do after owning Stable Coin is the exchange for Bitcoin - King of Cryptocurrencies.

1.2/ Bitcoin to Top-Cap Projects

After investors have bought Bitcoin, Bitcoin's price will increase, and investors will take profits and move the gains to some smaller projects than Bitcoin, which are Top Cap projects such as ETH, SOL, BNB, FTM, and DOT, etc.

After investors have bought Bitcoin, Bitcoin's price will increase, and investors will take profits and move the gains to some smaller projects than Bitcoin, which are Top Cap projects such as ETH, SOL, BNB, FTM, and DOT, etc.

1.3/ Top Cap to Mid-Cap Projects

A lot of money flows to Top-Cap causes its price to increase rapidly, and most of the Top projects have their ecosystems. When the top-cap projects grow, the cash flow will tend to smaller projects. These projects are called Mid-Caps.

@Bytenextio

A lot of money flows to Top-Cap causes its price to increase rapidly, and most of the Top projects have their ecosystems. When the top-cap projects grow, the cash flow will tend to smaller projects. These projects are called Mid-Caps.

@Bytenextio

@Bytenextio 1.4/ Mid Cap to Low-Cap Projects

After the money flows to the Mid-Cap, this is where the money flows first to perform critical functions, such as providing liquidity, swap, and farming in an ecosystem. After that, the cash flow tends to continue to flow to Low-Cap projects

After the money flows to the Mid-Cap, this is where the money flows first to perform critical functions, such as providing liquidity, swap, and farming in an ecosystem. After that, the cash flow tends to continue to flow to Low-Cap projects

@Bytenextio 1.5/ Low-Cap - End Point

With the small-capitalization of Low-Cap projects, when the cash flows in, the projects tend to increase in price very quickly in a short time; that's why these types of Altcoins tend to rally multiple the gains such as 2x, 4x, 10x, or even more.

With the small-capitalization of Low-Cap projects, when the cash flows in, the projects tend to increase in price very quickly in a short time; that's why these types of Altcoins tend to rally multiple the gains such as 2x, 4x, 10x, or even more.

@Bytenextio 1.6/ Back to Bitcoin or Selling into Fiat

When Small Cap Altcoins rally exponentially, this sort of euphoria-fuelled buy-side pressure precedes one of two things: Back to Bitcoin or Selling into Fiat; the investors will save Fiat and Stable Coin to wait for the next cycle.

When Small Cap Altcoins rally exponentially, this sort of euphoria-fuelled buy-side pressure precedes one of two things: Back to Bitcoin or Selling into Fiat; the investors will save Fiat and Stable Coin to wait for the next cycle.

@Bytenextio So that is all Money Flow in Crypto Market; it is not sure which projects or tokens, but it happened in the past with the same processing. We should follow up the market closely to catch this money flow at the right time. We did refer to this from @rektcapital

@Bytenextio @rektcapital 2/ Money Flow in Fantom Ecosystem

Firstly, Let have an overview of Fantom Ecosystem development in 2021 to remember impressive numbers and significant milestones. Then we will comprehend why Smart Money is flowing to Fantom Ecosystem in Jan 2022 and beyond!

Firstly, Let have an overview of Fantom Ecosystem development in 2021 to remember impressive numbers and significant milestones. Then we will comprehend why Smart Money is flowing to Fantom Ecosystem in Jan 2022 and beyond!

@Bytenextio @rektcapital 2.1/ Next, We should come back to the very first on the Ecosystem. @fantom has developed infrastructure for a long time & in Q2 of 2021, DeFi on Fantom started to launch projects such as @SpookySwap @Spirit_Swap @CoinZoo for a mass DeFi adoption. Thanks to Pontem.network

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo 2.2/The following reason is about @GeistFinance , Geist's TVL reached $3.7B in just four days after launching. It was a massive move because Geist Finance is a lending project being the backbone of Defi in Fantom supporting investors can leverage their budget to optimize profits

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.3/ Besides, Fantom Foundation Announces Massive Incentive Program to Reward DeFi Developers with 370 million $FTM. On top of that, Fantom Opera is also a friendly, eco chain with EVM compatibility. That's why Fantom Opera attracted many developers in a short time.

