Let's Get Started!

Today we bring you the Story and Financials of MAMAEARTH.

India's first Unicorn of 2022.

A Thread below🧵🧵🧵👇🏻

#startupindia #investing

Today we bring you the Story and Financials of MAMAEARTH.

India's first Unicorn of 2022.

A Thread below🧵🧵🧵👇🏻

#startupindia #investing

(1/14)

• Mamaearth is the 1st Asian Brand with a "MADE SAFE" certification.

• It's founders, Ghazal Alagh and Varun Alagh incorporated Honasa

Consumer Private Limited in 2016 and then went on to launch the

Mamaearth in December that year.

•It is Headquartered in Gurugram.

• Mamaearth is the 1st Asian Brand with a "MADE SAFE" certification.

• It's founders, Ghazal Alagh and Varun Alagh incorporated Honasa

Consumer Private Limited in 2016 and then went on to launch the

Mamaearth in December that year.

•It is Headquartered in Gurugram.

(2/14)

• Idea behind the Brand:

When the founders were expecting their first child, they realized that the baby care products they came across contained harmful toxins and safer alternatives weren't available.

• Idea behind the Brand:

When the founders were expecting their first child, they realized that the baby care products they came across contained harmful toxins and safer alternatives weren't available.

(3/14)

• Finding no solutions, they researched the ways they can make safer products for the babies. They spent sleepless nights over founding a new brand, created a dedicated R&D team for it, applied for required certifications.

All of these ultimately gave rise to Mamaearth.

• Finding no solutions, they researched the ways they can make safer products for the babies. They spent sleepless nights over founding a new brand, created a dedicated R&D team for it, applied for required certifications.

All of these ultimately gave rise to Mamaearth.

(4/14)

• Mamaearth’s target market:

The baby care market in India is expected to grow at 17% CAGR in revenue in the next 3 years. In terms of the products available,

The following are their product segments:

•Baby

•Beauty

•Hair

•Face

•Body

•Gift packs

• Mamaearth’s target market:

The baby care market in India is expected to grow at 17% CAGR in revenue in the next 3 years. In terms of the products available,

The following are their product segments:

•Baby

•Beauty

•Hair

•Face

•Body

•Gift packs

(5/14)

• Mamaearth - Business Model

Mamaearth formulates products that are then produced by contract

manufacturers under a license from the Mamaearth brand.

• Mamaearth - Business Model

Mamaearth formulates products that are then produced by contract

manufacturers under a license from the Mamaearth brand.

(6/14)

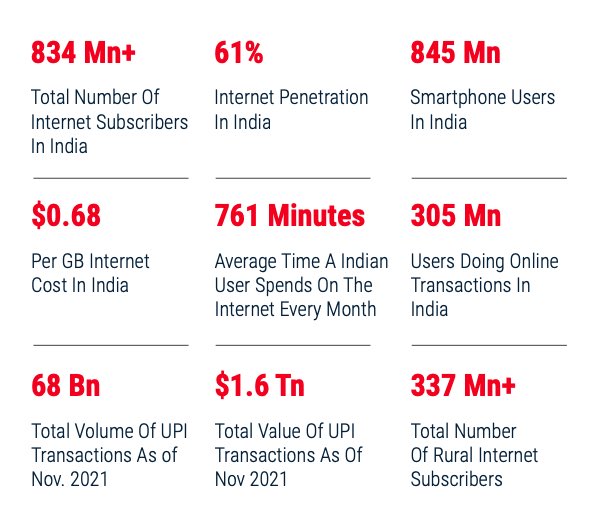

• Mamaearth - Revenue Model

Mamaearth is a digital-first FMCG company whose revenue model is based on the offers that are posted on the D2C platforms (Amazon, Flipkart, etc.) & their eventual sales along with the sale of products displayed at traditional offline stores.

• Mamaearth - Revenue Model

Mamaearth is a digital-first FMCG company whose revenue model is based on the offers that are posted on the D2C platforms (Amazon, Flipkart, etc.) & their eventual sales along with the sale of products displayed at traditional offline stores.

(7/14)

• Funding and Investors:

Mamaearth raised a total of $109.87 million in funding over 7 rounds. The latest funding of $37.5Mn helped the company achieve a unicorn valuation.

•Here's a list of all the funding the company received since its inception.

• Funding and Investors:

Mamaearth raised a total of $109.87 million in funding over 7 rounds. The latest funding of $37.5Mn helped the company achieve a unicorn valuation.

•Here's a list of all the funding the company received since its inception.

(8/14)

• Mamaearth Acquisition:

Mamearth has acquired 2 companies to date - Mompresso an Mompresso MyMoney, both of which were acquired by the D2C brand on December 24, 2021.

• Mamaearth Acquisition:

Mamearth has acquired 2 companies to date - Mompresso an Mompresso MyMoney, both of which were acquired by the D2C brand on December 24, 2021.

(9/14)

• Mamaearth - Growth and Revenue

When Mamaearth was launched, it had only six products in its catalog. The range now comprises more than 80 natural, toxin-free products that are used by over 15 lakh consumers.

Besides, Mamaeath is now available in more than 500 cities.

• Mamaearth - Growth and Revenue

When Mamaearth was launched, it had only six products in its catalog. The range now comprises more than 80 natural, toxin-free products that are used by over 15 lakh consumers.

Besides, Mamaeath is now available in more than 500 cities.

(10/14)

• The Numbers:

1) Revenue FY21 - ₹461 Cr vs ₹110 Cr in FY20

2) Domestic Sales Contribution stands at 98%

3) Global sales witnessed a growth of 9.5x

4)FY21 Profit - ₹24.6 Cr vs A loss of ₹5.92 Cr in FY20

• The Numbers:

1) Revenue FY21 - ₹461 Cr vs ₹110 Cr in FY20

2) Domestic Sales Contribution stands at 98%

3) Global sales witnessed a growth of 9.5x

4)FY21 Profit - ₹24.6 Cr vs A loss of ₹5.92 Cr in FY20

(11/14)

5) On a unit level, it can be discovered that the company spent Rs 0.95 to earn a single rupee of operating revenue in FY21.

6)EBITDA margins at 6.5% in FY21 vs -5% in FY20

5) On a unit level, it can be discovered that the company spent Rs 0.95 to earn a single rupee of operating revenue in FY21.

6)EBITDA margins at 6.5% in FY21 vs -5% in FY20

(12/14)

• Competitors :

1) Himalayas

2) J&J

3) Nykaa

4) Kimberly Clark

5) Proctar & Gamble

6) Unilever

7) Besides, more and more companies are popping up with the toxin-free ideology nowadays and increasing the overall competition of Mamaearth.

• Competitors :

1) Himalayas

2) J&J

3) Nykaa

4) Kimberly Clark

5) Proctar & Gamble

6) Unilever

7) Besides, more and more companies are popping up with the toxin-free ideology nowadays and increasing the overall competition of Mamaearth.

(13/14)

• Mamaearth - Future Plans:

Their plan is to build Mamaearth into an ₹500 crore brand by acquiring five million new consumers in the next 3 years.

They are also looking at launching more brands which would be focused on the needs of the new-age, millennial consumers

• Mamaearth - Future Plans:

Their plan is to build Mamaearth into an ₹500 crore brand by acquiring five million new consumers in the next 3 years.

They are also looking at launching more brands which would be focused on the needs of the new-age, millennial consumers

(14/14)

• That’s all about Mamaearth, tell us in the comments which startup should be cover next?

Happy Reading!🙂

• That’s all about Mamaearth, tell us in the comments which startup should be cover next?

Happy Reading!🙂

• • •

Missing some Tweet in this thread? You can try to

force a refresh