Your Friday ''wtf is going on in fixed income & macro'' thread.

Here you go!

1/12

Here you go!

1/12

One of the most overlooked headlines of the week was:

*BOJ COMMITS TO BUY UNLIMITED AMOUNTS OF 10-YEAR JAPANESE GOVERNMENT BONDS AT 0.25%

JGB yields (and FX hedging costs) are important to find out if the big Japanese fixed income buyers find foreign bonds attractive or not

2/

*BOJ COMMITS TO BUY UNLIMITED AMOUNTS OF 10-YEAR JAPANESE GOVERNMENT BONDS AT 0.25%

JGB yields (and FX hedging costs) are important to find out if the big Japanese fixed income buyers find foreign bonds attractive or not

2/

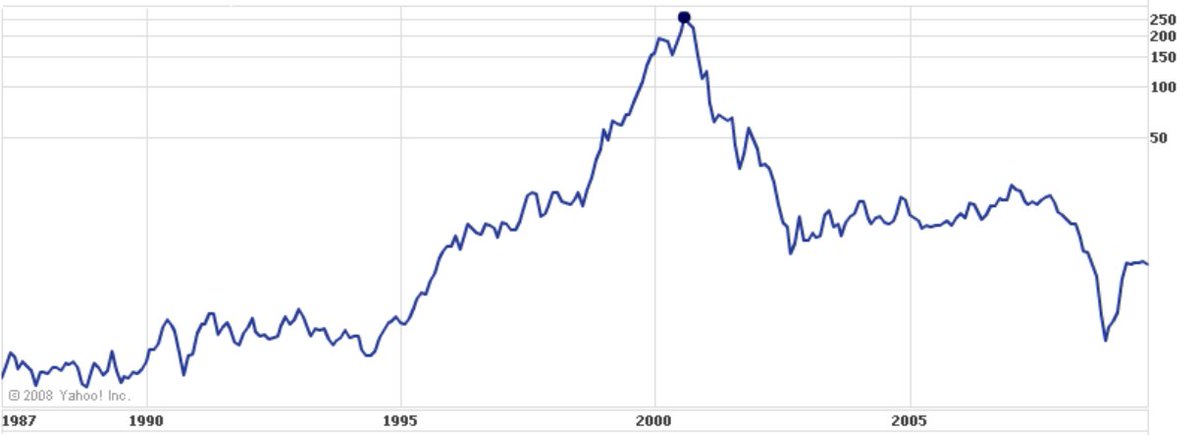

Japanese investors have very low and sticky domestic yields, hence they have learnt to look for opportunities abroad.

They generally hedge FX risk on a 3-month rolling basis: sell JPY, buy USD, buy Treasuries, hedge JPY/USD for 3 months and roll the hedge.

3/

They generally hedge FX risk on a 3-month rolling basis: sell JPY, buy USD, buy Treasuries, hedge JPY/USD for 3 months and roll the hedge.

3/

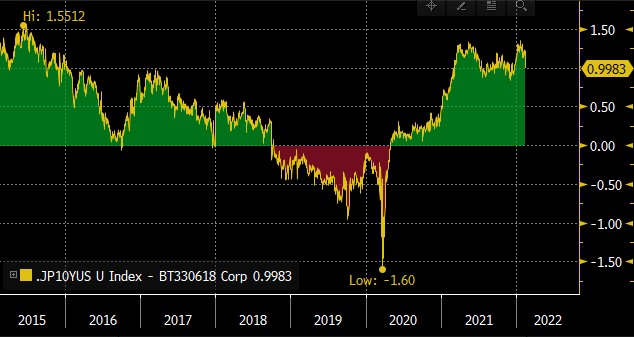

Here is how a 10y Treasury bought by a Japanese investor hedging USD/JPY for 3 months looks like when compared with a 10y Japanese bond

The 3m FX-hedged UST yields almost 1% more

That's a decent pick-up, and the BOJ capping JGB yields at 0.25% helps Japanese demand for USTs

3/

The 3m FX-hedged UST yields almost 1% more

That's a decent pick-up, and the BOJ capping JGB yields at 0.25% helps Japanese demand for USTs

3/

Moving to Europe, where Lagarde went on the wires saying ''if we acted too hastily now, the recovery of our economies could be considerably weaker and jobs would be jeopardized.''

