Countries are making big bets on the technologies we need for the energy transition, unlocking enormous opportunity, but also creating the prospect of trade and other conflicts. @CSISEnergy is launching “Energy Rewired” to study how these bets will change the world's energy map.

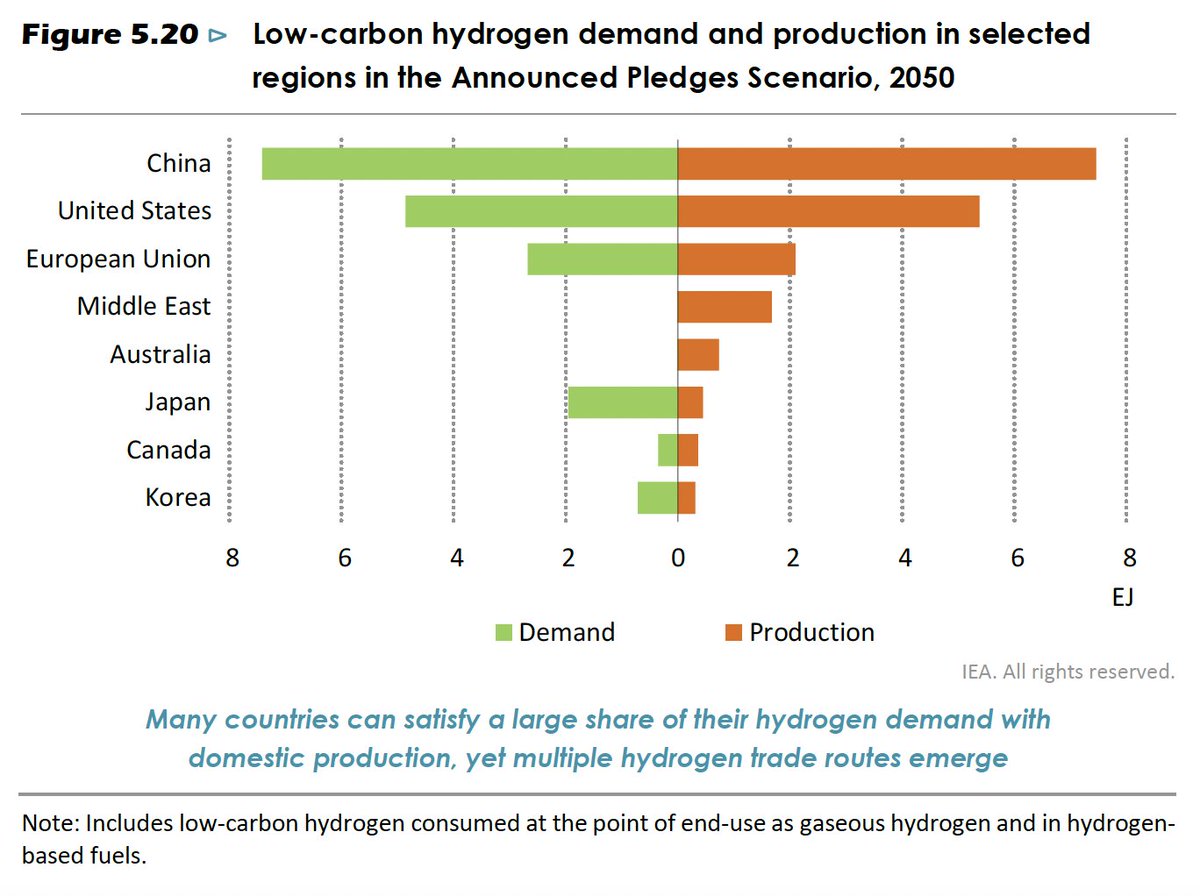

To start with, we will publish country briefs that focus on specific technologies like solar, wind, hydrogen, batteries, CCUS and others. We ask three questions: What is the country’s vision? What is the strategy? What is the geographic focus?

Over time, as we build the data, we plan to tackle higher order questions: which countries might pull ahead? What can we learn from each other? What conflicts or tensions might arise? How can the United States and its partners safeguard their interests in this world?

We have two excellent pieces to get us started, both on hydrogen—the first on Australia and the second on Russia. Go read them, and follow this space for more!

csis.org/analysis/austr…

csis.org/analysis/russi…

csis.org/analysis/austr…

csis.org/analysis/russi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh