Some wild moves in the @altosresearch data this week!

The housing market is still roaring even as rates rise.

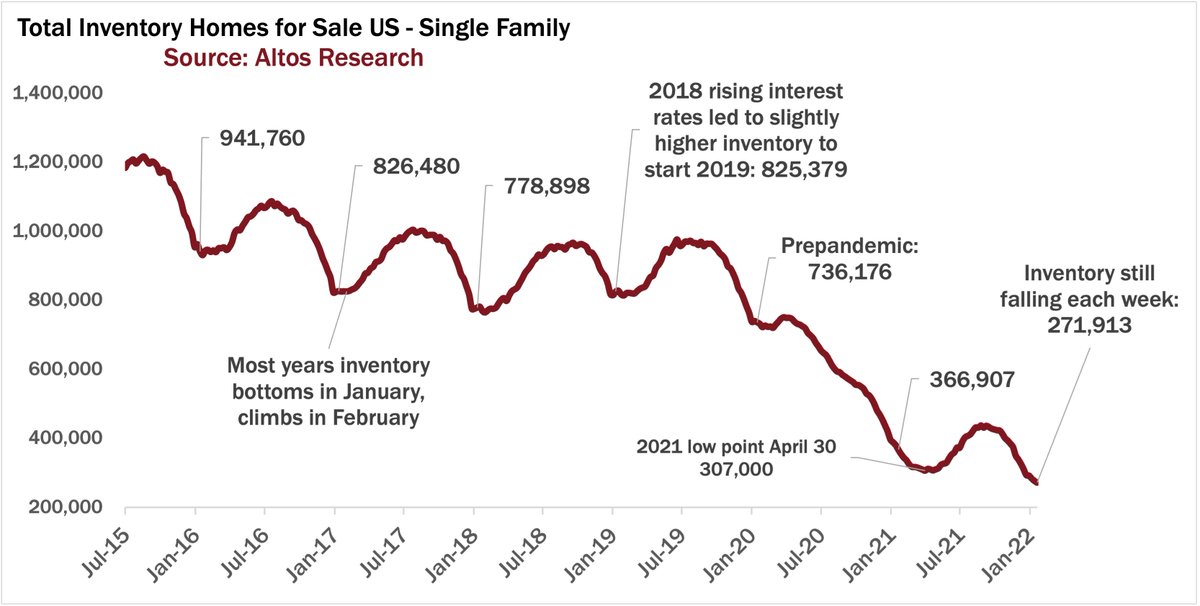

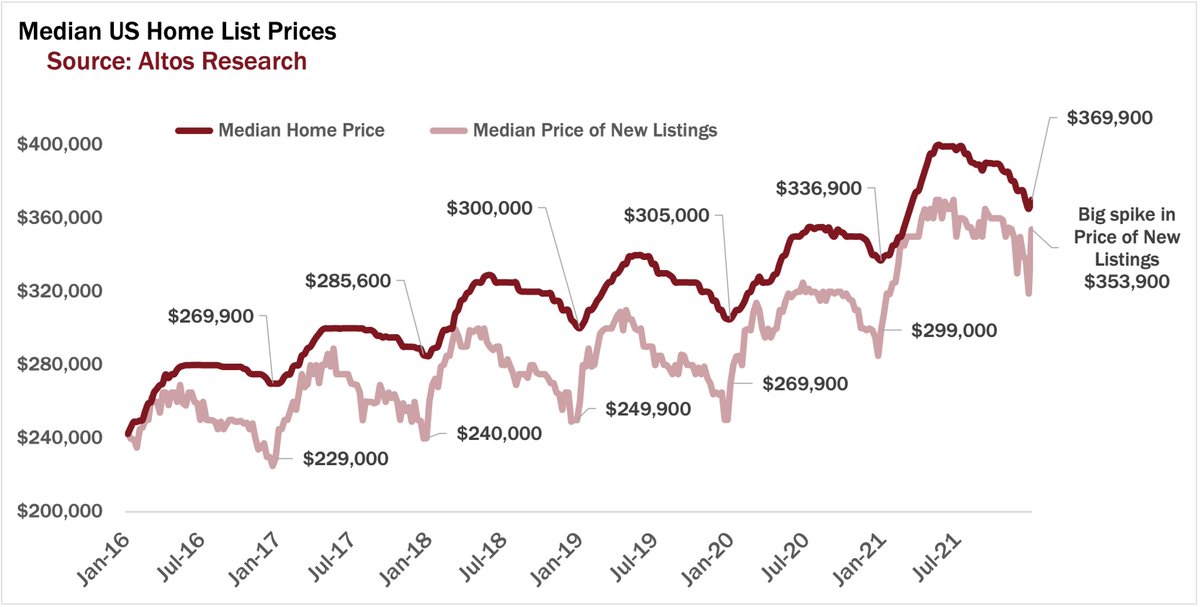

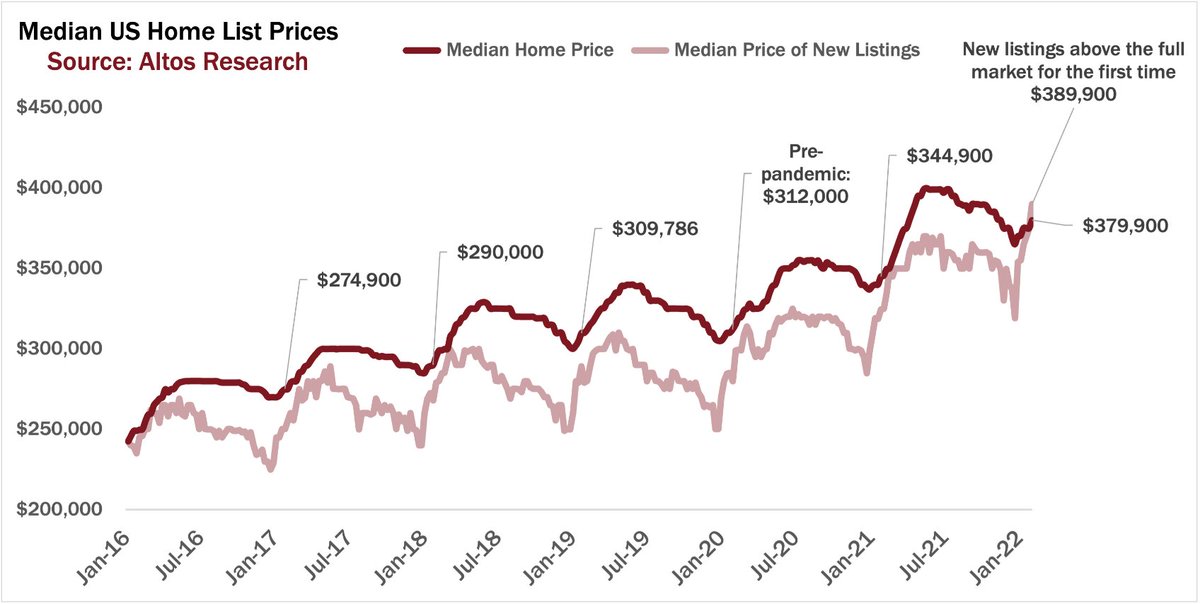

This week, for the first time ever(!), the price of newly listed homes (light red line) jumped above the price of the whole market (dark red).

🧵📽️👇

1/7

The housing market is still roaring even as rates rise.

This week, for the first time ever(!), the price of newly listed homes (light red line) jumped above the price of the whole market (dark red).

🧵📽️👇

1/7

Normally due to the velocity of sales at lower price points, the price of the new listings is below the whole market.

But now even expensive homes are moving fast and new sellers pricing ⬆️ to capture demand.

$389,900 vs. $379,900

This is bullish for future sales $.

2/7

But now even expensive homes are moving fast and new sellers pricing ⬆️ to capture demand.

$389,900 vs. $379,900

This is bullish for future sales $.

2/7

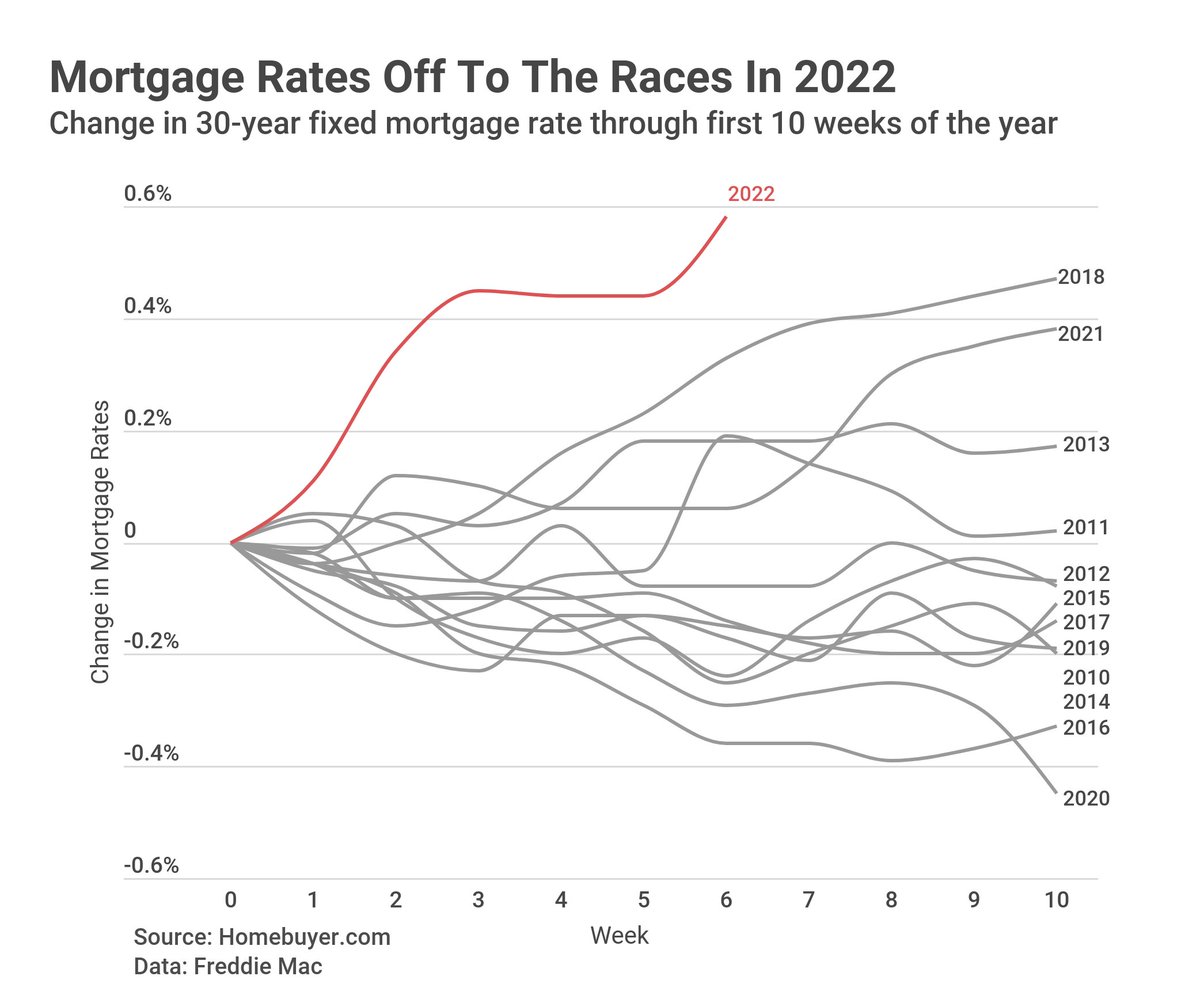

But of course this is happening simultaneous with spiking mortgage rates. This chart from @homebuyer shows really well how fast rates have moved.

Today's buyers locked their cheaper rates in December and January and are rushing to get in before it gets more expensive.

3/7

Today's buyers locked their cheaper rates in December and January and are rushing to get in before it gets more expensive.

3/7

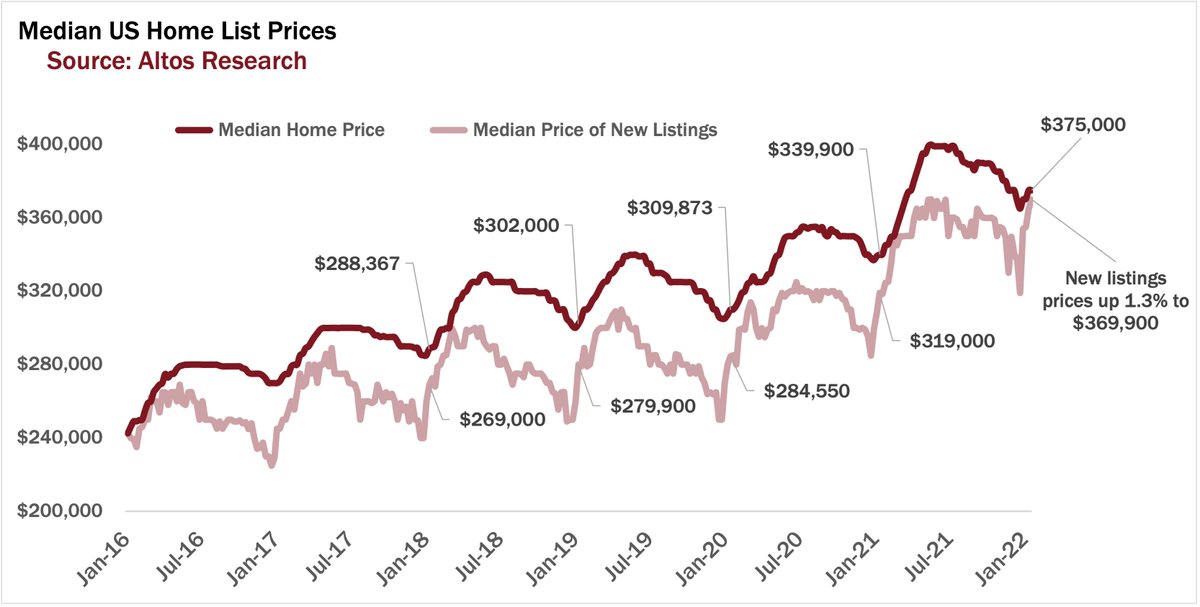

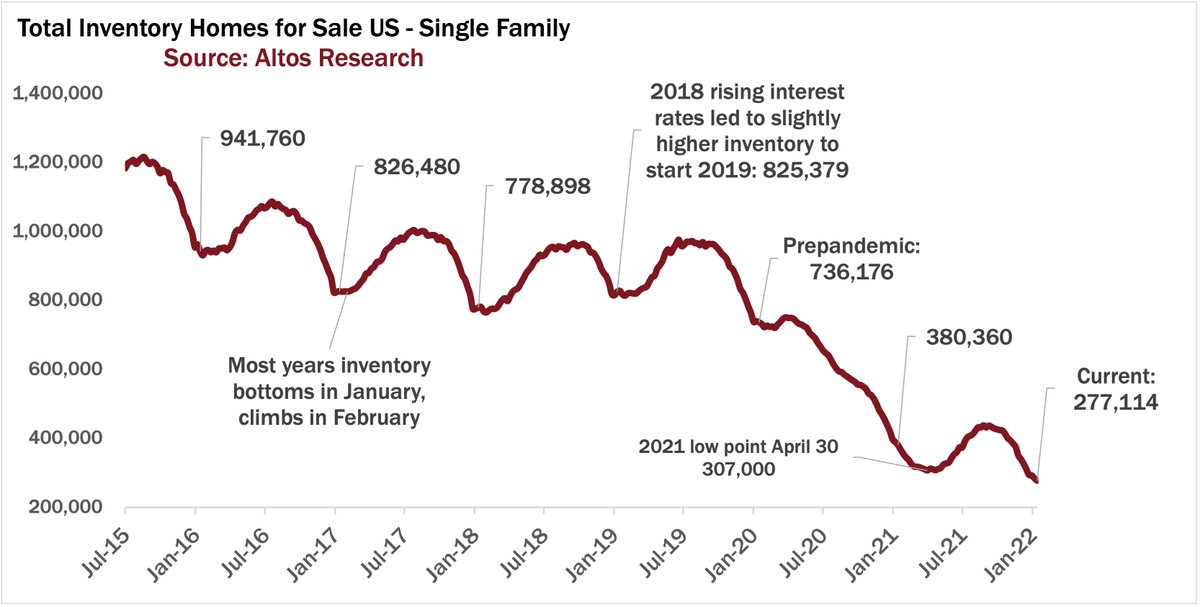

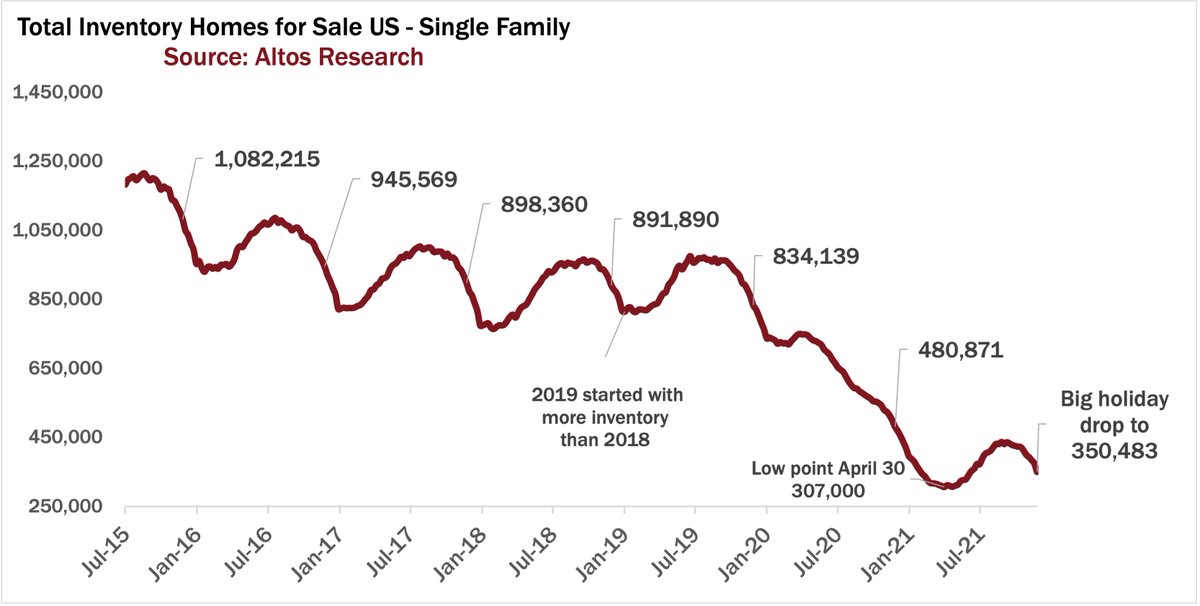

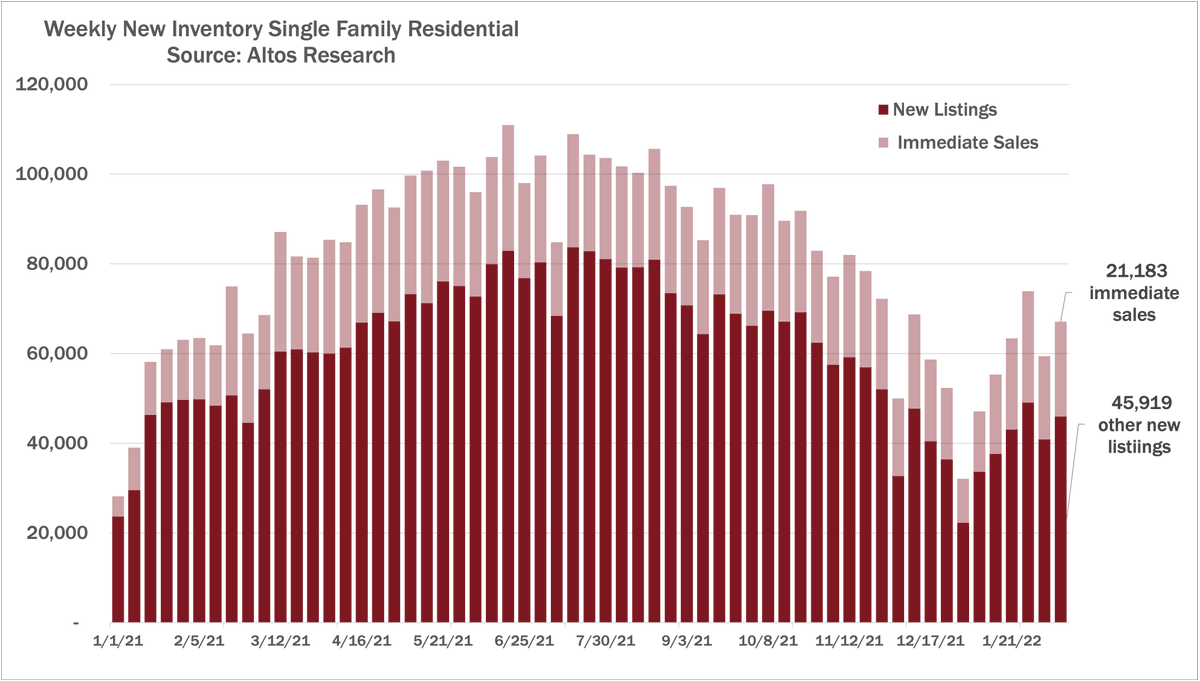

We hit a new record low in available inventory. Under 250k single family homes active. Another 70k listed this week.

Also new: supply chains are notably decreasing inventory. As completion gets delayed until 2023, we remove them from this active count.

4/7

Also new: supply chains are notably decreasing inventory. As completion gets delayed until 2023, we remove them from this active count.

4/7

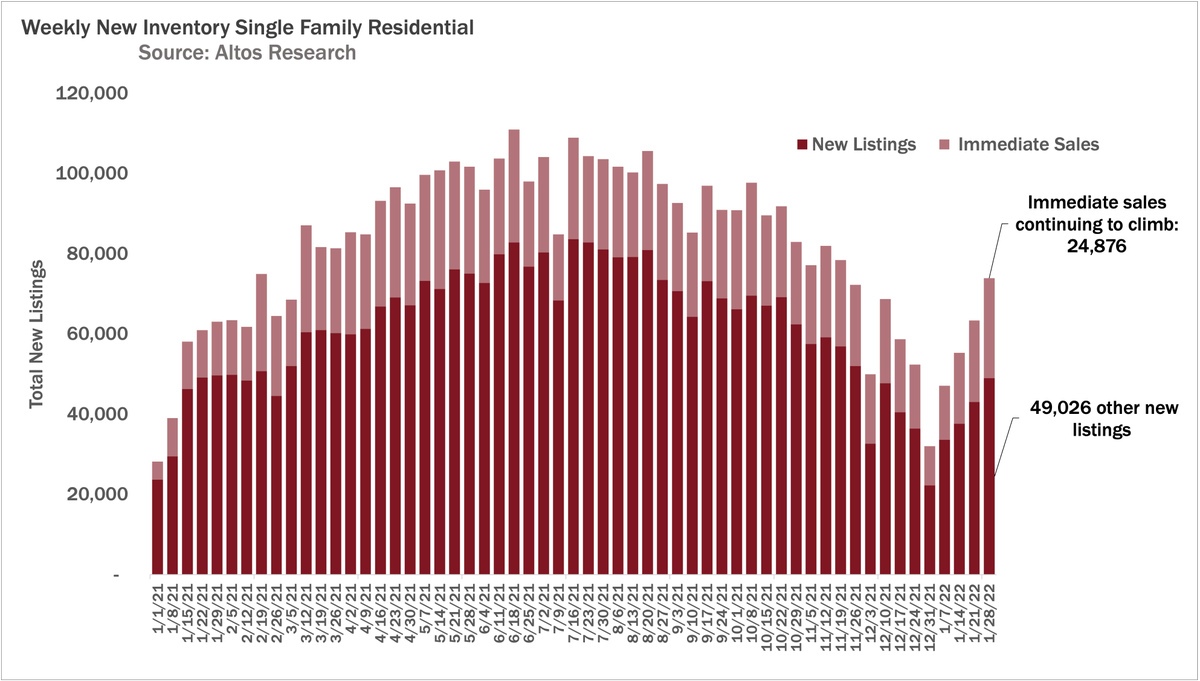

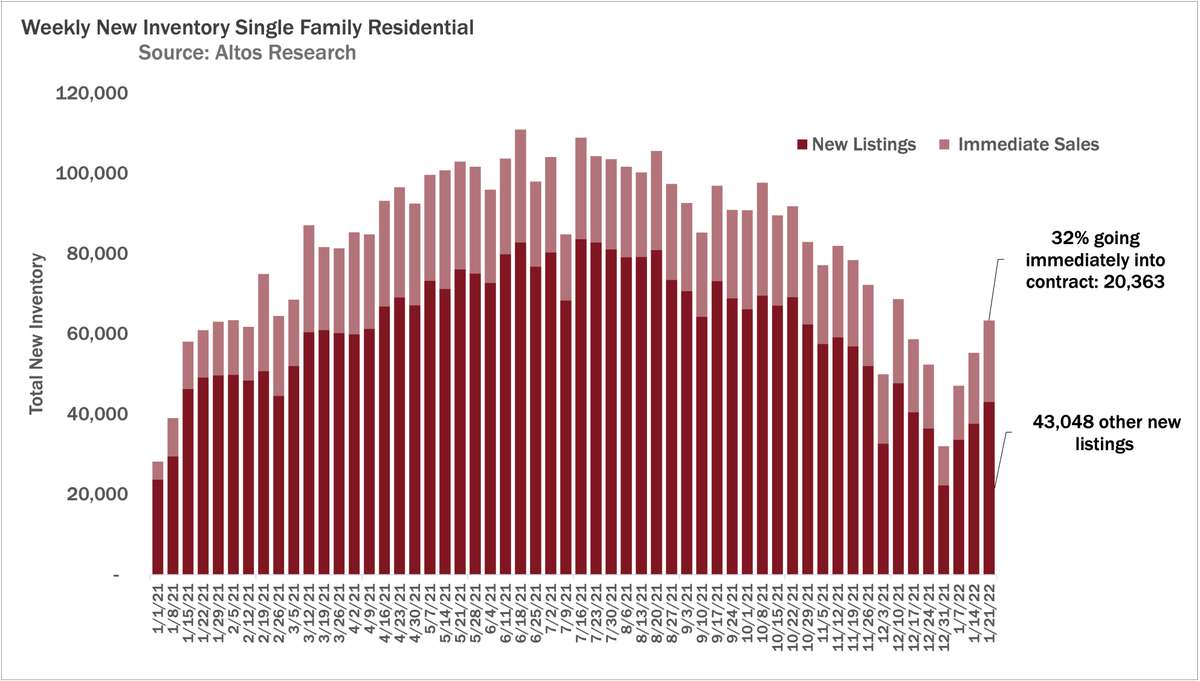

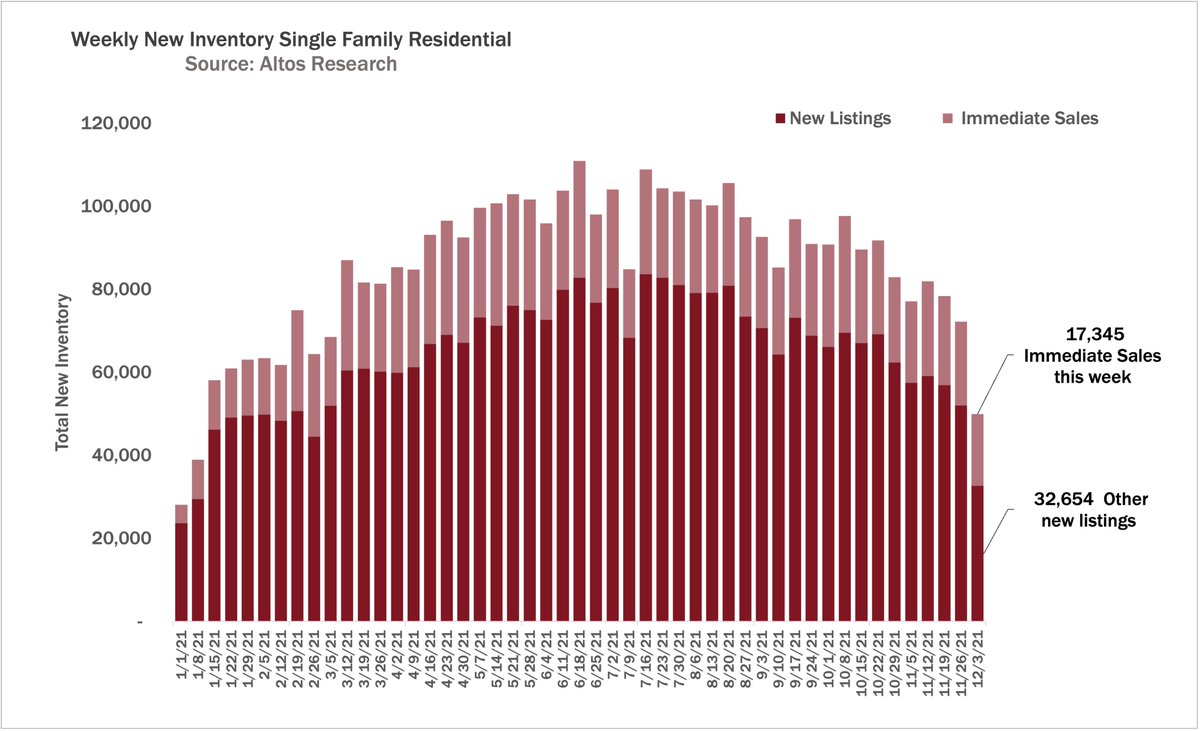

Still 30% of the new listings get offers essentially immediately. Buyers haven't slowed any due to rising rates (yet!)

Each bar here is a week, the light red portion are those that went pending within hours or days.

5/7

Each bar here is a week, the light red portion are those that went pending within hours or days.

5/7

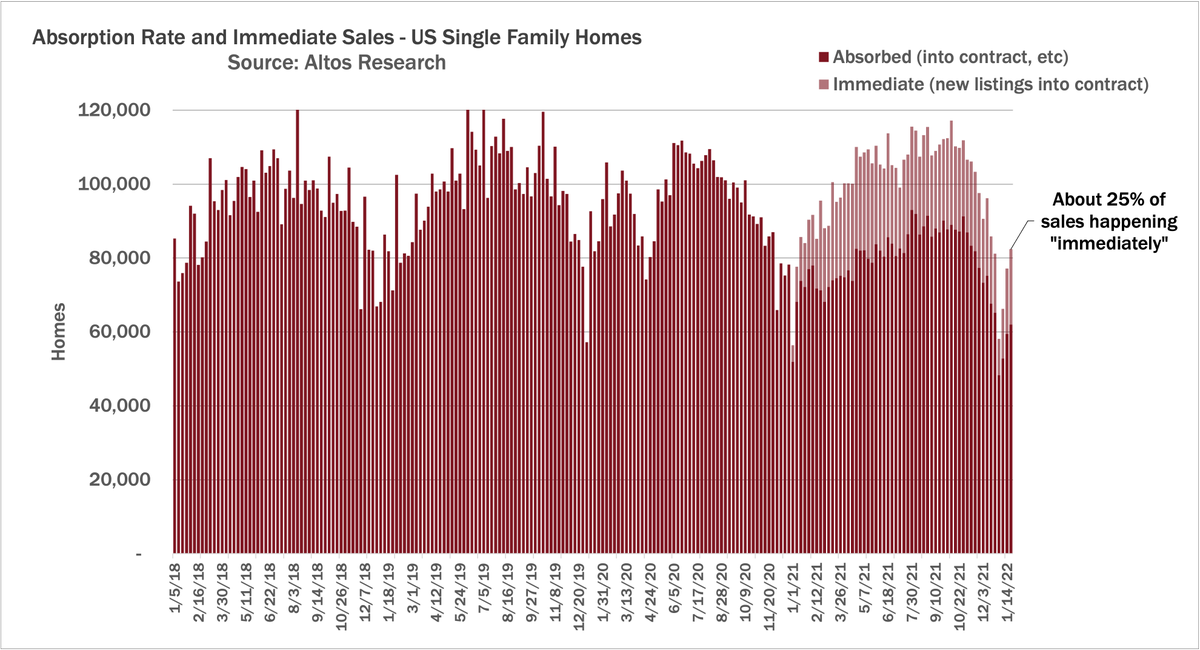

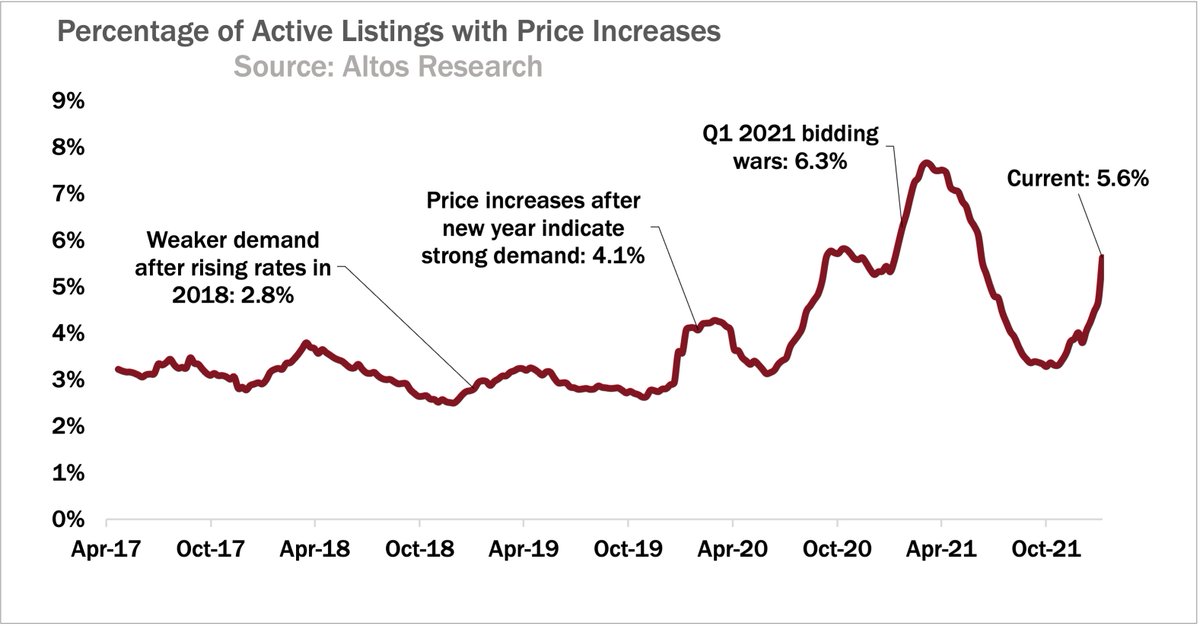

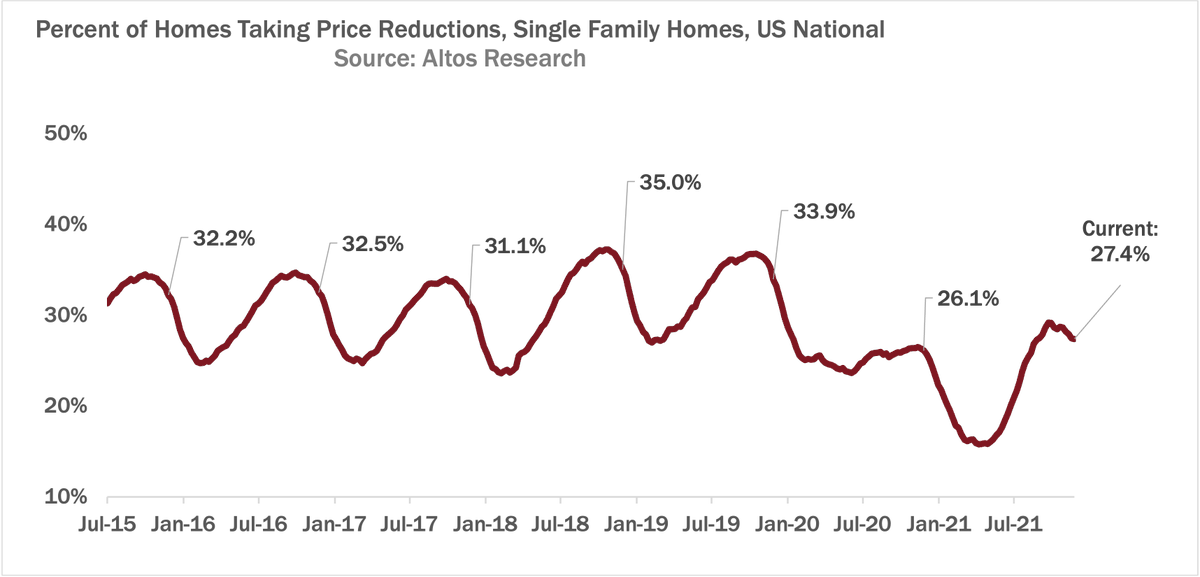

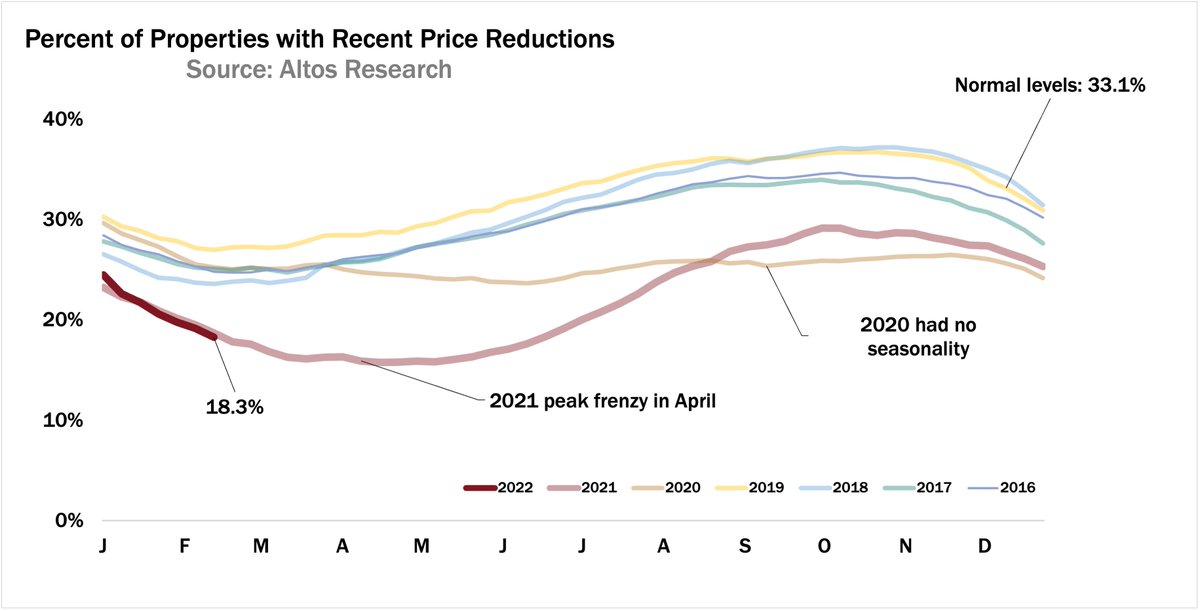

When buyers finally respond to rising rates, we'll see it in this leading indicator. Price reductions are at record low for this time of year. Only 18% of the market has taken a price cut. Normally you'd expect 30%.

Keep your eyes here in coming months (April?)

6/7

Keep your eyes here in coming months (April?)

6/7

For full details see this week's @AltosResearch market video.

How soon will spiking rates hit home buyers?

(Recorded in a foreign hotel with no green screen. 🤓)

7/7

How soon will spiking rates hit home buyers?

(Recorded in a foreign hotel with no green screen. 🤓)

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh