❓ Have @USSpensions correctly followed the scheme rules in dealing with the 2020 valuation?

I'm not convinced they have, and see what they've done as having significantly biased the JNC process against @UCU and in favour of @UniversitiesUK.

Read on... 1/

I'm not convinced they have, and see what they've done as having significantly biased the JNC process against @UCU and in favour of @UniversitiesUK.

Read on... 1/

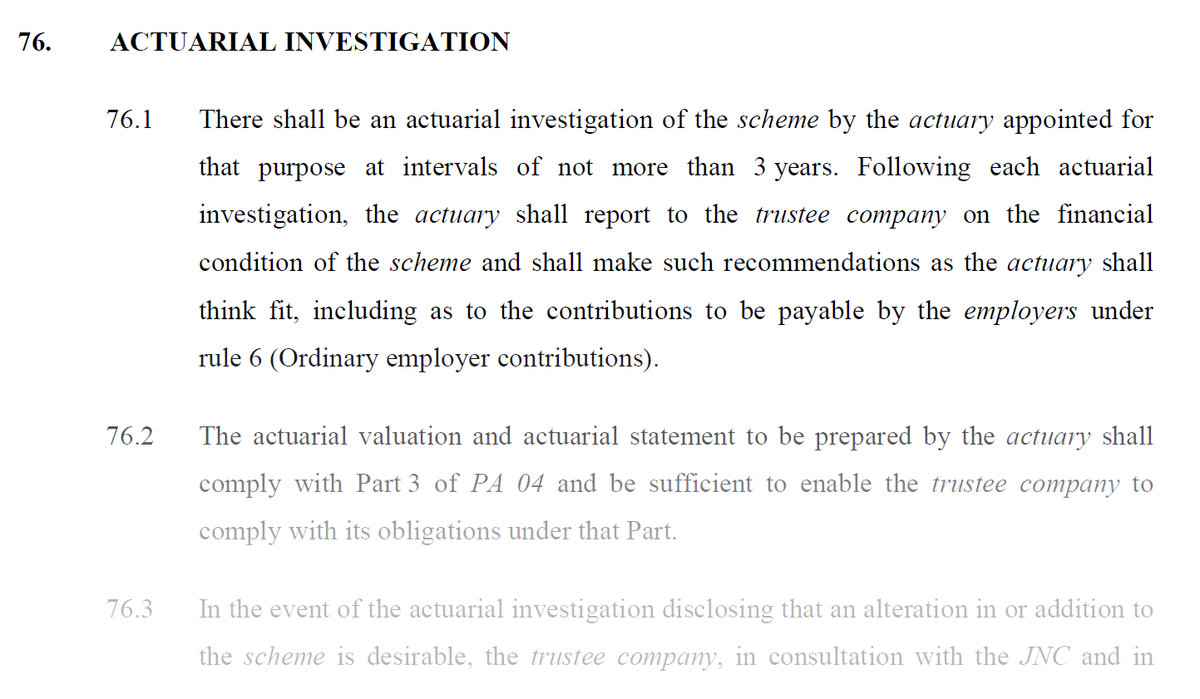

I'm focussing on the 'Rule 76' process, which sets out how the JNC (made up of UCU & UUK reps, plus an independent chair) deals with the outcome of a valuation in which costs have increased. The process starts with the #USS laying out the increase. Or it should. 2/

Let's look at the 'Cost Sharing' rule, 64.10, referenced as part of the Rule 76 process. It sets out the rights of the JNC to determine a change in benefits or contribution rate splits between members and employers, with a 'cost-sharing' backstop for if the JNC does not agree. 3/

Notice that 64.10 refers to 'an increase' in the contribution rate (singular), and gives the JNC the power to decide how to deal with the cost of 'that increase' (again, singular), before specifying how 'that cost' (singular) will be cost-shared in the absence of a decision. 4/

