Here's the @FT's @bethanstaton reporting a snap summary by @USSemployers of their constultation, saying responses indicate a "clear rejection of the @UCU proposals". It appears @UniversitiesUK's popaganda campaign to kill an attempt at a resolution succeeded. Great job! #USSmess

https://twitter.com/bethanstaton/status/1494748965618728960

@FT @bethanstaton @USSEmployers @ucu @UniversitiesUK The #USS dispute is now well and truly on fire, as eyes turn towards the formal JNC meeting(s) next week. Higher Education disputes also ramp up, with more universities brought into the action over the fundmantal Four Fights dispute.

https://twitter.com/ucu/status/1494737218895757317

As for the behaviour of @AlistairJarvis's @UniversitiesUK, and their marshalling of opinion against the @UCU proposals, have they made employers aware of the precariousness of their position at the JNC? Smooth passage for the cuts should not be taken for granted. #USSmess

@AlistairJarvis @UniversitiesUK @ucu With no resolution looking possible before a JNC vote, the decision will almost certainly fall to the JNC chair. This casting vote has been no friend to @UCU in the past, but the manipulative, hard-line approach taken by UUK is unlikely to be looked on favourably.

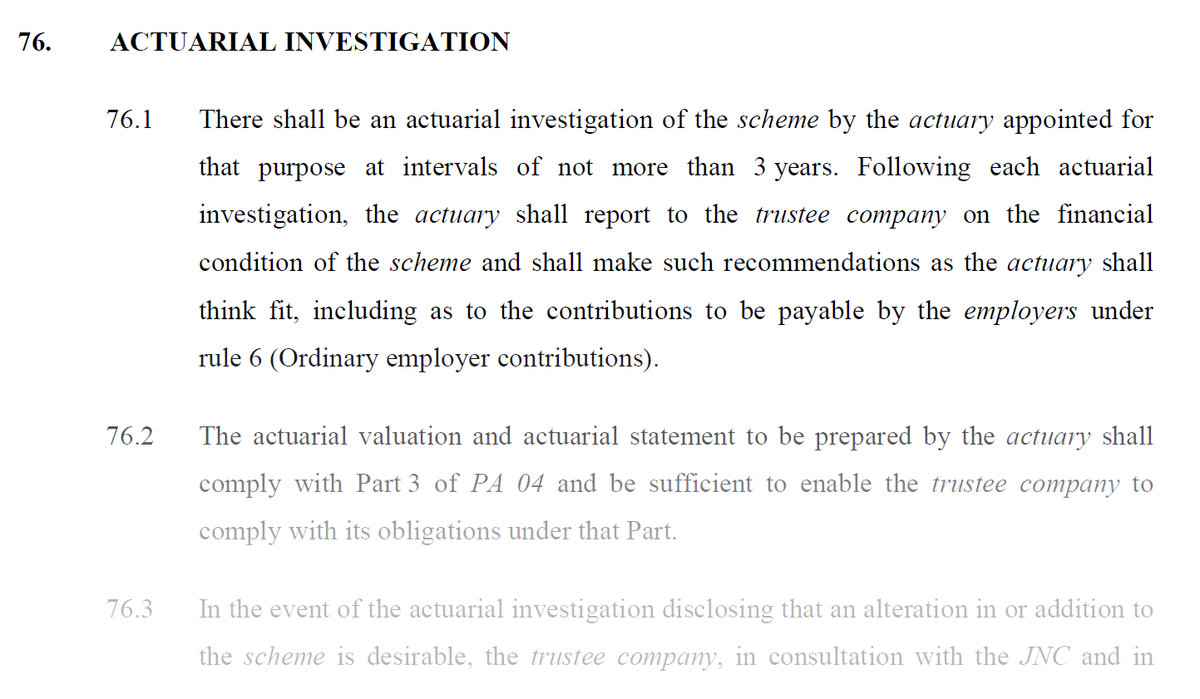

@AlistairJarvis @UniversitiesUK @ucu And don't forget that @UCU has raised some pretty serious process concerns. I consider @USSpensions to have acted in breach of the rules in how they conducted their 'Rule 76' application, leading to a loophole which @UniversitiesUK exploited last summer.

https://twitter.com/Sam_Marsh101/status/1441699697408761858

So, the news from yesterday, while disappointing, is for the most part unexpected, and the fight very much remains on! #OneOfUsAllOfUs #USSmess #USSstrike #NotTodayUUK

• • •

Missing some Tweet in this thread? You can try to

force a refresh