$MELT @defrost_finance thread

@defrost_finance is a combination of @MIM_Spell and @Platypusdefi on $AVAX. Although we got in at $600k - $800k 1 week ago, it’s still crazily undervalued at a MC of only $2m.

1/n

@defrost_finance is a combination of @MIM_Spell and @Platypusdefi on $AVAX. Although we got in at $600k - $800k 1 week ago, it’s still crazily undervalued at a MC of only $2m.

1/n

And after all the Sifu, $TIME and $SPELL drama I predict it’s about to get a lot more attention.

So time for a thread, but first here’s a summary:

2/n

So time for a thread, but first here’s a summary:

2/n

- $MELT MC of $2m is hugely undervalued relative to its peers and growth potential

- Allows users to mint stables with LP tokens

- $MELT staking boosts stablecoin rewards

- Favourable narrative

- Strong roadmap

- First class devs and engaged community

- Audited

3/n

- Allows users to mint stables with LP tokens

- $MELT staking boosts stablecoin rewards

- Favourable narrative

- Strong roadmap

- First class devs and engaged community

- Audited

3/n

Like $SPELL, the platform enables stablecoin minting using yield bearing LP positions and $xJOE.

But unlike $SPELL and competing protocols, you can use its token $MELT to boost stablecoin farming rewards (similar to staked $PTP).

4/n

But unlike $SPELL and competing protocols, you can use its token $MELT to boost stablecoin farming rewards (similar to staked $PTP).

4/n

Even at a $2m $MELT MC, I’m farming my @curve stable LP for over 200% APR, paid mainly in $MELT and a portion in $H2O.

5/n

5/n

$H2O is @defrost_finance’s overcolalateralsised stablecoin, analogous to $MIM and became $AVAX’s first native stablecoin when @defrost_finance launched late last year.

6/n

6/n

Before the latest drama, SPELL had been a wildly successful defi protocol. I predict it will remain so, but that a substantial amount of capital will move to other stablecoin protocols such as $MELT and $MORE.

7/n

7/n

$H2O being overcollateralized means its USD peg is backed by LP token deposits larger than the value of all $H2O in circulation.

8/n

8/n

Overcollateralization is common in defi stablecoin projects, but is particularly important where LP tokens are used as collateral, since the protocol needs to account for and be able to respond to volatility and liquidity in more than one token.

9/n

9/n

H2O’s collateral is arguably even safer than other overcollateralized protocols since the majority of collateral is in CRV stablecoin LPs and none in its native token $MELT (which can lead to circular collateralisation risks).

10/n

10/n

$H2O is slightly under peg at the moment, hovering around $0.97 - $0.98. This is because you mint H2O by going through supervaults which themselves give incentive rewards.

11/n

11/n

Due to these rewards, users have looped and traded out of their $H2O to deposit more supervault collateral to earn yield and mint more H2O etc. etc.

12/n

12/n

As the protocol becomes more popular the peg should naturally get closer to $1, since it's an easy arb and since as discussed above, there is plenty of collateral backing H2O.

13/n

13/n

And additionally, Defrost is about to introduce a new super vault designed to tackle the H2O peg and potentially further support the price of MELT. More info here: medium.com/@Defrost_Finan…

14/n

14/n

Metrics and Charts

Soon after its launch @defrost_finance reached its TVL peak of c. $180m in December. $MELT then lost TVL throughout the remainder of December and January, to reach a 2022 low of c. $52m TVL has now reduced to c. 60m.

15/n

Soon after its launch @defrost_finance reached its TVL peak of c. $180m in December. $MELT then lost TVL throughout the remainder of December and January, to reach a 2022 low of c. $52m TVL has now reduced to c. 60m.

15/n

As you can see from the chart, its TVL has steadily increased in the last two weeks.

$61m of TVL and a MC of $2m gives a ridiculously low TVL ratio of 0.033. For a comparison, MORE’s is c. 0.28 and $SPELL’s is 0.14534 - more than 8x and 4x respectively of $MELT’s.

16/n

$61m of TVL and a MC of $2m gives a ridiculously low TVL ratio of 0.033. For a comparison, MORE’s is c. 0.28 and $SPELL’s is 0.14534 - more than 8x and 4x respectively of $MELT’s.

16/n

I think all 3 protocols will do well, but these metrics (and others IMO) favour $MELT.

Price Chart

Because $H2O was AVAX’s first native stablecoin, the $MELT launch was hyped and its price followed that hype, reaching highs of $23 before retracing significantly.

17/n

Price Chart

Because $H2O was AVAX’s first native stablecoin, the $MELT launch was hyped and its price followed that hype, reaching highs of $23 before retracing significantly.

17/n

However since making its lows 3 weeks ago, $MELT has rebounded strongly, having made 5 higher lows in the last 3 weeks. You don’t need to be a TA expert to realise how bullish this chart is. And when the chart lines up with fundamentals, I buy in heavily.

18/n

18/n

Currently $MELT stakers accrue revenue through 3 sources; stability fees, liquidations, and 20% of the auto-compounding rewards from supervaults. Up to date figures are not available, but from the docs:

19/n

19/n

“In the first month, about 10,000 H2Os have been collected by the contract from stability fees and liquidation penalties. These will be provided as MELT staking rewards to initial stakers."

20/n

20/n

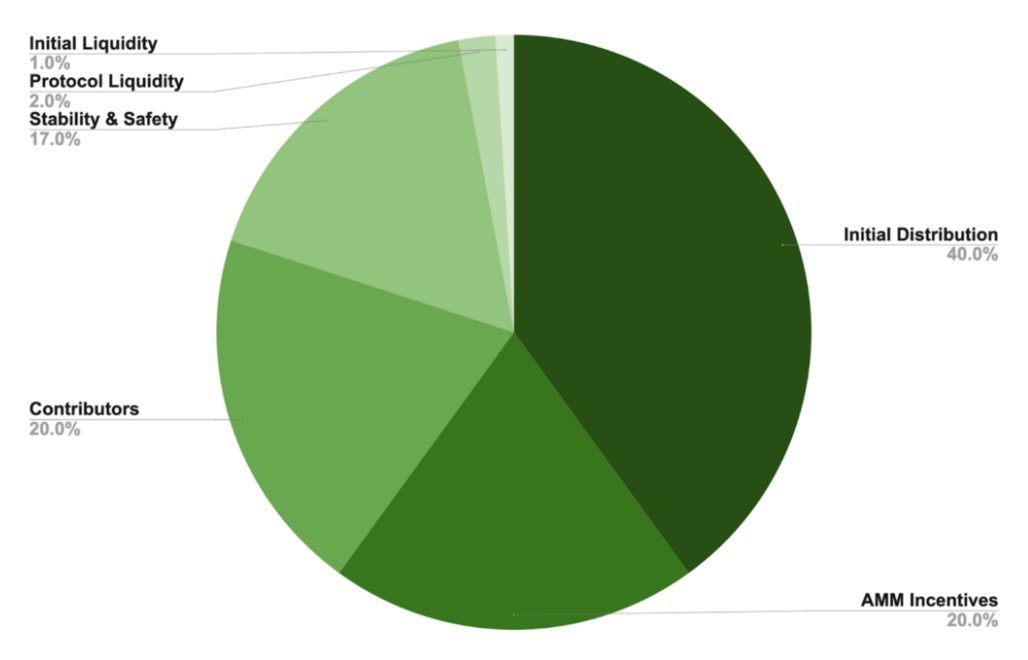

Emissions

$MELT tokens are applied as the incentive for Providing H2O liquidity on both @CurveFinance and @traderjoexyz. The basic reward in the DefrostH2O3CRV boosting pool and H2O/AVAX boosting pool is 50,000 MELT and 1,000 MELT per day respectively.

21/n

$MELT tokens are applied as the incentive for Providing H2O liquidity on both @CurveFinance and @traderjoexyz. The basic reward in the DefrostH2O3CRV boosting pool and H2O/AVAX boosting pool is 50,000 MELT and 1,000 MELT per day respectively.

21/n

$MELT is also rewarded to $MELT stakers on an auto-compounding basis - currently 107% APY.

10% of rewards are unlocked every 6 days, therefore leading to a more gradual and sustainable release to the market.

More info on emissions here:

docs.defrost.finance/tokenomics/mel…

22/n

10% of rewards are unlocked every 6 days, therefore leading to a more gradual and sustainable release to the market.

More info on emissions here:

docs.defrost.finance/tokenomics/mel…

22/n

Roadmap

$MELT already had an ambitious roadmap when it launched in November and it has already accomplished several of its core milestones, such as community governance and Supervaults.

23/n

$MELT already had an ambitious roadmap when it launched in November and it has already accomplished several of its core milestones, such as community governance and Supervaults.

23/n

The roadmap is constantly evolving. The two items I am most looking forward to are cross chain implementations - cross-chained assets will eventually be whitelisted for minting H2O and H2O itself will go cross chain.

medium.com/@Defrost_Finan…

24/n

medium.com/@Defrost_Finan…

24/n

Before concluding this thread, I should also touch on:

- Dev: their lead dev Doran @cryptodoran is an absolute galaxy brain. His commitment to the project is clear given how he and the rest of the team has remained throughout this retrace.

25/n

- Dev: their lead dev Doran @cryptodoran is an absolute galaxy brain. His commitment to the project is clear given how he and the rest of the team has remained throughout this retrace.

25/n

- Community: The @defrost_finance community is incredibly engaged and knowledgeable. They quickly brought me up to speed on the protocol in their discord and are constantly making innovative suggestions for improvements.

26/n

26/n

- Audited: Defrost and its contracts have been audited by Certik. While this does not eliminate all risk, it gives comfort to whales, which are key to a stablecoin project’s liquidity. certik.com/projects/defro…

27/n

27/n

Conclusion

So there you have it - I hope after reading this thread you’re as bullish on $MELT as I am. Here’s a quick summary for you:

- It’s MC of $2m is hugely undervalued relative to its peers and growth potential

- Allows users to mint stables with LP tokens

28/n

So there you have it - I hope after reading this thread you’re as bullish on $MELT as I am. Here’s a quick summary for you:

- It’s MC of $2m is hugely undervalued relative to its peers and growth potential

- Allows users to mint stables with LP tokens

28/n

- $MELT staking boosts stablecoin rewards

- Favourable narrative

- Strong roadmap

- First class devs and engaged community

- Favourable narrative

- Strong roadmap

- First class devs and engaged community

Further reading

Chart: dexscreener.com/avalanche/0x29…

T: @defrost_finance

Linktree: linktr.ee/Defrost_Finance

30/30

Chart: dexscreener.com/avalanche/0x29…

T: @defrost_finance

Linktree: linktr.ee/Defrost_Finance

30/30

• • •

Missing some Tweet in this thread? You can try to

force a refresh