IMPACT OF SABER LP TOKEN PROPOSAL ON SOLEND

Lately, the proposal of the addition of the @Saber_HQ LP token to be an asset on @solendprotocol has been executed. Check the thread below to see the impact of this addition.

#Solanaszn #impact $SLND $SBR

Lately, the proposal of the addition of the @Saber_HQ LP token to be an asset on @solendprotocol has been executed. Check the thread below to see the impact of this addition.

#Solanaszn #impact $SLND $SBR

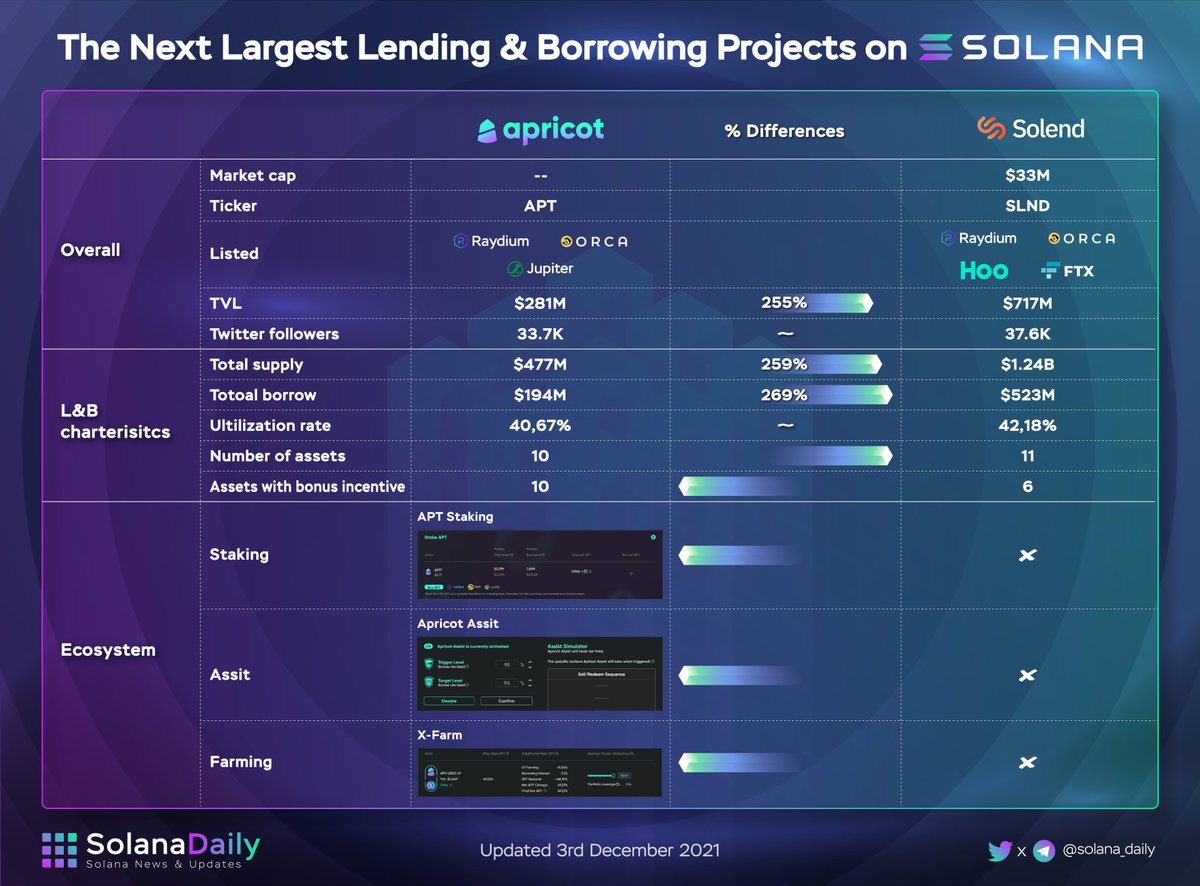

@Saber_HQ @solendprotocol 1. @solendprotocol is by far the largest lend-borrow market on Solana, with over $1B of user deposits.

However, over $234M of this is in USDC or USDT ~ ¼ total deposit. If this were in Saber, it would earn both swap fees and contribute to TVL of both protocols

#Solanaszn #impact

However, over $234M of this is in USDC or USDT ~ ¼ total deposit. If this were in Saber, it would earn both swap fees and contribute to TVL of both protocols

#Solanaszn #impact

@Saber_HQ @solendprotocol 2. So, based on this, there was a proposal of 85,000 SBR of incentives for borrowing USDC-USDT LP on @solendprotocol

#Solanaszn #impact

#Solanaszn #impact

@Saber_HQ @solendprotocol 3. BENEFIT:

The action would contribute TVL for both Saber and @solendprotocol . This is a win-win situation for both projects, and the users would benefit from this too.

#Solanaszn #impact

The action would contribute TVL for both Saber and @solendprotocol . This is a win-win situation for both projects, and the users would benefit from this too.

#Solanaszn #impact

@Saber_HQ @solendprotocol 4. Moreover, it would increase the circulating supply of Saber USDT-USDC LP. The more supply of LP token, the more rewards the user can earn from different staking projects in the ecosystem, creating a more dynamic capital turnover in the ecosystem.

#Solanaszn #impact

#Solanaszn #impact

@Saber_HQ @solendprotocol 5. Then, it shall increase interest rates for lending USDT-USDC LP. The LP token therefore not only earning swap fees but is also earning potentially large amounts of interest, resulting in the Double utilization of the capital for user

#Solanaszn #impact

#Solanaszn #impact

@Saber_HQ @solendprotocol 6. Last, this would create a new wave of the lending sector in Solana to lend/borrow the LP token from different pools and other projects. In the long term, the addition would motivate the entire Solana ecosystem, serving the mutual prosperity of the Solana ecosystem

@Saber_HQ @solendprotocol 7. DRAWBACK:

The more SBR being used as incentive, the more $SBR would be sold to the market, therefore decreasing the price of SBR, making the SBR rewards less attractive for users.

#Solanaszn #impact

The more SBR being used as incentive, the more $SBR would be sold to the market, therefore decreasing the price of SBR, making the SBR rewards less attractive for users.

#Solanaszn #impact

@Saber_HQ @solendprotocol 8. SBR 0.5% withdraw fee would affect the the user appetite

Last, in the long term, this may Distract the nature of LP token. Which means that Users tend to borrow, forget to provide liquidity for LP token, slowing down the development of the projects in Solana.

#Solanaszn

Last, in the long term, this may Distract the nature of LP token. Which means that Users tend to borrow, forget to provide liquidity for LP token, slowing down the development of the projects in Solana.

#Solanaszn

@Saber_HQ @solendprotocol 9. However, I still believe this proposal would bring along far more benefits than drawbacks. And overall, it would create motivation for the entire Solana ecosystem to develop.

This is the researcher’s perspective, Not financial advice.

#Solanaszn #impact

This is the researcher’s perspective, Not financial advice.

#Solanaszn #impact

• • •

Missing some Tweet in this thread? You can try to

force a refresh