The bond market is talking. Very loudly.

Let me try to translate for you what it's saying.

A ''wtf is going on in fixed-income'' thread.

1/10

Let me try to translate for you what it's saying.

A ''wtf is going on in fixed-income'' thread.

1/10

Central Bankers are freaking out about inflation, and they want to be seen as reacting strongly

As a former bond investor, all you hear is ''green light to push short-term rates to🌙and test them''

And indeed: Fed Funds futures now price in more than 5 hikes in 2022

2/10

As a former bond investor, all you hear is ''green light to push short-term rates to🌙and test them''

And indeed: Fed Funds futures now price in more than 5 hikes in 2022

2/10

Investors often think in probability terms

While the mean outcome sits at around 5.3 hikes, the hawkish right tail is getting increasingly fatter

Markets are pricing >17% chance the Fed will hike 7+ times (!) in 2022 vs 3% prob. of 0-3 hikes

@MetreSteven any thoughts?

3/10

While the mean outcome sits at around 5.3 hikes, the hawkish right tail is getting increasingly fatter

Markets are pricing >17% chance the Fed will hike 7+ times (!) in 2022 vs 3% prob. of 0-3 hikes

@MetreSteven any thoughts?

3/10

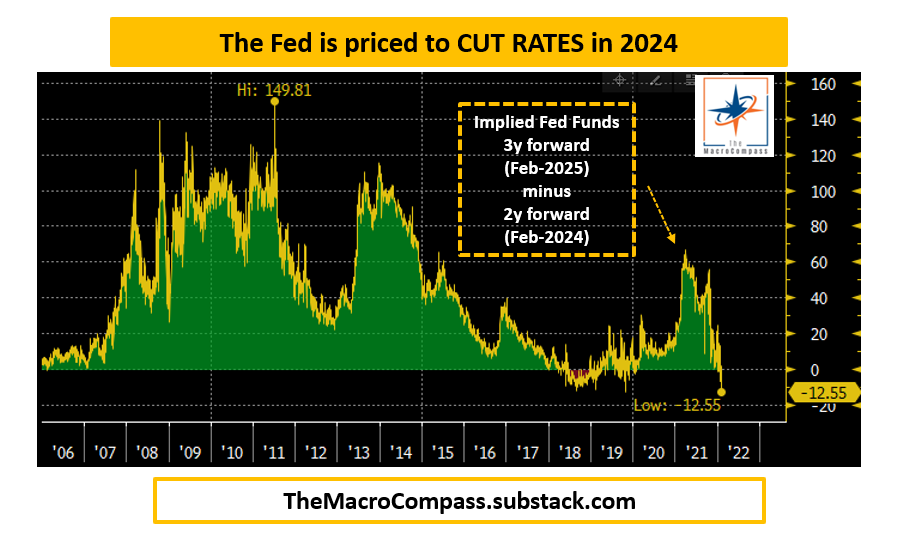

Alright, but what's the bond market saying about the medium term then?

Fed Funds are priced to peak in early 2024 at around 1.90%, and the Fed is priced to lean towards RATE CUTS after that - basically, forward rates are inverted already few years down the road!

4/10

Fed Funds are priced to peak in early 2024 at around 1.90%, and the Fed is priced to lean towards RATE CUTS after that - basically, forward rates are inverted already few years down the road!

4/10

Fixed income investors are pricing a very fast & short hiking cycle: 7 hikes in 2 years and done - with chances the Fed will have to cut soon after.

This is also reflected in an inverted inflation breakeven curve: 3% inflation for a couple of years, and back to 2% after.

5/10

This is also reflected in an inverted inflation breakeven curve: 3% inflation for a couple of years, and back to 2% after.

5/10

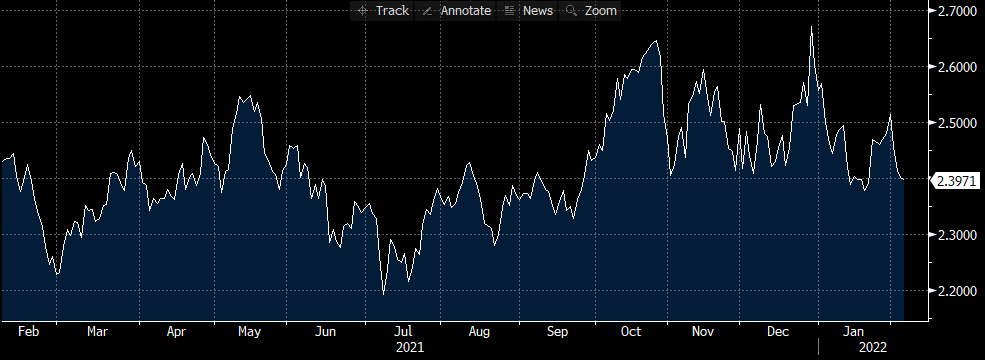

Also, long-term (5y forward, 5y) inflation expectations have gone nowhere over the last 12 months: trading in a range between 2.1% and 2.4% based on PCE inflation.

So much for a regime change.

The bond market thinks inflationary pressures are real, but not here to stay.

6/10

So much for a regime change.

The bond market thinks inflationary pressures are real, but not here to stay.

6/10

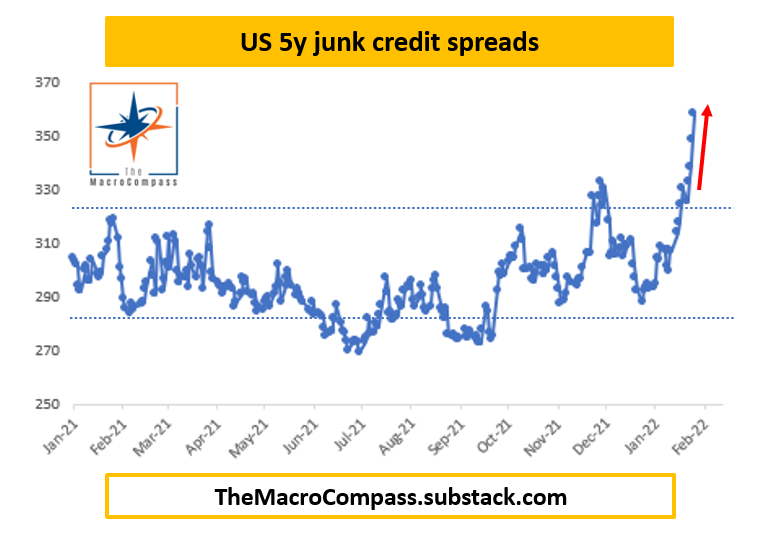

If inflation expectations trade sideways but nominal yields move, real rates go up fast.

5y US real yields moved up 65 bps in 1 month - that's really quick.

Financial conditions for the private sector are tightening, and now credit spreads have started to widen too.

7/10

5y US real yields moved up 65 bps in 1 month - that's really quick.

Financial conditions for the private sector are tightening, and now credit spreads have started to widen too.

7/10

The borrowing costs for the private sector are:

Real Yields + Credit Spreads

When both go up, refinancing debt & accessing new credit becomes prohibitive if real wages haven't gone up

And they have actually gone...down

@LynAldenContact, what's your take here?

8/10

Real Yields + Credit Spreads

When both go up, refinancing debt & accessing new credit becomes prohibitive if real wages haven't gone up

And they have actually gone...down

@LynAldenContact, what's your take here?

8/10

Even EU is in the same boat now, after Lagarde turned very hawkish yesterday

The 5y-30y EU curve is flattening quick as the ECB signals hikes while structural headwinds limit the upside for long-term growth & inflationary pressures.

@AndreasSteno: are they gonna hike?

9/10

The 5y-30y EU curve is flattening quick as the ECB signals hikes while structural headwinds limit the upside for long-term growth & inflationary pressures.

@AndreasSteno: are they gonna hike?

9/10

A very hawkish stance while the growth impulse decelerates = flatter curves

The risk of inversion (!) is real - but pay attention to which curve you use

I cover this & more in my primer on yield curve inversions published this week

👇

themacrocompass.substack.com/p/yield-curve-…

10/10

The risk of inversion (!) is real - but pay attention to which curve you use

I cover this & more in my primer on yield curve inversions published this week

👇

themacrocompass.substack.com/p/yield-curve-…

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh