As promised, here are few popular and well-known option strategies.

It is often said that naked option buying is injurious to wealth, as it needs momentum in your direction. But by building the strategies, one can minimise/ limit the loss.

Hit LIKE and RETWEET.

Let's begin...

It is often said that naked option buying is injurious to wealth, as it needs momentum in your direction. But by building the strategies, one can minimise/ limit the loss.

Hit LIKE and RETWEET.

Let's begin...

Tip : In the payoff graphs attached for each strategies below, the Orange color area shows from where the loss begins and green area represents the profit zone.

Horizontal line of the graph(x axis) is price range and verticle line(y axis) is profit amount.

Horizontal line of the graph(x axis) is price range and verticle line(y axis) is profit amount.

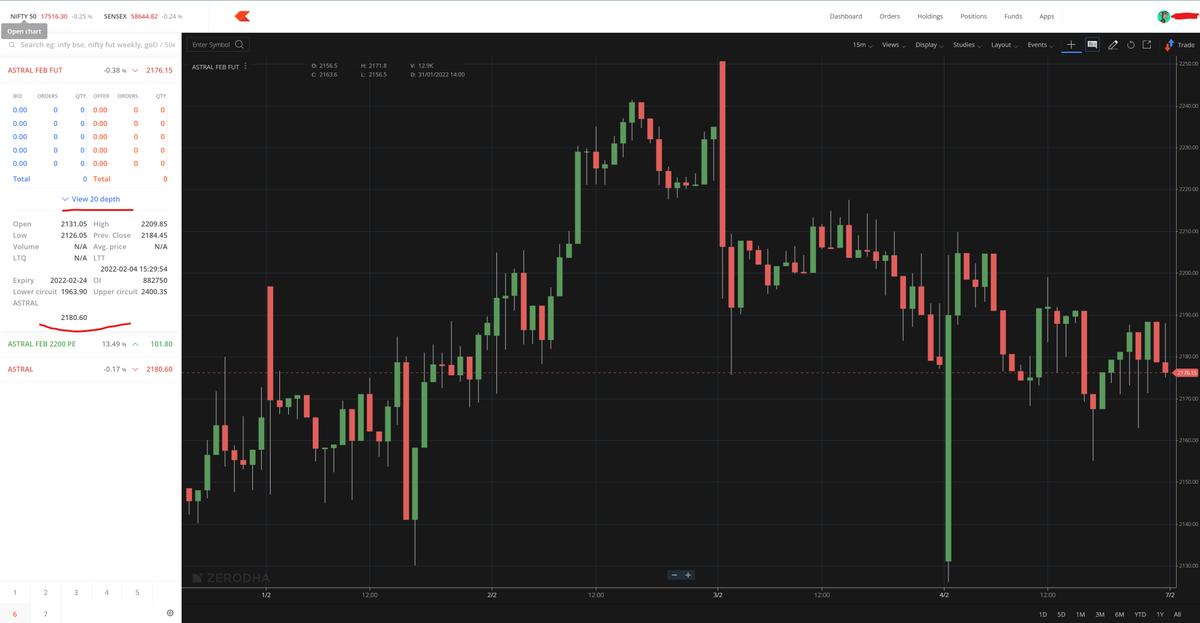

1. Covered call

🎯 We usually build this position for sideways to mild bullish market

🎯 It includes buying an underlying asset/futures of the security and selling higher strike call option

🎯Intention is to benefit from theta decay of sold call option premium in sideways market.

🎯 We usually build this position for sideways to mild bullish market

🎯 It includes buying an underlying asset/futures of the security and selling higher strike call option

🎯Intention is to benefit from theta decay of sold call option premium in sideways market.

🎯Traders should build this position if they are sure of the stock will trade in a range till the expiry or the written call option strike has some sort of resistance for the underlying stock.

🎯 This has unlimited loss potential if stock moves down.

🎯 This has unlimited loss potential if stock moves down.

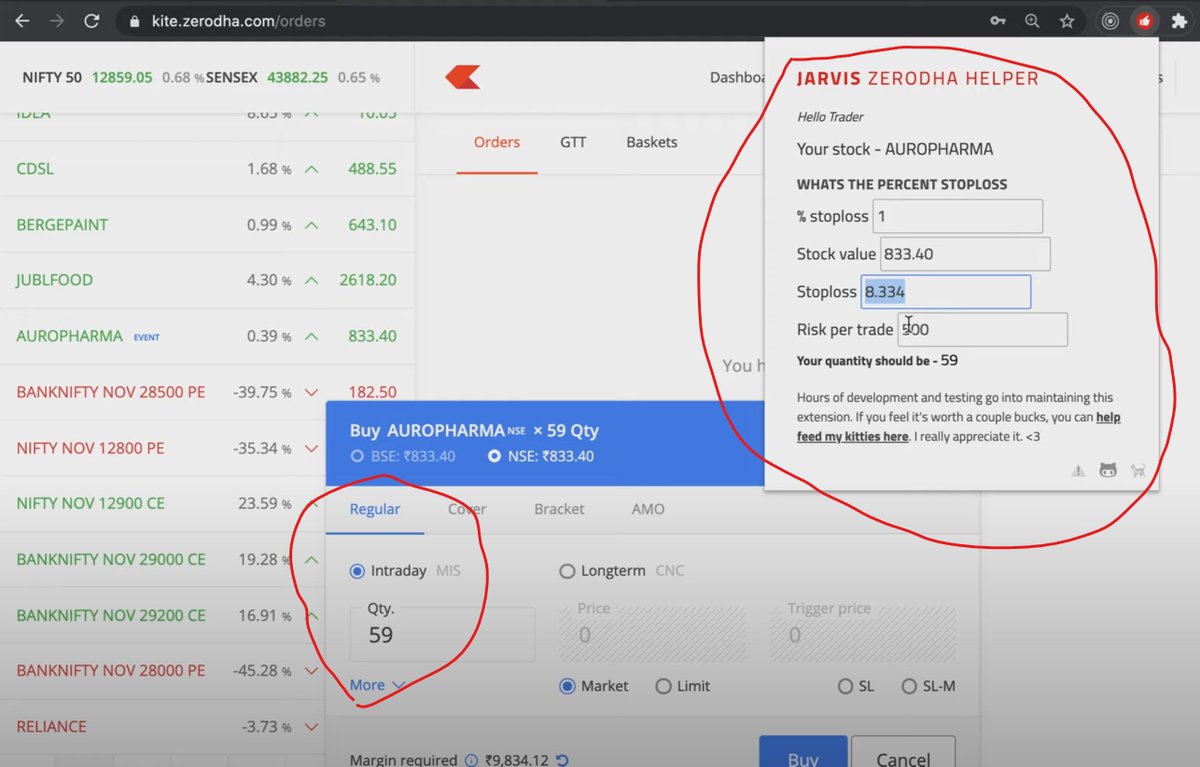

2. Covered put

🎯We usually build this position to protect the long position from downside loss.

🎯It includes buying a underlying asset and buying an equal quantity put option

🎯This put option acts as an insurance in black swan events,

🎯We usually build this position to protect the long position from downside loss.

🎯It includes buying a underlying asset and buying an equal quantity put option

🎯This put option acts as an insurance in black swan events,

and the loss is limited no matter how much ever the underlying price moves down.

🎯 If the stock moves upward or stays in sideways range, the premium of put will decay and give you premium loss but it greatly protects traders from the blackswan losses which can happen at any

🎯 If the stock moves upward or stays in sideways range, the premium of put will decay and give you premium loss but it greatly protects traders from the blackswan losses which can happen at any

point of time in market.

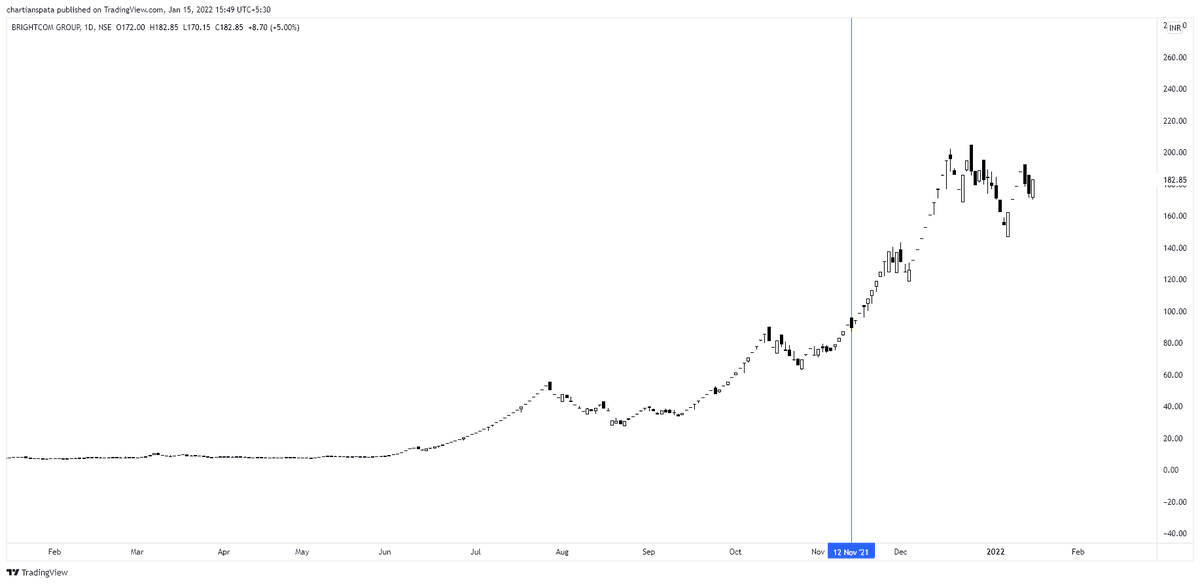

3. Bull call spread

🎯We usually build this position when we are moderately bullish on the stock.

🎯 This includes buying an atm/itm call option and simultaneously selling higher strike call option where you see the resistance.

🎯The loss is limitted if the stock moves down as

🎯We usually build this position when we are moderately bullish on the stock.

🎯 This includes buying an atm/itm call option and simultaneously selling higher strike call option where you see the resistance.

🎯The loss is limitted if the stock moves down as

shown in payoff graph and max profit is also limitted. But we will have higher profit than loss if the view goes right.

This strategy can be used by safe players.

This strategy can be used by safe players.

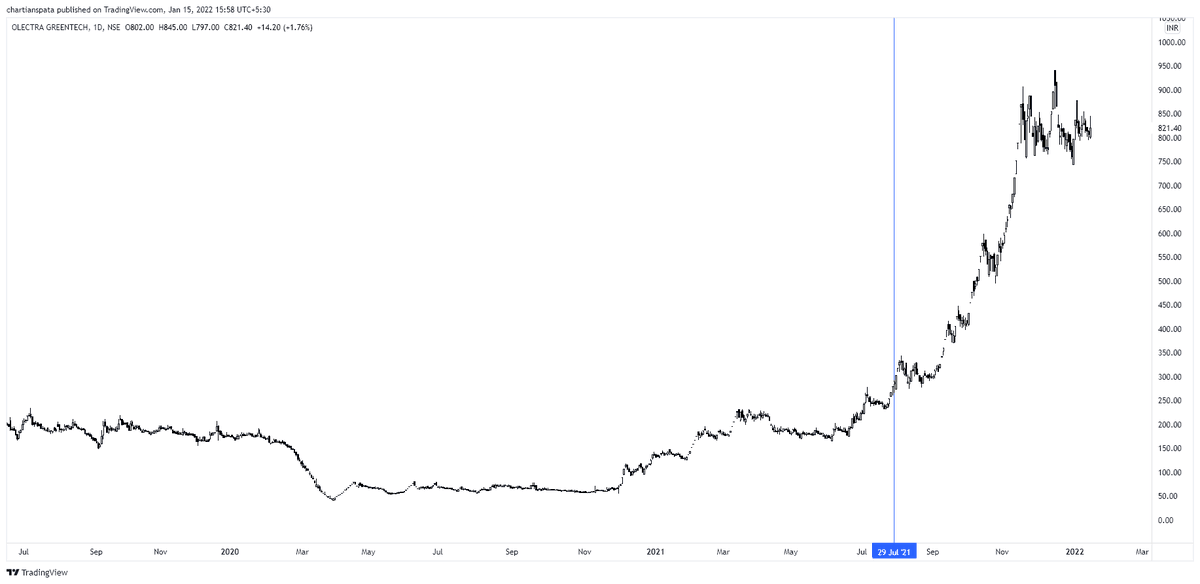

4.Bear put spread

This is exact opposite of bull call spread.

🎯We usually build this position when we are moderately bearish on the stock.

🎯 This includes buying an atm/itm put option and simultaneously selling lower strike put option where you see the support.

This is exact opposite of bull call spread.

🎯We usually build this position when we are moderately bearish on the stock.

🎯 This includes buying an atm/itm put option and simultaneously selling lower strike put option where you see the support.

🎯The loss is limitted if the stock moves up as shown in payoff graph and max profit is also limitted. But we will have higher profit than loss if the view goes right.

This strategy can be used by safe players.

This strategy can be used by safe players.

5. Protective collor

🎯This is hybrid of covered call with a put option buy.

🎯When we are bullish on a stock which is at 100 rs, we will create a covered call option which includes buying an underlying asset and selling a higher strike(near to resistance) call.

🎯This is hybrid of covered call with a put option buy.

🎯When we are bullish on a stock which is at 100 rs, we will create a covered call option which includes buying an underlying asset and selling a higher strike(near to resistance) call.

🎯As you know covered call has unlimited loss potential if stock moves down. For this reason if stock reaches resistance, to protect ourselves from downside risks from covered call, we will buy an OTM put option. This will limit the trader from downside risk till expiry.

Lets discuss the remaining five popular option strategies in next part of the tweet as readers might get overwhelmed if it is in one single thread.

Support us by hitting on LIKE and RETWEET button if you felt this thread helped you and informative.

Support us by hitting on LIKE and RETWEET button if you felt this thread helped you and informative.

Join us at t.me/chartians

• • •

Missing some Tweet in this thread? You can try to

force a refresh