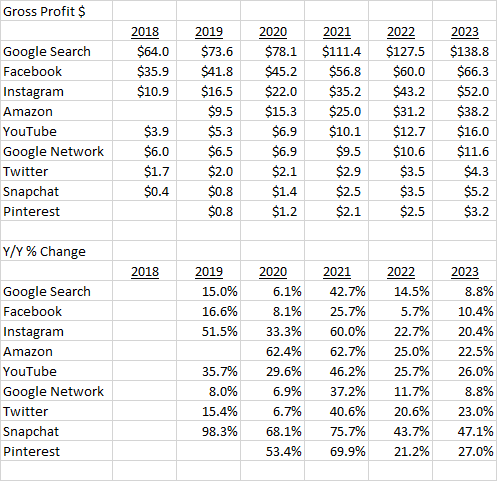

Latest attempt at sizing the ad platforms*. These are my estimates and probably wrong. Posting Gross Profit $ first, because of different margin structures, and most people don't click to the second tweet in a thread, and I think GP$ are more important.

*ex TikTok

*ex TikTok

Here's ad platform revenue estimates. TikTok is supposedly $4B in 2021 and $12B in 2022 to put it into perspective.

An interesting way to look at it is by y/y change in dollars added to revenue. For instance, Google Search grew $12.8B in 2019, down almost 20% Y/Y. In 2021 it added $44.4B!

Snapchat is the only platform that on current estimates will grow dollars added in 2022 vs 2021.

Snapchat is the only platform that on current estimates will grow dollars added in 2022 vs 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh