3 Ways to Ride the Complete Trend in a Stock

1. Supertrend

2. Moving Averages

3. Relative Strength

A Thread🧵 With Examples

Retweet Comment and Share :)

1. Supertrend

2. Moving Averages

3. Relative Strength

A Thread🧵 With Examples

Retweet Comment and Share :)

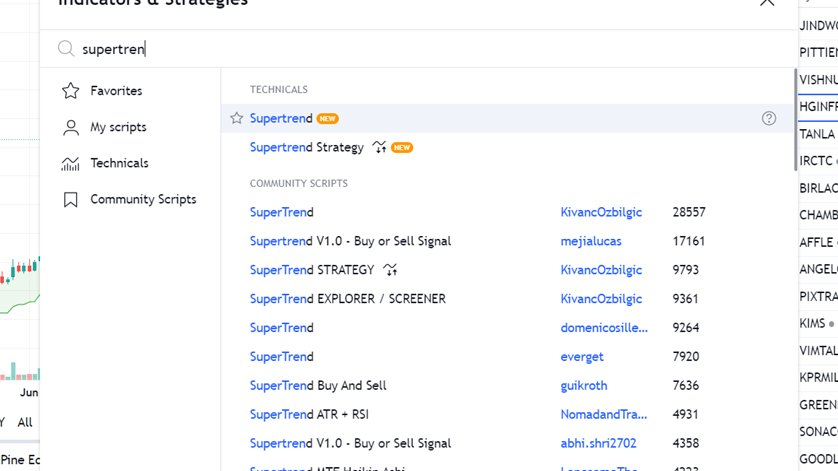

SuperTrend :

It is TrendFollowing Indicator That generates Buy / Sell signals based on the ATR value or volatility of the stock

Supertrend also works as a trailing stop-loss for the existing trades Best on daily time frame

2/n

It is TrendFollowing Indicator That generates Buy / Sell signals based on the ATR value or volatility of the stock

Supertrend also works as a trailing stop-loss for the existing trades Best on daily time frame

2/n

Supertrend Conditions

Works Best on 10 , 3 settings

One can try and backtest on 10 ,2 at own also !

Doesnt Work well in Sideways Zone as it is trend following indicator

3/n

Works Best on 10 , 3 settings

One can try and backtest on 10 ,2 at own also !

Doesnt Work well in Sideways Zone as it is trend following indicator

3/n

1. Works Best In trending Markets

2. Keep Riding the trend till Supertrend Turns Red

3. Use Price Action to Enter and Supertrend As Trailing Stoploss

4. Sometimes Gives Multiple Signals Where you can take Small Stoploss .

Example :

4/n

2. Keep Riding the trend till Supertrend Turns Red

3. Use Price Action to Enter and Supertrend As Trailing Stoploss

4. Sometimes Gives Multiple Signals Where you can take Small Stoploss .

Example :

4/n

Supertrend to be avoided in Sideways markets as it gives a lot of false Signals .

Use Normal Support Resistance as Stoploss in this case

5/n

Use Normal Support Resistance as Stoploss in this case

5/n

3. Moving average stoploss

The “well known” moving averages, such as the 50, 100, 200 daily moving averages act as natural support and resistance.

21 ema Momentum Trades

50 ema short term trades

200 ema positional trades

200 Weekly ema Long term trades

6/n

The “well known” moving averages, such as the 50, 100, 200 daily moving averages act as natural support and resistance.

21 ema Momentum Trades

50 ema short term trades

200 ema positional trades

200 Weekly ema Long term trades

6/n

Shouldn’t be used in sidways stocks , either it should be clear uptrend or clear downtrend

Stock Will Give multiple Signals which has to be ignored

Red 21 ema

Green 50 ema

7/n

Stock Will Give multiple Signals which has to be ignored

Red 21 ema

Green 50 ema

7/n

Heres A Tweet about how avoid Big Losses in trading

8/n

https://twitter.com/JayneshKasliwal/status/1487313991991181315?s=20&t=PVh6uFO1QlG6b5fS1YEjQg

8/n

What is Relative Strength ?

📌Relative strength is a strategy used in momentum investing and in identifying value stocks.

📌It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark

9/n

📌Relative strength is a strategy used in momentum investing and in identifying value stocks.

📌It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark

9/n

Conditions of Relative Strength

Relative Strength has a reference zero line

Line >0 Stock is Outperforming

Line <0 Stock is Underperforming

RS period 65 as we have around 65 trading days in 3 month

RS reference as Nifty50 as benchmark index as

10/n

Relative Strength has a reference zero line

Line >0 Stock is Outperforming

Line <0 Stock is Underperforming

RS period 65 as we have around 65 trading days in 3 month

RS reference as Nifty50 as benchmark index as

10/n

How to apply in #tradingview

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 65 period

11/n

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 65 period

11/n

Keep Holding Stocks Till RS is positive to Stay in Complete Trend .

Use 123 for Longer form of trading

Works well in all Markets and all Conditions

12/n

Use 123 for Longer form of trading

Works well in all Markets and all Conditions

12/n

Follow me @JayneshKasliwal fo more such Content

Telegram : t.me/Techno_Charts

Youtube : youtube.com/channel/UCQZW1…

Telegram : t.me/Techno_Charts

Youtube : youtube.com/channel/UCQZW1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh