@prism_protocol - strategies 101

S02E07 - Keep collateral airdrops on @anchor_protocol

Right now $bLUNA gives us no claim rights on the airdrops - neither genesis airdrops nor regular ones.

What if we could change that?

/1

S02E07 - Keep collateral airdrops on @anchor_protocol

Right now $bLUNA gives us no claim rights on the airdrops - neither genesis airdrops nor regular ones.

What if we could change that?

/1

DISCLAIMER: This thread might not age well.

Anchor will likely have a new borrow model (v2) implemented soon enough that will change the game entirely.

As well, airdrops are kinda losing popularity recently as they create extra selling pressure.

Having said that...

/2

Anchor will likely have a new borrow model (v2) implemented soon enough that will change the game entirely.

As well, airdrops are kinda losing popularity recently as they create extra selling pressure.

Having said that...

/2

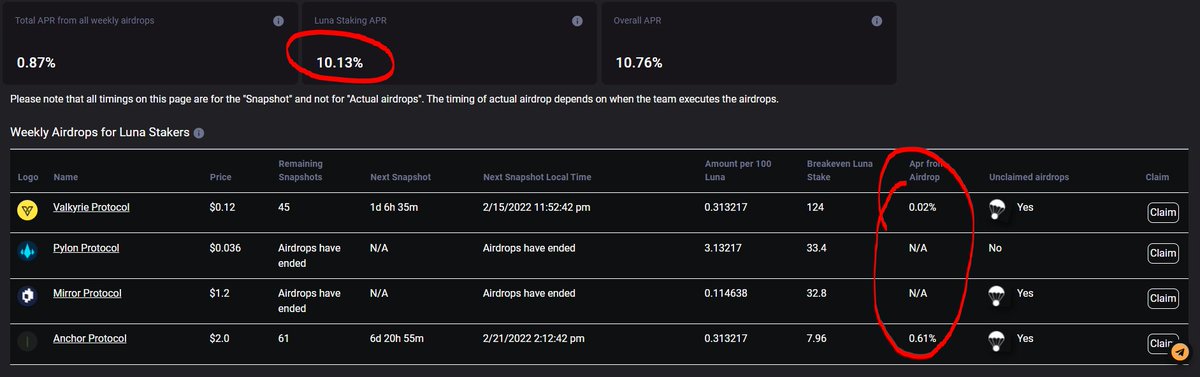

As of today, according to stats provided by @SmartStake:

$LUNA staking APR = 10.13%

APR from airdrops to $LUNA stakers = 0.63%

Note that "0.87%" airdrop APR in the top left corner includes $MIR and $MINE airdrops which have ended.

/3

$LUNA staking APR = 10.13%

APR from airdrops to $LUNA stakers = 0.63%

Note that "0.87%" airdrop APR in the top left corner includes $MIR and $MINE airdrops which have ended.

/3

While 0.63% might not be a lot (in absolute term), comparing 10.76% vs 10.13% and means that extra 6% of yield is left on the table.

That yield is neither collected by the $bLUNA collateral providers nor collected by @anchor_protocol as protocol's revenue.

/4

That yield is neither collected by the $bLUNA collateral providers nor collected by @anchor_protocol as protocol's revenue.

/4

To put it into perspective - right now there is ~$3.1b worth of $bLUNA provided as collateral on @anchor_protocol.

0.63% APR on that is $19.5m yearly.

/5

0.63% APR on that is $19.5m yearly.

/5

@prism_protocol could potentially refract $bLUNA into 3 parts:

1️⃣ Principal part

2️⃣ Regular yield (in $UST)

3️⃣ Airdrops

Anchor currently uses only 1️⃣ and 2️⃣.

We could either allow ⚓ to collect 3️⃣ or let the collateral providers have it.

Either way, it would find some use.

/6

1️⃣ Principal part

2️⃣ Regular yield (in $UST)

3️⃣ Airdrops

Anchor currently uses only 1️⃣ and 2️⃣.

We could either allow ⚓ to collect 3️⃣ or let the collateral providers have it.

Either way, it would find some use.

/6

Alternatively, @LidoFinance could adjust their $bLUNA contracts to allow for separate airdrop collection.

Any chance of that happening sooner or later? 👀

/7

Any chance of that happening sooner or later? 👀

/7

The thread came out shorter this time around - I hope you enjoyed it nonetheless.😃

Next up:

S02E08 - Leverage on a leverage with @Levana_protocol

Full list of episodes:

/8-end

Next up:

S02E08 - Leverage on a leverage with @Levana_protocol

Full list of episodes:

https://twitter.com/AgilePatryk/status/1448951059402137611

/8-end

• • •

Missing some Tweet in this thread? You can try to

force a refresh