Portfolio update!

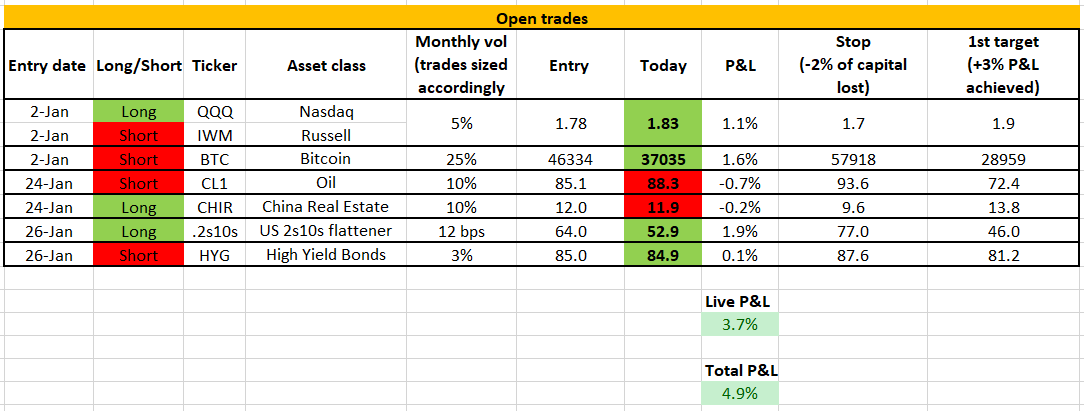

Open trades:

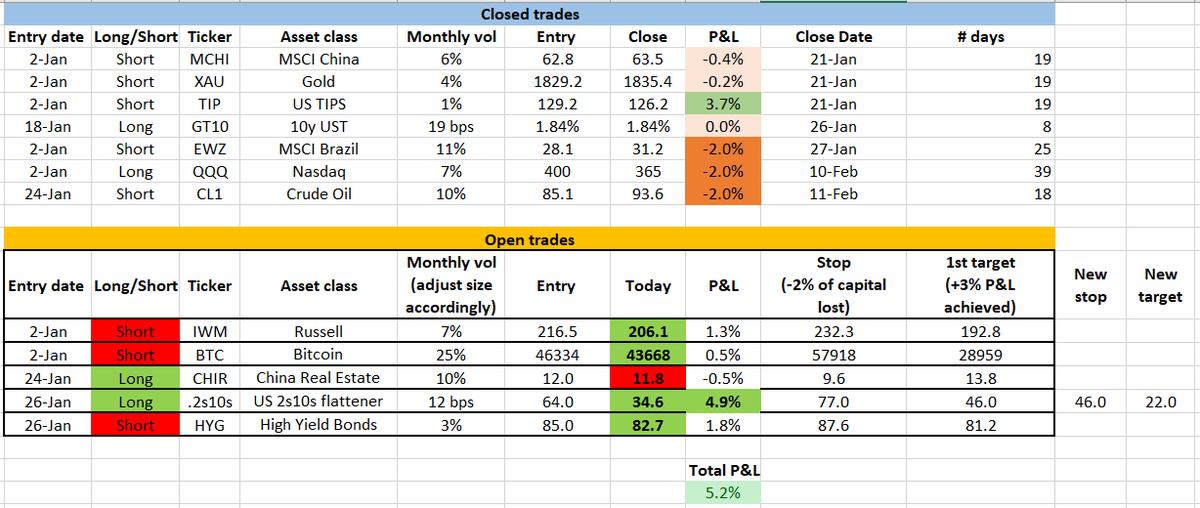

- Short Russell

- Long Chinese Real Estate

- Flatter 2y-10y yield curve in the US

- Short Bitcoin

- Short High Yield Bonds

Stopped out in short Oil (FinTwit warned me!)

As already announced, moved the long QQQ/IWM into an outright short Russell

Open trades:

- Short Russell

- Long Chinese Real Estate

- Flatter 2y-10y yield curve in the US

- Short Bitcoin

- Short High Yield Bonds

Stopped out in short Oil (FinTwit warned me!)

As already announced, moved the long QQQ/IWM into an outright short Russell

My global macro long/short portfolio aims at generating 10%+ total return per year with annualized volatility in the 10-15% area.

It's hard, trust me.

Every trade is sized to lose max 2% of my capital: higher vol instrument = smaller size.

Hard stop losses, let the profits run.

It's hard, trust me.

Every trade is sized to lose max 2% of my capital: higher vol instrument = smaller size.

Hard stop losses, let the profits run.

P&L YTD: +5.2%

You'll see me posting updates also when the P&L is negative: nothing to hide here.

It's a journey we're all in together.

So far, I have been

- Clearly wrong 3 times

- Very, very right 2 times

- Right 2 times more

My long-run average is 53-54%

Yep, not a wizard

You'll see me posting updates also when the P&L is negative: nothing to hide here.

It's a journey we're all in together.

So far, I have been

- Clearly wrong 3 times

- Very, very right 2 times

- Right 2 times more

My long-run average is 53-54%

Yep, not a wizard

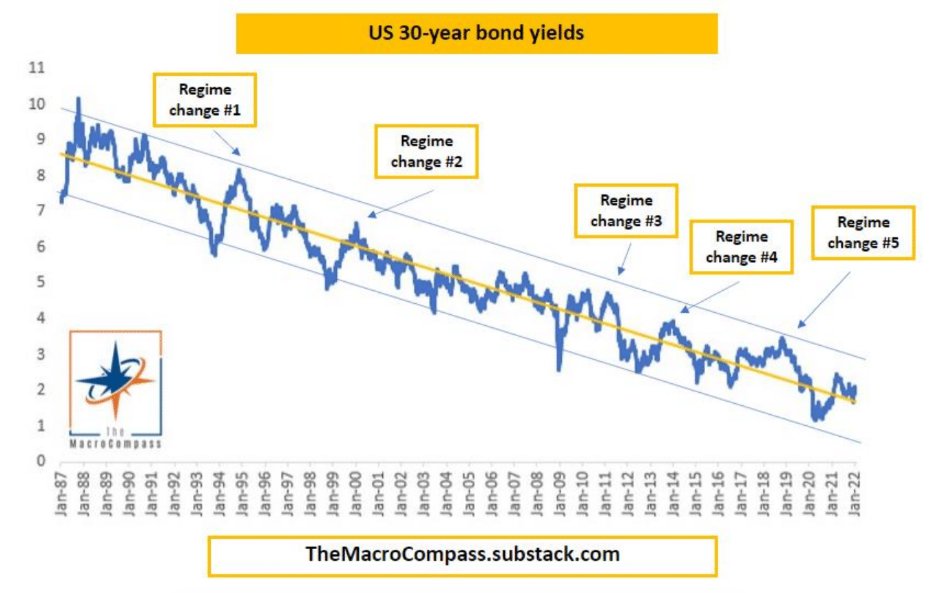

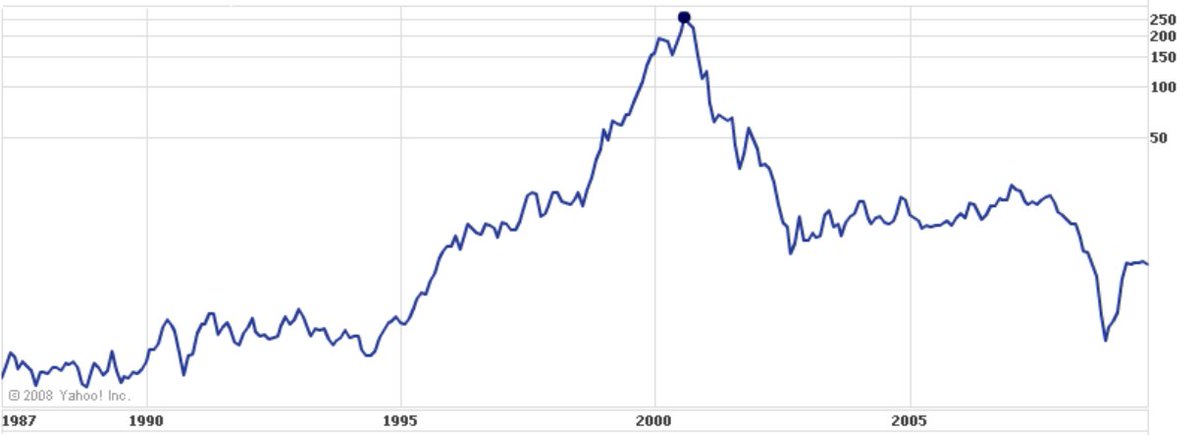

At the moment, the portfolio is very skewed towards one core macro thesis: the Fed is tightening in a slowdown (flatter curves, short Bitcoin as a proxy for high-beta risk, short HYG) & China > US small-cap.

That's not good, I need to balance it out.

Ideas for cheap hedges?

That's not good, I need to balance it out.

Ideas for cheap hedges?

• • •

Missing some Tweet in this thread? You can try to

force a refresh