1) A thread on Pension Record errors

#MedTwitter - if you've ever had an annual allowance charge, it is worth checking your #nhspension

Lots of good #MedEd threads on this subject from @goldstone_tony

Here's a round up of the major errors, and a few of the niche ones too

#MedTwitter - if you've ever had an annual allowance charge, it is worth checking your #nhspension

Lots of good #MedEd threads on this subject from @goldstone_tony

Here's a round up of the major errors, and a few of the niche ones too

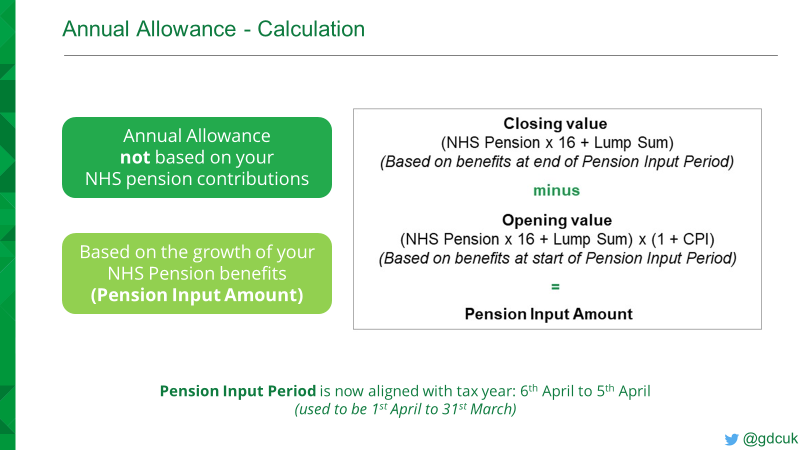

2) Annual Allowance in #nhspension is measured by the growth in the benefits that you've accrued (NOT based on contributions)

Your benefits are based on your pensionable pay

👉If your pensionable pay is wrong, then accrued benefit calcs & annual allowance calcs will be wrong

Your benefits are based on your pensionable pay

👉If your pensionable pay is wrong, then accrued benefit calcs & annual allowance calcs will be wrong

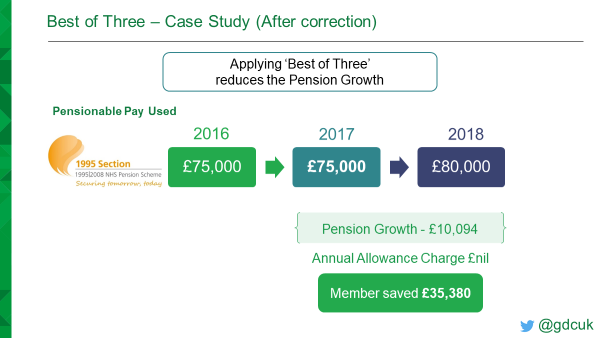

3) Best of Three error

Before June 2020, the 95 scheme AA statements were based on previous year's pensionable pay, rather than 'Best of the last 3 years'

If your pay went down then up again, your AA statement would reflect an artificial pay rise and increased growth 👇

Before June 2020, the 95 scheme AA statements were based on previous year's pensionable pay, rather than 'Best of the last 3 years'

If your pay went down then up again, your AA statement would reflect an artificial pay rise and increased growth 👇

4) Best of Three error

Applying 'Best of Three' gets rid of the artificial growth and in this example, saved £35,380 AA charge 🤯

Revised AA statements for McCloud (covering 2015-2022) should fix this for 2015 members

However, check 2010/11 - 2014/15, to get McCloud ready

Applying 'Best of Three' gets rid of the artificial growth and in this example, saved £35,380 AA charge 🤯

Revised AA statements for McCloud (covering 2015-2022) should fix this for 2015 members

However, check 2010/11 - 2014/15, to get McCloud ready

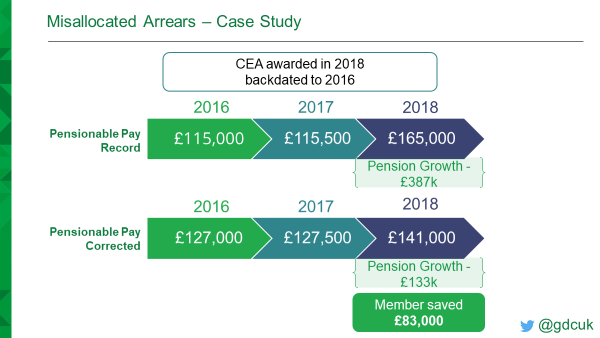

5) Misallocated Arrears error

If you receive pensionable pay arrears for a previous year, then your pension record should be adjusted so that the pay is credited to the correct year

Historic Clinical Excellence Awards are the biggest culprit here (plus backdated On Call pay)

If you receive pensionable pay arrears for a previous year, then your pension record should be adjusted so that the pay is credited to the correct year

Historic Clinical Excellence Awards are the biggest culprit here (plus backdated On Call pay)

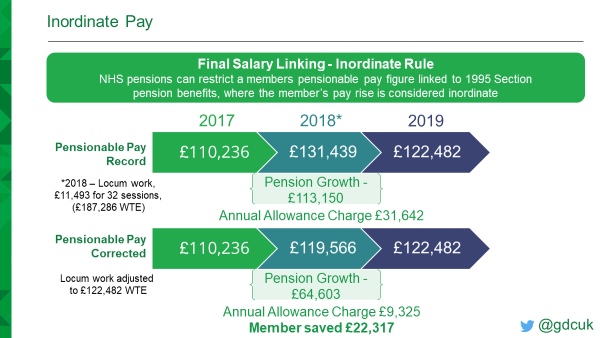

5) Inordinate Pay error

Inordinate rules allow NHSBSA to reduce your pensionable pay at retirement if it is considered too high

I proposed this could apply during member's career - NHSBSA agreed🥳

Can apply if you take on short term work that artificially increases your pay

Inordinate rules allow NHSBSA to reduce your pensionable pay at retirement if it is considered too high

I proposed this could apply during member's career - NHSBSA agreed🥳

Can apply if you take on short term work that artificially increases your pay

6) Inordinate Pay

There are many members who receive annual allowance charges for pension benefits that never manifest

Whilst not an "error", I've proposed to NHSBSA that inordinate rules be extended to ameliorate this - just awaiting response from DHSC

There are many members who receive annual allowance charges for pension benefits that never manifest

Whilst not an "error", I've proposed to NHSBSA that inordinate rules be extended to ameliorate this - just awaiting response from DHSC

https://twitter.com/gdcuk/status/1469952476866658304?s=20&t=Ih0d8Fk4dOBYxLSp97KrDw

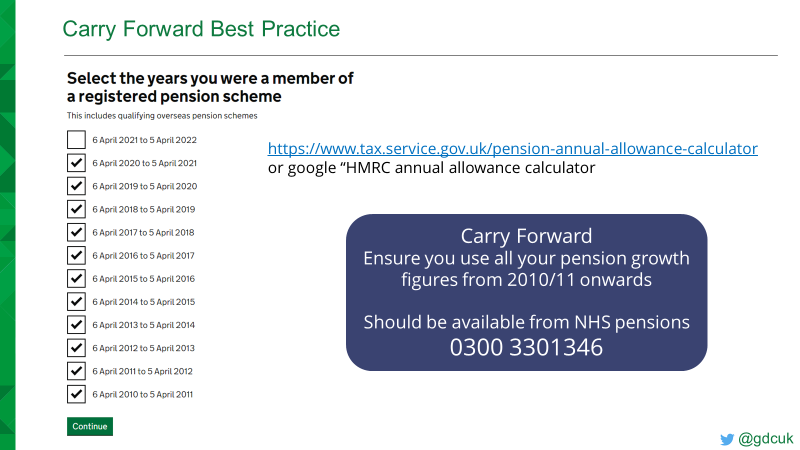

7) Carry Forward error

Not really a pension record error

You can carry forward 3 years unused Annual Allowance, but those years are impacted by the years before them

You need to use your growth figures back to 2010/11 (you'll also need them for the McCloud AA re-assessment)

Not really a pension record error

You can carry forward 3 years unused Annual Allowance, but those years are impacted by the years before them

You need to use your growth figures back to 2010/11 (you'll also need them for the McCloud AA re-assessment)

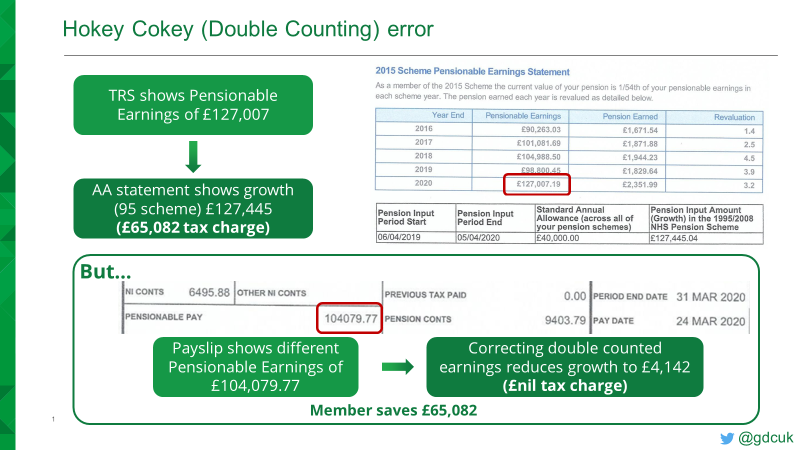

7) Hokey Cokey error

When opting out & re-joining within the same year, sometimes the pre-opt out pay on your record is added again to the pay after you re-join

Easy way to check - compare total pensionable pay on your March payslip against the TRS

When opting out & re-joining within the same year, sometimes the pre-opt out pay on your record is added again to the pay after you re-join

Easy way to check - compare total pensionable pay on your March payslip against the TRS

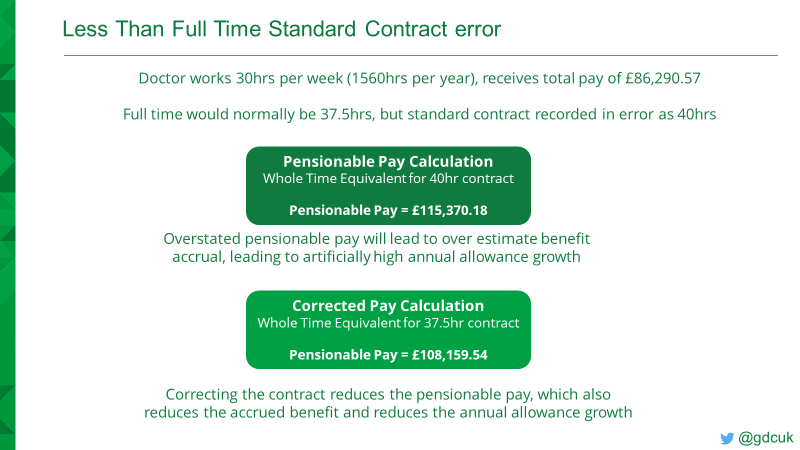

8) Less Than Full Time Standard Contract error

Pay contracts are recorded based on either Sessions (typically 10 per week) or Hours (typically 37.5 per week)

If the standard contract is recorded incorrectly this can artificially inflate your pensionable pay (& AA Charge)

Pay contracts are recorded based on either Sessions (typically 10 per week) or Hours (typically 37.5 per week)

If the standard contract is recorded incorrectly this can artificially inflate your pensionable pay (& AA Charge)

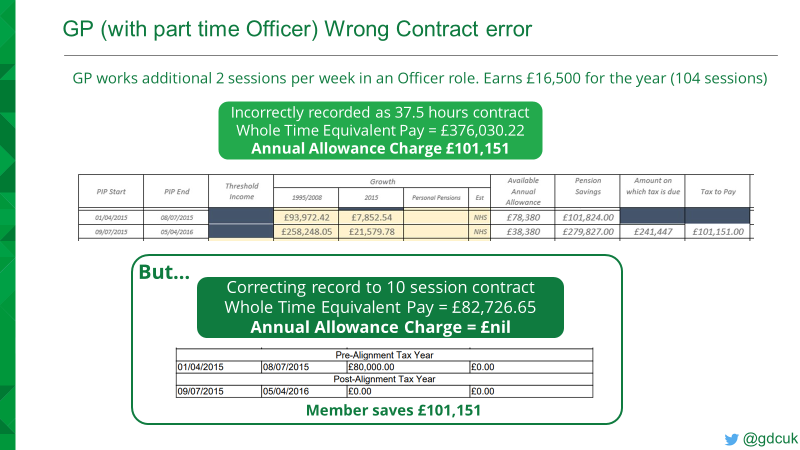

9) GP (with part time Officer) Wrong Contract error

If you work sessions, but your contract has been recorded as hours, this can artificially inflate your pensionable pay, which ultimately artificially increase your annual allowance charge

If you work sessions, but your contract has been recorded as hours, this can artificially inflate your pensionable pay, which ultimately artificially increase your annual allowance charge

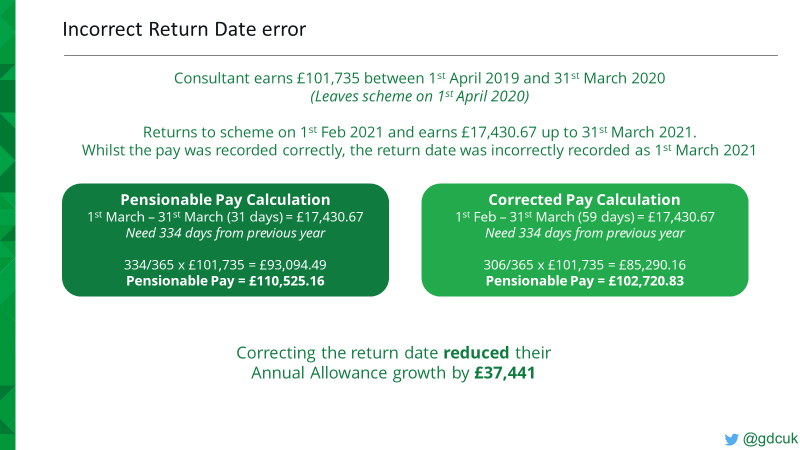

10) Incorrect Return Date error

Pensionable pay is based on chunks of 365 days active service

If the wrong date of return is used with the correct pensionable pay, you can end up with artificially high pay, leading to higher growth and AA charges

Pensionable pay is based on chunks of 365 days active service

If the wrong date of return is used with the correct pensionable pay, you can end up with artificially high pay, leading to higher growth and AA charges

11) Exceeding Full Time error

When a member has multiple Less Than Full Time roles that add up to more than 10 PAs, errors can creep in if both employers pension each role

The record can be trimmed by NHSBSA, but this can sometimes lead to artificially high pay & AA charges

When a member has multiple Less Than Full Time roles that add up to more than 10 PAs, errors can creep in if both employers pension each role

The record can be trimmed by NHSBSA, but this can sometimes lead to artificially high pay & AA charges

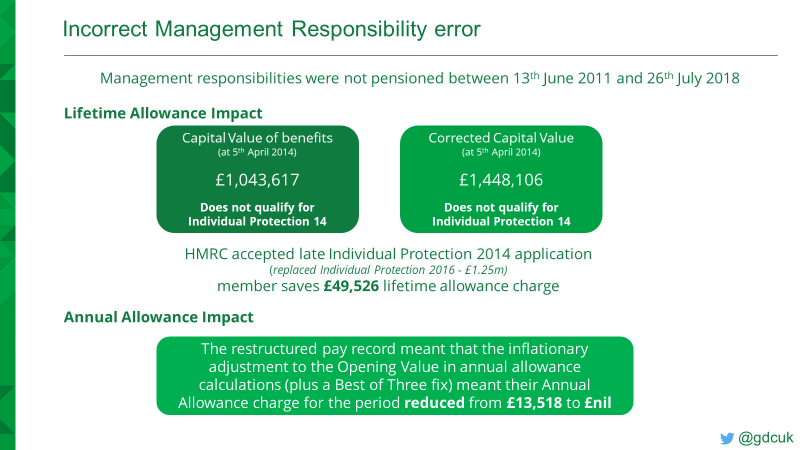

12) Incorrect Management Responsibility error

Some historic management responsibilities that should have been pensionable were recorded as non-pensionable

This leads to reduced benefits, impacting lifetime allowance protection & AA charges

Good case study with @DB_Wales👇

Some historic management responsibilities that should have been pensionable were recorded as non-pensionable

This leads to reduced benefits, impacting lifetime allowance protection & AA charges

Good case study with @DB_Wales👇

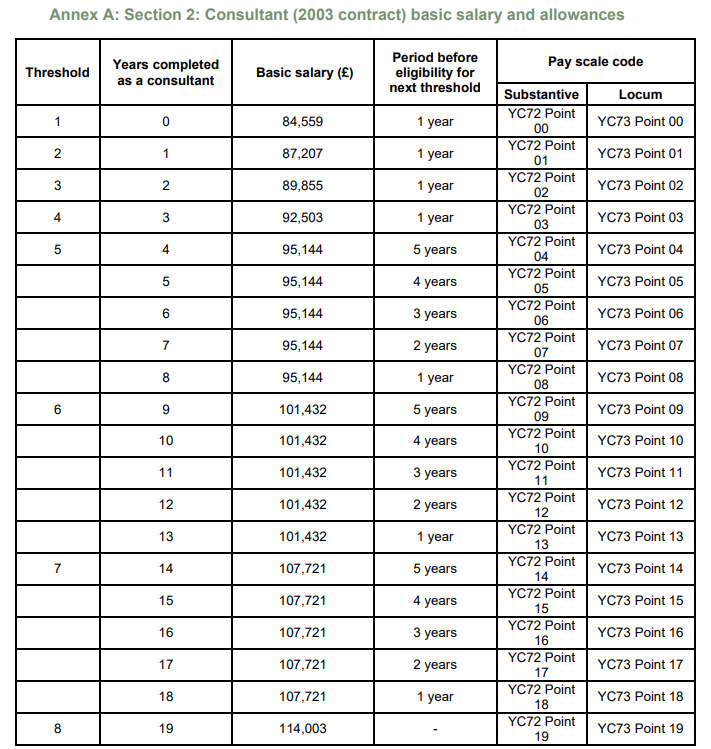

13) Incorrect Increment error

Errors can occur with recording the correct increment progression (particularly new consultants or when moving to/from University employer)

Can sometimes leave the consultant on a lower salary

I have corrected some records going back 5+ years🤯

Errors can occur with recording the correct increment progression (particularly new consultants or when moving to/from University employer)

Can sometimes leave the consultant on a lower salary

I have corrected some records going back 5+ years🤯

14) Incorrect On Call error

This is where member is paid the 'Cat B' on call rate, when working under 'Cat A' definition

Also On Call payment is a percentage of basic pay, sometimes this has been inflated to include CEA payments

This is where member is paid the 'Cat B' on call rate, when working under 'Cat A' definition

Also On Call payment is a percentage of basic pay, sometimes this has been inflated to include CEA payments

15) Incorrect Added Years errors

Sometimes added years payments are collected, but the contract has not been reflected on the Annual Allowance statement or TRS

Some have their contract ceased (as out the scheme for 12 months+) but payments still being collected on re-joining

Sometimes added years payments are collected, but the contract has not been reflected on the Annual Allowance statement or TRS

Some have their contract ceased (as out the scheme for 12 months+) but payments still being collected on re-joining

16) University / Direction Status Employer errors

Employer typically has no direct access to pension record, so data can get lost / mistyped when the data is transferred to NHSBSA and manually rekeyed

Employer typically has no direct access to pension record, so data can get lost / mistyped when the data is transferred to NHSBSA and manually rekeyed

17) National Clinical Excellence Awards enhancement error

Occurs where member receives full NCEA, but works less than full time - particularly in University sector

Whole Time Equivalent calculations result in increasing pensionable value of the NCEA

(saved £54k AA fixing this)

Occurs where member receives full NCEA, but works less than full time - particularly in University sector

Whole Time Equivalent calculations result in increasing pensionable value of the NCEA

(saved £54k AA fixing this)

