WEAK DOLLAR KEY

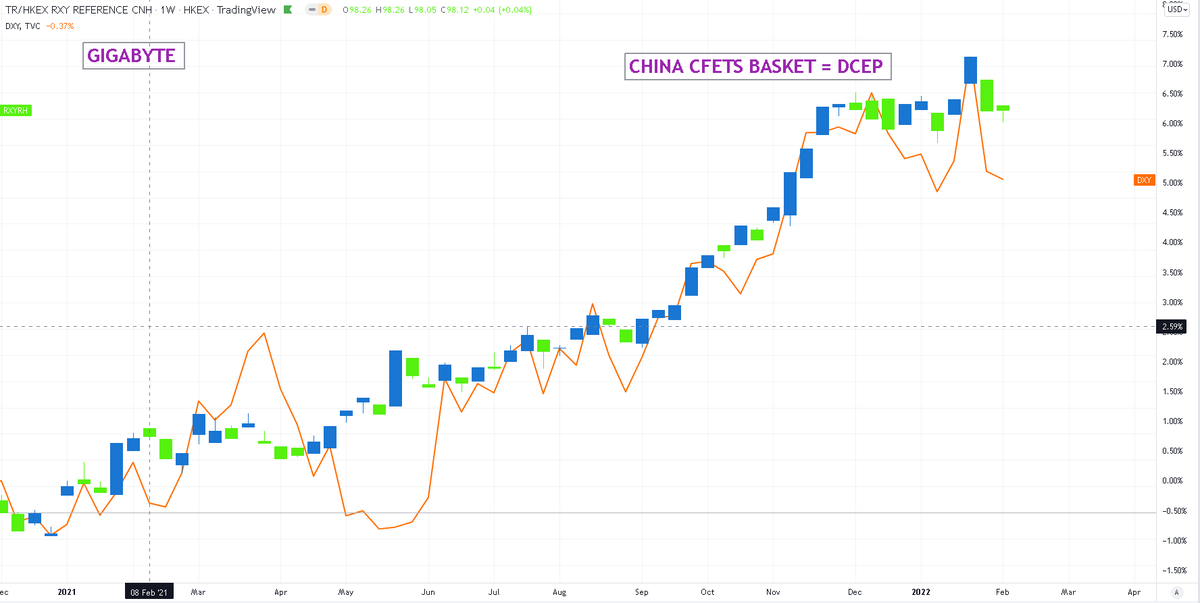

last Friday, China launched DCEP, ECB turned hawkish. Add rocketing US rates driven by huge NDP, AHE & CPI, Yet #Dollar down*. We know a weaker dollar is supportive 'risk'. IMV its driven by #PBOC selling dollars. China's #CFETS basket at 2 Year highs correlates

last Friday, China launched DCEP, ECB turned hawkish. Add rocketing US rates driven by huge NDP, AHE & CPI, Yet #Dollar down*. We know a weaker dollar is supportive 'risk'. IMV its driven by #PBOC selling dollars. China's #CFETS basket at 2 Year highs correlates

with $DXY strength. DCEP is now up & running and the $RMB strength necessary to its survival & credibility is no longer necessary, indeed its harmful. A strong $RMB was essential to avoid the loss of credibility endured by the only other reserve currency launched in the last 100

years. Long time FX people will remember the still born launch of the Euro, which crashed and required G7 intervention to stabilise it. This is a luxury China doesnt have, so it was essential to keep the currency strong before its launch to avoid a similar loss of credibility.

Ensuring a successful e-CNY delivery is why RMB has been extraordinarily strong in the face of Evergrande, Covid, Trade Tensions, Stakeholder/Shareholder pivot. Much of this strength coincides with a stronger dollar - (Chart). China will use rising US rates to unload dollars.

China's 1.0 Trio Dollar FX portfolio necissitates they act countercylically, selling Dollars while the Fed raises rates. The timing couldn't be better coinciding with China's new reserve alternate to the dollar. It also explain geo-political posturing by the CN/RU axis over

Ukraine/Taiwan. CN/RU misadveturism toward America is aimed at highlighting US military impotency. A key tenant in the dollar's store of value proposition is that its strong military backed up its value. With CN/RU testing hypersonic missiles and US seemingly powerless to prevent

the menacing threat to europe with russian troops parked on the Ukranian border and constant incursions into Taiwanese air - space, there is a case to be made to the E-CNY as a reserve alternate with its timely entrance to the market. CN/RU are pushing on an open door with

exploding twin US deficits and a world overweight dollars and underweight Chinese assets. As I've highlighted it was essential that China let the $RMB strengthen at a time of historic sifnificance and historic threats to the motherland and its e-Project.

In recent weeks, they've cut rates twice in succession, and adjusted weighting of euro and dollar in their FX basket- all dovish signals. A weaker dollar is a win/win as we know historically its it supports risk assets. A key driver of my bearish #BTC view since last Nov, was

China's experience with outflows in 2014/2017 gave them cause to worry about Yuan sovereignty, and so in the run up to DCEP launch, they were always going to hostile to the threat of outflows ( especially with historic theats to China I've highlighted above) while preparing for

E-CNY ''Go for Launch''. From here on in, expect to see a weakening in the FX basket, not through higher USD/CNY, but rather via the back door, where they sell dollars vs the basket. I think its good for stocks, and very good for #BTC which based on day DCEP launched.

• • •

Missing some Tweet in this thread? You can try to

force a refresh