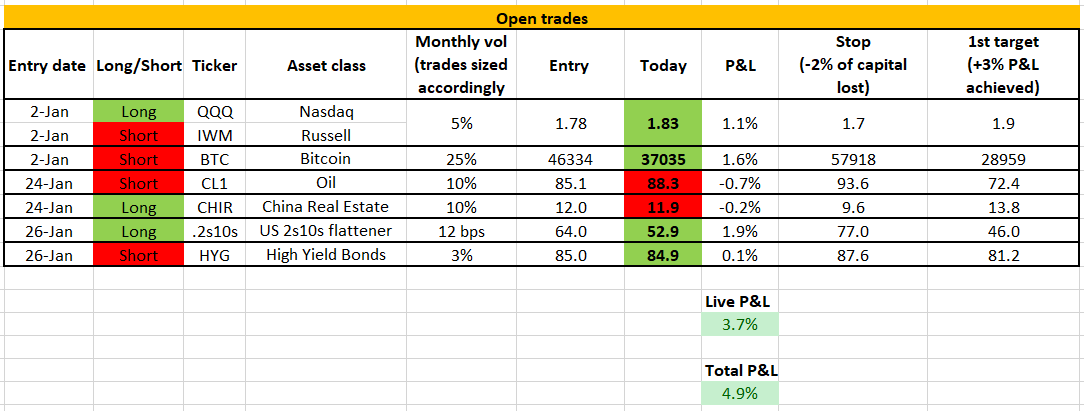

Portfolio update (+4.9% P&L YTD)

- Long Nasdaq vs short Russell

- Short Bitcoin

- Short Crude Oil

- Long Chinese Real Estate

- Long 10y UST vs 2y UST (flatter curve)

- Short High Yield Bonds

Why this setup?

- Long Nasdaq vs short Russell

- Short Bitcoin

- Short Crude Oil

- Long Chinese Real Estate

- Long 10y UST vs 2y UST (flatter curve)

- Short High Yield Bonds

Why this setup?

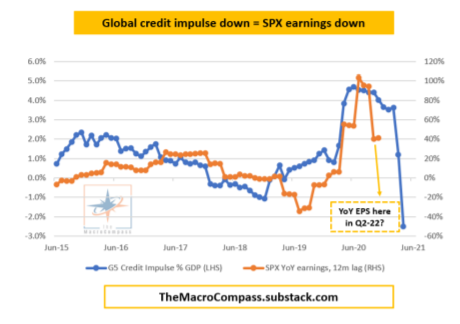

The overarching macro thesis is that US growth will slow down further while the Fed tightens - a delicate situation for most risk assets.

Bitcoin and High Yield bonds ranked as the most exposed assets to such a tricky macro environment and with plenty of room to reprice.

Bitcoin and High Yield bonds ranked as the most exposed assets to such a tricky macro environment and with plenty of room to reprice.

I like commodities structurally, but I felt like Crude Oil was stretched on the back of geopolitical tensions and due for a correction as aggregate demand slowed materially into Q1.

The trade is not working and rolls against me, will stop out if proven wrong.

The trade is not working and rolls against me, will stop out if proven wrong.

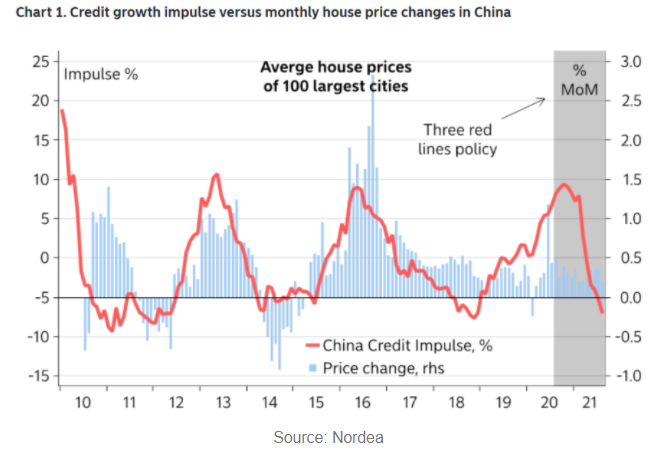

Chinese Real Estate and long QQQ/short IWM are medium-term trades.

Chinese developers were slaughtered but we got the first clear indications Xi is redirecting some credit towards developers via state-owned banks.

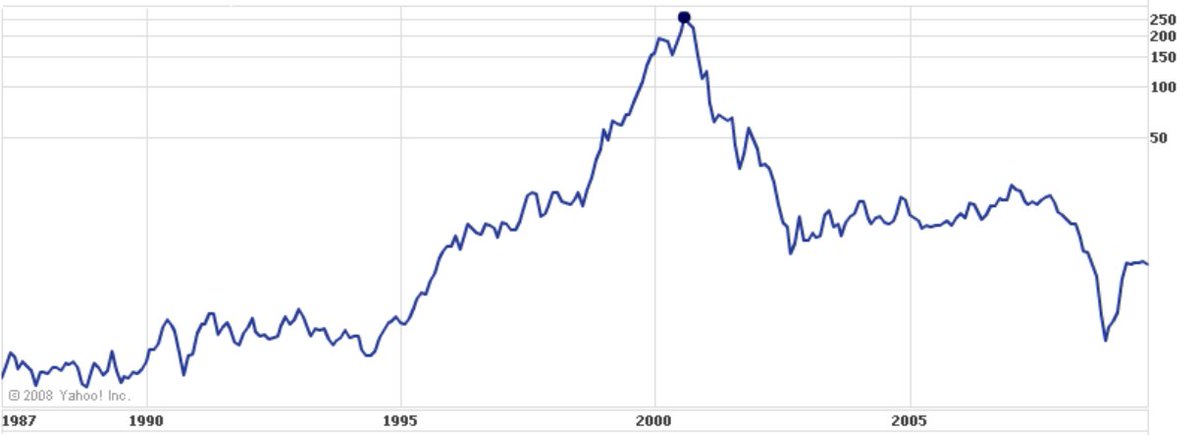

QQQ > IWM a structural winning trade in a slowing economy.

Chinese developers were slaughtered but we got the first clear indications Xi is redirecting some credit towards developers via state-owned banks.

QQQ > IWM a structural winning trade in a slowing economy.

As the Fed tightens while the growth impulse is clearly decelerating, it cements expectations for a weak long-term structural growth (low long-end yields).

At the same time, front-end yields move higher to price in the Fed hiking cycle.

Result: flatter yield curves.

At the same time, front-end yields move higher to price in the Fed hiking cycle.

Result: flatter yield curves.

Every trade loses maximum 2% of my residual capital (hard stop losses).

Trades are designed to realistically achieve >2.5% P&L if I am right.

Hint: I am right just slightly above 50% of the times.

Being a disciplined soldier with some macro edge is good enough.

Trades are designed to realistically achieve >2.5% P&L if I am right.

Hint: I am right just slightly above 50% of the times.

Being a disciplined soldier with some macro edge is good enough.

• • •

Missing some Tweet in this thread? You can try to

force a refresh