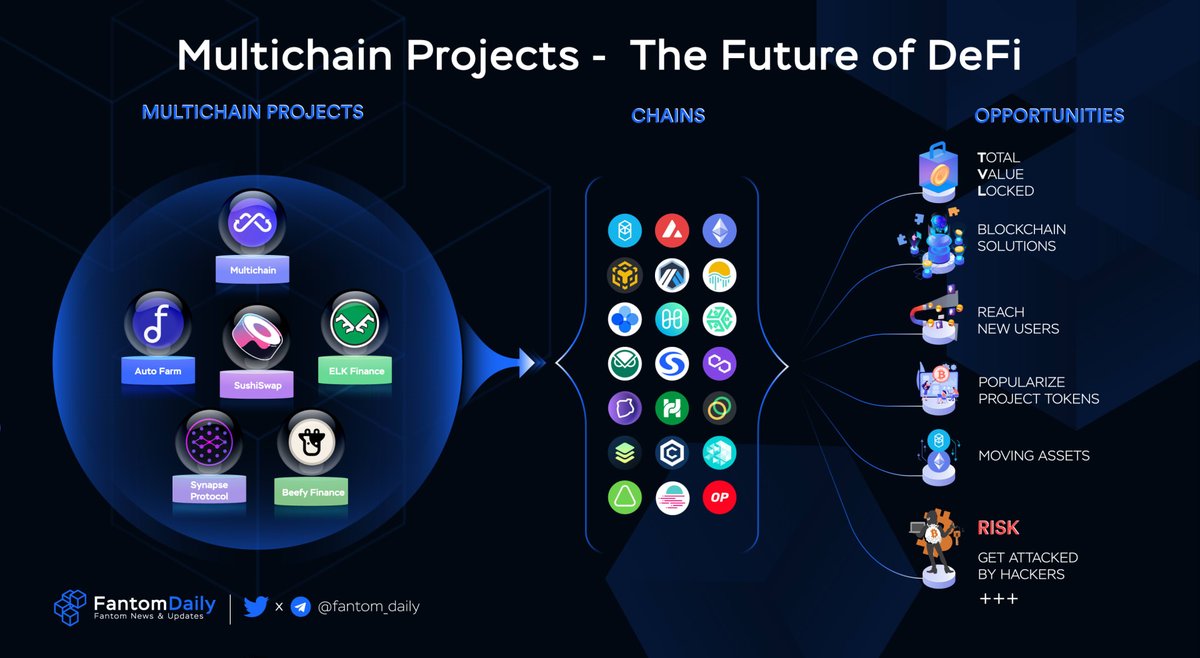

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.4/ After expanding over 100+ Dapps on Fantom Opera, all projects were trying to partner and integrate with many projects out of Fantom Opera. It has made products diverse & potential. That's also why TVL in Fantom did not flow back to another chain.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.5/Finally, When Fantom Ecosystem is over 200 projects. Andre Cronje and Daniel announced an experiment on Fantom in 2022: Ve(3,3) Mechanism on Defi. At that moment, Fantom prices & Total Value Lock increased rapidly; Fantom became the most mentioned on Twitter on the same day.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.6/ After all, Fantom TVL has grown 2300% from Aug 2021 until Jan 2022. However, the Investor is still optimistic about the future of Fantom because there are still gaming, metaverse & meme projects which haven't thrived yet. "2022 may be the year of $FTM" being said.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.7/ As Layer Theory, Money will flow from Layer 1 to Layer 4 in An Ecosystem. However, it may only happen in an ecosystem full of Native Infrastructure Legos. Fantom Ecosystem may be an exception. It was from Layer 1 to DEX/AMM - Lending - Other Dapps like it happened before.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.8/ If projects could get money from other chains, Smart Money will go to Bridges & DEX/AMM in Fantom to move assets, swap and add liquidity, or some mid-cap projects with many token utilities such as add liquidity, stake & farm.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance 2.9/ As you can see, the Fantom Mid-Caps are @SpookySwap , @MultichainOrg , @HectorDAO_HEC , @GeistFinance , @tombfinance , @Spirit_Swap , @OpenOceanGlobal , @YoshiExchange . They play essential roles in liquidity providing, swap, farming & staking.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange 2.10/ After from Mid-Caps, Money Flow will get into Low-Caps which are so small but it already had some simple features like Farming, Swapping, Lending, Staking and even NFT Trading or Minting NFT.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange 2.11/ Those Low-Cap Projects are @beethoven_x @LiquidDriver @retreeb_io @CoinZoo @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance . more and more!

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance 2.12/ Last but not least, Smart Money may flow to some potential projects with super small market cap projects. These small projects are @atlas , @Jetfuelfinance , @RevenantFinance , @SecureDao , @kektoken , @fantomstarter , @MensaPro , @MorpheusSwap , @AtlasCloud__ .

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ In my Opinion, All projects above are not sure for money flow or price prediction. We just mentioned them because of Market Cap & Preference; Please do not take it as financial advice. You should do your own research on our lists.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ 3/ How to Follow Up Smart Money Flow

There are many ways to follow up it, But we get it with three sources @DeFiLlama , @Coingecko , and projects' website.

There are many ways to follow up it, But we get it with three sources @DeFiLlama , @Coingecko , and projects' website.

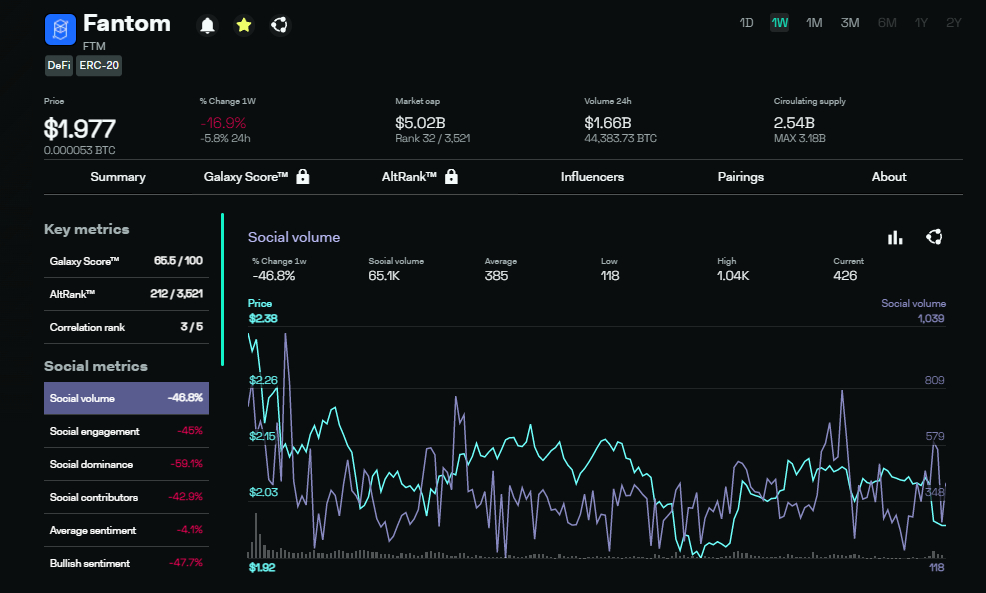

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ @DefiLlama @coingecko 3.1/ DeFiLlama is an excellent tool to check Total Valued Lock in the projects. CoinGecko is a place where we can track prices, volume trading & an overview of the Ecosystem. Projects' Website and Twitter are the way to stay updated latest news of projects.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ @DefiLlama @coingecko Regarding my experience, DeFiLlama is the place I followed the most because Total Value Locked is a metric for the health of the projects. If TVL is high & Market Cap is low Which may mean that the Projects are undervalued.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ @DefiLlama @coingecko 4/ Final words/closing thought

In Conclusion, We can not make sure anything for the crypto market. It is all about theory & experience. Besides, We should use other methods & tools to get a higher prediction from our opinions.

In Conclusion, We can not make sure anything for the crypto market. It is all about theory & experience. Besides, We should use other methods & tools to get a higher prediction from our opinions.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ @DefiLlama @coingecko Cryptocurrency Market is a high-risk, high-return market. We should be careful with our budgets by doing research more and more. Money Flow is the theory, not a 100% happening thing. Always consider timing & analysis to invest in any blockchain projects.

@Bytenextio @rektcapital @fantom @SpookySwap @Spirit_Swap @CoinZoo @GeistFinance @MultichainOrg @HectorDAO_HEC @tombfinance @OpenOceanGlobal @YoshiExchange @beethoven_x @LiquidDriver @retreeb_io @FantohmDAO @Screamdotsh @paint_swap @TarotFinance @GtonCapital @financegrim @Spartacus_Fi @Scarab_Finance @QiDaoProtocol @PotluckProtocol @trava_finance @atlas @Jetfuelfinance @RevenantFinance @SecureDao @kektoken @fantomstarter @MensaPro @MorpheusSwap @AtlasCloud__ @DefiLlama @coingecko 5/ Disclaimer

All of the research is based on data from the internet & my experiences, not financial advice. Please do your own research before making any investment decision.

All of the research is based on data from the internet & my experiences, not financial advice. Please do your own research before making any investment decision.

• • •

Missing some Tweet in this thread? You can try to

force a refresh