How ve(3,3) Change DeFi in the Future Forever 🚀

DeFi 1.0 and 2.0 have been lackluster in capital efficiency💰. Besides, holders and stakers have not received adequate rewards for supporting the projects. Then, the model Ve(3,3) was born. Read more in the threads below🎉

#FTM

DeFi 1.0 and 2.0 have been lackluster in capital efficiency💰. Besides, holders and stakers have not received adequate rewards for supporting the projects. Then, the model Ve(3,3) was born. Read more in the threads below🎉

#FTM

1.1/ Since DeFi burst onto the scene back in August 2017, the TVL has risen exponentially. At the end of 2018, TVL was around $300 million. By 2019 it was $800 million. However, the ATH of 2022 saw an astonishing of about $300 billion, now approximately $240 billion.

1.2/When it comes to DeFi, we can mention benefits of DeFi 1.0 included

- Easy Accessibility

- Low fees and high-interest rates - Increased transparency and security

- Functional autonomy

Represent for DeFi 1.0 projects such as @yearnfinance @CurveFinance @Uniswap @SushiSwap

- Easy Accessibility

- Low fees and high-interest rates - Increased transparency and security

- Functional autonomy

Represent for DeFi 1.0 projects such as @yearnfinance @CurveFinance @Uniswap @SushiSwap

@yearnfinance @CurveFinance @Uniswap @SushiSwap 1.3/ More specifically, we can see some projects with attractive profits such as

- High APR, APY

- Diverse products

- Auto compounding

- Stable Farming & Staking Mechanism.

- High APR, APY

- Diverse products

- Auto compounding

- Stable Farming & Staking Mechanism.

@yearnfinance @CurveFinance @Uniswap @SushiSwap 1.4/ However, High Reward always goes with High Risk and it's bad cases like

- Project Team Rug Pull

- Attacked by Hackers

- Impermanent Loss

- etc.

Image Source: @defiyield_app

- Project Team Rug Pull

- Attacked by Hackers

- Impermanent Loss

- etc.

Image Source: @defiyield_app

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app 1.5/ As a result, DeFi 2.0 is a movement of projects improving on the problems of DeFi 1.0. DeFi aims to bring finance to the masses but has struggled with scalability, security, centralization, liquidity, and accessibility to information.

Image: @Coin98Insights @Cointelegraph

Image: @Coin98Insights @Cointelegraph

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph 1.6/ As of December 2021, We did see the performance of some outstanding Defi 2.0 projects like @spell @OlympusDAO @wonderland @ConvexFinance which brought people to a new earning mechanism with a better capital efficiency for users.

Image Source: @Coin98Insights

Image Source: @Coin98Insights

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance 1.7/ But it seems not enough for stakers in reward. @AndreCronjeTech means that Holders need to get more rewards when farming and staking. He had released his new experiment on #Fantom called the model ve(3,3), which is about giving more bonuses to Holders & Stakers

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech 1.8/ Before we go to What exactly Ve(3,3) is, we better need to have a deep dive into who is @AndreCronjeTech ?

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech 1.9/ Andre Cronje is known as Satoshi Nakamoto of DeFi, he is one of the most influential people in the DeFi world. His fame became widely known after launching the @iearnfinance (YFI) project – a yield farming protocol.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance 1.10/ He is also the father of the @thekeep3r (KP3R) project. Based on information on @CoinMarketCap , he also contributes to notable DeFi projects such as @akropolisio , @CoverProtocol , @CreamdotFinance V2, @picklefinance , @powerpoolcvp , @SushiSwap , etc.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp 1.11/ Cronje also served as Chief Crypto Code Reviewer at Crypto Briefing and as Technical Advisor to the @FantomFDN . He also has a unique approach to new projects, as in his Twitter profile “I test in prod”. That's also how veDAO was born.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN 1.12/ After the announcements of @AndreCronjeTech , @danielesesta - the KOL famous in the cryptocurrency world, also spoke about working with Cronje to create a new token on the Fantom Ecosystem. After that, Andre Cronje and Sestagalli's moves were all interested & analyzed.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.13/ So, what could two of the brightest minds in DeFi be building? Although there is not much information about the project, with the above moves, TVL and the price of tokens in Fantom have increased rapidly in a short time.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.14/ Soon after, the project's model was also @AndreCronjeTech with a marketing way to the point. Ve(3,3) is a combination of Ve and (3,3), specifically:

- 've' (vote escrow) in the form of protocols like Convex and Curve

- Staking/dilution (3,3) is similar to OlympusDAO

- 've' (vote escrow) in the form of protocols like Convex and Curve

- Staking/dilution (3,3) is similar to OlympusDAO

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.15/ Besides, (3,3) represents the model of @OlympusDAO - the model that brings Game Theory into Crypto. It is a mutual relationship. When everyone is united, everyone will win. So, Ve(3,3) project encourages everyone to lock tokens into the pool and benefit from that action.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.16/ Project highlights

The project is an exciting combination of @CurveFinance , @ConvexFinance , and @OlympusDAO that comes with improvements.

- Emission is flexible according to the total supply

- More benefits for veToken holders

- VeToken is formed as NFT

The project is an exciting combination of @CurveFinance , @ConvexFinance , and @OlympusDAO that comes with improvements.

- Emission is flexible according to the total supply

- More benefits for veToken holders

- VeToken is formed as NFT

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.17/ In my opinions, The project can also be tied to a Metaverse or NFT related project. This is not out of the question given that the Fantom Foundation recently extended its ongoing $370 million liquidity mining incentives to GameFi projects.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.18/ How to own token ve(3,3)?

Ve(3,3) is a token where 100% of the circulating tokens will belong to the community: no private investors, team tokens, Marketing tokens! Andre's tweet about tokenomics was explosive, getting users excited because it was actually a full DAO model.

Ve(3,3) is a token where 100% of the circulating tokens will belong to the community: no private investors, team tokens, Marketing tokens! Andre's tweet about tokenomics was explosive, getting users excited because it was actually a full DAO model.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.19/ However, because it is not open for sale on CEX/DEX exchanges, as well as users will not have the right to vote at first, initially ve(3,3) tokens will be distributed to the top 25 protocols on the market on Fantom by TVL.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.20/ The first method is participating in the top 20 protocols on FTM: the only way to get (indirect) ownership of this token is to own some or all of the top 20 tokens on FTM according to TVL. Then you will stake the top 20 tokens to the project pool for receiving ve(3,3) token

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.21/ The second method is Buying $KP3R , KP3R is an ERC-20 token but will launch on FTM soon and KP3R is also transitioning to a tick (3.3) model. Therefore, if this new pattern works explosively, creating a new trend, KP3R will also increase strongly.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta 1.22/ Currently, there are two projects with ve(3,3) models on Fantom, @_veDAO_ , and @0xDAO_fi ; for a better overview, please see the comparison table below of these two outstanding projects.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.23/ After the two projects above were launched, the Fantom Ecosystem has undergone significant changes with suspicious numbers such as:

- Top 3 Total Value Locked (just below Ethereum and Terra)

- Daily Fantom Addresses increase ~20K

- Daily Active Addresses over 100K

- etc.un

- Top 3 Total Value Locked (just below Ethereum and Terra)

- Daily Fantom Addresses increase ~20K

- Daily Active Addresses over 100K

- etc.un

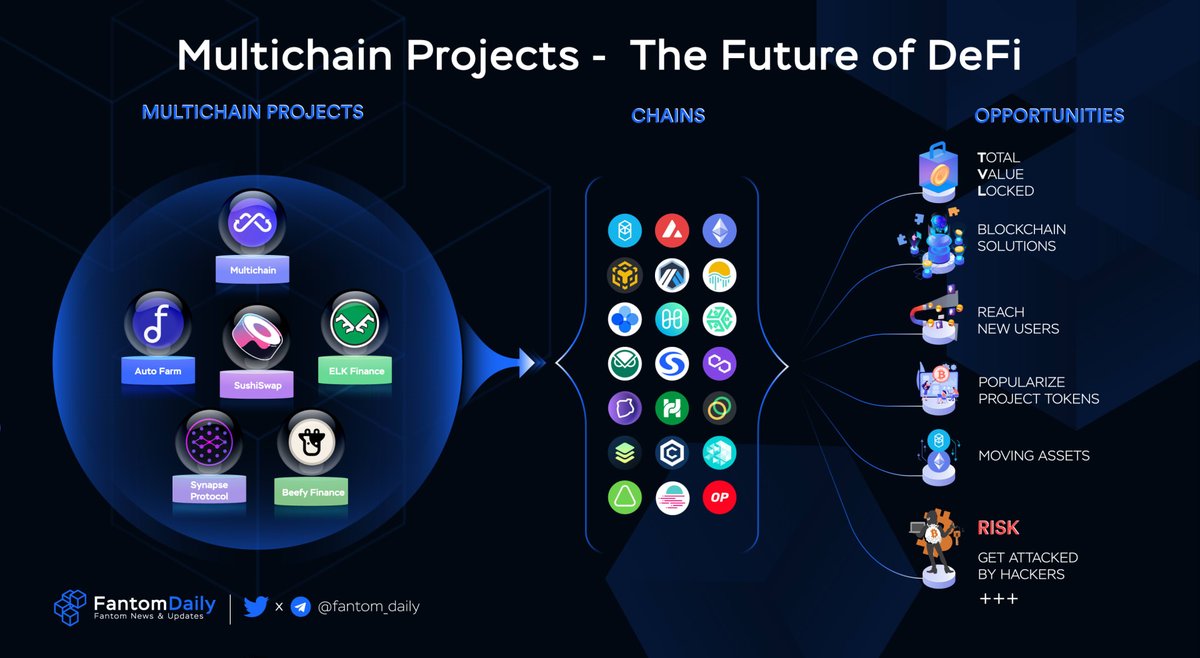

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.24/ Besides, the TVL rank in Fantom also had significant changes when multi-chain projects simultaneously increased TVL and reached the top 20 rapidly to get Ve(3,3) token. This is also a big move that made Fantom's TVL increase 100% in just two weeks.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.25/ Why is Fantom for the experiment and not Ethereum, BSC, or Solana?

Fantom is a fast blockchain, and the lack of high transfer fees is normally associated with Ethereum. The network found considerable popularity and adoption in the DeFi industry in 2021.

Fantom is a fast blockchain, and the lack of high transfer fees is normally associated with Ethereum. The network found considerable popularity and adoption in the DeFi industry in 2021.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.26/ Will any other ecosystems explode with the Ve(3,3) model project in the future? In my opinion, it could be BSC and Solana because the above two ecosystems have cheap transaction fees, fast speed, and the ecosystem is ready and fully compatible with EVM.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.27/ Is Ve(3,3) just a temporary trend, or will it be a step to change DeFi forever? Although it's just an experiment at the moment, I think it will change DeFi forever in the future because of its anti-inflation and more benefits for users or the community at large.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.28/ With the above model, end-users and the whole community, including investors and projects in the ecosystem, benefit. Blockchains need a model like ve(3,3) instead of just focusing on short-term profits like today's DeFi 1.0 projects.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi 1.29/ For a more comprehensive analysis, you can refer to the following tweet by @JackNiewold - Founder of Crypto Pragmatist:

https://twitter.com/JackNiewold/status/1481007067142008838

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi @JackNiewold 1.30/ Disclaimer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi @JackNiewold 1.31/ The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Fantom Daily.

@yearnfinance @CurveFinance @Uniswap @SushiSwap @defiyield_app @Coin98Insights @Cointelegraph @spell @OlympusDAO @wonderland @ConvexFinance @AndreCronjeTech @iearnfinance @thekeep3r @CoinMarketCap @akropolisio @CoverProtocol @CreamdotFinance @picklefinance @powerpoolcvp @FantomFDN @danielesesta @_veDAO_ @0xDAO_fi @JackNiewold DeFi 1.0 - Outstanding Projects

@SushiSwap @CurveFinance @Screamdotsh @iearnfinance @MakerDAO @tombfinance @SpookySwap @Uniswap @AaveAave @compoundfinance

DeFi 2.0 - Outstanding Projects

@MIM_Spell @ConvexFinance @FantohmDAO @OlympusDAO @HectorDAO_HEC

#FTM $FTM

@SushiSwap @CurveFinance @Screamdotsh @iearnfinance @MakerDAO @tombfinance @SpookySwap @Uniswap @AaveAave @compoundfinance

DeFi 2.0 - Outstanding Projects

@MIM_Spell @ConvexFinance @FantohmDAO @OlympusDAO @HectorDAO_HEC

#FTM $FTM

• • •

Missing some Tweet in this thread? You can try to

force a refresh