Dear @paraga + @nedsegal:

Please read, like, and share my latest letter to $TWTR leadership:🧵👇

Find a business with a... long-lasting moat around it … protecting a terrific economic castle w/ an honest lord in charge of the castle.

-Warren Buffett

1/x

getrevue.co/profile/compou…

Please read, like, and share my latest letter to $TWTR leadership:🧵👇

Find a business with a... long-lasting moat around it … protecting a terrific economic castle w/ an honest lord in charge of the castle.

-Warren Buffett

1/x

getrevue.co/profile/compou…

The Moat:

Twitter’s job is to help Users find Creators, serving as a User acquisition vehicle for Creators. When done well, this happens within the platform and builds lock-in for both parties, as the challenge of recreating that connection elsewhere is not worth the switch.

2/x

Twitter’s job is to help Users find Creators, serving as a User acquisition vehicle for Creators. When done well, this happens within the platform and builds lock-in for both parties, as the challenge of recreating that connection elsewhere is not worth the switch.

2/x

Twitter's moat lives in the space and tools that strengthen the loop between Creators and Users. These one-to-one connections aggregate into many-to-many communities that feel personalized. The resultant network effect is Twitter’s core moat.

3/x

3/x

The Castle:

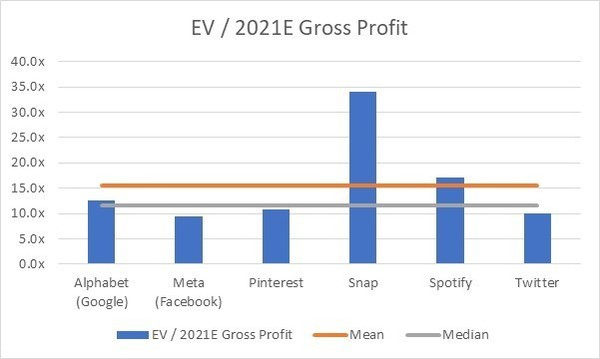

Owners have been patient as the platform and the team have improved. That patience is being tested - owners fronted the cost but are yet to receive commensurate benefits. Twitter is amongst the least well valued companies in its ecosystem.

4/x

Owners have been patient as the platform and the team have improved. That patience is being tested - owners fronted the cost but are yet to receive commensurate benefits. Twitter is amongst the least well valued companies in its ecosystem.

4/x

Lord of the Castle:

In my last letter, I said that “intensity is the price of excellence” and asked if leadership is ready to make the hard choices that sustained excellence requires. Twitter's culture must embrace leaner, stronger, and more urgent. This requires full buy-in.

5/x

In my last letter, I said that “intensity is the price of excellence” and asked if leadership is ready to make the hard choices that sustained excellence requires. Twitter's culture must embrace leaner, stronger, and more urgent. This requires full buy-in.

5/x

Click below to read both of my letters to Twitter management. Subscribe to stay in touch with subsequent letters.

Like and Follow to help nudge Twitter management toward a more urgent, efficient, and valuable future.

-End-

getrevue.co/profile/compou…

Like and Follow to help nudge Twitter management toward a more urgent, efficient, and valuable future.

-End-

getrevue.co/profile/compou…

Here’s the tweet for Letter #1:

https://twitter.com/compound248/status/1471888518192451591

• • •

Missing some Tweet in this thread? You can try to

force a refresh