How do you punish / deter Russia? Most options on the table are either too big or too small. One option that isn’t talked about, but should be: targeting Russia’s participation in Europe’s energy transition. This could really hit Russia.

A thread.

A thread.

Russia is too integrated into the European energy system to attack today. You cannot stop Russian gas exports. You can hit their growth prospects but who cares—they will adapt (or evade). Even NS2 is a poor target too—best case, it’s a reputational loss. Russian power is intact.

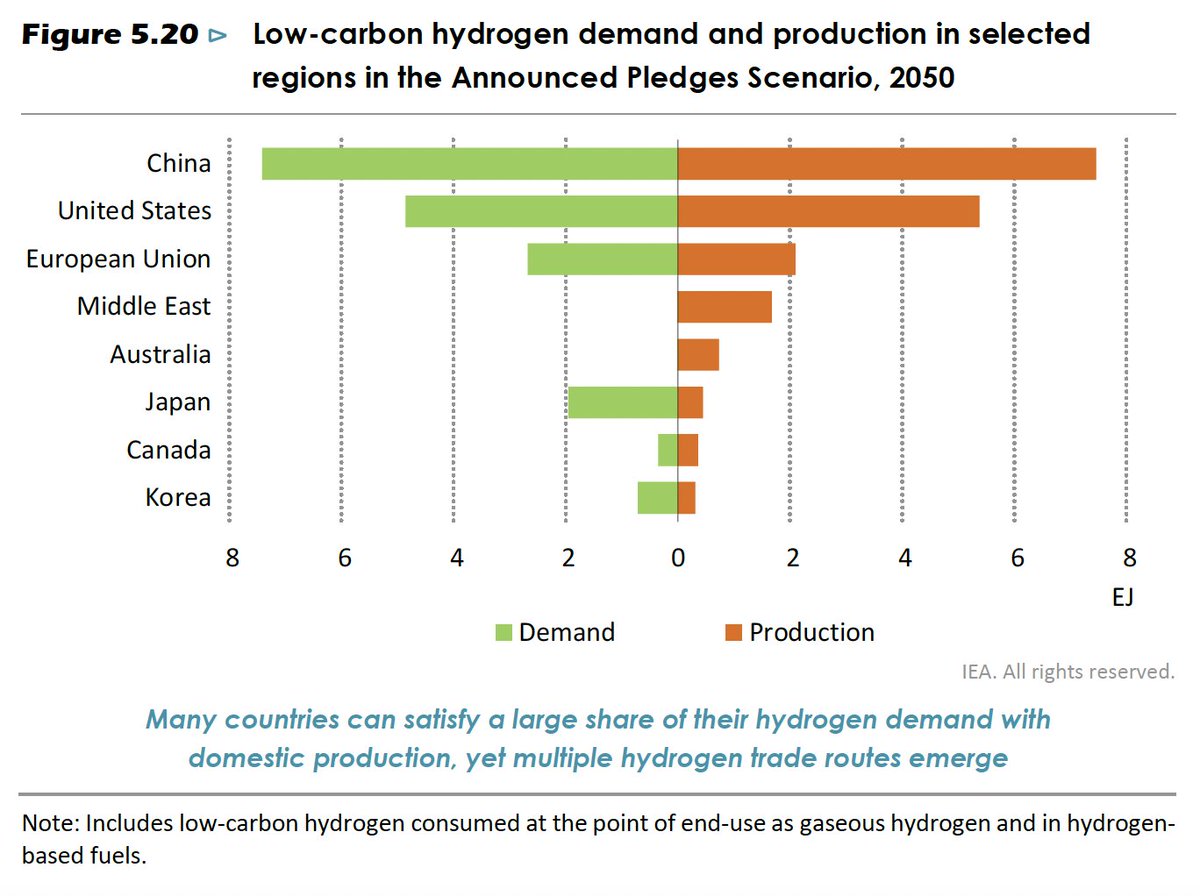

But the energy system is changing. Europe is changing. Russia knows this—even if it is sometimes in denial, or wants to taunt Europe. Russia understands that the European Green Deal is an existential threat. Without the European energy market, what is Russia?

How do you target Russia’s role in the energy transition? Stop any cooperation, technology transfer or investment in hydrogen, ammonia, carbon capture, low-carbon steel and other technologies. Write rules that allow you to target Russian exports based on carbon content.

Tighten rules about who can own assets in the clean energy economy (unlike the current policy that allows Russian companies to own anything they like in Europe). Prevent Russian assets like refineries and gas station networks from accessing public money to be repurposed.

This is a long-haul strategy. It depends on Europe throwing its geo-economic weight around. But it goes to the core of Russia’s strategic interests and long-term relevance. The message: Russia can play a role in the new energy economy, but only if it follows the rules. Fin.

• • •

Missing some Tweet in this thread? You can try to

force a refresh