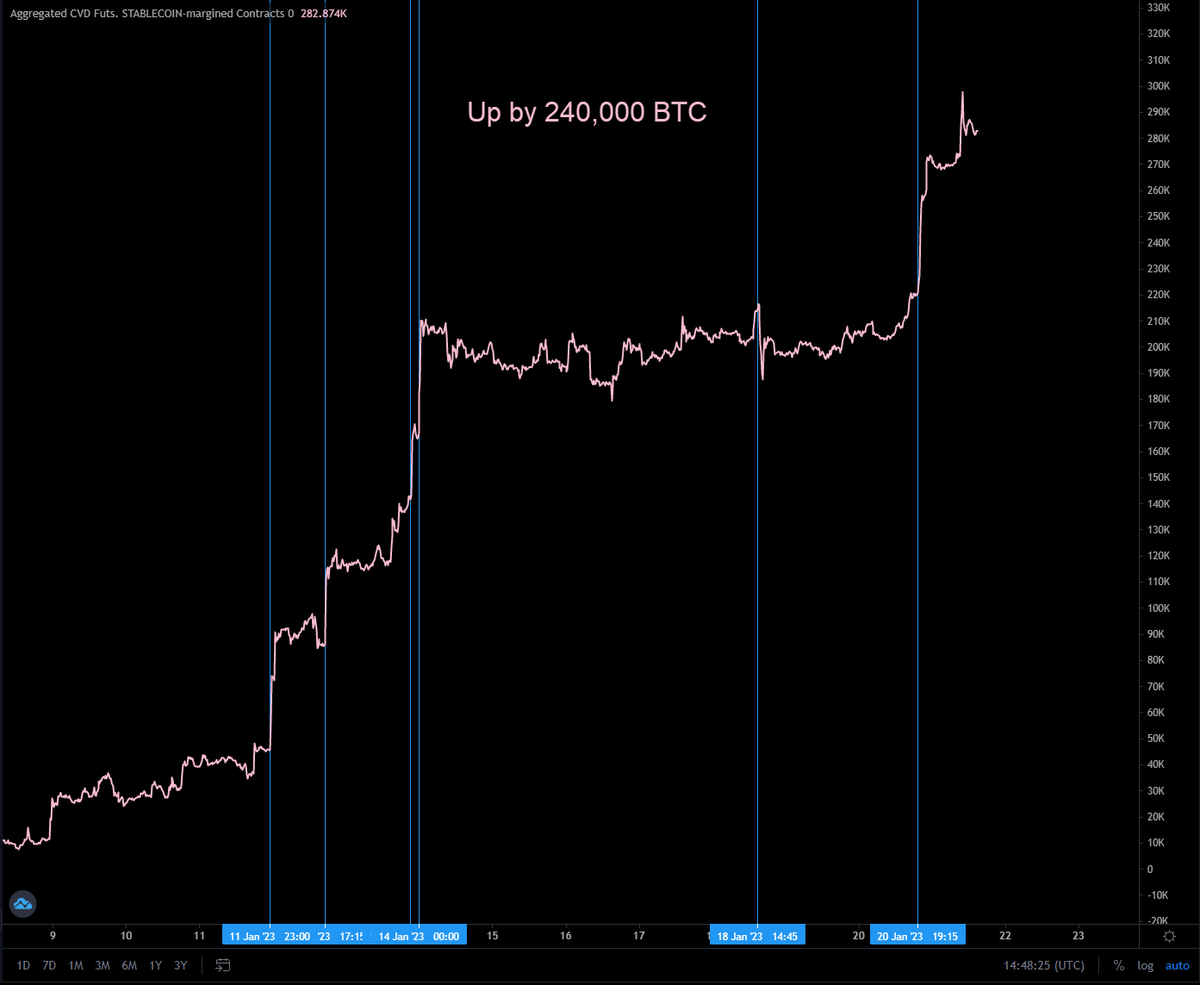

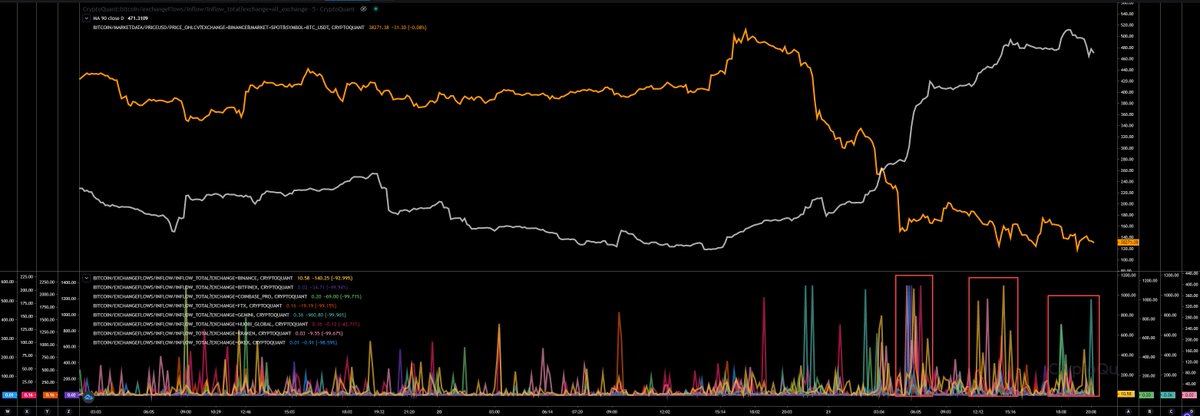

🚨🚨 Quick Update: Hourly view showing they are just selling, but the netflow showing a nice negative netflow indicating big outflows. However, we have received more inflows. So, we should expect more sell pressure.

#BTC #ETH #XRP

#BTC #ETH #XRP

We can't compare the current "sell-off" with the sell pressure of the weeks before. The whales ratio is falling. Indicating no more constant whales tokens flowing in. That could be a sign that we will lift up at least heading to 40k as expected. But we need patience.

The block view showing the same. Big outflows detected in the last few hours no big positive netflows detected. I think thats indicating that they are selling remaining tokens on exchanges. So, we are not done yet, but we should lift up a bit, still expecting 40k, first.

#Binance again the main driver here had a lot of big inflows the whole afternoon. The last relatively big inflow was just an hour again and had a volume of almost 400 #BTC. Compared to the inflows 5 hours ago, its nothing! That's bullish. At least no big inflows here anymore.

#Gemini with #Binance two dump drivers. #Gemini last big inflow of almost 1,000 #BTC is just few minutes ago. So, you know.

At least the inflow activity (addresses count on exchanges related to inflows) are declining too. However the transaction count related to inflows are still rising. Less wallets but more transactions, thats a sign of whales. They sell more volume and less wallets are involved.

Also here you can see how the count of inflows are declining. As mentioned #Gemini has received a big one, but #Binance is receiving less tokens. If we keep in that way, we will at least get a dump break. Matches to the whales ratio. So, let them sell the remaining tokens and

we will lift up again. Not saying we are done yet! We need to wait what happens in the next hours and even this weekend. Patience is key as usual. To make clear, I expect less sell pressure soon and I think thats the opportunity where we will start to lift up again.

We need more sell pressure to cross all the walls heading 35k. However, they expect 35k it seems. So please, don't rush to trades and keep calm. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh