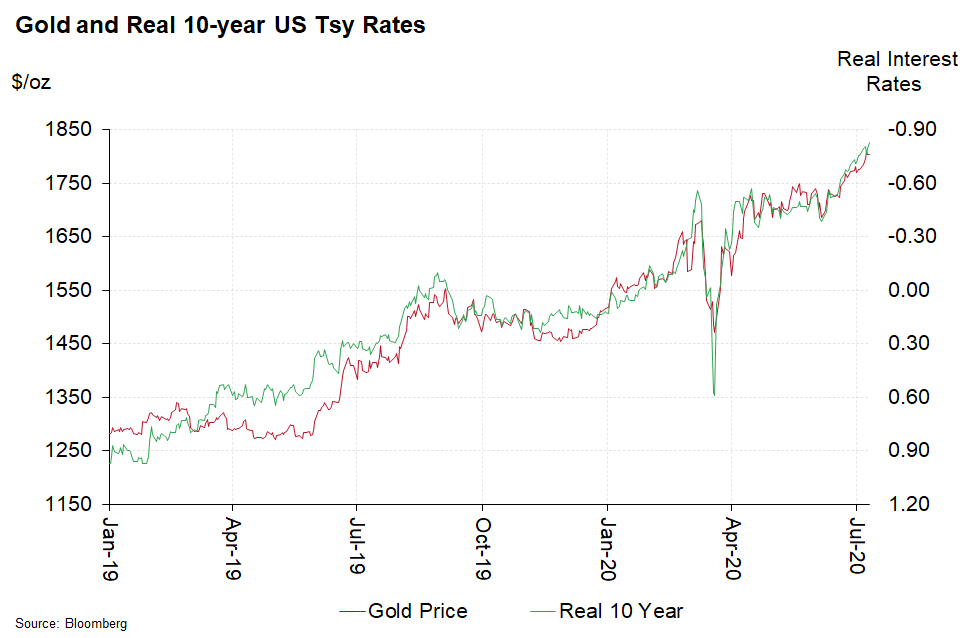

Spot #gold is trading aroundv$1827/oz with a $0.30/oz bid-ask spread on Friday morning in London.

Although it bounced after stronger US inflation data, it couldn't hold those gains as yields firmed late in the day.

But lets look at a slightly longer term perspective...

Although it bounced after stronger US inflation data, it couldn't hold those gains as yields firmed late in the day.

But lets look at a slightly longer term perspective...

Since the start of the year, #gold is essentially flat...

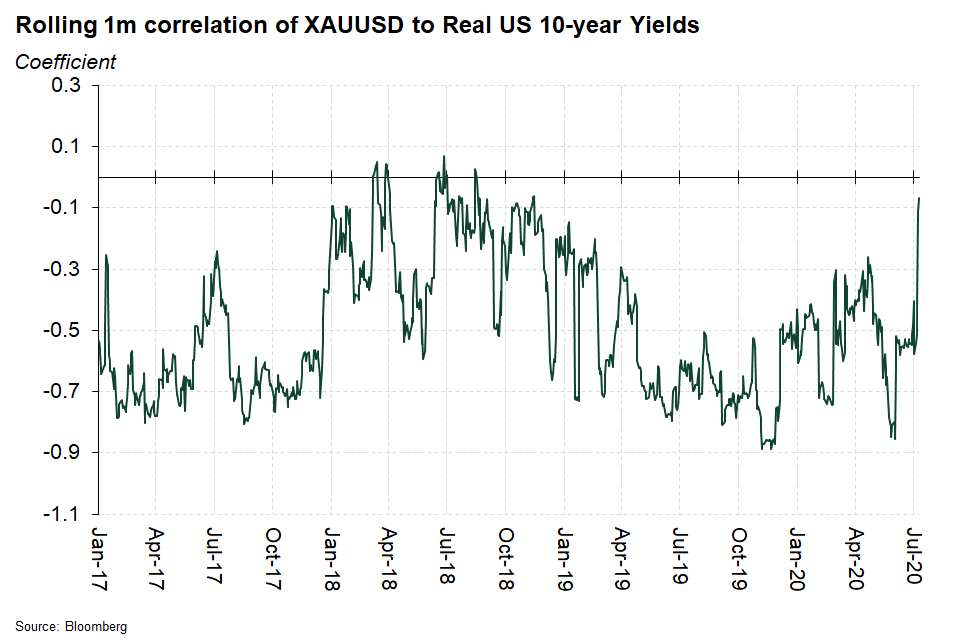

There have been a lot of questions about why gold is not weaker this year - the Fed is obviously going to hike A LOT and starting in March. The move in real yields would normally have pointed to lower #gold prices yet hasn't.

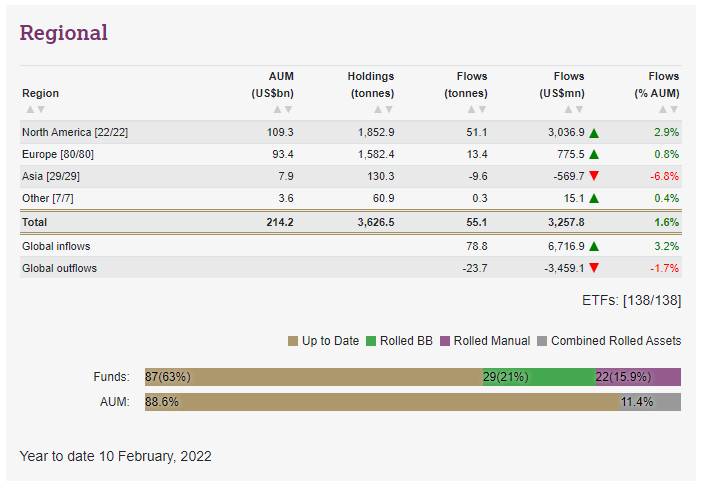

Treu, inflows into ETF have been supportive this year, but have been relative small at 'only' 55t or $3.26bn.

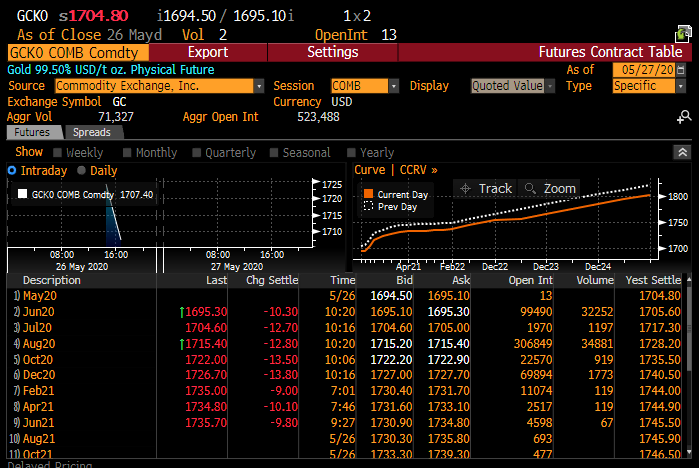

Managed Money held via Comex #gold futures hasn't helped, however, with net longs 112t lower between 28/12 and 1/2/21.

Some (and you know who you are @EdVanDerWalt) have suggested that large central bank buying has been taking place, but there is no evidence of that and I haven't heard any talk of unusual flows.

Rather it may be because of less exciting supply and demand fundamentals.

From the executive summary of our recently-publised Gold Demand Trends...

From the executive summary of our recently-publised Gold Demand Trends...

There's also another factor that doesn't get as much attention as it should - (small investment) Bar and Coin demand, which was again very strong in Q4-21 and for 2021 as a whole.

And finally #gold supply fell in 2021, with technical issues leading to Mine Production disappointment, especially in the second half of the year.

Recycling fell 11% y/y in 2021 too.

Recycling fell 11% y/y in 2021 too.

For more information on underlying supply and demand in the gold market, which goes some way to explain this year's reslience in #gold, see our recent #GoldDemandTrends publication.

gold.org/goldhub/resear…

gold.org/goldhub/resear…

@threadreaderapp please unroll.

• • •

Missing some Tweet in this thread? You can try to

force a refresh