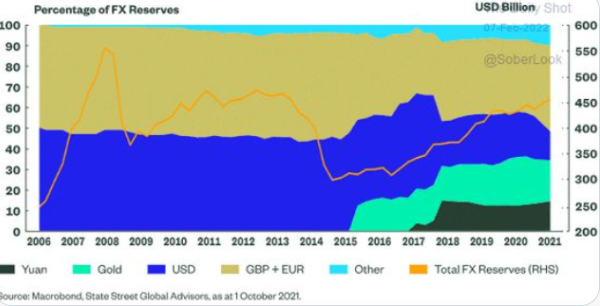

Russian FX reserves, in % (left) and USD billion (right)

Since 2017, Putin has been accumulating Gold & CNY and reducing USD & EUR

In case of escalation though, he will need to inevitably deplete these reserves to defend the RUB.

How will this play out?

Mini thread

👇

Since 2017, Putin has been accumulating Gold & CNY and reducing USD & EUR

In case of escalation though, he will need to inevitably deplete these reserves to defend the RUB.

How will this play out?

Mini thread

👇

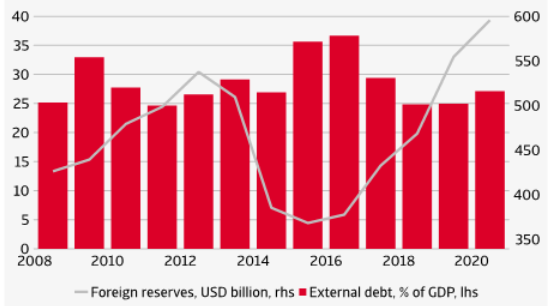

In 2014, Russia had to deplete >20% of its FX reserves due to Crimea-related sanctions and a big drop in oil prices.

Since then, Putin has applied a ''fortress'' strategy by reducing external debt & accumulating (non-EUR or USD) FX reserves

Since then, Putin has applied a ''fortress'' strategy by reducing external debt & accumulating (non-EUR or USD) FX reserves

Few more things are different vs 2014:

1) Russia has diversified its export base a bit away from Europe and towards China

2) The oil & gas market is much tighter

3) Oil, gold & CNY (Russian ''assets'') keep appreciating against EUR & USD (Russian ''liabilities'')

1) Russia has diversified its export base a bit away from Europe and towards China

2) The oil & gas market is much tighter

3) Oil, gold & CNY (Russian ''assets'') keep appreciating against EUR & USD (Russian ''liabilities'')

Nevertheless:

- The global economic system is still highly dependent on the USD

- Russia has a net external debt = 30% of GDP

- Russia is a net importer of several important items from Europe

Defending the RUB and the economy is likely to prove tough, but less than 2014.

- The global economic system is still highly dependent on the USD

- Russia has a net external debt = 30% of GDP

- Russia is a net importer of several important items from Europe

Defending the RUB and the economy is likely to prove tough, but less than 2014.

• • •

Missing some Tweet in this thread? You can try to

force a refresh