I've been looking a bit more at the move in #gold in Asia on Monday morning.

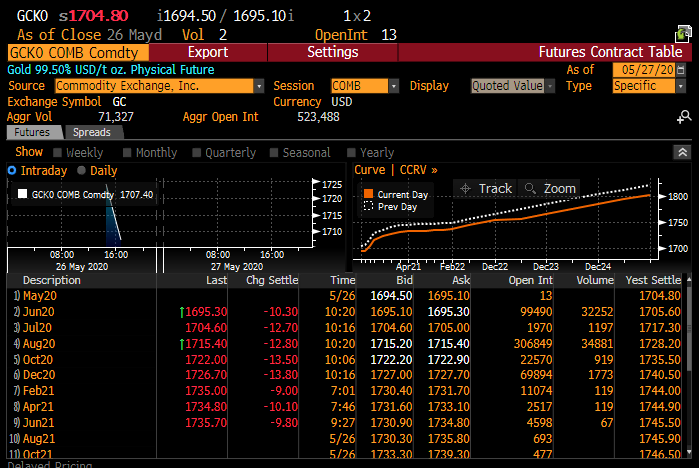

Between 23:30 and 23:45 BST 17,538 contracts traded on Comex, low was $1677.90.

Between 23:45 to Midnight a further 7,825 contracts traded and 5,705 in the 15 minutes that followed.

Between 23:30 and 23:45 BST 17,538 contracts traded on Comex, low was $1677.90.

Between 23:45 to Midnight a further 7,825 contracts traded and 5,705 in the 15 minutes that followed.

What triggered the initial move lower in #gold?

It's hard to be sure but the dollar did open a little firmer than Friday's close.

It's hard to be sure but the dollar did open a little firmer than Friday's close.

Could the sell-off have been a 'fat finger' or something malicious? Either are possible.

But its also possible that #gold slipped lower as the dollar firmed, triggering stop-loss selling, which caused gold to slip lower, triggering more stops until the selling was exhaused.

But its also possible that #gold slipped lower as the dollar firmed, triggering stop-loss selling, which caused gold to slip lower, triggering more stops until the selling was exhaused.