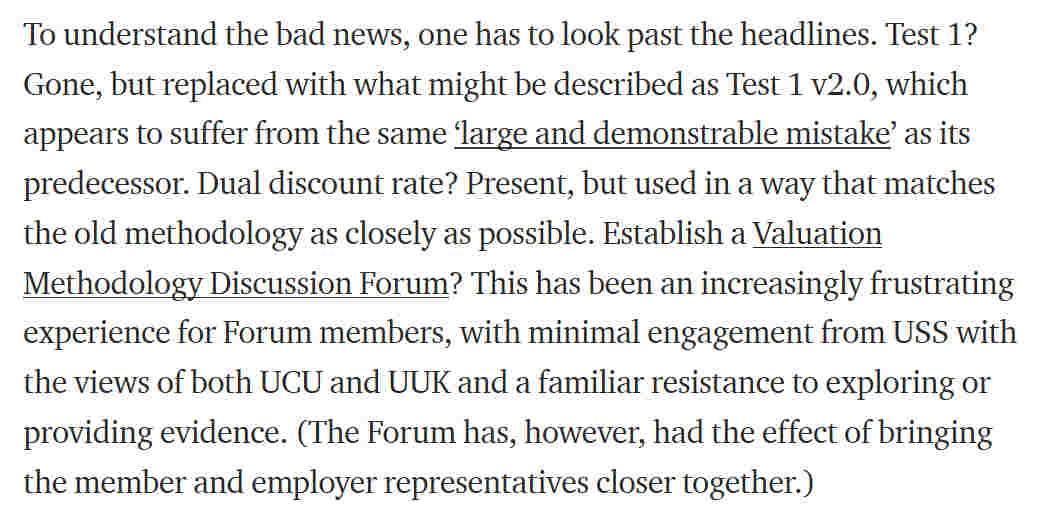

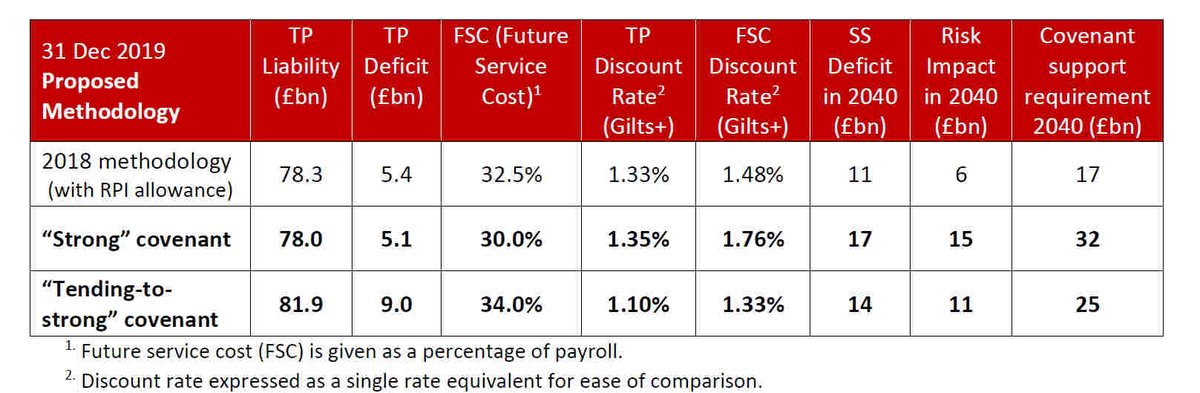

And here's the point: @USSPensions did not provide the JNC with a single cost increase ('that increase') over which to make a decision. Instead, they determined that multiple rates could apply, conditional on the level of covenant support that employers agreed to provide. 5/

And this is no mere technical matter, but one that directly impacted on the JNC's decision-making! As explained previously, @UCU's proposal to deal with the valuation outcome was made unviable by @UniversitiesUK, who withdrew their covenant support, forcing up the price. 6/

I don't believe @USSPensions should ever have implemented a Rule 76 process with multiple rates (which looks to me like a breach of the scheme rules), and certainly not one in which a loophole could be exploited by one party, in this case @UniversitiesUK. 7/

And @USSPensions intend to file the valuation by the end of September, *before* members are consulted over the benefit changes pushed through by UUK. One wonders what recourse is available to scheme members who have once again been badly let down. Bring on the court cases. 8/8

PS The Scheme Rules are available at the link below. Please do have a look! uss.co.uk/about-us/schem…

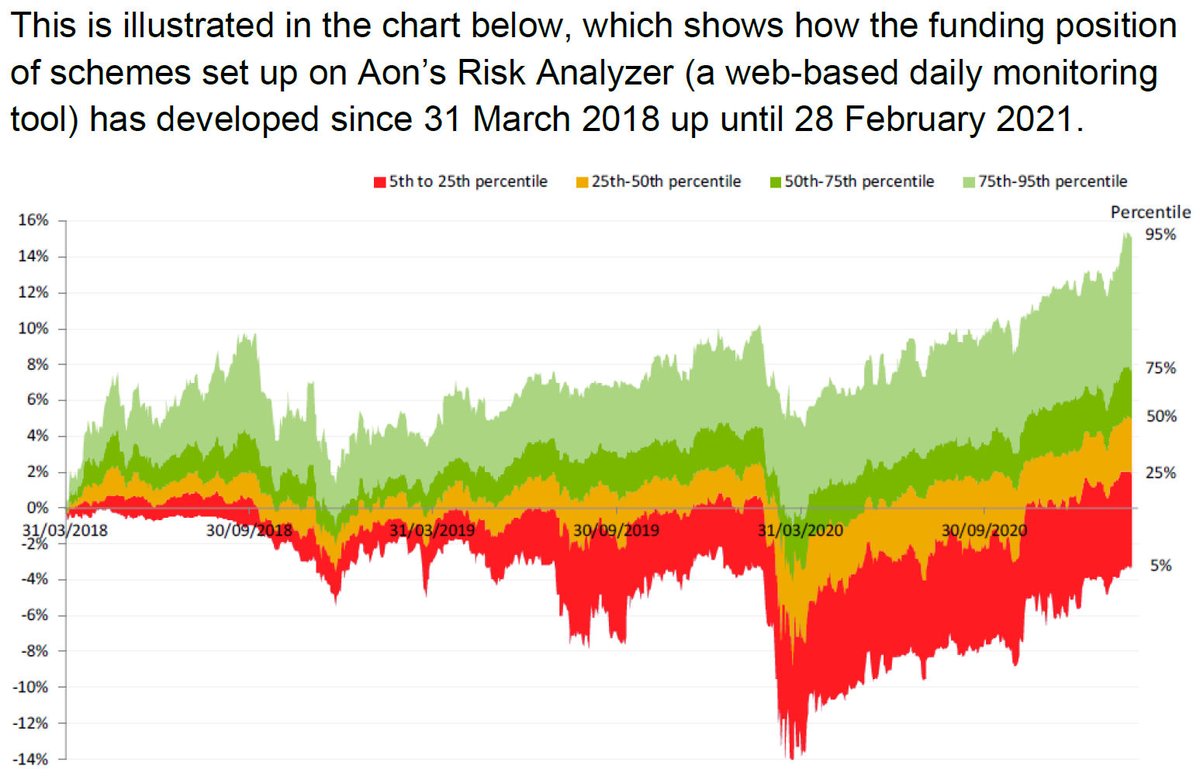

PPS Interestingly, and almost certainly relevantly, the 'central case' USS refer to below was not the basis on which the JNC decision was made. We never got issued a new Rule 76 report for any other rate, yet UUK's proposals (voted through) were costed against a lower rate.

In other words, something's gone wrong here!

• • •

Missing some Tweet in this thread? You can try to

force a refresh