That's European jargon for ''we don't agree with market pricing, it's too aggressive''

4/

That's European jargon for ''we don't agree with market pricing, it's too aggressive''

4/

For context, the futures market is pricing ECB deposit rates to be at 0.8% by December 2024

Starting from -0.50% today, that would imply by far the fastest ECB hiking cycle ever experienced since 2005

The ECB pushback has started.

Implications for EUR/USD, @AndreasSteno?

5/

Starting from -0.50% today, that would imply by far the fastest ECB hiking cycle ever experienced since 2005

The ECB pushback has started.

Implications for EUR/USD, @AndreasSteno?

5/

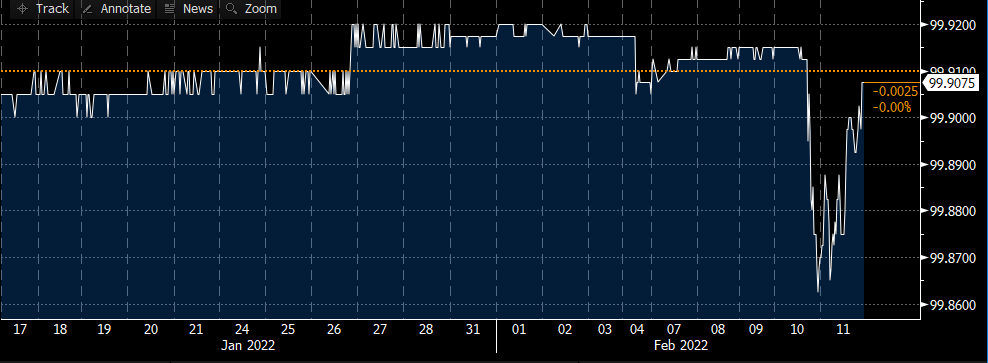

In the US, we got the first relevant curve inversion

The slope between 5y and 30y OIS swaps (reflecting the expected path for Fed Funds future over time) briefly traded below 0 yesterday

@RaoulGMI is very attentive to these turns: what do you make of this first inversion?

6/

The slope between 5y and 30y OIS swaps (reflecting the expected path for Fed Funds future over time) briefly traded below 0 yesterday

@RaoulGMI is very attentive to these turns: what do you make of this first inversion?

6/

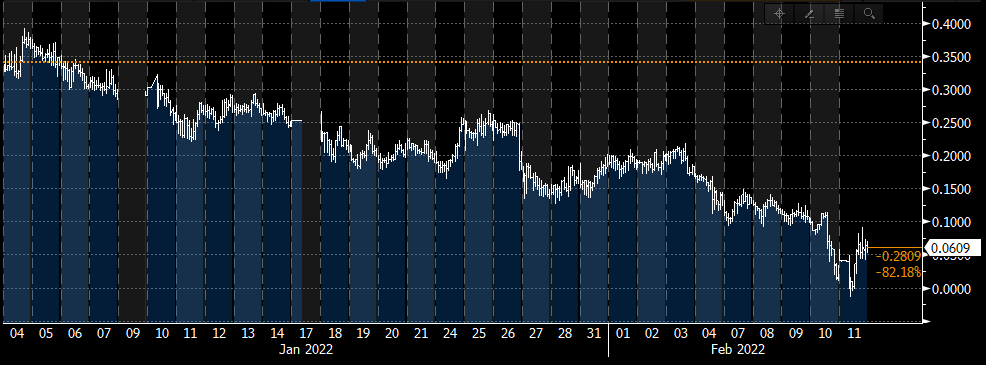

This happened as traders went ballistic on pricing 2022 Fed action to the most hawkish levels one could reasonably foresee.

At some point, traders started pricing >20% of an emergency Fed hike before March.

The contract below is the Feb2022 Fed Funds Future.

7/

At some point, traders started pricing >20% of an emergency Fed hike before March.

The contract below is the Feb2022 Fed Funds Future.

7/

The sharp rebound seen today is due to the Fed confirming their March tapering schedule

Powell has been very clear on the sequencing:

- Taper purchases to zero

- First hike

- QT

No accelerated taper = no emergency hike

@LynAldenContact what would you do if you were JPOW?

8/

Powell has been very clear on the sequencing:

- Taper purchases to zero

- First hike

- QT

No accelerated taper = no emergency hike

@LynAldenContact what would you do if you were JPOW?

8/

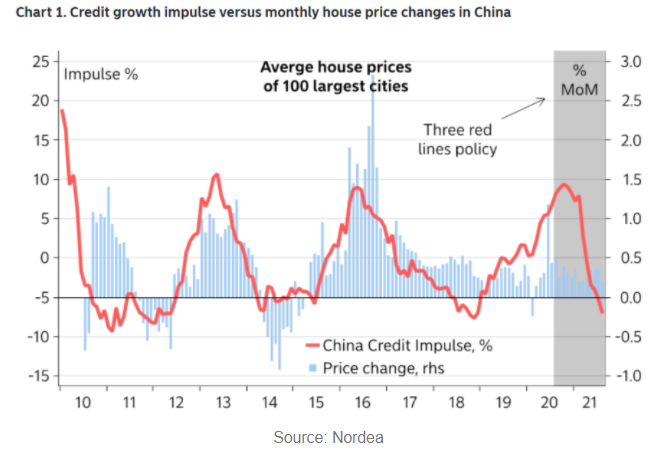

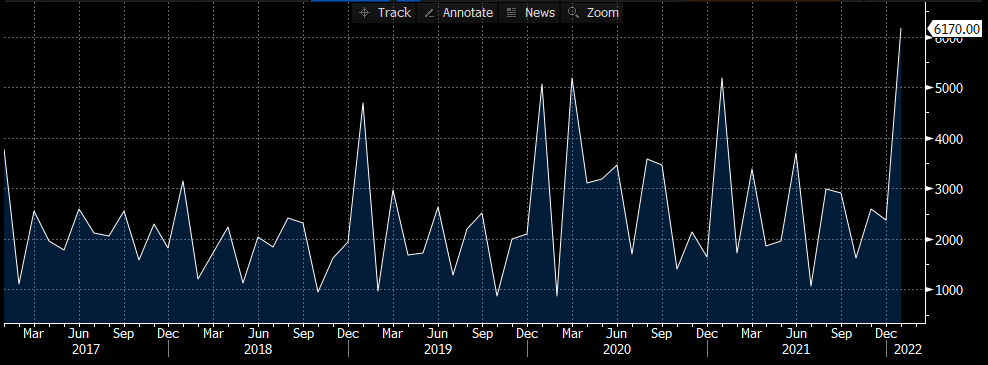

Elsewhere in the world, China has started stimulating more seriously.

The January credit data were a large beat, and Xi has been pushing state-owned banks to lend especially to distressed real estate developers.

The Chinese January credit data look like this

9/

The January credit data were a large beat, and Xi has been pushing state-owned banks to lend especially to distressed real estate developers.

The Chinese January credit data look like this

9/

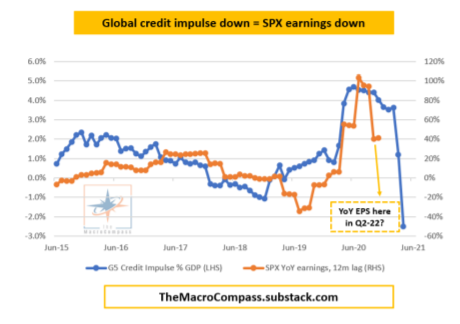

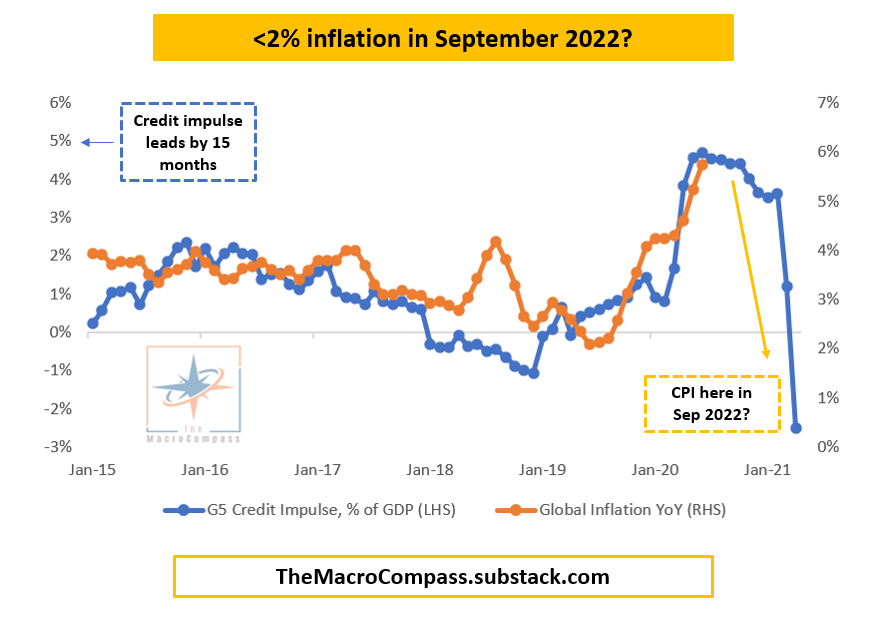

Chinese credit is a relevant contributor to my G5 Credit Impulse, which leads economic activity and asset class performances by 6-12 months and hence it bodes well for Q422 and onwards.

In the meantime, the 2021 slowdown will weigh on economic activity and CPI until then!

10/

In the meantime, the 2021 slowdown will weigh on economic activity and CPI until then!

10/

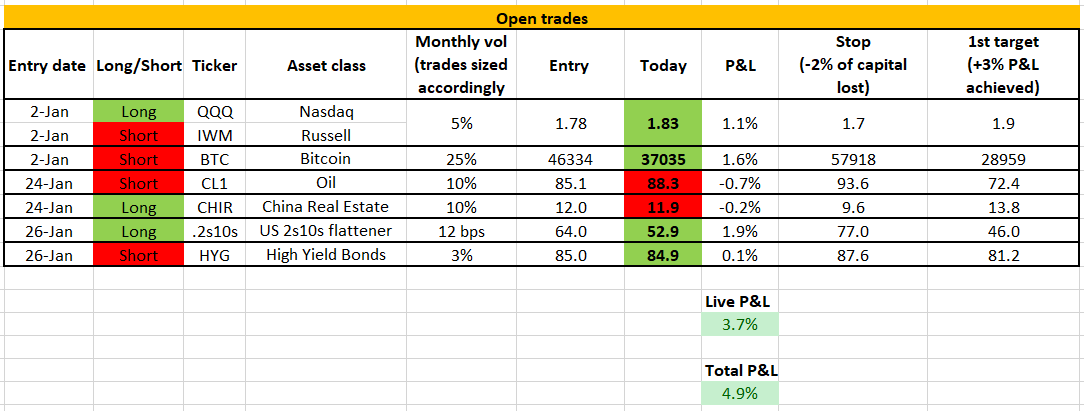

Short portfolio update

- Stopped out of short Oil trade

- Live P&L +6.2% YTD

Current trades

- Short Russell (IWM)

- Short Bitcoin

- Long Chinese Real Estate (CHIR)

- US 2s10s flattener

- Short High Yield Bonds

11/

- Stopped out of short Oil trade

- Live P&L +6.2% YTD

Current trades

- Short Russell (IWM)

- Short Bitcoin

- Long Chinese Real Estate (CHIR)

- US 2s10s flattener

- Short High Yield Bonds

11/

On Monday, I will publish the second piece of my Bond Market 101 Series on my free newsletter TheMacroCompass.Substack.com

On The Macro Compass, I go the extra mile to provide solid financial education material

If you subscribe (free), you'll receive it directly in your inbox

12/

On The Macro Compass, I go the extra mile to provide solid financial education material

If you subscribe (free), you'll receive it directly in your inbox

12/

• • •

Missing some Tweet in this thread? You can try to

force a refresh