1/ app.moremoney.finance is another protocol on #Avalanche which allows you to mint protocol native stable coin $Money against collateral including LPs and interest-bearing assets.

2/ First way to farm is to deposit $DAI and borrow $Money against it at 125% CDR / 80% LTV. Your $DAI will be deposited by the protocol to the partner protocols like Banker Joe, AAVE or Benqi.

3/ Let's assume we borrow $Money at 130% CDR and after looping it 10 times you will get 40% APY on your $DAI. Note, that there is 0.5% repayment fee on borrowed $Money.

4/ The good part of this strategy is that you are earning pure yeild on your $DAI and if $Money losses peg you can just buy discounted $Money on the market and repay your loan very cheap.

5/ Next strategy provides higher APY and it is easier to execute but it involves more risks.

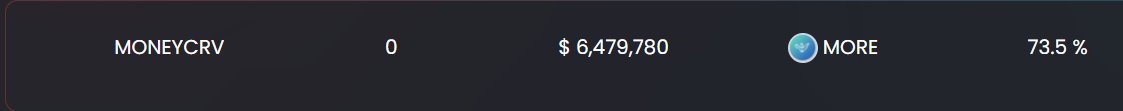

7/ Note: The farmed token vest linearly at the pace of 1.5% daily. Also I assume that high APY might drop over time.

8/ In the second strategy you are exposed both to farm token $More and native stable coin $Money. So if you do not feel comfortable with that it is better to stick with the first strategy.

9/ @Moremoneyfi is a new project but has the same mechanics of over-collateralized stable coin as many other projects. It has been already audited by @peckshield github.com/MoreMoney-Fina…

10/ Please DYOR and never invest more than you can afford to lose. Thank you and stay safe.

11/ There are so many strategies to share, wish there will be a bigger audience for it. So if you liked this thread, I would love if you could share it by retweeting the first tweet:

https://twitter.com/DeFi_Made_Here/status/1488625216217489408?s=20&t=KZJ1SAAwGFTZRmbkqg0mCg

• • •

Missing some Tweet in this thread? You can try to

force a refresh