Lets talk about @MaviaGame (Heroes of Mavia), a clash of clans-esque style strategy game powered by #NFTs and the blockchain... A 🧵..

*FYI - This isn't an endorsement to invest in anything, just my personal observations and opinions - #NFA*

[1/22]

*FYI - This isn't an endorsement to invest in anything, just my personal observations and opinions - #NFA*

[1/22]

What is @MaviaGame ?

Heroes of Mavia is a clan-based strategy game which is built upon NFTs, Fungible token economy & the blockchain.

Players will use their base (NFT) and army to battle other players for in-game currency in a #P2E fashion.

[2/22]

Heroes of Mavia is a clan-based strategy game which is built upon NFTs, Fungible token economy & the blockchain.

Players will use their base (NFT) and army to battle other players for in-game currency in a #P2E fashion.

[2/22]

The core objective of the game is for users to grow their base and army using in-game resources that are earned by attacking other players bases.

Lets jump into the foundational building blocks.. Bases, Heroes, Statues, resources, tokens.. OH MY! ⏩

[3/22]

Lets jump into the foundational building blocks.. Bases, Heroes, Statues, resources, tokens.. OH MY! ⏩

[3/22]

What is a base?

The game revolves around a players base. Bases will be minted as an in-game NFT asset via their land settler program.

Bases come in..

👉common - 0.3 eth

👉rare - 0.6 eth

👉legendary - 0.9 eth

More - tinyurl.com/5n7r497e [4/22]

The game revolves around a players base. Bases will be minted as an in-game NFT asset via their land settler program.

Bases come in..

👉common - 0.3 eth

👉rare - 0.6 eth

👉legendary - 0.9 eth

More - tinyurl.com/5n7r497e [4/22]

Other key points for Bases..

👉Needed to play the game.

👉Can be rented or placed into a partnership. Both models will can be a source of passive income.

👉Can be upgraded via $Ruby (Increases economic value). This encourages the $Ruby economic loop and sink.

[5/22]

👉Needed to play the game.

👉Can be rented or placed into a partnership. Both models will can be a source of passive income.

👉Can be upgraded via $Ruby (Increases economic value). This encourages the $Ruby economic loop and sink.

[5/22]

What are Heroes & Statues (NFTs)?

👉Heroes assist in attacking opponent bases and protecting your base. Each base can contain 4 heroes max.

👉Statues act as an in-game multiplier on your base. For example, a gold statue will be able to speed up gold production etc..

[6/22]

👉Heroes assist in attacking opponent bases and protecting your base. Each base can contain 4 heroes max.

👉Statues act as an in-game multiplier on your base. For example, a gold statue will be able to speed up gold production etc..

[6/22]

Key points on Heroes..

👉Can be sold via Mavia marketplace.

👉Can be upgraded via $Ruby similar to bases.

👉Can be equipped with skins that are purchased with $Ruby

[7/22]

👉Can be sold via Mavia marketplace.

👉Can be upgraded via $Ruby similar to bases.

👉Can be equipped with skins that are purchased with $Ruby

[7/22]

What are the 'in-game' resources (Assets)?

The whitepaper references the following:

👉Gold

👉Oil

👉Ruby (Also part of token economy)

The main resource the economy will revolve around is Ruby. There isn't much information on Gold or Oil but will have in-game utility.

[8/22]

The whitepaper references the following:

👉Gold

👉Oil

👉Ruby (Also part of token economy)

The main resource the economy will revolve around is Ruby. There isn't much information on Gold or Oil but will have in-game utility.

[8/22]

What is the in-game fungible token model?

The game features a 2 token economic model.

$MAVIA - Governance token (Think $AXS)

$RUBY - In-game rewards & utility token (Think $SLP)

[9/22]

The game features a 2 token economic model.

$MAVIA - Governance token (Think $AXS)

$RUBY - In-game rewards & utility token (Think $SLP)

[9/22]

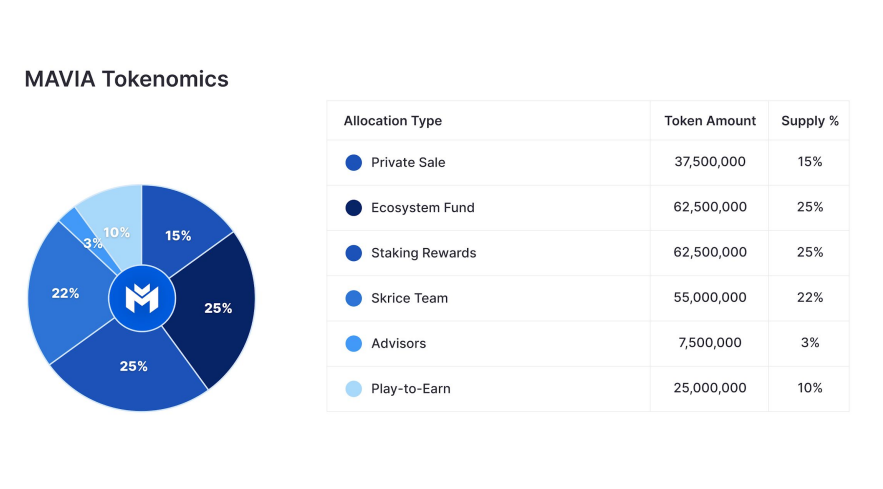

Lets spend some time on the tokenomics themselves, the team has put effort into creating a sustainable ecosystem, albeit it's all still an experiment until proven.

Mavia's goal is to cycle the value back through in-game assets via upgrades and multipliers.

[10/22]

Mavia's goal is to cycle the value back through in-game assets via upgrades and multipliers.

[10/22]

High level overview of $Ruby..

👉Players incentivized to spend $Ruby by upgrading their in-games assets (Bases, heroes, statues)

👉Withdrawing $Ruby is discouraged via a 15% withdraw fee to a users wallet (This has pros and cons)

i.e. reduce sell pressure on $Ruby

[11/22]

👉Players incentivized to spend $Ruby by upgrading their in-games assets (Bases, heroes, statues)

👉Withdrawing $Ruby is discouraged via a 15% withdraw fee to a users wallet (This has pros and cons)

i.e. reduce sell pressure on $Ruby

[11/22]

An additional point on $Ruby..

If $Ruby is bought on an exchange and deposited into the game to play the player will receive a 10% deposit bonus.

[12/22]

If $Ruby is bought on an exchange and deposited into the game to play the player will receive a 10% deposit bonus.

[12/22]

High level overview of $MAVIA..

👉 $MAVIA will be used a governance token which will contain staking incentives.

👉 $MAVIA will also be used outside of the game via Mavia web platform to buy and sell in-game assets and rent bases.

[13/22]

👉 $MAVIA will be used a governance token which will contain staking incentives.

👉 $MAVIA will also be used outside of the game via Mavia web platform to buy and sell in-game assets and rent bases.

[13/22]

One more *critical* point on tokenomics which makes @MaviaGame stand out for me.

Watch this video of the tokenomics model of all of the in-game loops and how the token emissions and sinks (Burn) are distributed.

In my opinion.. Top Notch!

[14/22]

Watch this video of the tokenomics model of all of the in-game loops and how the token emissions and sinks (Burn) are distributed.

In my opinion.. Top Notch!

https://twitter.com/MaviaGame/status/1478846667302608896?s=20&t=rdbf8aj2lPh1RXRCNRlCRQ

[14/22]

So what is the roadmap and when will the game be delivered?

👉Q1 2022 - Token launch / NFT sale

👉Q2 2022 - Alpha / Beta testing

👉Q3 2022 - Public Beta launch

👉Q4 2022 - Mavia game release / global launch

[16/22]

👉Q1 2022 - Token launch / NFT sale

👉Q2 2022 - Alpha / Beta testing

👉Q3 2022 - Public Beta launch

👉Q4 2022 - Mavia game release / global launch

[16/22]

Who is the team behind the Project?

The game is being developed by a game studios by the name of @SkriceStudios headquartered in Hanoi, VN per their LinkedIn profile (See relevant links at the end)

They appear to have an active team and also actively hiring.

[17/22]

The game is being developed by a game studios by the name of @SkriceStudios headquartered in Hanoi, VN per their LinkedIn profile (See relevant links at the end)

They appear to have an active team and also actively hiring.

[17/22]

Who is partnered with Skrice studios x Heros of Mavia?

Investors:

👉 @BinanceLabs

👉 @GenblockCapital

👉 @exnetworkcap

👉 @DoublePeakGroup

E-Sports:

👉 @TeamQuesoGG

In my opinion, this is a solid list of prominent names with a proven track record.

[18/22]

Investors:

👉 @BinanceLabs

👉 @GenblockCapital

👉 @exnetworkcap

👉 @DoublePeakGroup

E-Sports:

👉 @TeamQuesoGG

In my opinion, this is a solid list of prominent names with a proven track record.

[18/22]

Final thoughts:

👉Large ambitious undertaking with aggressive deadlines for a large game.

👉 Fundamentally the pieces are coming together on the front end. Now it is all in the execution.

👉 The tokenomic model looks promising and has potential to be successful.

[19/22]

👉Large ambitious undertaking with aggressive deadlines for a large game.

👉 Fundamentally the pieces are coming together on the front end. Now it is all in the execution.

👉 The tokenomic model looks promising and has potential to be successful.

[19/22]

Continued...

👉 Backers and partners along with the the team are solid.

I will need to see how the team executes and iteratively assess as it's early but out of most games in this space this one looks promising.

I am watching this one closely 😁

[20/22]

👉 Backers and partners along with the the team are solid.

I will need to see how the team executes and iteratively assess as it's early but out of most games in this space this one looks promising.

I am watching this one closely 😁

[20/22]

Hope you all enjoyed this thread on @MaviaGame. If this added value to you in any way I ask that you like, retweet or comment if you desire to and it's greatly appreciated!

Feel free to add to this if I missed or misrepresented anything, cheers 🎉

[21/22]

Feel free to add to this if I missed or misrepresented anything, cheers 🎉

[21/22]

Relevant links:

Game Deck - tinyurl.com/fwfzrp9m

Website (Mavia) - mavia.com

Website (Skrice) - skrice.com

LinkedIn - tinyurl.com/bddyjucu

Binance Labs article - tinyurl.com/2pvm77bh

Other partner articles - skrice.com/studio

[22/22]

Game Deck - tinyurl.com/fwfzrp9m

Website (Mavia) - mavia.com

Website (Skrice) - skrice.com

LinkedIn - tinyurl.com/bddyjucu

Binance Labs article - tinyurl.com/2pvm77bh

Other partner articles - skrice.com/studio

[22/22]

• • •

Missing some Tweet in this thread? You can try to

force a refresh