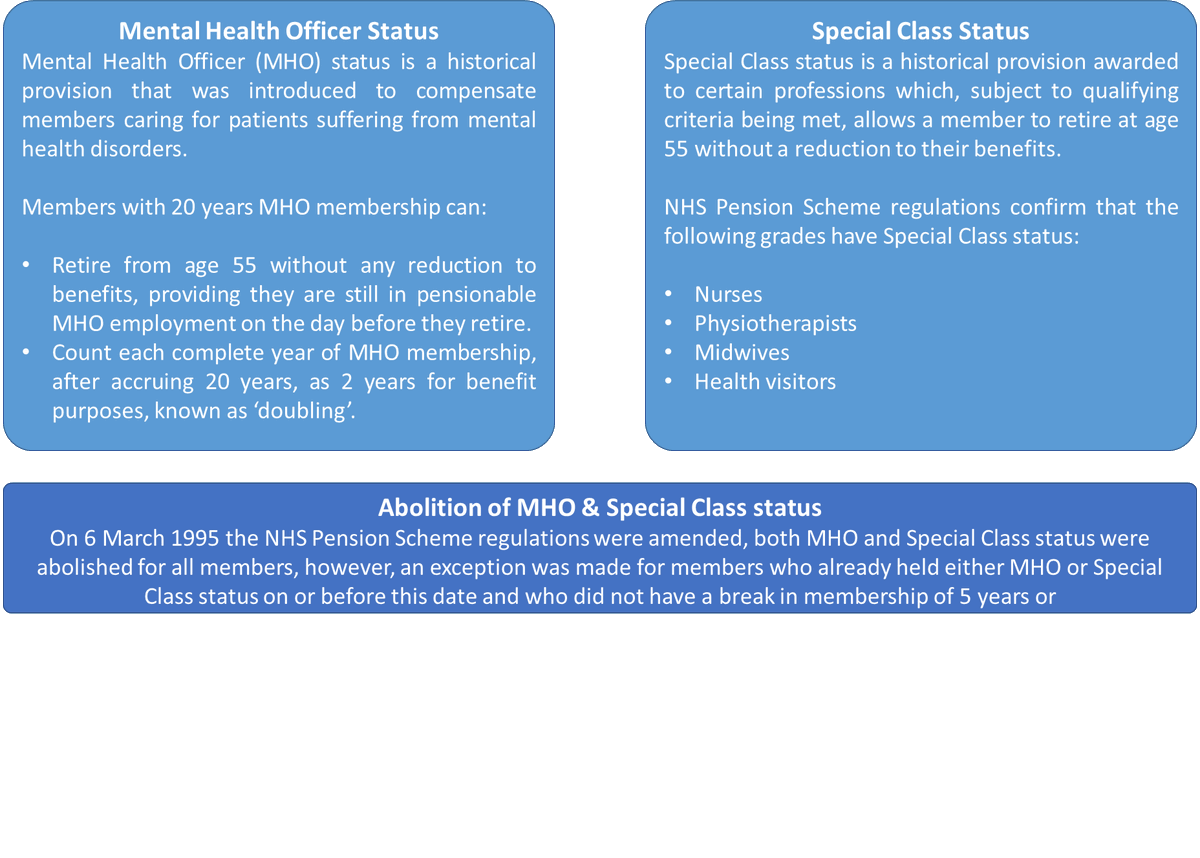

18) Missing MHO / Special Class status

Occurs where 1 or many historic employments miss the correct MHO/SC status

Can result in the wrong doubling date for MHO (resulting in less benefit)

Worse cases can result in unnecessary actuarial reduction at 55

Occurs where 1 or many historic employments miss the correct MHO/SC status

Can result in the wrong doubling date for MHO (resulting in less benefit)

Worse cases can result in unnecessary actuarial reduction at 55

19) GP pension record errors

Too many issues to mention in one tweet over the handling of GP pension data and the subsequent errors that occur with Annual Allowance amongst many things

Some great work by @nick_grundy shining a light on these issues

Too many issues to mention in one tweet over the handling of GP pension data and the subsequent errors that occur with Annual Allowance amongst many things

Some great work by @nick_grundy shining a light on these issues

https://twitter.com/nick_grundy/status/1372844086797930496?s=20&t=NOkYxV46zJlCsFtsOXpfaQ

20) The cost of errors is astounding

I've worked with many doctors, nurses, accountants & advisers, fixed well over £1m AA errors (£11m LTA)

AA is not fit for purpose, I hope a fix will come🤞

But, we still have to deal with the current set up, so check your pension record👍

I've worked with many doctors, nurses, accountants & advisers, fixed well over £1m AA errors (£11m LTA)

AA is not fit for purpose, I hope a fix will come🤞

But, we still have to deal with the current set up, so check your pension record👍

• • •

Missing some Tweet in this thread? You can try to

force a refresh