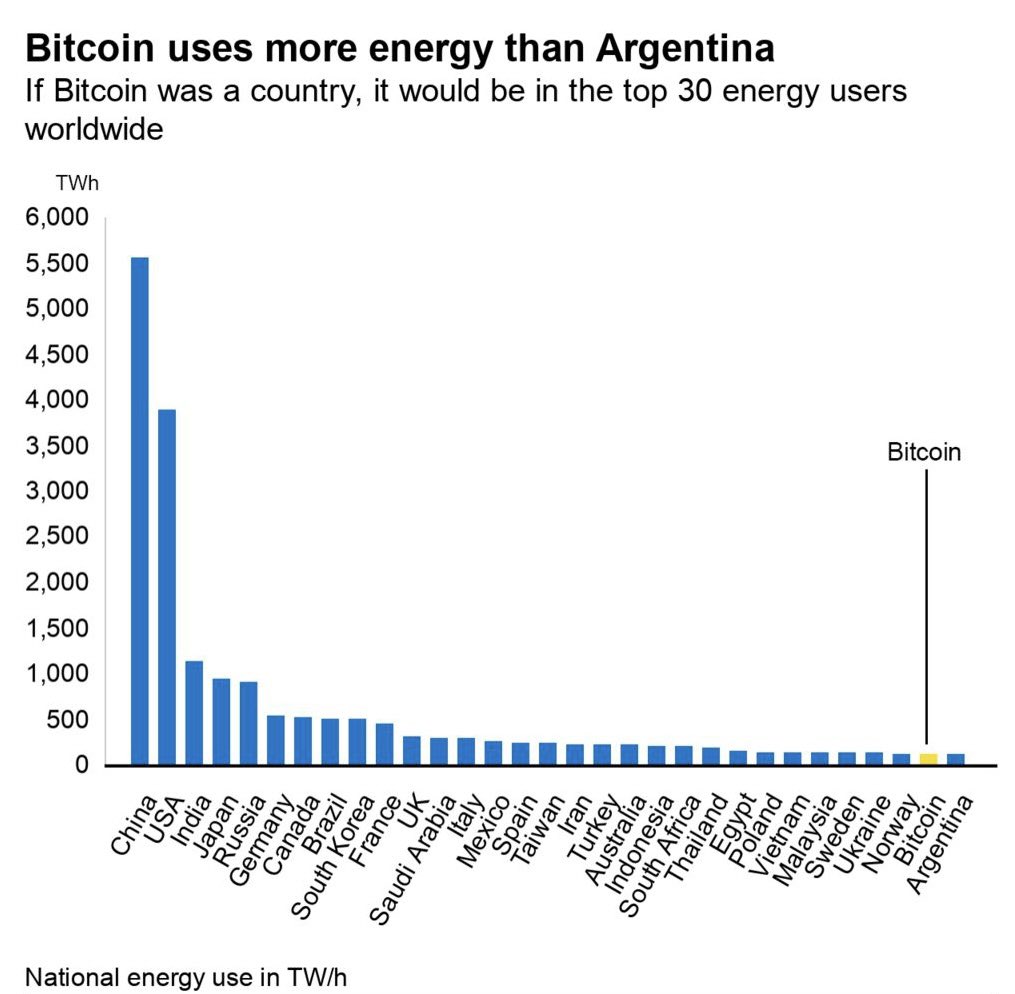

If you’re worried about the #Bitcoin network energy usage, here are some facts to lean on…

Factually it uses <1% of global energy.

Factually it uses <1% of global energy.

As per the BlockCap report it uses much lesser than 1% of global energy, yet serving as the decentralized digital alternative to an inflationary & central banking based financial system.

Comparing national energy consumption to #Bitcoin network, the kind of energy it consumes is important to take into consideration…

Excess energy from hydro power, natural gas flares, geothermal energy. More energy is wasted in transmission losses than what’s used by Bitcoin.

Excess energy from hydro power, natural gas flares, geothermal energy. More energy is wasted in transmission losses than what’s used by Bitcoin.

Looking at just the US energy grid, there’s about 67% of wasted energy during the generation & transmission processes. If #Bitcoin network is tapping into those wasted energy sources like mining from old hydroelectric plants, mining from natural gas flares etc… it’s great.

Just about 34% of energy reaches the customer, tapping into mostly the wasted energy to secure the best open monetary network in the world is a great use of it I’d argue.

Truth. Gold mining, refining, storage, transportation, fiat & banking infrastructure, armored fleet, military/army/navy/Air Force and a bunch of other things are needed to secure the borders & sovereign currencies.

#Bitcoin energy should be compared to those combined 🤷♂️

#Bitcoin energy should be compared to those combined 🤷♂️

https://twitter.com/notgrubles/status/1483896608098037760

• • •

Missing some Tweet in this thread? You can try to

force a refresh