SRF Limited : Why is it getting all the praise?

Here’s an analysis of the company, it’s positioning, the segment growth, key risks, fundamentals and more!

An informative thread 🧵🧵🧵👇🏻

#investing #StockToWatch

Here’s an analysis of the company, it’s positioning, the segment growth, key risks, fundamentals and more!

An informative thread 🧵🧵🧵👇🏻

#investing #StockToWatch

(1/22)

• The business:

SRF is a multi-business chemicals conglomerate engaged in the manufacturing of industrial and specialty intermediates.

Their diversified portfolio covers Technical Textiles, Fluorochemicals Specialty, Chemicals, Packaging Films & Engineering Plastics.

• The business:

SRF is a multi-business chemicals conglomerate engaged in the manufacturing of industrial and specialty intermediates.

Their diversified portfolio covers Technical Textiles, Fluorochemicals Specialty, Chemicals, Packaging Films & Engineering Plastics.

(2/22)

• SRFs Journey:

Incorporated in 1970, SRF(Shri Ram Fibres Ltd) largely caters to automobiles,tyres, air conditioners, refrigerators,

pharmaceuticals, agrochemicals,

mining, manufacturing and packaging industries.

• SRFs Journey:

Incorporated in 1970, SRF(Shri Ram Fibres Ltd) largely caters to automobiles,tyres, air conditioners, refrigerators,

pharmaceuticals, agrochemicals,

mining, manufacturing and packaging industries.

(3/22)

• 2011-14 : They started expanding (added maiden overseas plants in Thailand and South Africa) with an investment of ₹25 Billion.

• 2015-18 : They invested ₹32Billion and ramped up the capacities. They entered into pharma segment by acquiring DuPont’s Dymel.

• 2011-14 : They started expanding (added maiden overseas plants in Thailand and South Africa) with an investment of ₹25 Billion.

• 2015-18 : They invested ₹32Billion and ramped up the capacities. They entered into pharma segment by acquiring DuPont’s Dymel.

(4/22

• 2018-21 : Their investments in chemical segment in the past generated a 61% growth in special chem business. During 2018-21, they invested ₹53Bn in capacity augmentation.

: 2022 & beyond: Expect SRF to generate higher revenue CAGR due to its capital outlay of ₹60Bn

• 2018-21 : Their investments in chemical segment in the past generated a 61% growth in special chem business. During 2018-21, they invested ₹53Bn in capacity augmentation.

: 2022 & beyond: Expect SRF to generate higher revenue CAGR due to its capital outlay of ₹60Bn

(5/22)

SRFs Revenue breakup:

• Chemicals : 43%

1) Industrial Chem - 3%

2) Refrigerants - 12%

3) Special Fluorochem - 28%

• Technical Textile - 15%

1) Tyre Fabrics- 10%

2) Industrial Yarn - 2%

3) Belting Fabrics - 3%

• Packaging Films - 39%

1) BOPET/BOPP films - 39%

SRFs Revenue breakup:

• Chemicals : 43%

1) Industrial Chem - 3%

2) Refrigerants - 12%

3) Special Fluorochem - 28%

• Technical Textile - 15%

1) Tyre Fabrics- 10%

2) Industrial Yarn - 2%

3) Belting Fabrics - 3%

• Packaging Films - 39%

1) BOPET/BOPP films - 39%

(6/22)

• SRFs Market Position:

Of the above mentioned sub-segments, SRF is an Indian Market Leader in-

1) Industrial Chem

2) Refrigerants

3) Specialty Fluorochem

4) Industrial Yarn

5) BOPP films

• It is also globally second in the Tyre Fabrics and Belting Fabrics

• SRFs Market Position:

Of the above mentioned sub-segments, SRF is an Indian Market Leader in-

1) Industrial Chem

2) Refrigerants

3) Specialty Fluorochem

4) Industrial Yarn

5) BOPP films

• It is also globally second in the Tyre Fabrics and Belting Fabrics

(7/22)

SRF: Always ahead!

SRFs ability to think ahead for a decade has always played out in its favour.

Their investment of ₹30Bn in 2013-18 in the chemicals to expand product portfolio led to 61% revenue CAGR for the special chemical segment over 2018-21

SRF: Always ahead!

SRFs ability to think ahead for a decade has always played out in its favour.

Their investment of ₹30Bn in 2013-18 in the chemicals to expand product portfolio led to 61% revenue CAGR for the special chemical segment over 2018-21

(8/22)

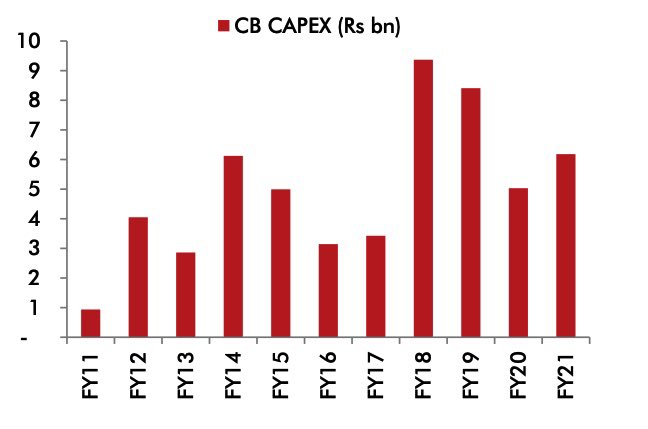

• Capex skewed towards fluoro specialty over the last decade, which contributes ~65% to the chemical segment. Management focused on the fluorospecialty since it can be scaled given large market size with agrichem & pharma customers & gives stability to profitability.

• Capex skewed towards fluoro specialty over the last decade, which contributes ~65% to the chemical segment. Management focused on the fluorospecialty since it can be scaled given large market size with agrichem & pharma customers & gives stability to profitability.

(9/22)

• Another instance of forward thinking:

Announced packaging film

capacity in Thailand and Hungry (FY18) despite capacity underutilization globally. These capacities came into play

in FY20 and FY21.

• Another instance of forward thinking:

Announced packaging film

capacity in Thailand and Hungry (FY18) despite capacity underutilization globally. These capacities came into play

in FY20 and FY21.

(10/22)

• HFC expansion: With Government of India's regulatory

restrictions (under Montreal Protocol) kicking in on capacity addition from December 2023, SRF has announced that it would expand its HFCs capacity with capital outlay of ₹25bn. This will commercialize in July-2023

• HFC expansion: With Government of India's regulatory

restrictions (under Montreal Protocol) kicking in on capacity addition from December 2023, SRF has announced that it would expand its HFCs capacity with capital outlay of ₹25bn. This will commercialize in July-2023

(11/22)

• The chemicals division will remain a key growth driver :

(1) with more molecules moving to MP & dedicated plant,

(2) focus on improving pharma revenues in spechem (currently ~5% of spechem revenues),

(3) Increasing HFC capacities

(4) foray into fluoropolymer.

• The chemicals division will remain a key growth driver :

(1) with more molecules moving to MP & dedicated plant,

(2) focus on improving pharma revenues in spechem (currently ~5% of spechem revenues),

(3) Increasing HFC capacities

(4) foray into fluoropolymer.

(12/22)

• Hiring the best:

Pharma comprises only 5% of the specialty chem segment & management has its medium-term guidance to grow the pharma segment's contribution to

15% in the next 2-3 years. In this pursuit, it is incrementally hiring people with a pharma background.

• Hiring the best:

Pharma comprises only 5% of the specialty chem segment & management has its medium-term guidance to grow the pharma segment's contribution to

15% in the next 2-3 years. In this pursuit, it is incrementally hiring people with a pharma background.

(13/22)

• Backward Integration:

A leader in Refrigerants, It is one of the few companies having backward integration to basic

building blocks, chloromethanes and anhydrous hydrogen fluoride (AHF), which enabled it to scale and expand product offerings.

next>>>

• Backward Integration:

A leader in Refrigerants, It is one of the few companies having backward integration to basic

building blocks, chloromethanes and anhydrous hydrogen fluoride (AHF), which enabled it to scale and expand product offerings.

next>>>

(14/22)

• Recently imposed ADD (Anti-

Dumping Duty) on R32 and HFC blends will ensure better pricing for these gases for SRF. It is expected to gain market share significantly as other players like GFL and

NFIL do not have concrete plans to expand or enter into HFCs.

• Recently imposed ADD (Anti-

Dumping Duty) on R32 and HFC blends will ensure better pricing for these gases for SRF. It is expected to gain market share significantly as other players like GFL and

NFIL do not have concrete plans to expand or enter into HFCs.

(15/22)

Let’s look into Packaging Films Segment:

Profitability is slowing in

this segment due to contraction in spreads. Which is guided by capacity addition at globally & rising PTA, MEG, PP prices.

For SRF, new capacities at Thailand and Hungry will provide additional volume

Let’s look into Packaging Films Segment:

Profitability is slowing in

this segment due to contraction in spreads. Which is guided by capacity addition at globally & rising PTA, MEG, PP prices.

For SRF, new capacities at Thailand and Hungry will provide additional volume

(16/22)

• Input prices on the up!

The prices of raw materials PTA and MEG are rising owing to strong crude prices. The contracting spreads will reflect on the margin trajectory of SRF in the short to medium term

• Input prices on the up!

The prices of raw materials PTA and MEG are rising owing to strong crude prices. The contracting spreads will reflect on the margin trajectory of SRF in the short to medium term

(17/22)

• Sharp Margin Contraction:

SRF has nearly 60% volume share of BOPET films and contraction in BOPET spreads affect segmental margins adversely. 2QFY22 saw this playing out with rising

PTA/MEG prices leading to sharp margin contraction.

• Sharp Margin Contraction:

SRF has nearly 60% volume share of BOPET films and contraction in BOPET spreads affect segmental margins adversely. 2QFY22 saw this playing out with rising

PTA/MEG prices leading to sharp margin contraction.

(18/22)

SRFs Balance Sheet:

SRF has improved its balance sheet with efficient capital allocation. It has fed capital to right business segments at the right time. Over the last few years,

capital allocation to the chem segment has improved & so has

margins & return ratios.

SRFs Balance Sheet:

SRF has improved its balance sheet with efficient capital allocation. It has fed capital to right business segments at the right time. Over the last few years,

capital allocation to the chem segment has improved & so has

margins & return ratios.

(19/22)

• Key Risks:

1) Project Execution Risk - Any slowdown in capex execution will pose a risk to its earnings

2) Slowdown in Global Agrochemical Industry could hurt SRFs growth

3) Slower Ramp up of new Products:

Any slowdown could hurt the margin expansions

• Key Risks:

1) Project Execution Risk - Any slowdown in capex execution will pose a risk to its earnings

2) Slowdown in Global Agrochemical Industry could hurt SRFs growth

3) Slower Ramp up of new Products:

Any slowdown could hurt the margin expansions

(20/22)

• Catalysts:

1) Improvement in revenue share of chemical segment.

2) Ramp up in favourable pricing environment for refrigerants.

3) Long term stability could be achieved if fluoropolymers market expands as SRF is investing heavily into this.

• Catalysts:

1) Improvement in revenue share of chemical segment.

2) Ramp up in favourable pricing environment for refrigerants.

3) Long term stability could be achieved if fluoropolymers market expands as SRF is investing heavily into this.

(21/22)

SRF stands at an inflection point for new growth period hoping to find strong demand of agrochemicals, pharma chemicals , improved pricing in refrigerants.

It has a very efficient management, always forward looking and sharp!

It should continue to grow in the future!

SRF stands at an inflection point for new growth period hoping to find strong demand of agrochemicals, pharma chemicals , improved pricing in refrigerants.

It has a very efficient management, always forward looking and sharp!

It should continue to grow in the future!

(22/22)

What do you think of #SRF and it’s all round growth plans?

Comment down below and don’t forget to hit the retweet if you liked our analysis!

@caniravkaria @PAlearner @nid_rockz @saketreddy @shivang_ran

What do you think of #SRF and it’s all round growth plans?

Comment down below and don’t forget to hit the retweet if you liked our analysis!

@caniravkaria @PAlearner @nid_rockz @saketreddy @shivang_ran

• • •

Missing some Tweet in this thread? You can try to

force a refresh