Leicester City’s 2020/21 accounts covered “one of the most successful seasons in the club’s history” when they finished 5th in the Premier League, won the FA Cup and reached the last 32 of the Europa League. Finances significantly impacted by COVID. Some thoughts follow #LCFC

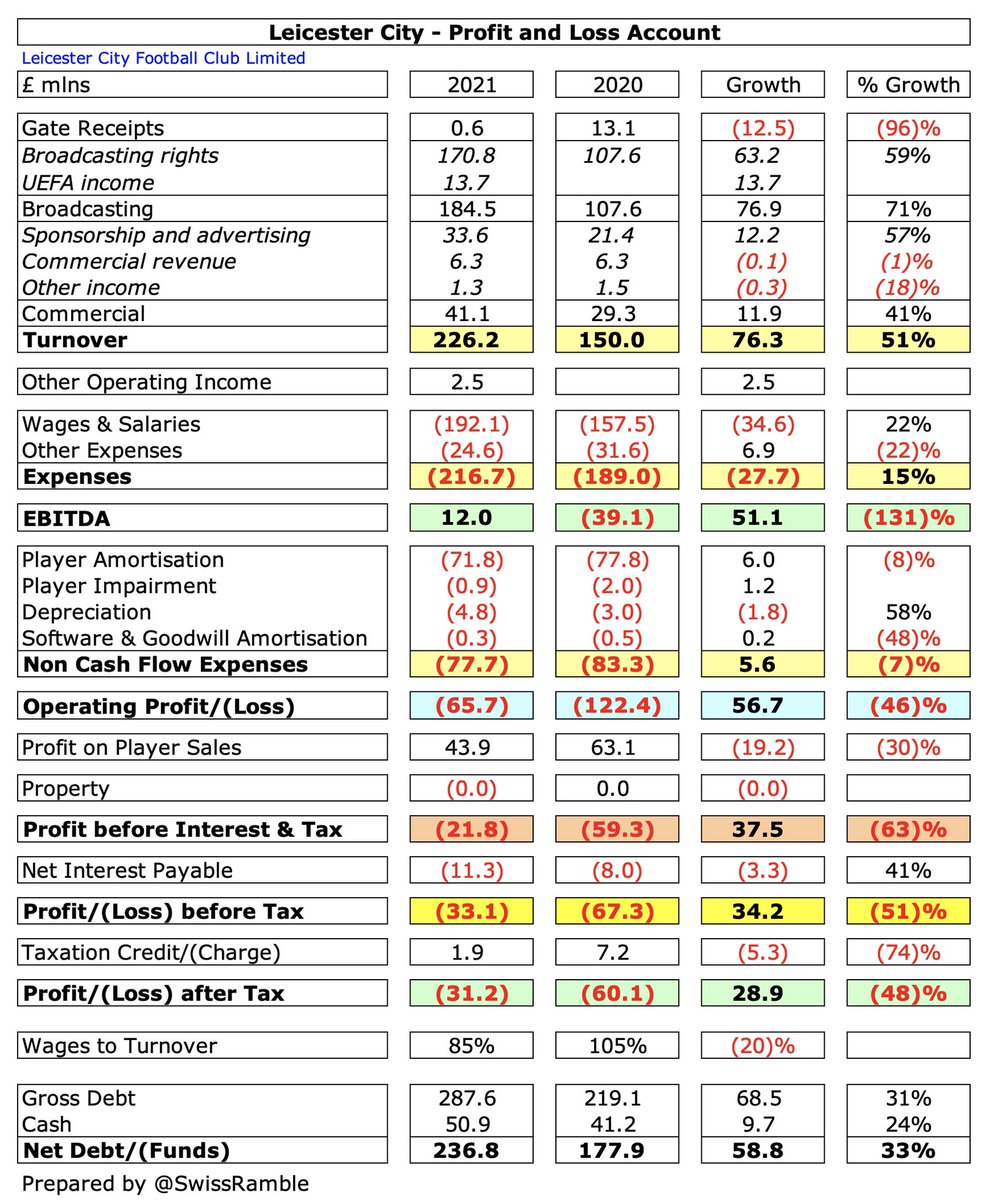

#LCFC pre-tax loss reduced from £67m to £33m (after tax £31m), as revenue rose £76m (51%) from £150m to £226m plus £2.5m other operating income, partly offset by profit on player sales falling £19m to £44m and operating expenses rising £22m (8%).

#LCFC revenue increase helped by on-pitch success, but also recognition of revenue from delayed 2019/20 season. Broadcasting rose £77m (71%) from £108m to £185m, while commercial grew £12m (41%) from £29m to £41m. These offset £13m (96%) reduction in match day to just £552k.

#LCFC wage bill shot up £35m (22%) from £157m to £192m, partly due to deferred salaries, but player amortisation fell £6m (8%) to £72m. Other expenses were cut £7m (22%) to £25m, but depreciation was up £2m to £5m and net interest payable also rose £3m to £11m.

Although the £33m loss is obviously not great, it’s actually one of the better financial results of the clubs that have reported so far in 2020/21, certainly compared to huge deficits at #CFC £156m and #THFC £80m, as football counted the cost of the pandemic.

#LCFC lost £36m revenue due to COVID, split match day £18m and broadcasting £18m (Premier League £14m, FA Cup prize money 50% cut £3.4m, UEFA rebate £0.5m). Offset by £33m deferred from 2019/20 (broadcasting £28m, sponsorship & advertising £5m). Total two-year COVID loss £50m.

#LCFC figures benefited from £44m profit on player sales, almost entirely due to Ben Chilwell’s big money move to #CFC, though this was down from prior year £63m. Second highest in 2020/21 Premier League to date, only surpassed by #MCFC £69m, but ahead of #CFC £28m & #THFC £19m.

#LCFC have now reported 3 consecutive years of losses, adding up to £121m, which is in stark contrast to the 4 years of profits after promotion to the Premier League in 2014. That included the amazing £92m surplus in 2017, which is actually the 3rd highest profit in PL history.

#LCFC made very little from player sales up to 2016, but profits have surged since then. Indeed, have the 5th highest profits in the Premier League in the 4 years up to 2020. However, this year’s gain will be much lower with the highest sale only being Ghezzal to Besiktas £3m.

#LCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(39)m to £12m. However, still the worst reported to date in 2020/21 Premier League, far below #MCFC £116m, #MUFC £95m and #THFC £95m.

#LCFC operating loss (excluding player sales and interest) narrowed from £122m to £66m, though was still firmly in the bottom half of the Premier League. This is the price paid for attempting to break into the top four, though in fairness hardly any clubs post operating profits.

#LCFC £226m revenue is actually £48m higher than the 2019 pre-pandemic level, despite £14m fall in match day, as there was growth in broadcasting £57m and commercial £5m, partly due to deferred revenue from 2019/20. Second highest ever, only behind 2017 £233m (Champions League).

Following the growth, #LCFC £226m revenue is 7th highest in England, though still a long way below the Big Six, e.g. less than half of #MCFC £570m & #MUFC £494m. In a normal year unaffected by COVID and accounting issues, Leicester will compete with #NUFC, #EFC & #WHUFC.

Based on 2019/20 results, #LCFC were 22nd in the Deloitte Money League, which ranks clubs globally by revenue. Interestingly, they are above traditionally big clubs like Benfica, Borussia Mönchengladbach, Ajax and Milan.

#LCFC broadcasting income rose £77m (71%) from £108m to £185m, mainly due to revenue from 9 games deferred to 2020/21 (played after end-May 2019/20 accounting close) and £14m from competing in the Europa League.

As 2019/20 season was extended, £28m revenue was booked in 2020/21 accounts. driving £56m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs like #LCFC with May year-end had largest revenue deferrals, while those with July close deferred zero revenue.

#LCFC 2020/21 broadcasting revenue would have been even higher without £2m Premier League broadcasters rebate, £12m other PL reductions (contributions to EFL clubs, cost of COVID tests, lost Chinese TV deal), £3.4m 50% FA Cup prize money cut and £0.5m UEFA rebate.

#LCFC earned £14m for reaching the Europa League last 32 (€17m per my model), though this was significantly lower than the Champions League representatives, e.g. #CFC and #MCFC received €120m for reaching the final (around seven times as much as Leicester).

Thanks to their solitary, albeit very lucrative, season in the Champions League exploits in 2017, #LCFC have earned just under €100m from Europe in the last 5 years, the 7th highest in England, though a lot less than #MCFC €422m.

#LCFC match day income fell £12.5m (96%) to just £552k, as all home games were played behind closed doors (except one with restricted capacity of 8,000). Chief executive Susan Whelan described the return of fans to the stadium this season as “transformational”.

#LCFC 2019/20 average attendance of 32,061 (for those games played with fans), was 11th highest in the Premier League, though a fair way below 10th placed #EFC 39,103.

#LCFC have announced plans to expand the King Power stadium, increasing the capacity to around 40,000 by adding 8,000 seats to the East Stand. The clubs said this was “a key part of the club’s long-term strategy for growth” with completion targeted for summer 2024.

#LCFC commercial income rose £12m (41%) from £29m to £41m, partly due to deferral of £5m sponsorship to 2020/21. This is the highest ever for the club, though a long way behind the Big Six, e.g. over £100m less than #AFC £142m, while #MCFC £272m is almost 7 times as much.

#LCFC owners King Power pay £16m sponsorship (shirt and stadium naming rights), which has driven most of the recent growth, though shirt deal replaced by 3-year deal with online trading company FBS in 2021/22. Adidas are kit supplier, while Bia Saigon are sleeve sponsor.

#LCFC 2020/21 accounts also included £2.5m other operating income. This was not detailed, but other clubs have booked insurance claims for losses sustained as a result of the pandemic here. #CFC £12.6m was mainly due to unexplained recharges.

#LCFC wage bill rose £35m (22%) from £157m to £192m, partly due to further investment in the playing squad, including contract extensions, but mostly because 20% of player & management bonuses was deferred from 2019/20. Wages up from only £57m in first season in Premier League.

Following the growth, #LCFC £192m wage bill is 7th highest in the Premier League, just behind #THFC £205m. That said, it’s around £150m below the highest-spending clubs to date in 2020/21, namely #MCFC £355m and #CFC £333m. Club did not use government’s job retention scheme.

As a result of the revenue increase, #LCFC wages to turnover ratio decreased (improved) from 105% to 85%, though this is still the worst in Premier League to date in 2020/21 with the next highest being #CFC 77%. Others likely to be worse when they publish COVID impacted accounts.

Remuneration for #LCFC highest paid director decreased by 21% from £356k to £282k, presumably for chief executive Susan Whelan. That seems pretty good value, compared to the likes of #MUFC Ed Woodward and #THFC Daniel Levy, who earned £2.9m and £2.7m respectively.

#LCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £6m (8%) from £78m to £72m, but this is up from just £3m in 2014. Also booked £0.9m impairment. Now 8th highest in Premier League, just below #THFC, but £90m less than #CFC.

#LCFC other expenses fell £7m (22%) from £32m to £25m, due to reduced match day costs, as games were played behind closed doors. This had previously quadrupled from £9m in 2015 to £36m in 2019. Includes £3.5m management fee charged by King Power, but not paid (as per prior year).

#LCFC spent £64m on player purchases, including Wesley Fofana from Saint-Etienne and Timothy Castagne from Atalanta. Gross spend has now fallen two years in a row from £119m peak in 2019, but was £10m higher than a close rival #WHUFC. Much lower than Big Six.

However, #LCFC have ramped up player investment, spending nearly half a billion in the last 5 years with “responsible yet ambitious investment”, compared to less than £100m in preceding 5-year period. Partly offset by sales increasing to £298m in the same period.

In fact, #LCFC have the 7th highest transfer expenditure in the Premier League over the 5 years up to 2020, with their gross spend being more than #THFC (though less than #EFC). However, it’s a different story for net spend with the Foxes only 11th highest.

#LCFC gross debt rose £69m to £288m, mainly £218m from the owners (including £38m from parent company in loans and leases) plus £69m bank loans. Debt has shot up from just £25m in 2018 and would be even higher without £103m conversion of shareholder loans into equity.

#LCFC £288m debt is 5th largest in Premier League after investment in the squad and new training ground. Much PL debt is funding for new stadiums, e.g. #THFC £854m, #BHAFC £306m and #AFC 218m, though #MUFC £530m is for Glazers’ purchase. #EFC £409m is “friendly” owner loan.

Since year-end #LCFC entered into a 5-year loan facility with King Power for £42.5m to finance working capital requirements for the next 12 months and replaced the £52.5m facility with Macquarie Bank with an £80m 4-year facility.

#LCFC paid £3m interest, all on the Macquarie Bank loan (between 2.8% and 5.15%). Interest on owner loans (6%) and finances leases (8%) is only accrued and not paid, which explains why interest payable in the P&L is much higher.

#LCFC did manage to cut transfer debt from £78m to £63m, which is around double £32m in 2017, but down from £97m peak two years ago. On the low side for the Premier League, over £100m less than #THFC. Also offset by £21m transfer fees owed by other clubs, so net payable is £44m.

Despite £66m operating loss, #LCFC had £17m operating cash flow (adding back £78m amortisation and £5m working capital), but spent £36m on infrastructure (mainly new training ground) and £24m on players (purchases £79m, sales £55m). Funded by new loans, mostly £51m from owners.

As a result, #LCFC cash balance increased £10m from £41m to £51m, which is around mid-table in the Premier League, though a lot less than #THFC £148m and #MUFC £111m. Can be misleading when clubs have commitments like outstanding transfer fees or capital expenditure.

In the last 4 years, the majority of #LCFC funding has come from loans (£163m from the owners, £67m from banks), though £36m was generated from operations. Over half has been invested in infrastructure £141m with £122m spent on improving the squad (net).

Since King Power acquired #LCFC in August 2010, the owners have put in £352m (£246m loans and £106m share capital), including £162m in the last two years alone. In fact, in the 10 years up to 2020 they have provided the 6th highest funding in the Premier League.

#LCFC directors are confident that the club continues to comply with the Premier League and UEFA Financial Fair Play regulations, notwithstanding the large loss, as financial results are currently assessed over two years to take into consideration the impact of COVID.

#LCFC CEO Susan Whelan concluded, “The club intends to extend its challenge to the Big Six clubs both on and off the pitch.” European qualification is important to meet that objective, but Leicester are fortunate to have generous owners who have invested for the long-term.

• • •

Missing some Tweet in this thread? You can try to

force a refresh