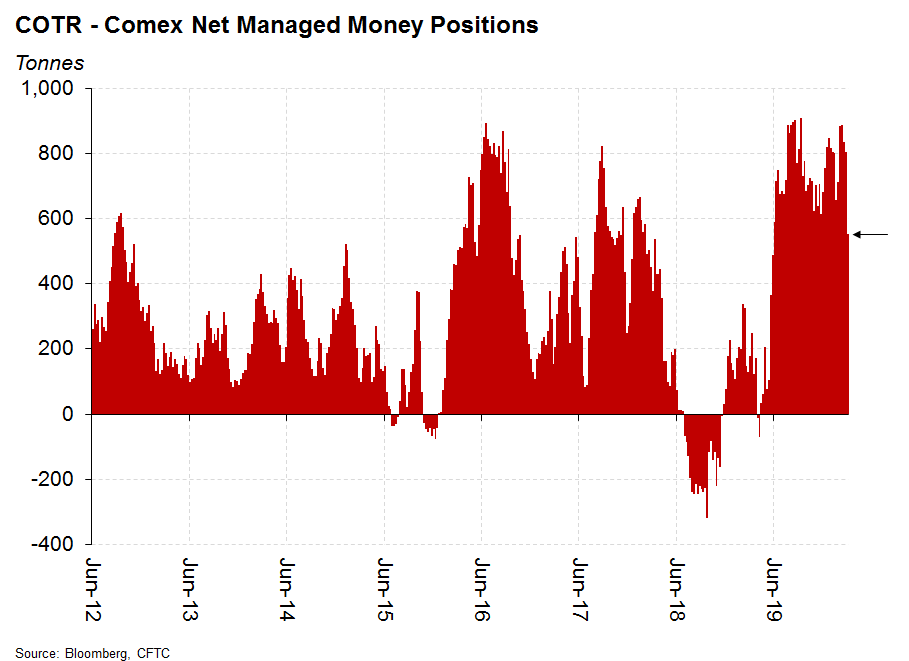

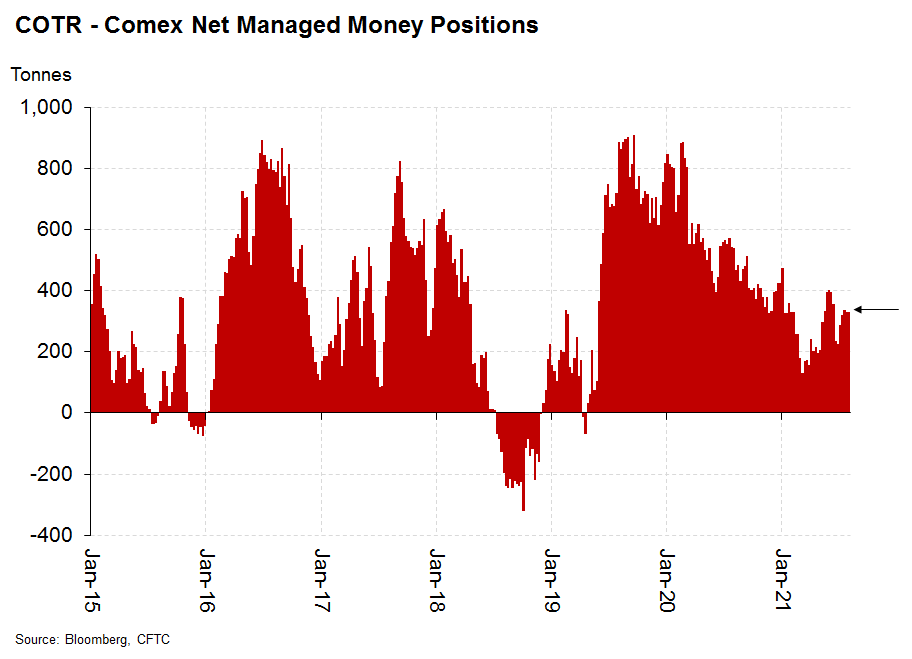

Based on the data I have available, its impossible to be sure. We do know that as of last Tuesday Net Managed Money positions in #gold, although modest, stood at 331t or about 10moz.

And gross long Net Managed Money positions close to 15moz, so there was certainly the capacity for stop-loss selling from managed money accounts to sell #gold.

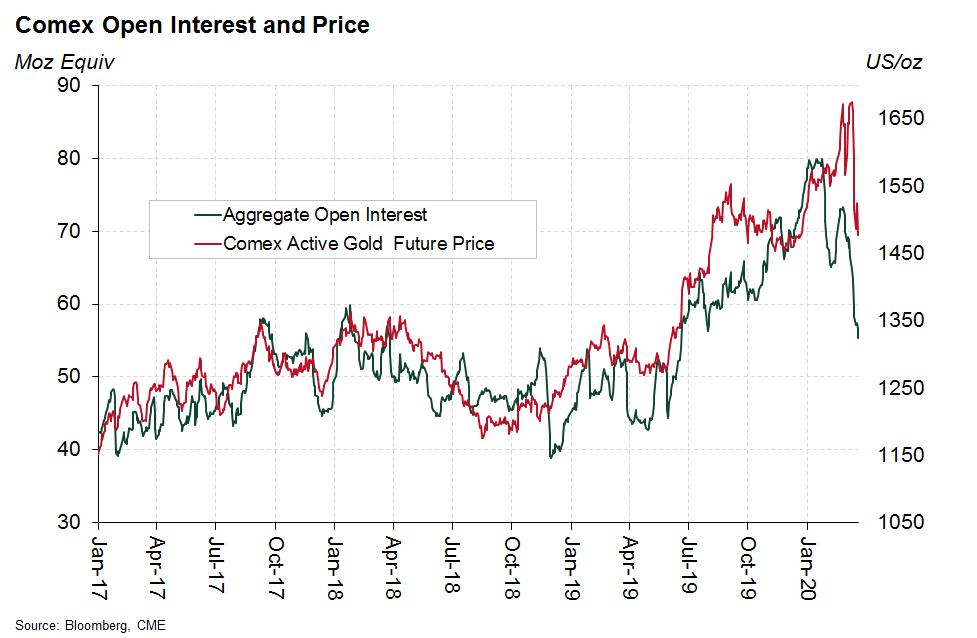

We will get some more insight when the Change in #gold open interest is published for the move - and more still on Friday when the next CFTC COT data is released.

Until then, only the CME can really know what was behind the move. Everything else is guesswork.

Until then, only the CME can really know what was behind the move. Everything else is guesswork.

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh